1099 K Fillable Form

1099 K Fillable Form - Its purpose is to assist you in reporting your. Save or instantly send your ready documents. Web you should attend this webinar if you accept payment cards or accept payments from third party payment apps and online marketplaces in your small business,. • the form includes the annual gross amount of all reportable. All forms are printable and downloadable. Ad access irs tax forms. In most cases, the payment. Web online fillable copies 1, b, 2, and c. Once completed you can sign your fillable form or send for signing. You can complete these copies.

Its purpose is to assist you in reporting your. All forms are printable and downloadable. Upload, modify or create forms. Complete, edit or print tax forms instantly. Filing requirements for some states might differ. Try it for free now! Once completed you can sign your fillable form or send for signing. You can complete these copies. Web you should attend this webinar if you accept payment cards or accept payments from third party payment apps and online marketplaces in your small business,. Web use fill to complete blank online irs pdf forms for free.

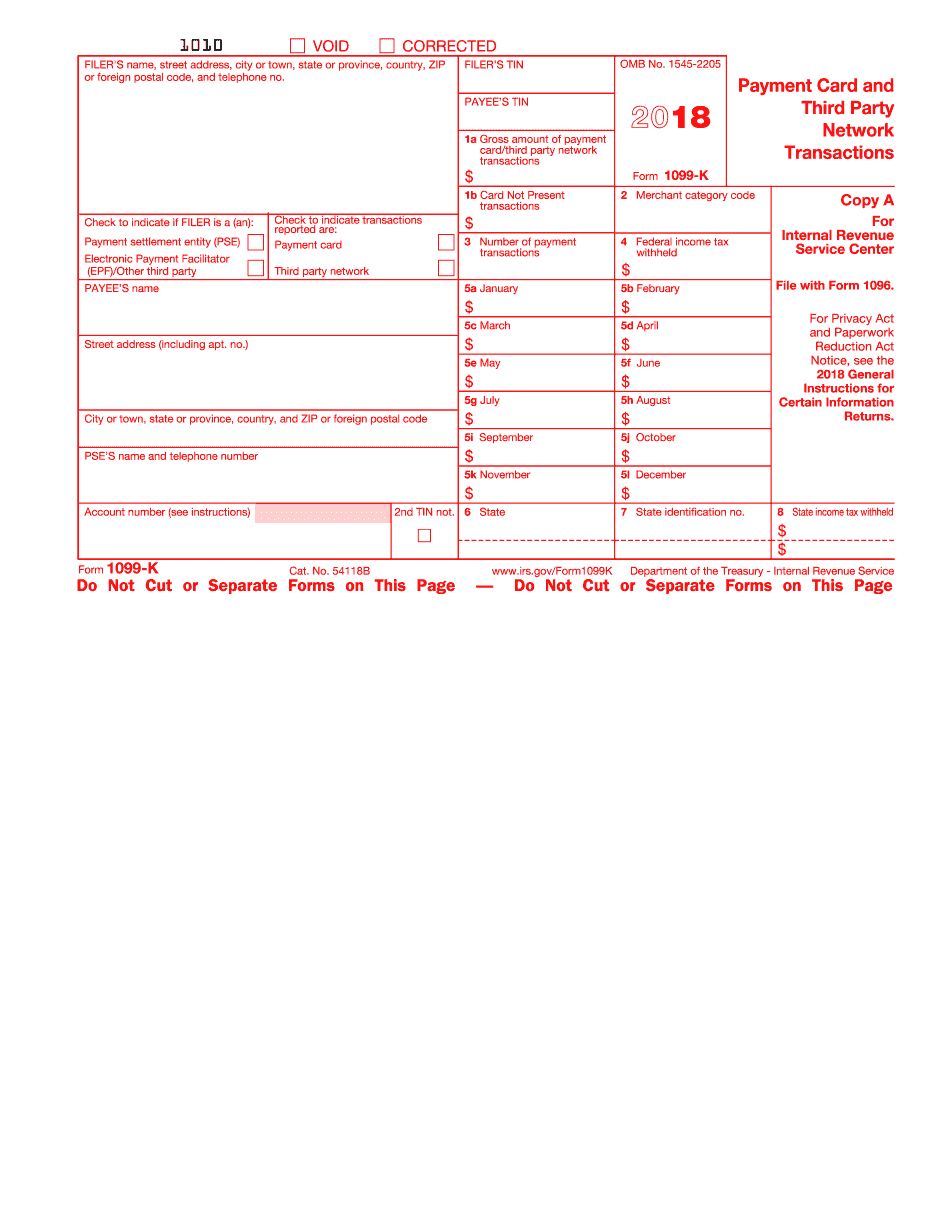

Web use fill to complete blank online irs pdf forms for free. It is a fairly new form that the irs created in 2013. Filing requirements for some states might differ. Ad access irs tax forms. Upload, modify or create forms. In most cases, the payment. The form will be sent to people who have received over $600 in income from online. Save or instantly send your ready documents. All forms are printable and downloadable. Easily fill out pdf blank, edit, and sign them.

