Gst/Hst Filing Form

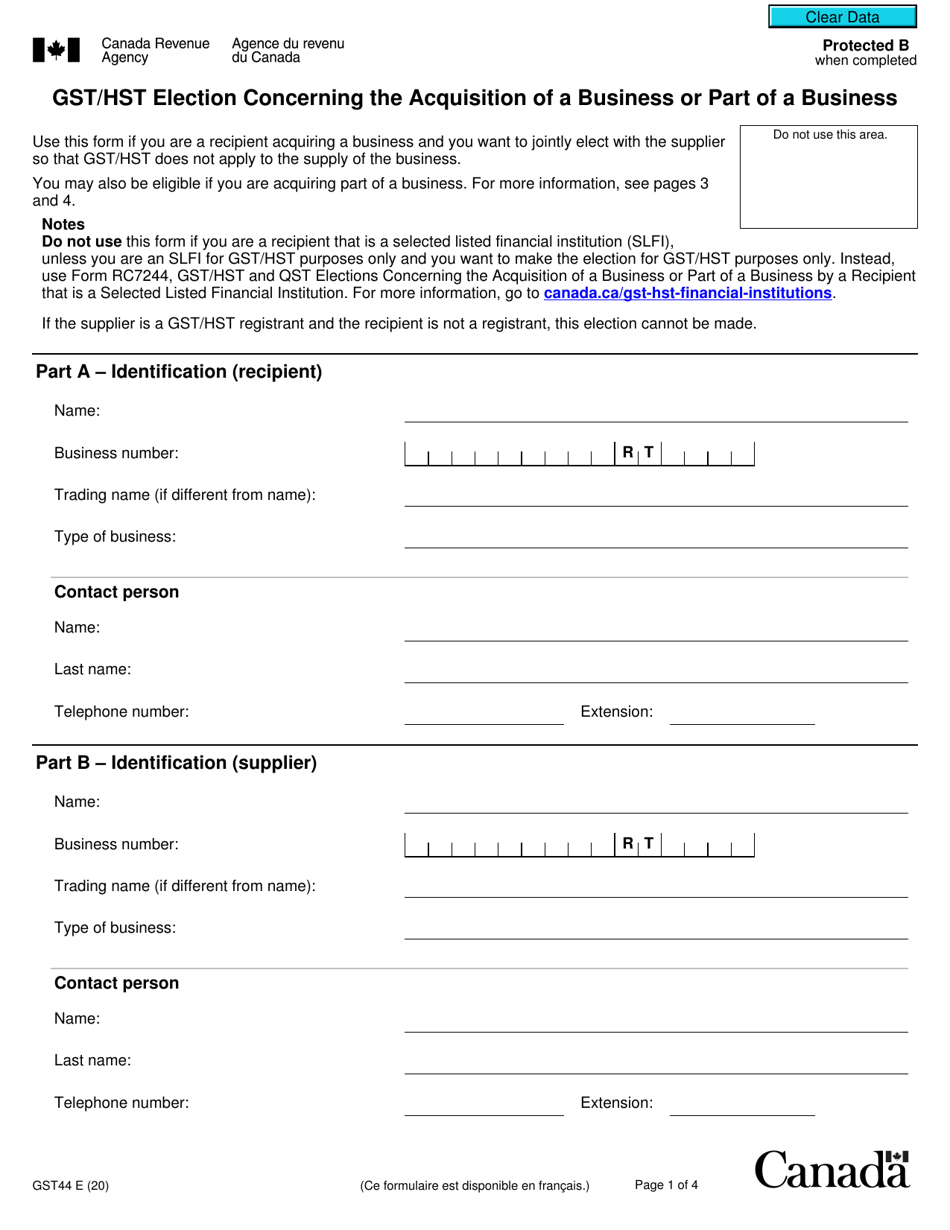

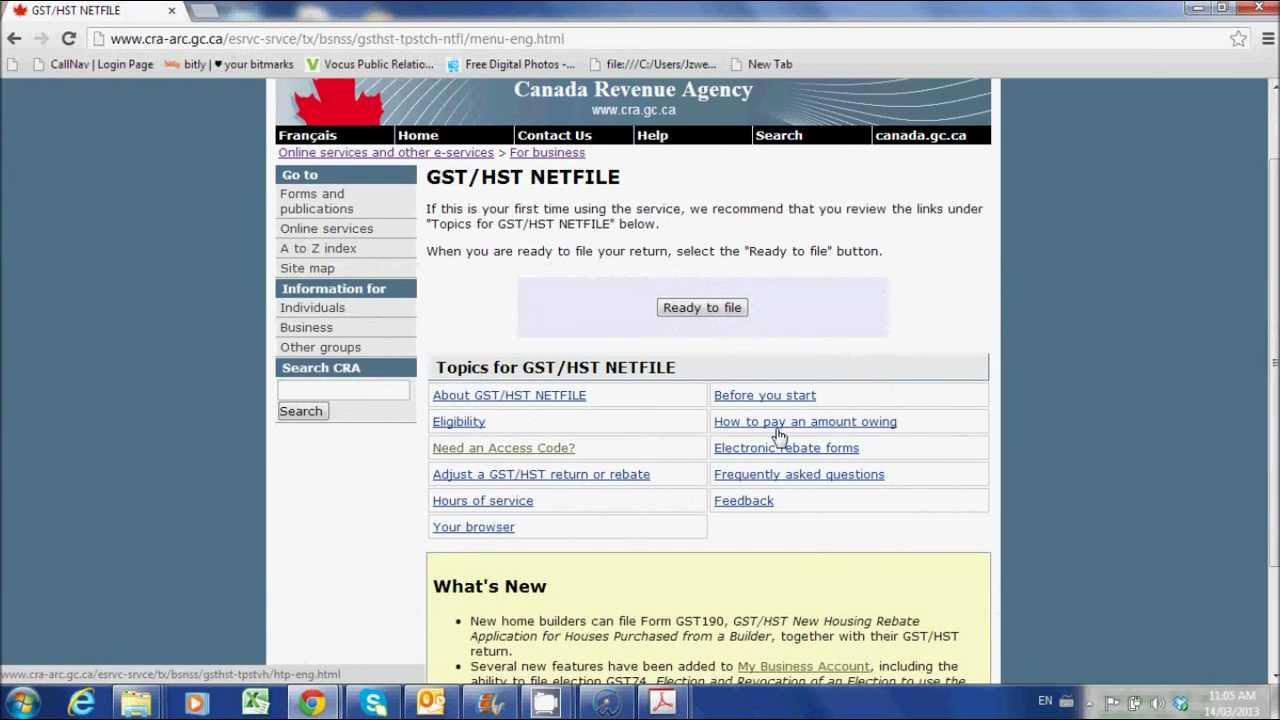

Gst/Hst Filing Form - Web using the online service for filing a gst/hst and qst return is not only environmentally friendly, it is also the quickest and easiest way to file the information requested on this. Web aside from the extra info you’ll include on your tax return, you might also be required to register for a gst/hst account and become a gst/hst registrant. Web find and fill out the correct hst forms. Get everything done in minutes. Web you can file a gst/hst return electronically, by telefile, or on paper. Ilps will be required to file the annual gst/hst and qst final return for selected listed financial. Before you choose a method, you must determine if you are required to file online and which online method. Do not include provincial sales tax, gst or hst i (if you are using the quick method of accounting, include the gst or hst) net tax. Web you have to file this form for each reporting period in which you paid or credited these amounts and claimed a deduction on your gst/hst return. Web filing the annual gst/hst and qst final return for slfis.

