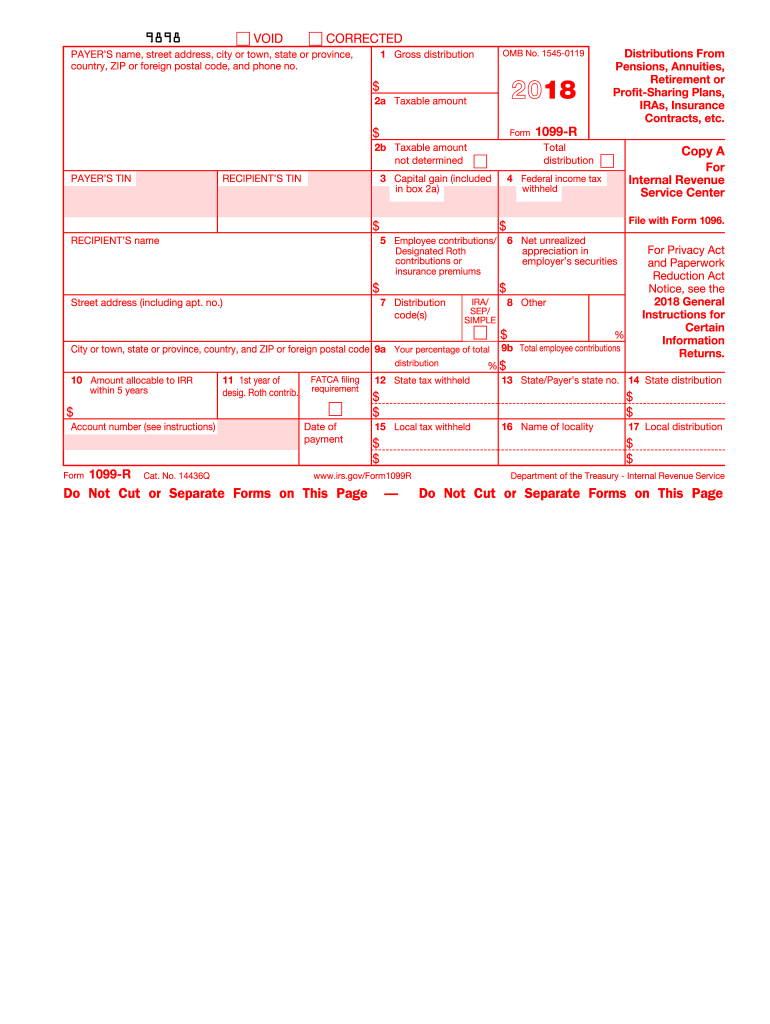

1099 R Blank Form

1099 R Blank Form - Aren't available to you by january 31, 2023, or if your information is incorrect on these forms, contact your employer/payer. Web 1 best answer margaretl expert alumni it is actually very common for a broker/administrator to check the box taxable amount not determined and not have taxable amount filled out. He can also find instructions on completing the template and a completed sample in pdf. See the instructions for your tax return. For privacy act and paperwork reduction act notice, see. Qualified plans and section 403(b) plans. You’ll generally receive one for distributions of $10 or more. All instructions for recipient will also be on one page. Copy a for internal revenue service center. $ for privacy act and paperwork reduction act notice, see the 2023 general instructions for certain information returns.

$ for privacy act and paperwork reduction act notice, see the 2023 general instructions for certain information returns. If the taxable amount isn’t calculated in box 2 the simplified method must be used. Anyone who receives a distribution over $10 should. Copy d and instructions for payer will be removed from the form. He can also find instructions on completing the template and a completed sample in pdf. If your annuity starting date is after 1997, you must use the simplified method to figure your taxable amount if your payer didn’t show the taxable amount in box 2a. All instructions for recipient will also be on one page. Web 1 best answer margaretl expert alumni it is actually very common for a broker/administrator to check the box taxable amount not determined and not have taxable amount filled out. Enter the payer ein, name, and address. You don't have to determine on your own the taxable amount, turbotax will help you with this.

Any individual retirement arrangements (iras). Web for internal revenue service center file with form 1096. All instructions for recipient will also be on one page. If your annuity starting date is after 1997, you must use the simplified method to figure your taxable amount if your payer didn’t show the taxable amount in box 2a. Anyone who receives a distribution over $10 should. Copy a for internal revenue service center. You’ll generally receive one for distributions of $10 or more. For privacy act and paperwork reduction act notice, see. For privacy act and paperwork reduction act notice, see. $ for privacy act and paperwork reduction act notice, see the 2023 general instructions for certain information returns.

Understanding Your Form 1099R (MSRB) Mass.gov

Within 5 years 11 1st year of desig. $ for privacy act and paperwork reduction act notice, see the 2023 general instructions for certain information returns. If the taxable amount isn’t calculated in box 2 the simplified method must be used. Any individual retirement arrangements (iras). Copy a for internal revenue service center.

Where To Get Blank 1099 Misc Forms Form Resume Examples EZVgexk9Jk

Any individual retirement arrangements (iras). Qualified plans and section 403(b) plans. Web 1 best answer margaretl expert alumni it is actually very common for a broker/administrator to check the box taxable amount not determined and not have taxable amount filled out. Aren't available to you by january 31, 2023, or if your information is incorrect on these forms, contact your.

Form 1099R Instructions & Information Community Tax

$ for privacy act and paperwork reduction act notice, see the 2023 general instructions for certain information returns. Enter the payer ein, name, and address. This helps to prevent them from underreporting their taxable income. Anyone who receives a distribution over $10 should. If the taxable amount isn’t calculated in box 2 the simplified method must be used.

2018 Form IRS 1099R Fill Online, Printable, Fillable, Blank pdfFiller

For privacy act and paperwork reduction act notice, see. He can also find instructions on completing the template and a completed sample in pdf. Copy a for internal revenue service center. Within 5 years 11 1st year of desig. For privacy act and paperwork reduction act notice, see.

1099r Blank Form Armando Friend's Template

You don't have to determine on your own the taxable amount, turbotax will help you with this. Copies b, c, and 2 will be on one page. $ for privacy act and paperwork reduction act notice, see the 2023 general instructions for certain information returns. Copy a for internal revenue service center. For privacy act and paperwork reduction act notice,.

Fillable Form 1099 S Form Resume Examples v19xKBO27E

You’ll generally receive one for distributions of $10 or more. Any individual retirement arrangements (iras). See the instructions for your tax return. Copy a for internal revenue service center. This helps to prevent them from underreporting their taxable income.

Eagle Life Tax Form 1099R for Annuity Distribution

For privacy act and paperwork reduction act notice, see. Copy d and instructions for payer will be removed from the form. Any individual retirement arrangements (iras). Enter the payer ein, name, and address. He can also find instructions on completing the template and a completed sample in pdf.

1099r Blank Form Armando Friend's Template

This helps to prevent them from underreporting their taxable income. Aren't available to you by january 31, 2023, or if your information is incorrect on these forms, contact your employer/payer. Copy d and instructions for payer will be removed from the form. 12 fatca filing requirement 13 date of payment cat. You don't have to determine on your own the.

1099 Form Printable 📝 Get IRS Form 1099 Printable for 2021 in PDF

Copy a for internal revenue service center. Aren't available to you by january 31, 2023, or if your information is incorrect on these forms, contact your employer/payer. Any individual retirement arrangements (iras). