Form 8915 - E

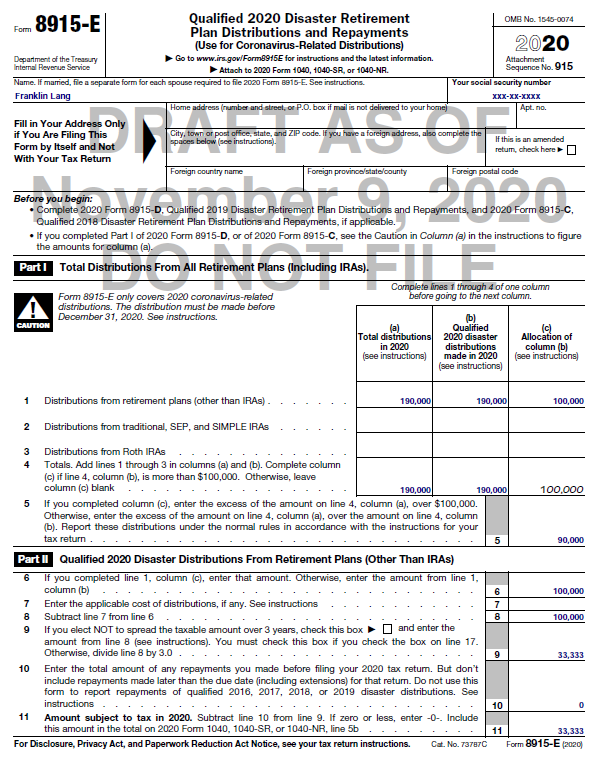

Form 8915 - E - Any distributions you took within the 2021 tax year will be taxable on your federal return. Web taxpayers deferred taxation of distributions from 401k accounts in 2020 if covid related. Department of the treasury internal revenue service. This will also include any coronavirus relate. The qualified 2020 disaster distributions for qualified. Any repayments you make will reduce the amount of qualified 2020 disaster. Will that deferred amount automatically carry over to our client's 2021 tax. We last updated the qualified hurricane retirement plan distributions. Qualified 2020 disaster retirement plan distributions and repayments.

Web taxpayers deferred taxation of distributions from 401k accounts in 2020 if covid related. We last updated the qualified hurricane retirement plan distributions. The qualified 2020 disaster distributions for qualified. Department of the treasury internal revenue service. Qualified 2020 disaster retirement plan distributions and repayments. Will that deferred amount automatically carry over to our client's 2021 tax. Any distributions you took within the 2021 tax year will be taxable on your federal return. Any repayments you make will reduce the amount of qualified 2020 disaster. This will also include any coronavirus relate.

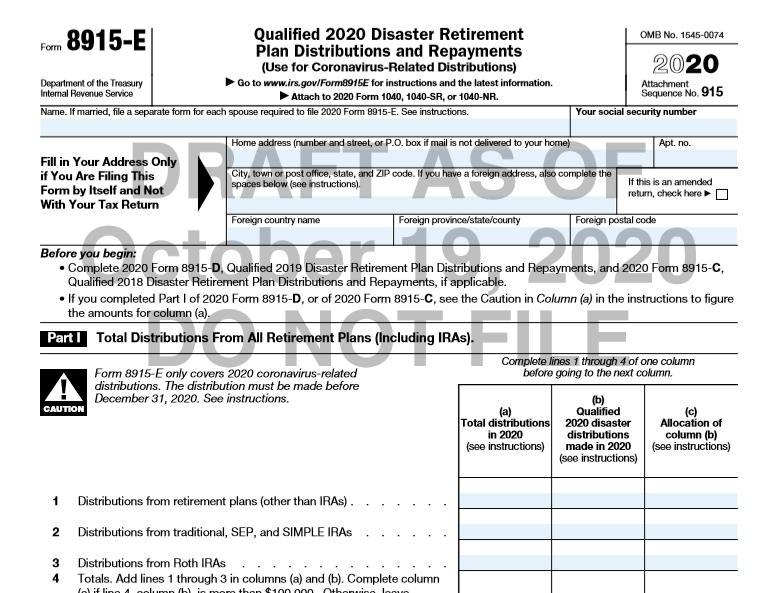

Qualified 2020 disaster retirement plan distributions and repayments. We last updated the qualified hurricane retirement plan distributions. The qualified 2020 disaster distributions for qualified. Will that deferred amount automatically carry over to our client's 2021 tax. Any repayments you make will reduce the amount of qualified 2020 disaster. Department of the treasury internal revenue service. This will also include any coronavirus relate. Any distributions you took within the 2021 tax year will be taxable on your federal return. Web taxpayers deferred taxation of distributions from 401k accounts in 2020 if covid related.

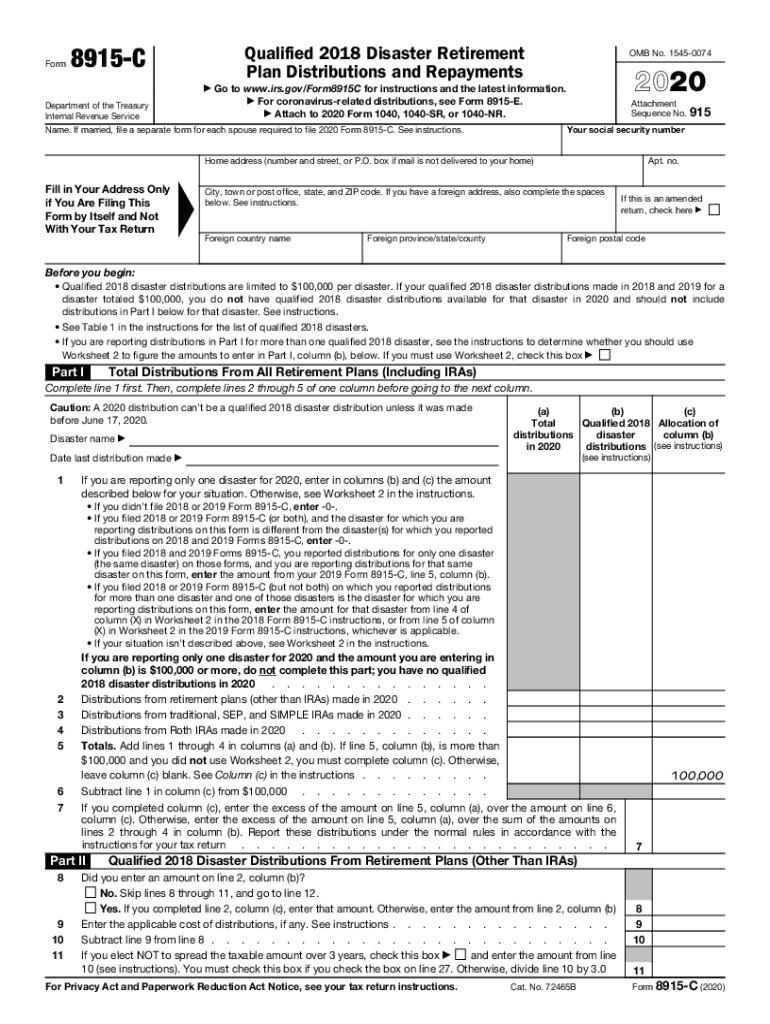

2020 Form IRS 8915C Fill Online, Printable, Fillable, Blank pdfFiller

Qualified 2020 disaster retirement plan distributions and repayments. Any distributions you took within the 2021 tax year will be taxable on your federal return. Department of the treasury internal revenue service. This will also include any coronavirus relate. Any repayments you make will reduce the amount of qualified 2020 disaster.

Fill Free fillable Form 8915E Plan Distributions and Repayments

Department of the treasury internal revenue service. Web taxpayers deferred taxation of distributions from 401k accounts in 2020 if covid related. This will also include any coronavirus relate. Qualified 2020 disaster retirement plan distributions and repayments. Any distributions you took within the 2021 tax year will be taxable on your federal return.

