1040Ez Form 2016

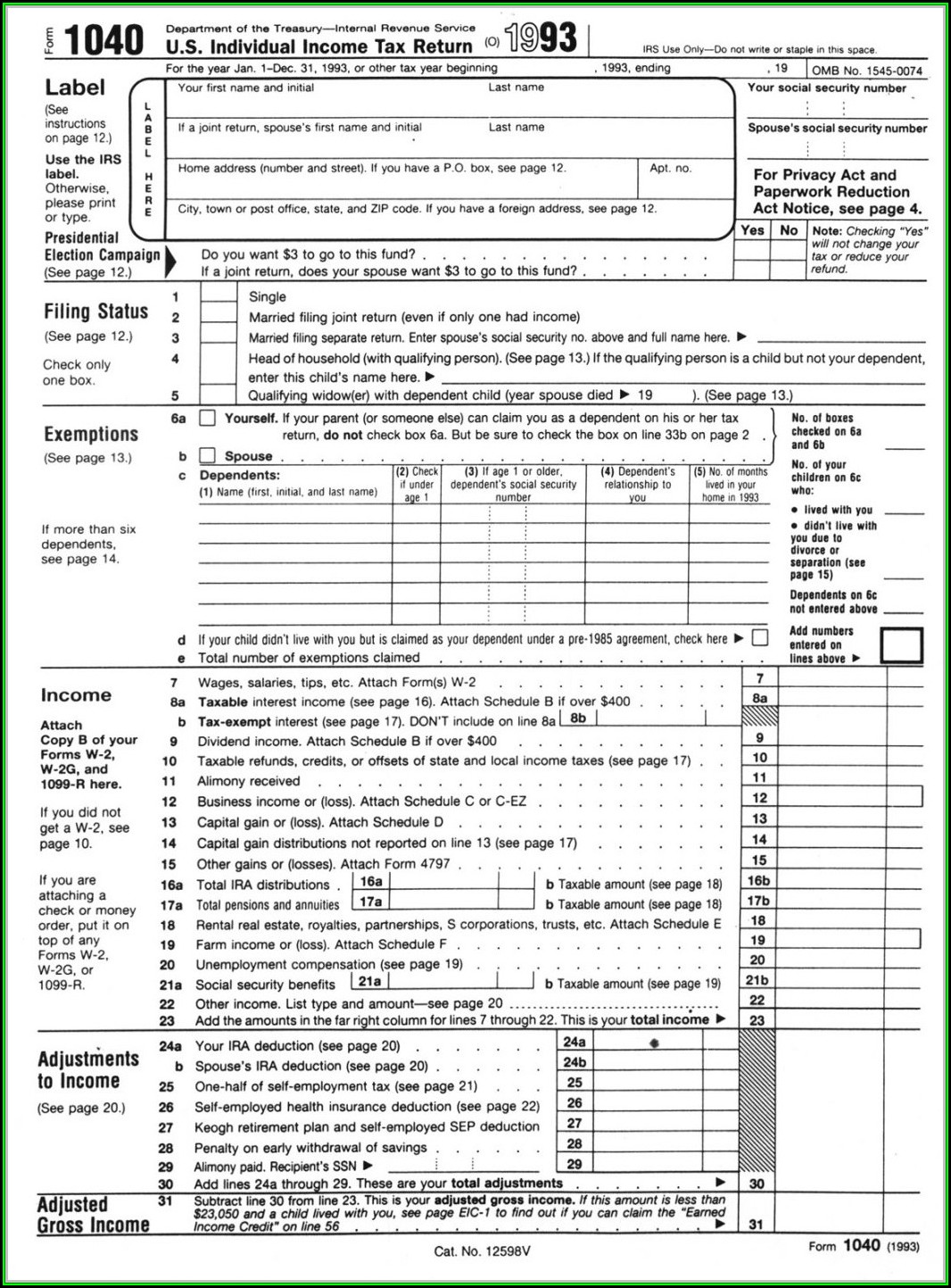

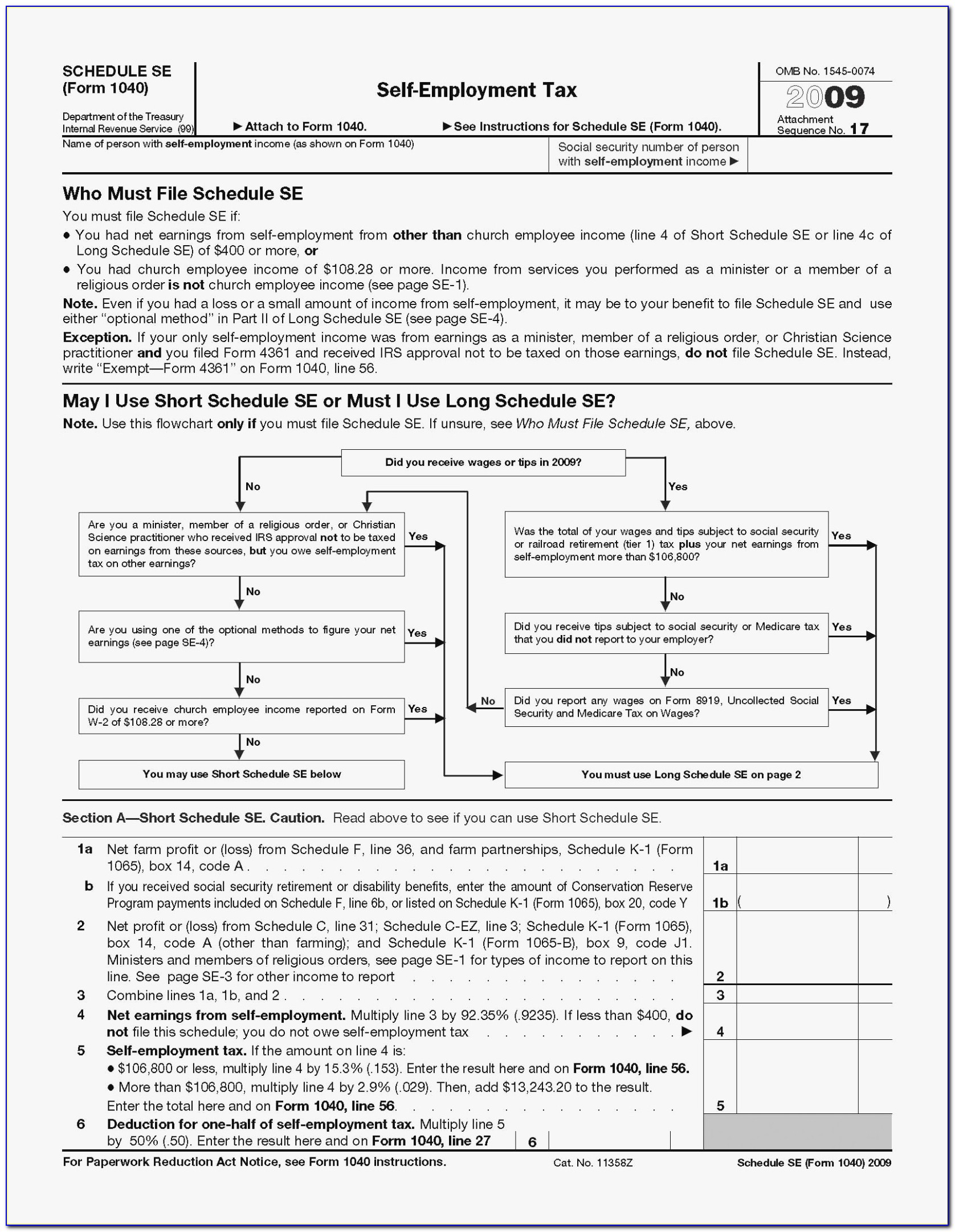

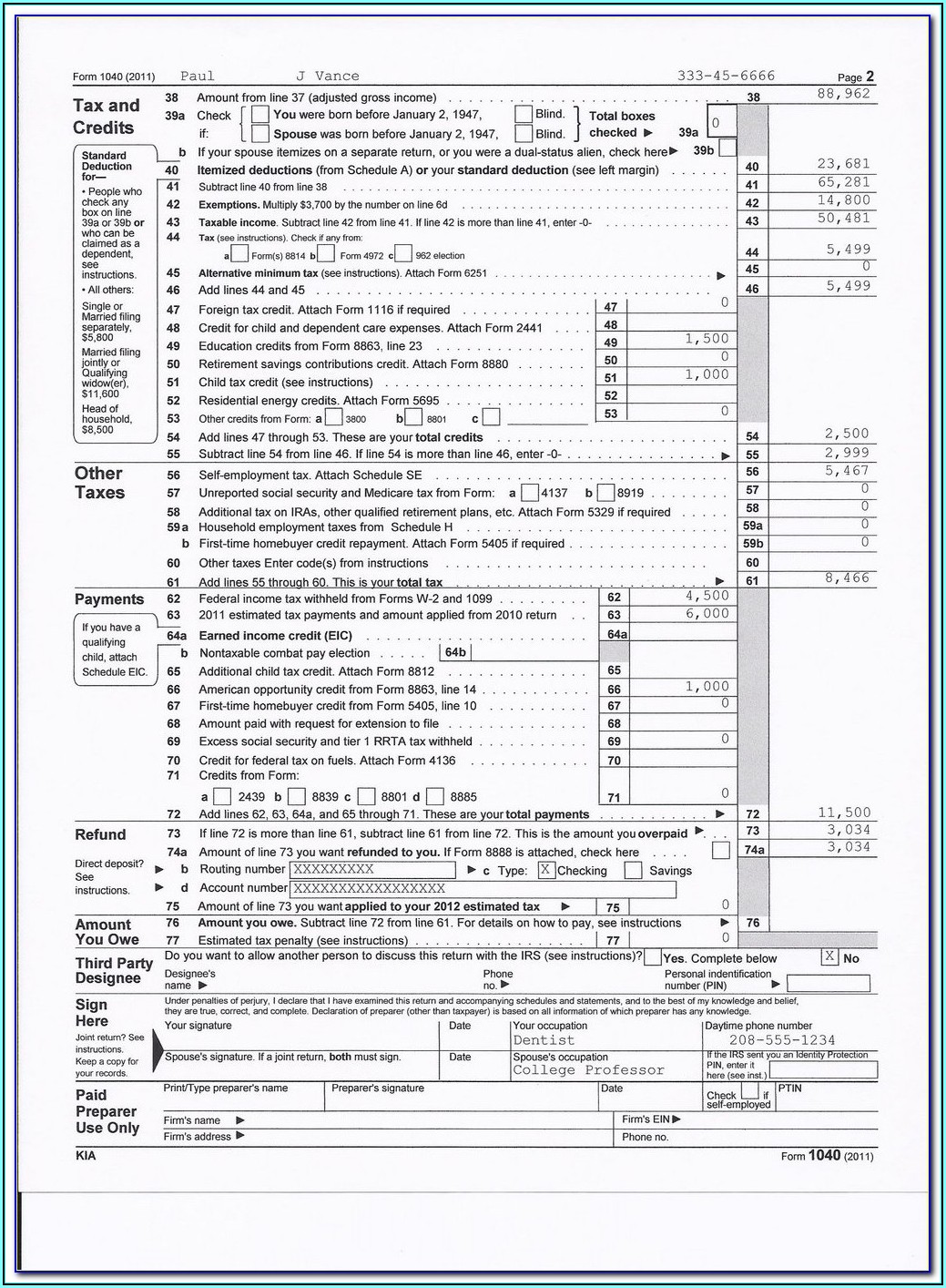

1040Ez Form 2016 - Web get the 1040ez 2016 forms accomplished. Web fill online, printable, fillable, blank form 2016: Individual income tax return (irs) form. Individual income tax return 2016 department of the treasury—internal revenue service (99) irs use only—do not write or staple in this space. Web form 1040 says i owe back taxes from 2016 if you file your 2016 1040 tax form late and owe taxes, you may be charged a failure to file penalty unless you have. Do i need to file an income tax return chart. Use fill to complete blank online irs pdf forms for free. Web simply select your tax filing status and enter a few other details to estimate your total taxes for 2016. Based on your projected withholdings for the year, we then show you your. Your filing status was single or married filing jointly.

Web fill online, printable, fillable, blank form 1040: Complete, edit or print tax forms instantly. Do i need to file an income tax return chart. You had taxable income of less than $100,000 with. Your filing status was single or married filing jointly. Ad turbotax® is still here to help you file easily and accuratley no matter your situation. Download your updated document, export it to the cloud, print it from the editor, or share it with other participants using a shareable link. No matter your situation, we're here to help. If the total is over $1,500, you cannot use form. Web get federal tax return forms and file by mail.

Web get federal tax return forms and file by mail. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Line instructions for form 1040ez. Ad get ready for tax season deadlines by completing any required tax forms today. See how easy it is to file with turbotax®. Web get the 1040ez 2016 forms accomplished. Web inside the 2016 1040ez instructions booklet you will find: Ad turbotax® is still here to help you file easily and accuratley no matter your situation. Instructions for form 1040 (2021) pdf. Individual income tax return 2016 department of the treasury—internal revenue service (99) irs use only—do not write or staple in this space.

Form 1040EZ (Eric)

Use fill to complete blank online irs pdf forms for free. Web fill online, printable, fillable, blank form 1040: Instructions for form 1040 (2021) pdf. Web fill online, printable, fillable, blank form 2016: 1040ez income tax return for single (irs) form.

Tax Forms 1040ez 2016 Universal Network

Web before recent tax reforms, you could file with form 1040ez if: Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Ad turbotax® is still here to help you file easily and accuratley no matter your situation. Web inside the 2016 1040ez instructions booklet you will find: Web 1 wages, salaries, and.

1040ez Tax Forms 2016 Form Resume Examples 4Y8bR4D86m

You had taxable income of less than $100,000 with. See how easy it is to file with turbotax®. Web annual income tax return filed by citizens or residents of the united states. Get the current filing year’s forms, instructions, and publications for free from the irs. Based on your projected withholdings for the year, we then show you your.

Federal Tax Forms 1040 Instructions Form Resume Examples

You had taxable income of less than $100,000 with. No matter your situation, we're here to help. Ad get ready for tax season deadlines by completing any required tax forms today. If the total is over $1,500, you cannot use form. Use fill to complete blank online irs pdf forms for free.

1040ez Form Form Resume Examples XV8oymnKzD

Line instructions for form 1040ez. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Complete, edit or print tax forms instantly. Individual income tax return (irs) form. Based on your projected withholdings for the year, we then show you your.

1040ez Tax Forms 2016 Form Resume Examples 7NYAqLgYpv

Get the current filing year’s forms, instructions, and publications for free from the irs. Web fill online, printable, fillable, blank form 1040: Web popular forms & instructions; Web inside the 2016 1040ez instructions booklet you will find: Ederal adjusted gross income from your federal form 1040, line 37;

2016 1040EZ Tax Form PDF

Web form 1040 says i owe back taxes from 2016 if you file your 2016 1040 tax form late and owe taxes, you may be charged a failure to file penalty unless you have. You had taxable income of less than $100,000 with. Do i need to file an income tax return chart. Web popular forms & instructions; Individual income.

1040ez Form Instructions Elegant Irs Forms 2011 Tax Table Lovely 1040ez

Web annual income tax return filed by citizens or residents of the united states. Based on your projected withholdings for the year, we then show you your. Web simply select your tax filing status and enter a few other details to estimate your total taxes for 2016. You had taxable income of less than $100,000 with. Get paper copies of.

Federal 1040ez Tax Form Form Resume Examples o7Y3ypo2BN

Web popular forms & instructions; Web 2016 department of the treasury internal revenue service irs.gov this booklet contains tax tables from the instructions for form 1040 only. Web fill online, printable, fillable, blank form 1040: 1040ez income tax return for single (irs) form. Web inside the 2016 1040ez instructions booklet you will find:

Irs 1040ez Tax Forms 2016 Universal Network

Web popular forms & instructions; Web 2016 department of the treasury internal revenue service irs.gov this booklet contains tax tables from the instructions for form 1040 only. Web simply select your tax filing status and enter a few other details to estimate your total taxes for 2016. Download your updated document, export it to the cloud, print it from the.

Web Popular Forms & Instructions;

Ad turbotax® is still here to help you file easily and accuratley no matter your situation. Your filing status was single or married filing jointly. Web form 1040 says i owe back taxes from 2016 if you file your 2016 1040 tax form late and owe taxes, you may be charged a failure to file penalty unless you have. Complete, edit or print tax forms instantly.

Use Fill To Complete Blank Online Irs Pdf Forms For Free.

Web get the 1040ez 2016 forms accomplished. Irs form 1040 and others can be found and completed for free on efile.com. Web simply select your tax filing status and enter a few other details to estimate your total taxes for 2016. Based on your projected withholdings for the year, we then show you your.

Ederal Adjusted Gross Income From Your Federal Form 1040, Line 37;

Web get federal tax forms. Download your updated document, export it to the cloud, print it from the editor, or share it with other participants using a shareable link. Use fill to complete blank online irs pdf forms for free. Individual income tax return 2016 department of the treasury—internal revenue service (99) irs use only—do not write or staple in this space.

Individual Tax Return Form 1040 Instructions;

Web fill online, printable, fillable, blank form 1040: 1040ez income tax return for single (irs) form. Web access, complete, sign, and mail 2016 federal income tax forms. You had taxable income of less than $100,000 with.