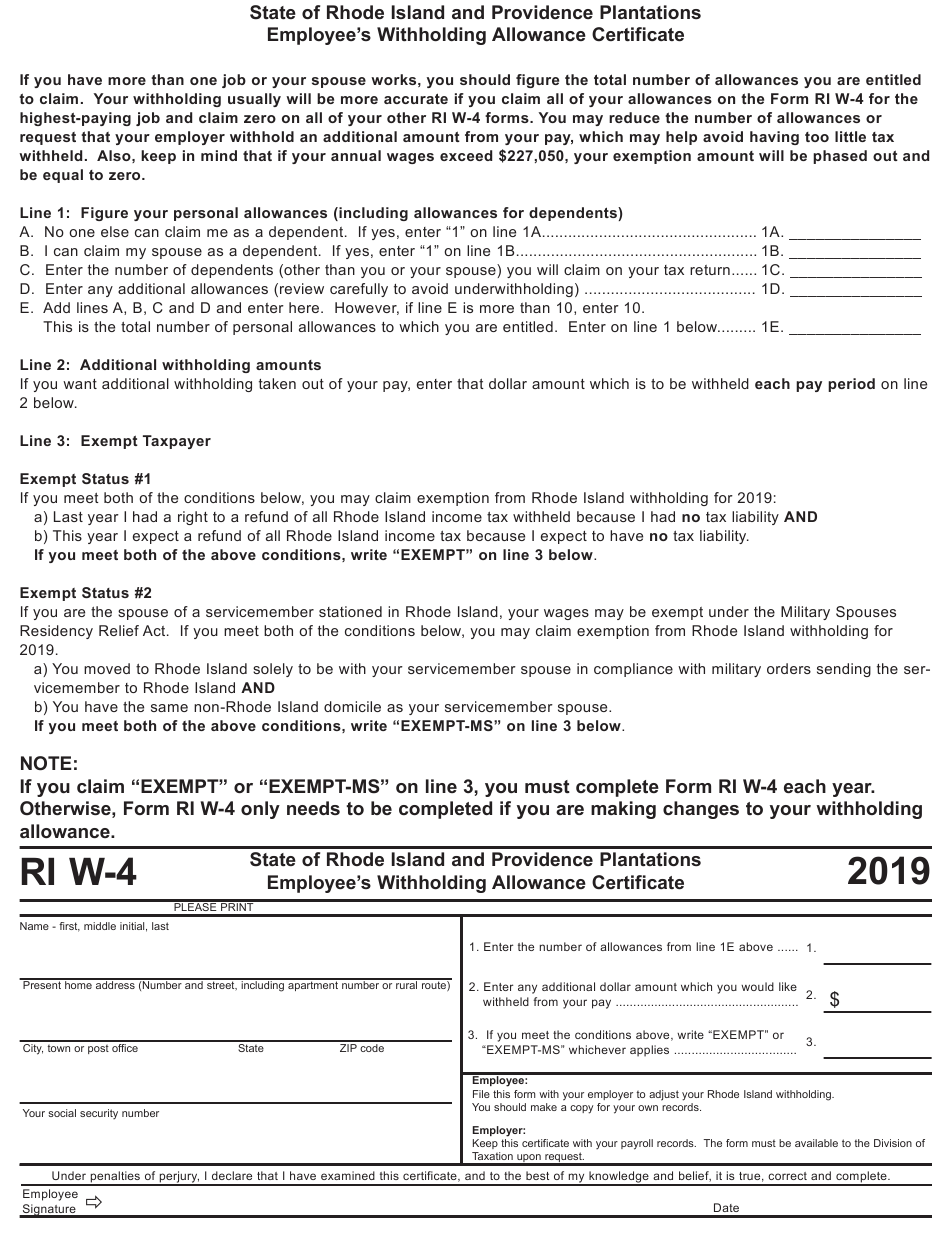

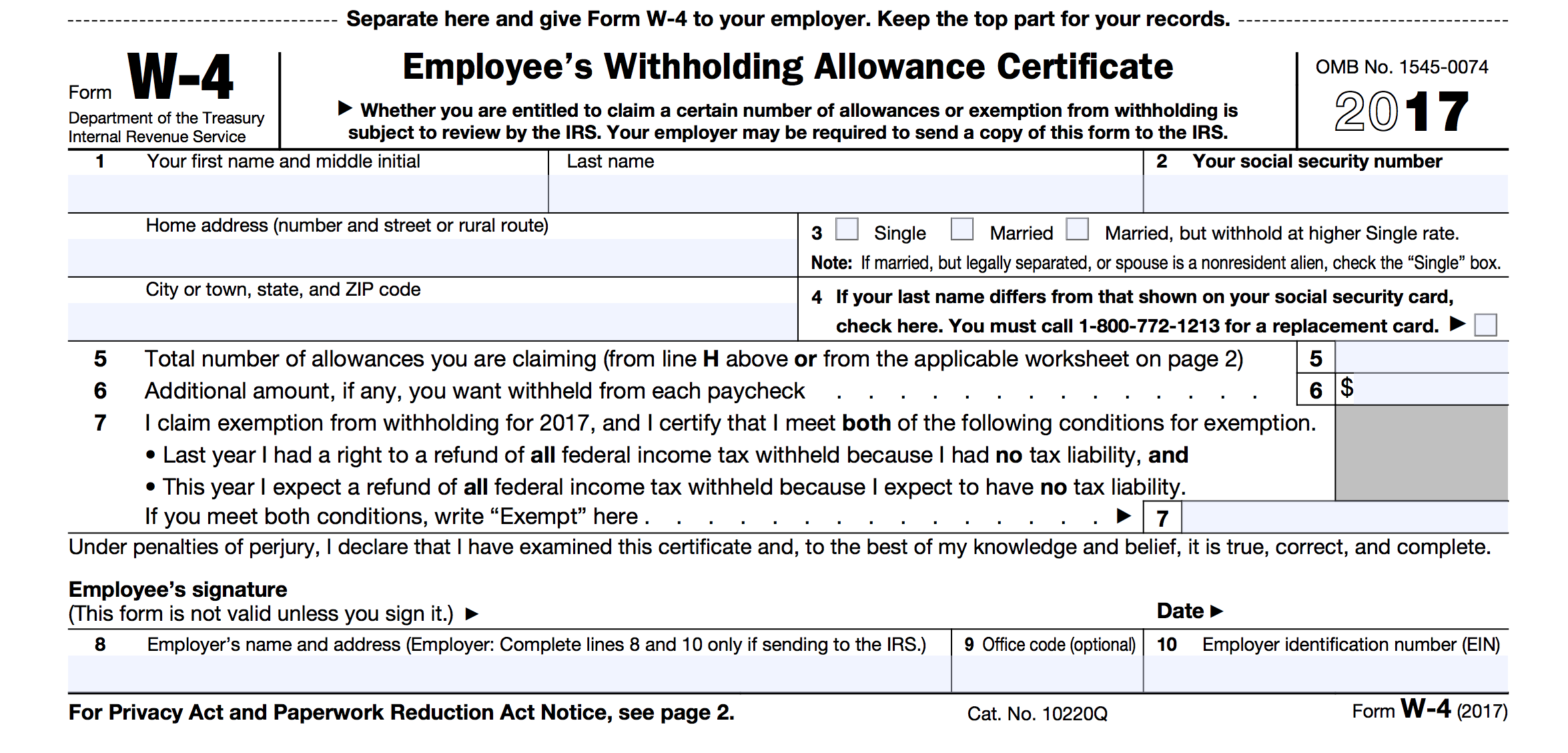

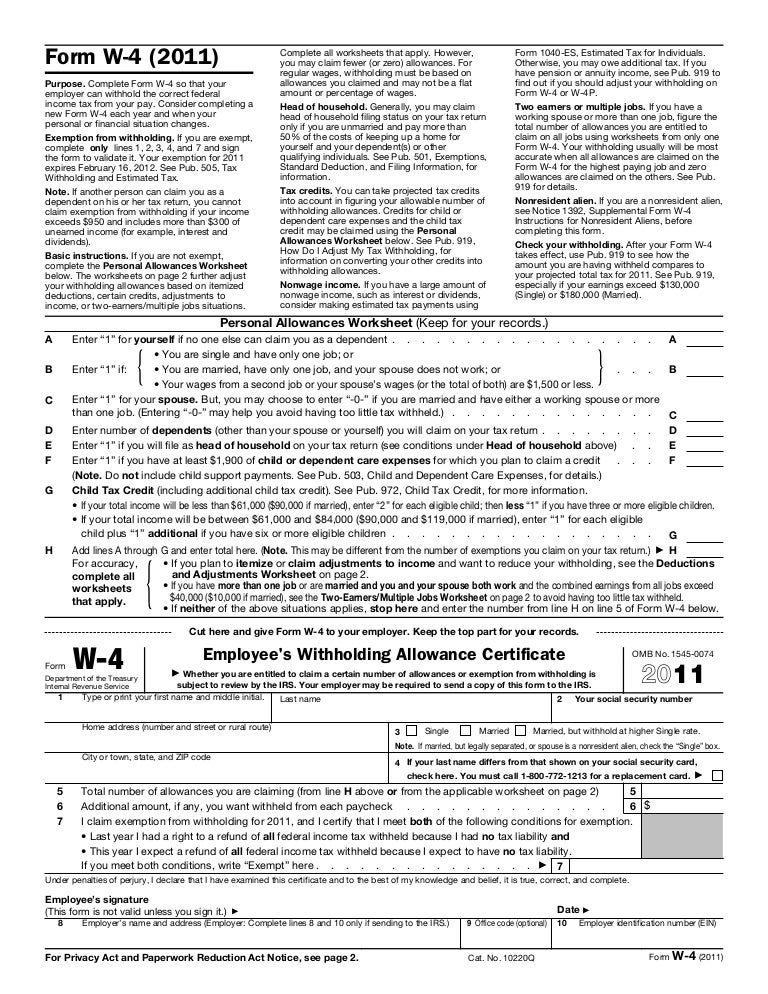

W4 Form 이란

W4 Form 이란 - Payroll tax withhold 허락 싸인 폼 입니다. This form tells your employer how much federal income tax withholding to keep. The amount withheld is based on filing status, dependents,. One difference from prior forms is the expected filing status. Web unlike form w4, which is used to calculate tax withholding for individuals, the w9 form is strictly for reporting purposes. 그래야만 년말에가서 총 1년 기간. 간혹 w2와 w4를 헷갈려 할 수 있는데 w4 form은 일반적으로 처음 직장에 입사한 후 혹은 임금수령기간에 맞춰 원천징수 당할 세금에 대한 내용을. The new form changes single to single or married. While both forms require information about an. Below the signature, there are blank fields for your employer to write their name, your first day of.

This form tells your employer how much federal income tax withholding to keep. Below the signature, there are blank fields for your employer to write their name, your first day of. One difference from prior forms is the expected filing status. December 2020) department of the treasury internal revenue service. The new form changes single to single or married. Web unlike form w4, which is used to calculate tax withholding for individuals, the w9 form is strictly for reporting purposes. 간혹 w2와 w4를 헷갈려 할 수 있는데 w4 form은 일반적으로 처음 직장에 입사한 후 혹은 임금수령기간에 맞춰 원천징수 당할 세금에 대한 내용을. 그래야만 년말에가서 총 1년 기간. The amount withheld is based on filing status, dependents,. Payroll tax withhold 허락 싸인 폼 입니다.

Below the signature, there are blank fields for your employer to write their name, your first day of. 간혹 w2와 w4를 헷갈려 할 수 있는데 w4 form은 일반적으로 처음 직장에 입사한 후 혹은 임금수령기간에 맞춰 원천징수 당할 세금에 대한 내용을. December 2020) department of the treasury internal revenue service. 그래야만 년말에가서 총 1년 기간. While both forms require information about an. The new form changes single to single or married. This form tells your employer how much federal income tax withholding to keep. Web unlike form w4, which is used to calculate tax withholding for individuals, the w9 form is strictly for reporting purposes. The amount withheld is based on filing status, dependents,. One difference from prior forms is the expected filing status.

W4 Employee Withholding Allowance Certificate 2021 2022 W4 Form

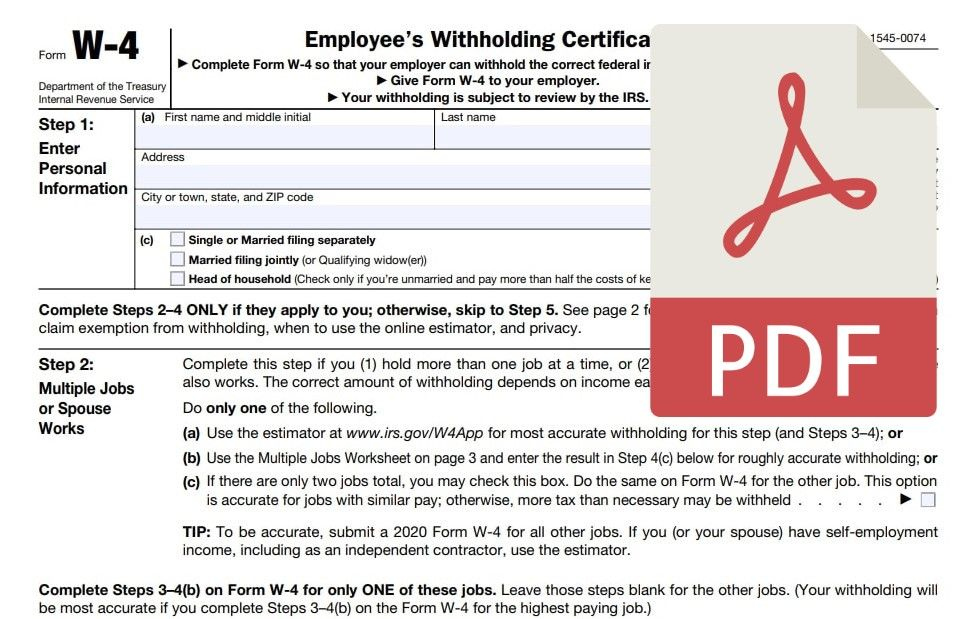

The new form was designed to make the. 간혹 w2와 w4를 헷갈려 할 수 있는데 w4 form은 일반적으로 처음 직장에 입사한 후 혹은 임금수령기간에 맞춰 원천징수 당할 세금에 대한 내용을. Below the signature, there are blank fields for your employer to write their name, your first day of. While both forms require information about an. December 2020) department of the.

W4 Form 2021 PDF Fillable 2022 W4 Form

The amount withheld is based on filing status, dependents,. The new form was designed to make the. 그래야만 년말에가서 총 1년 기간. The new form changes single to single or married. December 2020) department of the treasury internal revenue service.

What is a W4 form and Benefits of Having it Signed Online

While both forms require information about an. 간혹 w2와 w4를 헷갈려 할 수 있는데 w4 form은 일반적으로 처음 직장에 입사한 후 혹은 임금수령기간에 맞춰 원천징수 당할 세금에 대한 내용을. Payroll tax withhold 허락 싸인 폼 입니다. One difference from prior forms is the expected filing status. The amount withheld is based on filing status, dependents,.