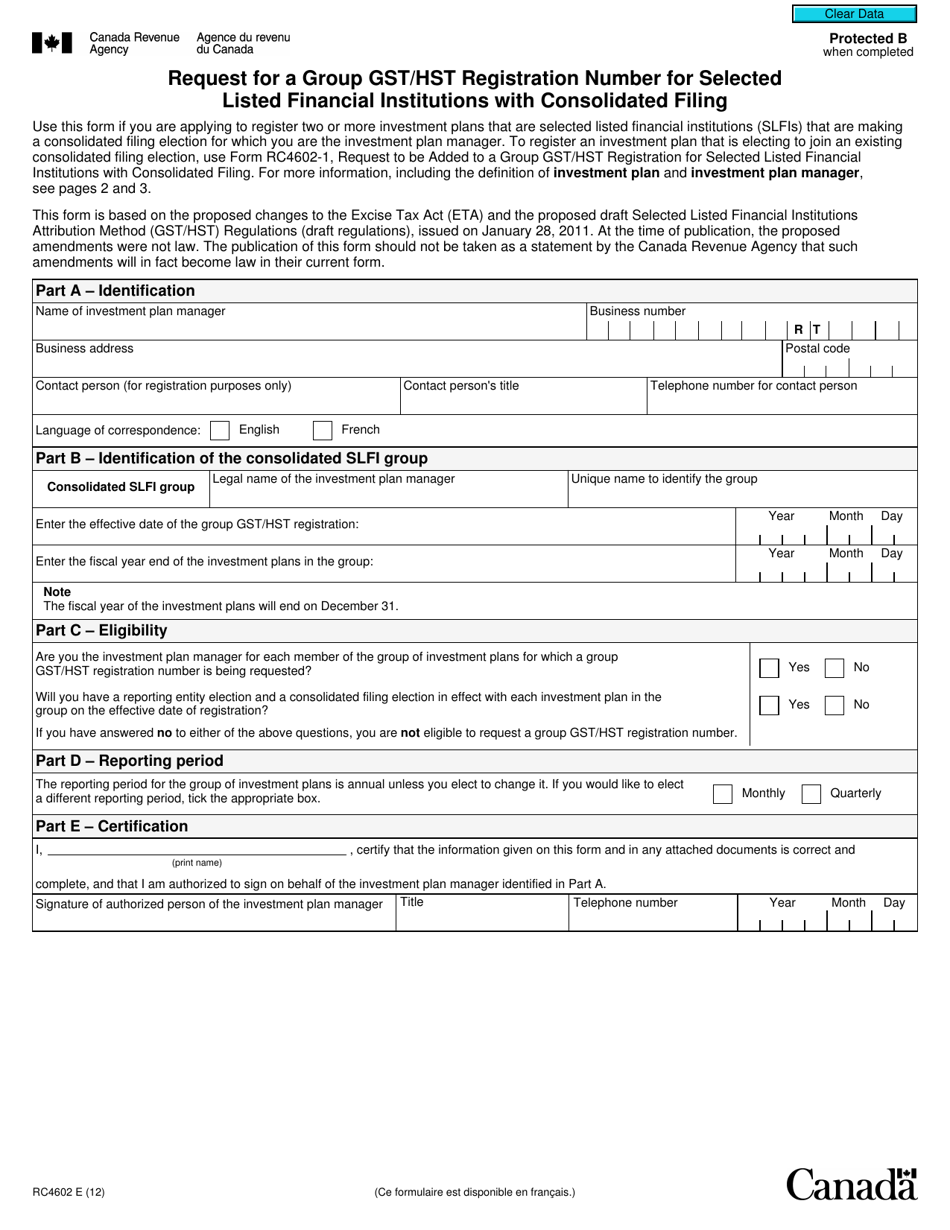

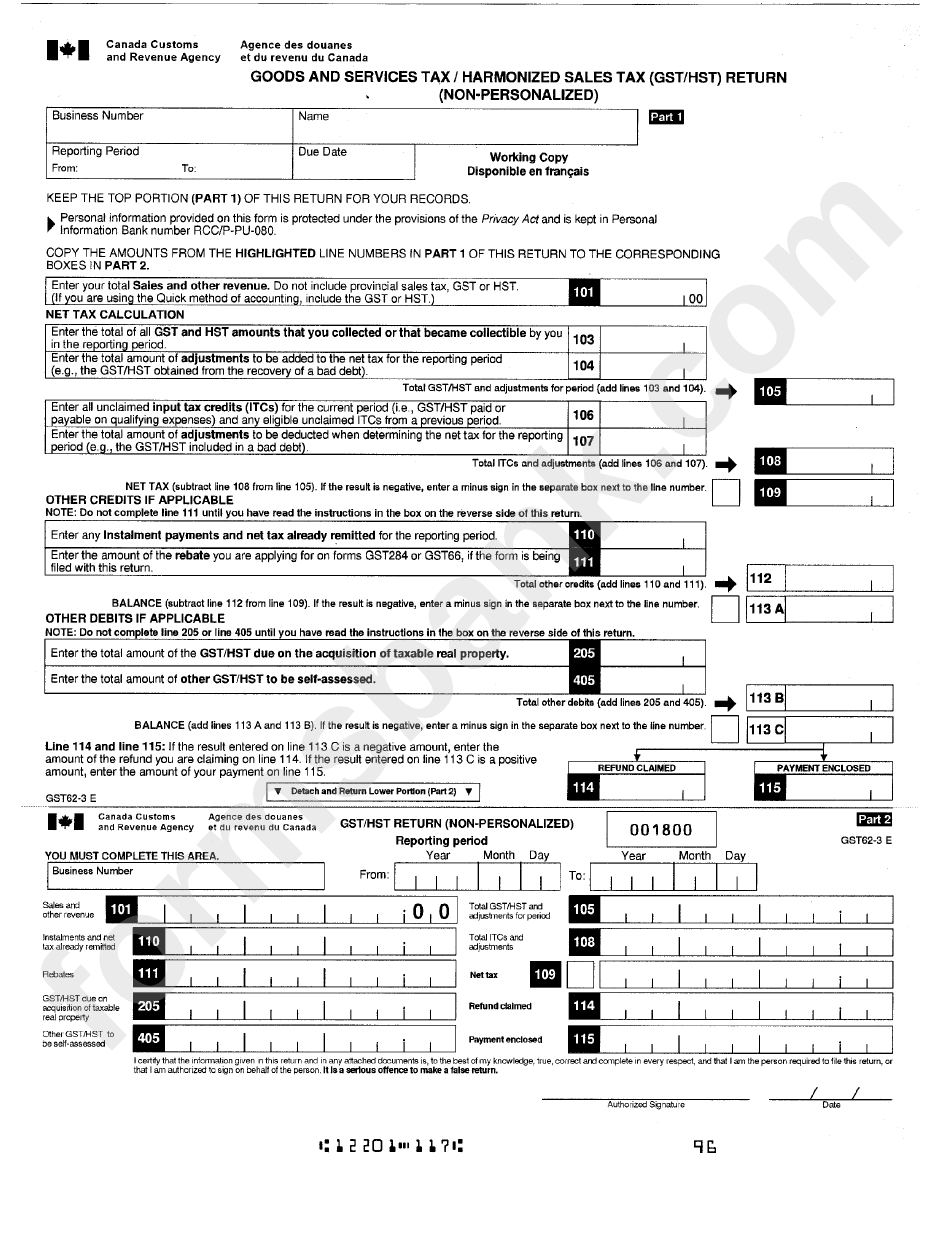

If you are a selected listed financial institution (slfi) that does not have a permanent. Web gst/hst and qst forms and publications for selected listed financial institutions. Web up to $40 cash back canada customs and revenue agency des doubles et du revenue du canada goods and services tax / harmonized sales tax (gst/hst) return. Web filing online since april 2022, businesses already registered for gst and qst are encouraged to file their gst/hst and qst returns online, as they no longer receive the. Web taxpayers in canada use form gst 34 to manually file goods and services tax or harmonized sales tax (gst/hst) returns, and to remit payments to the canada. Send (file) the return 4. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web aside from the extra info you’ll include on your tax return, you might also be required to register for a gst/hst account and become a gst/hst registrant. Web you can file a gst/hst return electronically, by telefile, or on paper. Web using the online service for filing a gst/hst and qst return is not only environmentally friendly, it is also the quickest and easiest way to file the information requested on this.

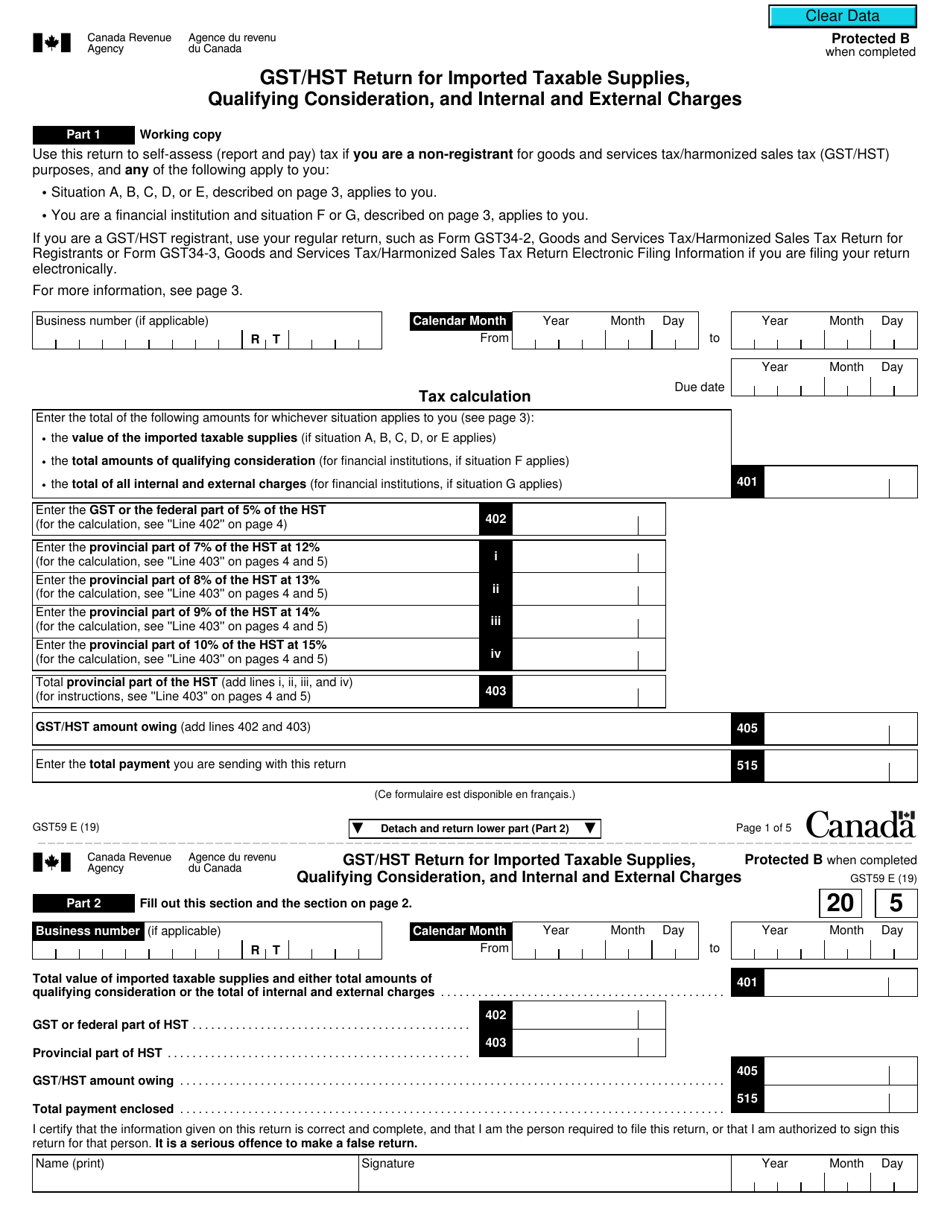

Web complete this form to make detailed gst/hst and qst calculations and report the taxes payable on the acquisition of taxable real property (immovables), taxable carbon. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web aside from the extra info you’ll include on your tax return, you might also be required to register for a gst/hst account and become a gst/hst registrant. Send (file) the return what is the due date to file a gst/hst return? Web the goods & services tax (gst)/harmonized sales tax (hst) is a value added tax that became effective in canada on january 1, 1991 and which replaced the. Web filing the annual gst/hst and qst final return for slfis. Before you choose a method, you must determine if you are required to file online and which online method. Web filing online since april 2022, businesses already registered for gst and qst are encouraged to file their gst/hst and qst returns online, as they no longer receive the. Election and application forms available to all businesses or individuals. Web up to $40 cash back canada customs and revenue agency des doubles et du revenue du canada goods and services tax / harmonized sales tax (gst/hst) return.