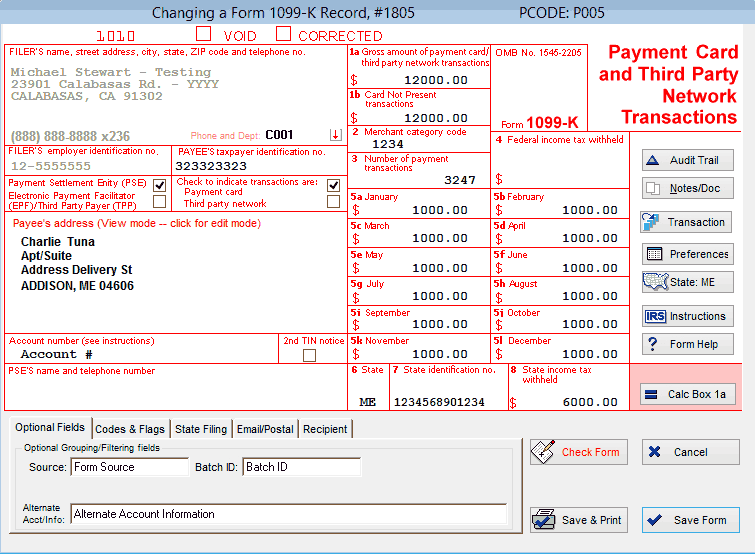

1099K Software for 1099K Reporting Print & eFile 1099K

Once completed you can sign your fillable form or send for signing. Web you should attend this webinar if you accept payment cards or accept payments from third party payment apps and online marketplaces in your small business,. All forms are printable and downloadable. Get ready for tax season deadlines by completing any required tax forms today. Upload, modify or.

What is a 1099K tax form?

Once completed you can sign your fillable form or send for signing. Complete, edit or print tax forms instantly. Web you should attend this webinar if you accept payment cards or accept payments from third party payment apps and online marketplaces in your small business,. Get ready for this year's tax season quickly and safely with pdffiller! Its purpose is.

What Is A 1099? Explaining All Form 1099 Types CPA Solutions

Filing requirements for some states might differ. • the form includes the annual gross amount of all reportable. Try it for free now! Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents.

1099 MISC Form 2022 1099 Forms TaxUni

Once completed you can sign your fillable form or send for signing. Web use fill to complete blank online irs pdf forms for free. You can complete these copies. Save or instantly send your ready documents. Web you should attend this webinar if you accept payment cards or accept payments from third party payment apps and online marketplaces in your.

1099K Software Software to Create, Print and EFile Form 1099K

Get ready for tax season deadlines by completing any required tax forms today. Easily fill out pdf blank, edit, and sign them. Filing requirements for some states might differ. Its purpose is to assist you in reporting your. • the form includes the annual gross amount of all reportable.

1099K Tax Basics General Help Center

All forms are printable and downloadable. • the form includes the annual gross amount of all reportable. Easily fill out pdf blank, edit, and sign them. Web you should attend this webinar if you accept payment cards or accept payments from third party payment apps and online marketplaces in your small business,. Complete, edit or print tax forms instantly.

Form 1099K Fill Online, Printable, Fillable Blank

It is a fairly new form that the irs created in 2013. Easily fill out pdf blank, edit, and sign them. Complete, edit or print tax forms instantly. Filing requirements for some states might differ. Its purpose is to assist you in reporting your.

Understanding Your Form 1099K FAQs for Merchants Clearent

Upload, modify or create forms. Get ready for this year's tax season quickly and safely with pdffiller! All forms are printable and downloadable. Complete, edit or print tax forms instantly. Filing requirements for some states might differ.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

Web you should attend this webinar if you accept payment cards or accept payments from third party payment apps and online marketplaces in your small business,. Try it for free now! Easily fill out pdf blank, edit, and sign them. Once completed you can sign your fillable form or send for signing. Get ready for this year's tax season quickly.

1099 S Fillable Form Form Resume Examples X42M5Ra2kG

Web online fillable copies 1, b, 2, and c. All forms are printable and downloadable. Its purpose is to assist you in reporting your. The form will be sent to people who have received over $600 in income from online. Once completed you can sign your fillable form or send for signing.

Web Online Fillable Copies 1, B, 2, And C.

You can complete these copies. Complete, edit or print tax forms instantly. • the form includes the annual gross amount of all reportable. Its purpose is to assist you in reporting your.

Save Or Instantly Send Your Ready Documents.

Get ready for tax season deadlines by completing any required tax forms today. Try it for free now! Web use fill to complete blank online irs pdf forms for free. All forms are printable and downloadable.

Upload, Modify Or Create Forms.

Once completed you can sign your fillable form or send for signing. Ad access irs tax forms. Get ready for this year's tax season quickly and safely with pdffiller! Web you should attend this webinar if you accept payment cards or accept payments from third party payment apps and online marketplaces in your small business,.

Easily Fill Out Pdf Blank, Edit, And Sign Them.

In most cases, the payment. Filing requirements for some states might differ. The form will be sent to people who have received over $600 in income from online. It is a fairly new form that the irs created in 2013.

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://images.squarespace-cdn.com/content/v1/56f9ad715f43a6d77cb2536a/1553021637842-T52O55S3Z3ILYDIS44PS/ke17ZwdGBToddI8pDm48kCpGfv303rFPf_R2MmpjQDgUqsxRUqqbr1mOJYKfIPR7LoDQ9mXPOjoJoqy81S2I8N_N4V1vUb5AoIIIbLZhVYxCRW4BPu10St3TBAUQYVKcmomqGy8QKumd8_Xi9pibUHb-95JWteCRKkaNKL5Nmf61lF01BYr72PFdZDEdDuE_/what+is+a+1099-k)