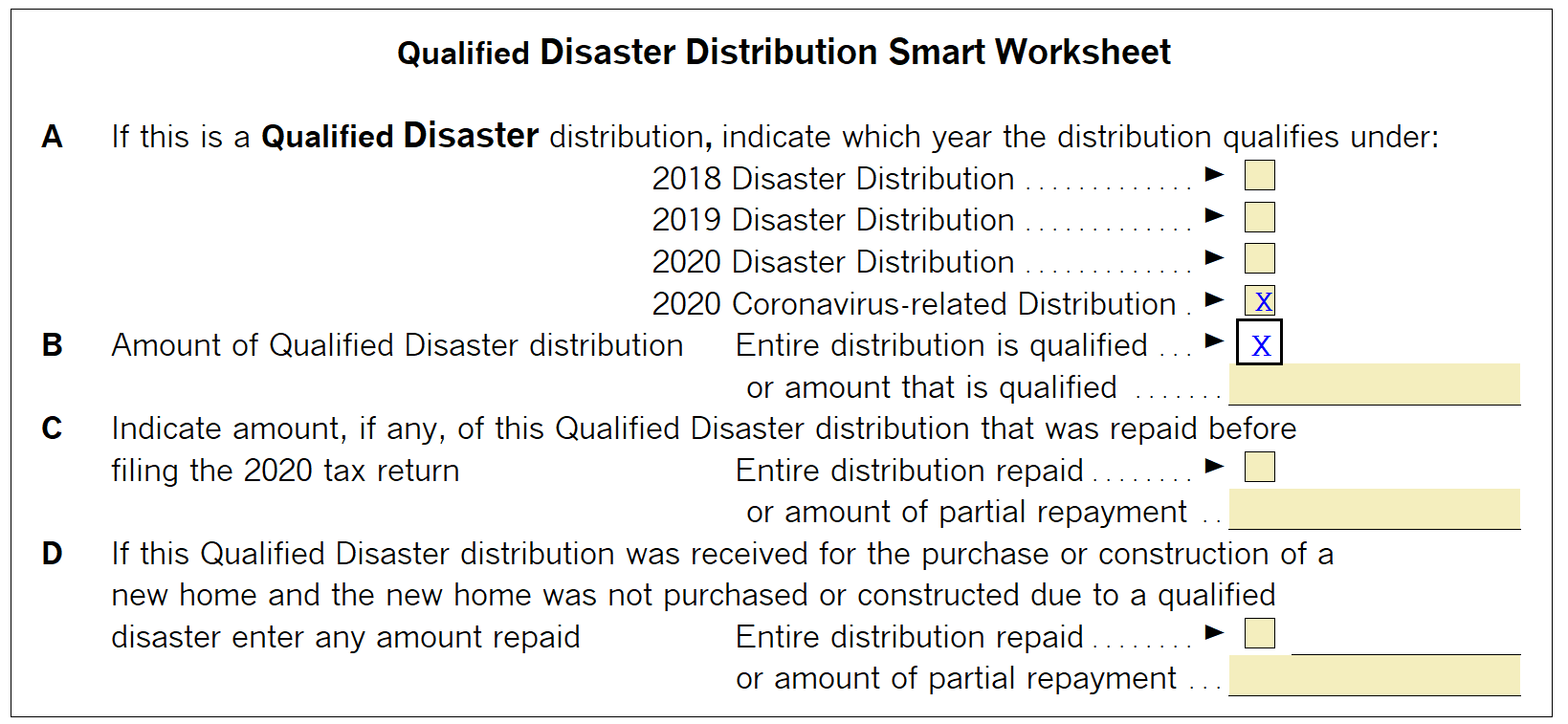

A Guide to the New 2020 Form 8915E

We last updated the qualified hurricane retirement plan distributions. The qualified 2020 disaster distributions for qualified. This will also include any coronavirus relate. Any repayments you make will reduce the amount of qualified 2020 disaster. Qualified 2020 disaster retirement plan distributions and repayments.

Kandy Snell

We last updated the qualified hurricane retirement plan distributions. Will that deferred amount automatically carry over to our client's 2021 tax. Web taxpayers deferred taxation of distributions from 401k accounts in 2020 if covid related. Qualified 2020 disaster retirement plan distributions and repayments. Any distributions you took within the 2021 tax year will be taxable on your federal return.

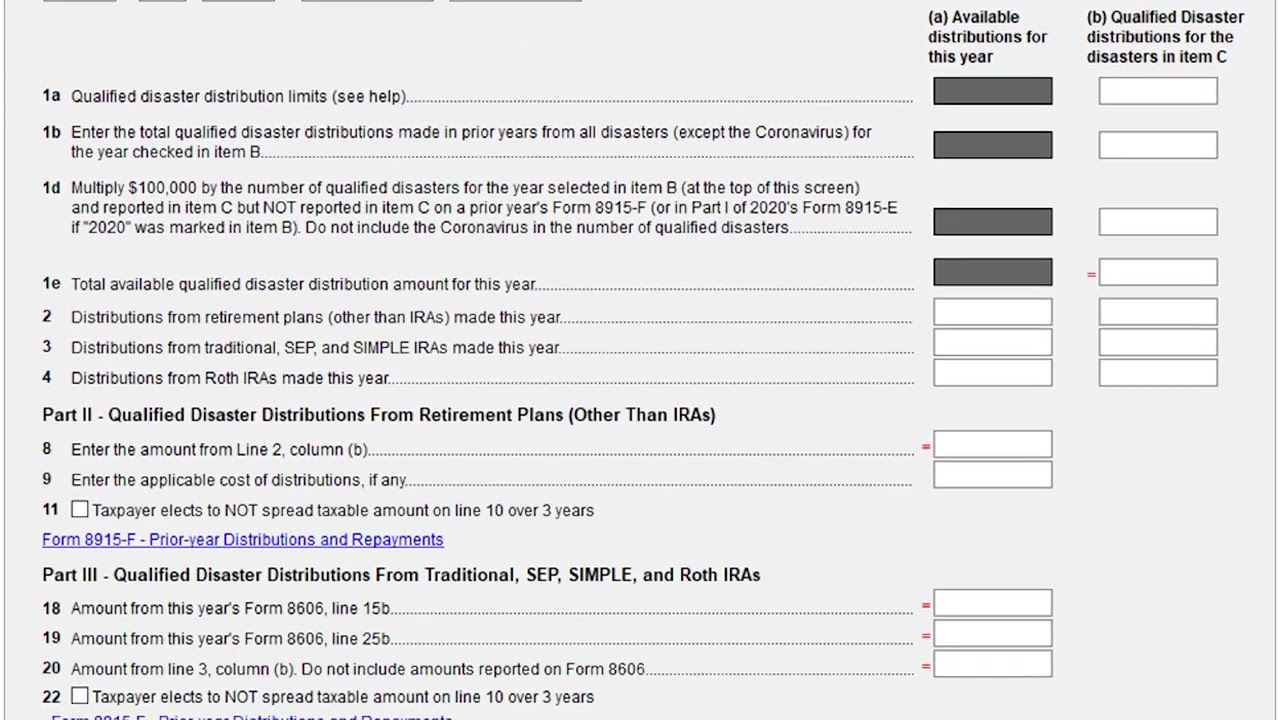

Generating Form 8915E in ProSeries Intuit Accountants Community

Web taxpayers deferred taxation of distributions from 401k accounts in 2020 if covid related. We last updated the qualified hurricane retirement plan distributions. Any distributions you took within the 2021 tax year will be taxable on your federal return. The qualified 2020 disaster distributions for qualified. Will that deferred amount automatically carry over to our client's 2021 tax.

National Association of Tax Professionals Blog

Any repayments you make will reduce the amount of qualified 2020 disaster. Department of the treasury internal revenue service. Web taxpayers deferred taxation of distributions from 401k accounts in 2020 if covid related. This will also include any coronavirus relate. Will that deferred amount automatically carry over to our client's 2021 tax.

8915e tax form release date Chaffin

We last updated the qualified hurricane retirement plan distributions. Will that deferred amount automatically carry over to our client's 2021 tax. The qualified 2020 disaster distributions for qualified. Department of the treasury internal revenue service. Qualified 2020 disaster retirement plan distributions and repayments.

8915e tax form instructions Somer Langley

Qualified 2020 disaster retirement plan distributions and repayments. Any distributions you took within the 2021 tax year will be taxable on your federal return. Web taxpayers deferred taxation of distributions from 401k accounts in 2020 if covid related. We last updated the qualified hurricane retirement plan distributions. Will that deferred amount automatically carry over to our client's 2021 tax.

Re When will form 8915E 2020 be available in tur... Page 19

Any distributions you took within the 2021 tax year will be taxable on your federal return. This will also include any coronavirus relate. Web taxpayers deferred taxation of distributions from 401k accounts in 2020 if covid related. We last updated the qualified hurricane retirement plan distributions. Qualified 2020 disaster retirement plan distributions and repayments.

Generating Form 8915E in ProSeries Intuit Accountants Community

We last updated the qualified hurricane retirement plan distributions. Will that deferred amount automatically carry over to our client's 2021 tax. Qualified 2020 disaster retirement plan distributions and repayments. Web taxpayers deferred taxation of distributions from 401k accounts in 2020 if covid related. Any repayments you make will reduce the amount of qualified 2020 disaster.

Department Of The Treasury Internal Revenue Service.

This will also include any coronavirus relate. Any distributions you took within the 2021 tax year will be taxable on your federal return. The qualified 2020 disaster distributions for qualified. Web taxpayers deferred taxation of distributions from 401k accounts in 2020 if covid related.

We Last Updated The Qualified Hurricane Retirement Plan Distributions.

Any repayments you make will reduce the amount of qualified 2020 disaster. Qualified 2020 disaster retirement plan distributions and repayments. Will that deferred amount automatically carry over to our client's 2021 tax.

.jpeg)