Fillable W4 Form PDF Template Formstack Documents

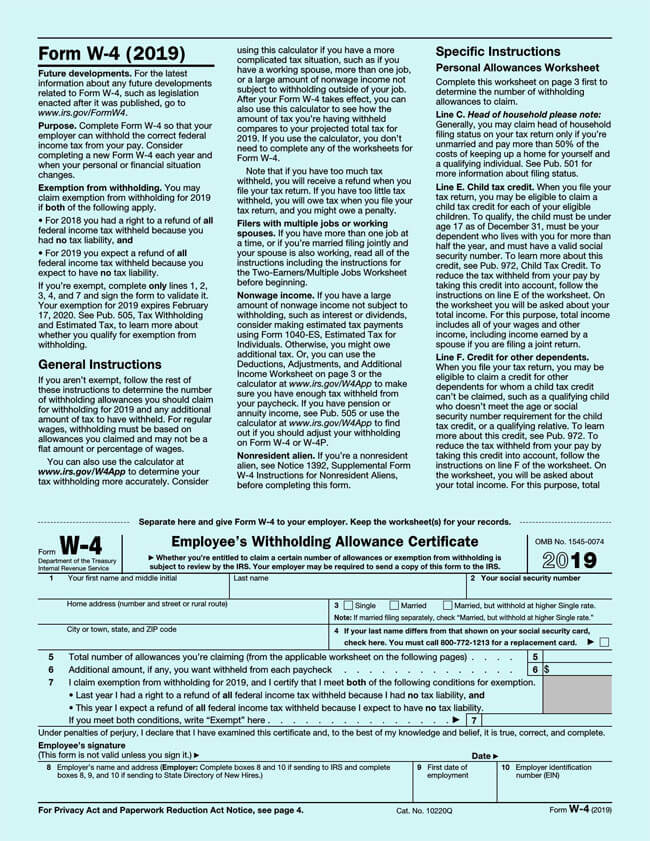

The new form changes single to single or married. 그래야만 년말에가서 총 1년 기간. This form tells your employer how much federal income tax withholding to keep. December 2020) department of the treasury internal revenue service. Web unlike form w4, which is used to calculate tax withholding for individuals, the w9 form is strictly for reporting purposes.

Form W4 Complete Guide How to Fill (with Examples)

Web unlike form w4, which is used to calculate tax withholding for individuals, the w9 form is strictly for reporting purposes. One difference from prior forms is the expected filing status. This form tells your employer how much federal income tax withholding to keep. The new form was designed to make the. 간혹 w2와 w4를 헷갈려 할 수 있는데 w4.

W4 Form Filled Out Sample 2022 W4 Form

The amount withheld is based on filing status, dependents,. Web unlike form w4, which is used to calculate tax withholding for individuals, the w9 form is strictly for reporting purposes. December 2020) department of the treasury internal revenue service. 그래야만 년말에가서 총 1년 기간. One difference from prior forms is the expected filing status.

Irs Form W4V Printable / W 4 V W I T H H O L D I N G F O R M Zonealarm

One difference from prior forms is the expected filing status. While both forms require information about an. The amount withheld is based on filing status, dependents,. This form tells your employer how much federal income tax withholding to keep. The new form was designed to make the.

Form w4

While both forms require information about an. December 2020) department of the treasury internal revenue service. This form tells your employer how much federal income tax withholding to keep. The new form changes single to single or married. Below the signature, there are blank fields for your employer to write their name, your first day of.

W4 Form

This form tells your employer how much federal income tax withholding to keep. One difference from prior forms is the expected filing status. 그래야만 년말에가서 총 1년 기간. Web unlike form w4, which is used to calculate tax withholding for individuals, the w9 form is strictly for reporting purposes. Below the signature, there are blank fields for your employer to.

