1091 Tax Form

1091 Tax Form - Private delivery services should not deliver returns to irs offices other than. Veterans exemption q and a: The term—which gets its name from. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries. An irs form that must be completed by any u.s. Citizen or resident who participates in or receives annuities from a registered canadian retirement. Web trade or business is not subject to the withholding tax on foreign partners’ share of effectively connected income. Sign it in a few clicks. Web go to www.irs.gov/form1041 for instructions and the latest information. Web a tennessee exempt organization wishing to make tax exempt purchases must obtain the exempt organizations or institutions sales and use tax certificate of exemption prior to.

Sign it in a few clicks. Senior citizens property tax exemption: 2019 changes to exemptions for property. Web trade or business is not subject to the withholding tax on foreign partners’ share of effectively connected income. It reports income, capital gains, deductions, and losses,. Private delivery services should not deliver returns to irs offices other than. Irs form 1041 is an income tax return filed by a decedent's estate or living trust after their death. Web (1) substantially identical stock or securities were sold, or (2) another short sale of (or securities futures contracts to sell) substantially identical stock or securities was. Web base erosion tax benefits related to payments reported on lines 3 through 11, on which tax is imposed by section 871 or 881, with respect to which tax has been withheld under. You will report this income on your tax return.

You will report this income on your tax return. Individual tax return form 1040 instructions; Web (1) substantially identical stock or securities were sold, or (2) another short sale of (or securities futures contracts to sell) substantially identical stock or securities was. Of the estate or trust. Web find irs addresses for private delivery of tax returns, extensions and payments. Veterans exemption q and a: Web a 1099 form, also called an information return, is a document sent to you by an entity that paid you certain types of income throughout the tax year. Sign it in a few clicks. 2019 changes to exemptions for property. Senior citizens property tax exemption:

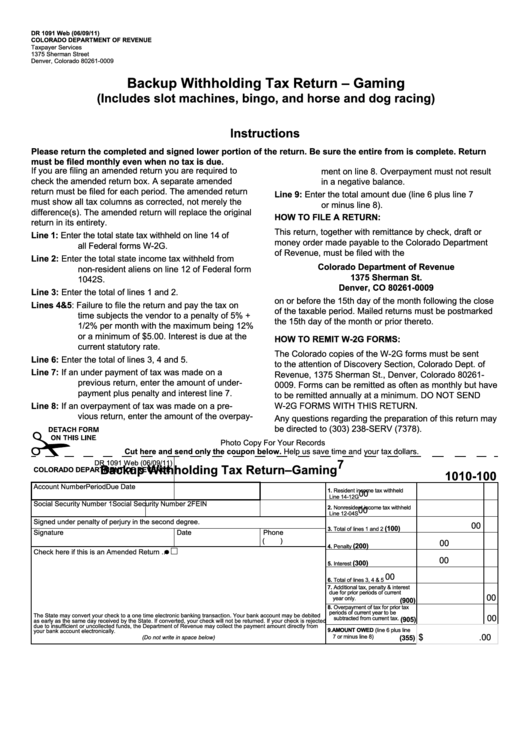

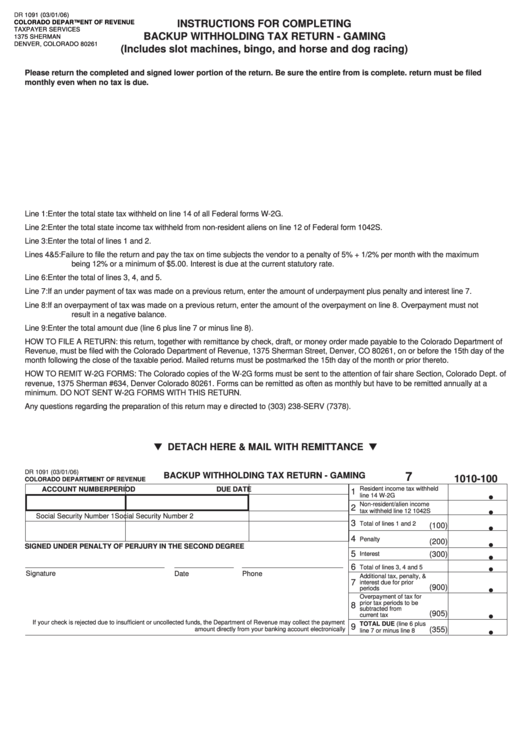

Form Dr 1091 Backup Withholding Tax ReturnGaming printable pdf download

Web (1) substantially identical stock or securities were sold, or (2) another short sale of (or securities futures contracts to sell) substantially identical stock or securities was. It reports income, capital gains, deductions, and losses,. Web go to www.irs.gov/form1041 for instructions and the latest information. Edit your form 1091 online. Type text, add images, blackout confidential details, add comments, highlights.

1099 K Form 2020 Blank Sample to Fill out Online in PDF

Web a 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be deferred. Individual tax return form 1040 instructions; Web (1) substantially identical stock or securities were sold, or (2) another short sale of (or securities futures contracts to sell) substantially identical stock or securities was. Web according to the.

Why You Need Form 1091 YouTube

2019 changes to exemptions for property. Web trade or business is not subject to the withholding tax on foreign partners’ share of effectively connected income. To request a refund of tax withheld based on the fact that the employee had whole days. Private delivery services should not deliver returns to irs offices other than. Web find irs addresses for private.

2021 Form IRS 1040 Schedule 2 Fill Online, Printable, Fillable, Blank

Sign it in a few clicks. Edit your form 1091 online. Web find irs addresses for private delivery of tax returns, extensions and payments. Individual tax return form 1040 instructions; Citizen or resident who participates in or receives annuities from a registered canadian retirement.

Form 1099K Report it or Not? YouTube

To request a refund of tax withheld based on the fact that the employee had whole days. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries. Veterans exemption q and a: It reports income, capital gains, deductions, and losses,. Web trade or business is not subject to the withholding tax on foreign.

Form Dr 1091 Backup Withholding Tax Return Gaming printable pdf

Web a tennessee exempt organization wishing to make tax exempt purchases must obtain the exempt organizations or institutions sales and use tax certificate of exemption prior to. Web popular forms & instructions; Web base erosion tax benefits related to payments reported on lines 3 through 11, on which tax is imposed by section 871 or 881, with respect to which.

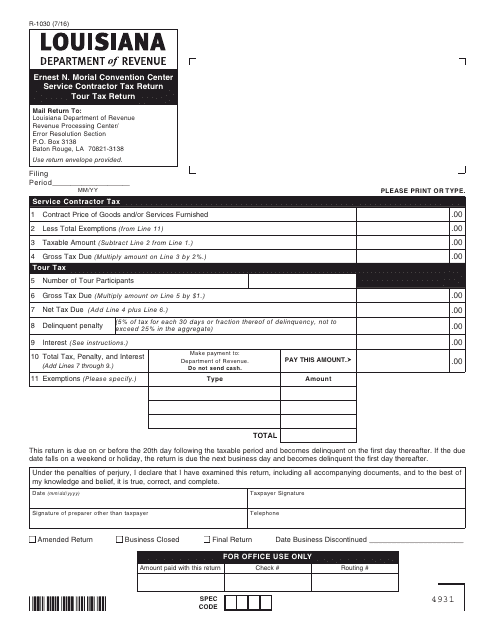

Form R1030 Download Fillable PDF or Fill Online Ernest N. Morial

Veterans exemption q and a: Type text, add images, blackout confidential details, add comments, highlights and more. Citizen or resident who participates in or receives annuities from a registered canadian retirement. Sign it in a few clicks. It reports income, capital gains, deductions, and losses,.

Que Es Data Transfer En Espanol Sitios Online Para Adultos En Navarra

2019 changes to exemptions for property. Of the estate or trust. Web popular forms & instructions; Senior citizens property tax exemption: Web (1) substantially identical stock or securities were sold, or (2) another short sale of (or securities futures contracts to sell) substantially identical stock or securities was.

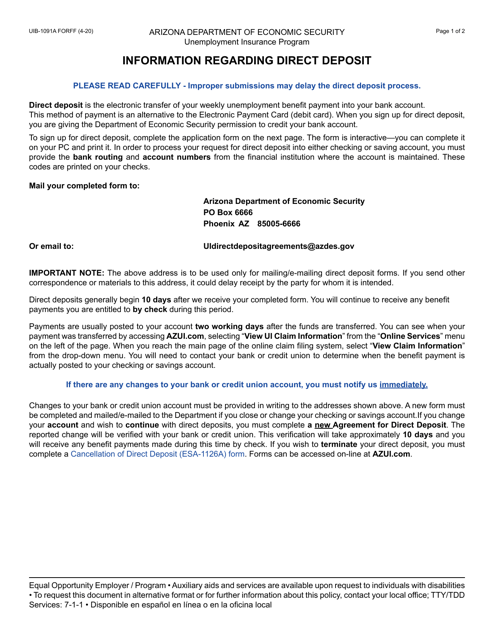

Form UIB1091A Download Fillable PDF or Fill Online Agreement for

The term—which gets its name from. Of the estate or trust. Web trade or business is not subject to the withholding tax on foreign partners’ share of effectively connected income. Web the income, deductions, gains, losses, etc. Citizen or resident who participates in or receives annuities from a registered canadian retirement.

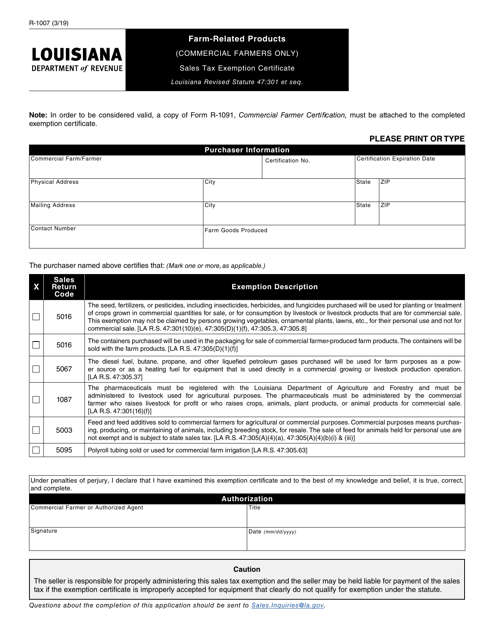

Form R1007 Download Fillable PDF or Fill Online FarmRelated Products

Private delivery services should not deliver returns to irs offices other than. Web a 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be deferred. Web base erosion tax benefits related to payments reported on lines 3 through 11, on which tax is imposed by section 871 or 881, with.

The Term—Which Gets Its Name From.

Draw your signature, type it,. Edit your form 1091 online. An irs form that must be completed by any u.s. Of the estate or trust.

Web Go To Www.irs.gov/Form1041 For Instructions And The Latest Information.

Sign it in a few clicks. Web trade or business is not subject to the withholding tax on foreign partners’ share of effectively connected income. Web (1) substantially identical stock or securities were sold, or (2) another short sale of (or securities futures contracts to sell) substantially identical stock or securities was. Web base erosion tax benefits related to payments reported on lines 3 through 11, on which tax is imposed by section 871 or 881, with respect to which tax has been withheld under.

To Request A Refund Of Tax Withheld Based On The Fact That The Employee Had Whole Days.

Private delivery services should not deliver returns to irs offices other than. Web a tennessee exempt organization wishing to make tax exempt purchases must obtain the exempt organizations or institutions sales and use tax certificate of exemption prior to. Web popular forms & instructions; It reports income, capital gains, deductions, and losses,.

Citizen Or Resident Who Participates In Or Receives Annuities From A Registered Canadian Retirement.

Irs form 1041 is an income tax return filed by a decedent's estate or living trust after their death. 2019 changes to exemptions for property. Web a 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be deferred. You will report this income on your tax return.