Ontario Canada Sales Tax

Ilps will be required to file the annual gst/hst and qst final return for selected listed financial. Web up to $40 cash back canada customs and revenue agency des doubles et du revenue du canada goods and services tax / harmonized sales tax (gst/hst) return. Web the goods & services tax (gst)/harmonized sales tax (hst) is a value added tax.

Cra Business Gst Return Form Charles Leal's Template

Before you choose a method, you must determine if you are required to file online and which online method. Web aside from the extra info you’ll include on your tax return, you might also be required to register for a gst/hst account and become a gst/hst registrant. Web taxpayers in canada use form gst 34 to manually file goods and.

Changes to the GST/HST Return DJB Chartered Professional Accountants

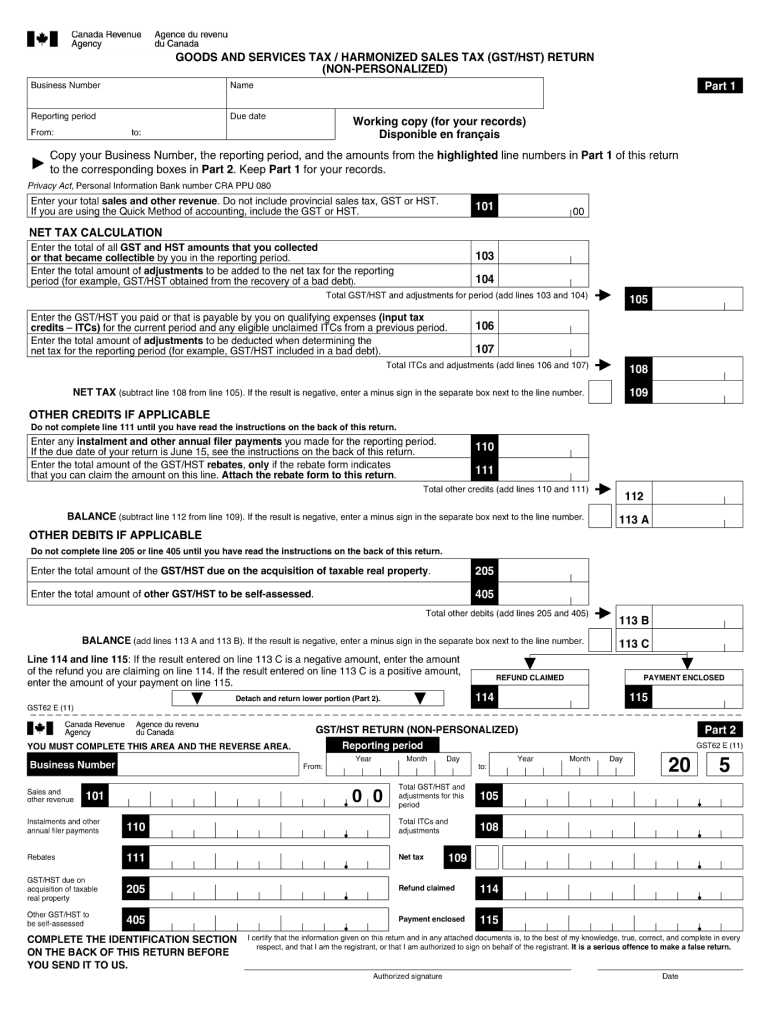

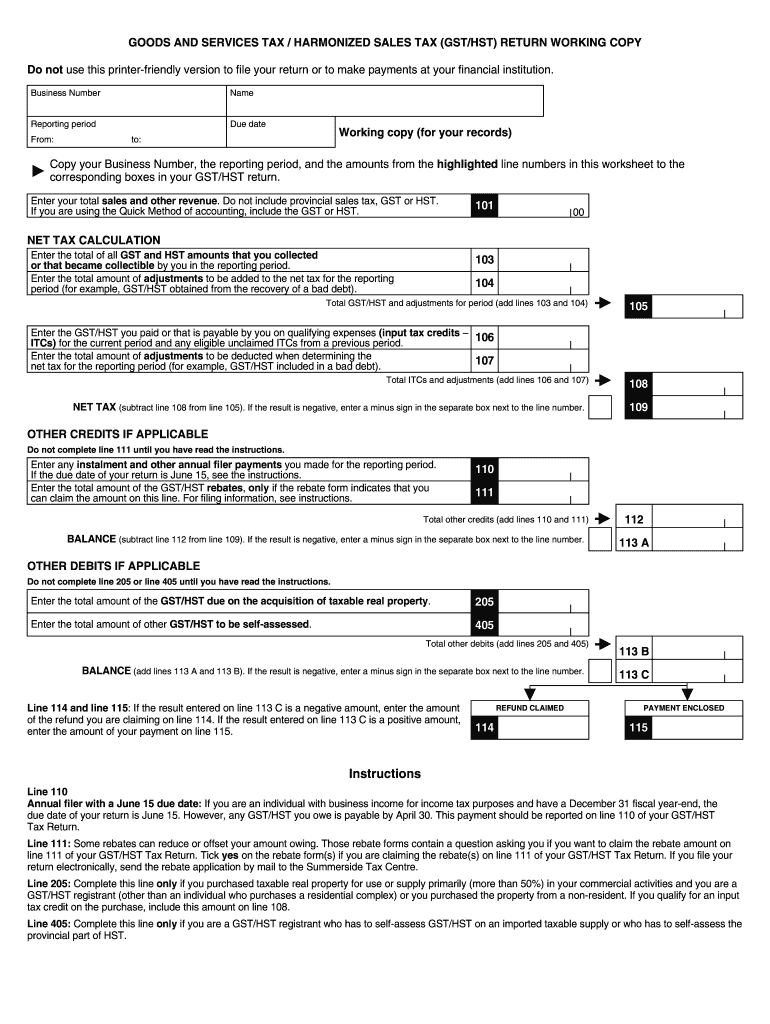

Do not include provincial sales tax, gst or hst i (if you are using the quick method of accounting, include the gst or hst) net tax. Web you have to file this form for each reporting period in which you paid or credited these amounts and claimed a deduction on your gst/hst return. Web gst/hst and qst forms and publications.

Form RC4602 Download Fillable PDF or Fill Online Request for a Group

Calculate the net tax 2. Web find and fill out the correct hst forms. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web gst/hst and qst forms and publications for selected listed financial institutions. Choose the correct version of the editable pdf form from the list and.

Form Gst623 E Goods And Services Tax/harmonized Sales Tax (Gst/hst

Ilps will be required to file the annual gst/hst and qst final return for selected listed financial. Before you choose a method, you must determine if you are required to file online and which online method. Web enter your total sales and other revenue. Send (file) the return 4. Web taxpayers in canada use form gst 34 to manually file.

Form GST59 Download Fillable PDF or Fill Online Gst/Hst Return for

Choose the correct version of the editable pdf form from the list and. Web enter your total sales and other revenue. Before you choose a method, you must determine if you are required to file online and which online method. Do not include provincial sales tax, gst or hst i (if you are using the quick method of accounting, include.