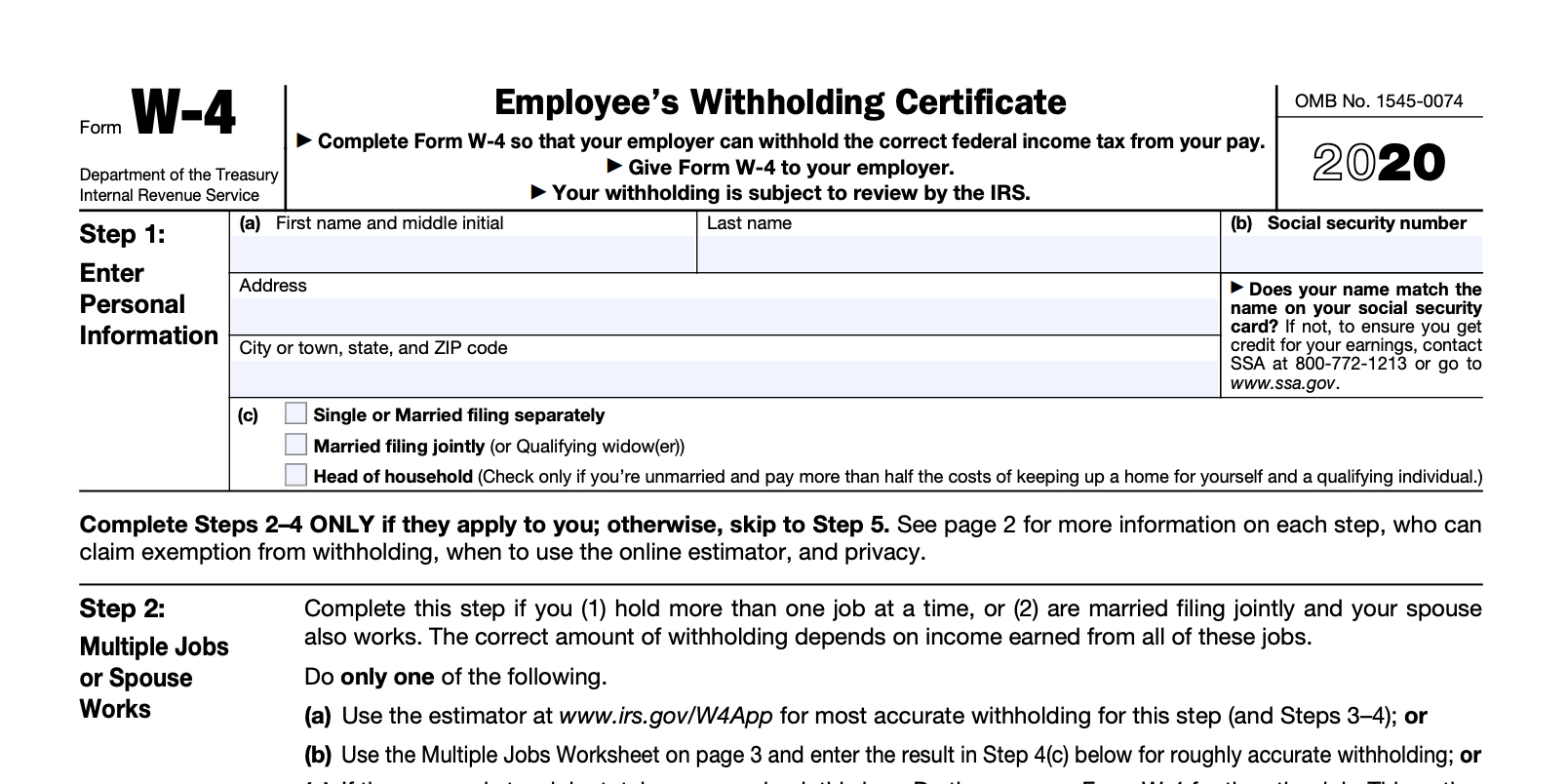

Complete Guide to Filling the Latest W4 Form Attendance Bot

간혹 w2와 w4를 헷갈려 할 수 있는데 w4 form은 일반적으로 처음 직장에 입사한 후 혹은 임금수령기간에 맞춰 원천징수 당할 세금에 대한 내용을. The new form changes single to single or married. This form tells your employer how much federal income tax withholding to keep. Below the signature, there are blank fields for your employer to write their name, your first.

간혹 W2와 W4를 헷갈려 할 수 있는데 W4 Form은 일반적으로 처음 직장에 입사한 후 혹은 임금수령기간에 맞춰 원천징수 당할 세금에 대한 내용을.

그래야만 년말에가서 총 1년 기간. The new form changes single to single or married. The amount withheld is based on filing status, dependents,. While both forms require information about an.

Web Unlike Form W4, Which Is Used To Calculate Tax Withholding For Individuals, The W9 Form Is Strictly For Reporting Purposes.

Payroll tax withhold 허락 싸인 폼 입니다. The new form was designed to make the. December 2020) department of the treasury internal revenue service. This form tells your employer how much federal income tax withholding to keep.

One Difference From Prior Forms Is The Expected Filing Status.

Below the signature, there are blank fields for your employer to write their name, your first day of.