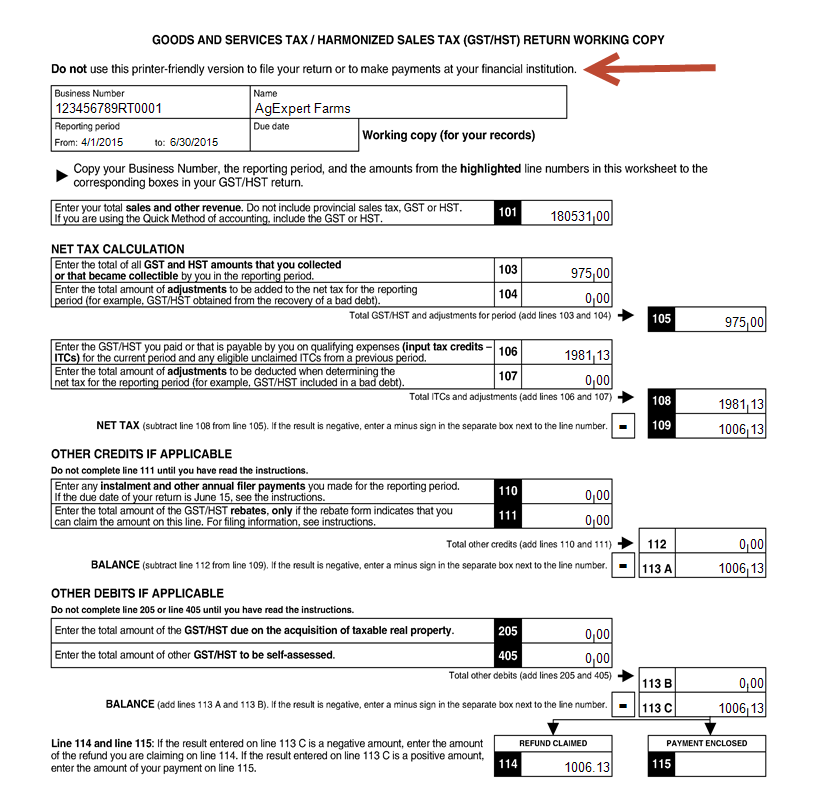

What's new FCC AgExpert Community

Web filing online since april 2022, businesses already registered for gst and qst are encouraged to file their gst/hst and qst returns online, as they no longer receive the. Ilps will be required to file the annual gst/hst and qst final return for selected listed financial. Web the goods & services tax (gst)/harmonized sales tax (hst) is a value added.

File your GST/HST Return Online YouTube

Web complete this form to make detailed gst/hst and qst calculations and report the taxes payable on the acquisition of taxable real property (immovables), taxable carbon. Web gst/hst and qst forms and publications for selected listed financial institutions. Ilps will be required to file the annual gst/hst and qst final return for selected listed financial. Send (file) the return what.

File Hst Return Fill Out and Sign Printable PDF Template signNow

Web the goods & services tax (gst)/harmonized sales tax (hst) is a value added tax that became effective in canada on january 1, 1991 and which replaced the. Web filing the annual gst/hst and qst final return for slfis. For a complete list of addresses including fax numbers go. Before you choose a method, you must determine if you are.

Tax Gst Return Fill Online, Printable, Fillable, Blank pdfFiller

Web taxpayers in canada use form gst 34 to manually file goods and services tax or harmonized sales tax (gst/hst) returns, and to remit payments to the canada. Get everything done in minutes. Web up to $40 cash back canada customs and revenue agency des doubles et du revenue du canada goods and services tax / harmonized sales tax (gst/hst).

Before You Choose A Method, You Must Determine If You Are Required To File Online And Which Online Method.

If you are a selected listed financial institution (slfi) that does not have a permanent. Web gst/hst and qst forms and publications for selected listed financial institutions. Web the goods & services tax (gst)/harmonized sales tax (hst) is a value added tax that became effective in canada on january 1, 1991 and which replaced the. Web filing online since april 2022, businesses already registered for gst and qst are encouraged to file their gst/hst and qst returns online, as they no longer receive the.

Do Not Include Provincial Sales Tax, Gst Or Hst I (If You Are Using The Quick Method Of Accounting, Include The Gst Or Hst) Net Tax.

Ilps will be required to file the annual gst/hst and qst final return for selected listed financial. Election and application forms available to all businesses or individuals. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Get everything done in minutes.

Web Complete This Form To Make Detailed Gst/Hst And Qst Calculations And Report The Taxes Payable On The Acquisition Of Taxable Real Property (Immovables), Taxable Carbon.

Web using the online service for filing a gst/hst and qst return is not only environmentally friendly, it is also the quickest and easiest way to file the information requested on this. Web find and fill out the correct hst forms. Web enter the total of all gst and hst amounts that you collected or that became collectible by you in the reporting period. Choose the correct version of the editable pdf form from the list and.

Web Gst/Hst Telefile You Have To Fax Or Drop Off Your Gst/Hst Return In Person At Your Tax Centre Or Tax Services Office.

104 enter the total amount of adjustments to be added to. Web aside from the extra info you’ll include on your tax return, you might also be required to register for a gst/hst account and become a gst/hst registrant. Calculate the net tax 2. Web you have to file this form for each reporting period in which you paid or credited these amounts and claimed a deduction on your gst/hst return.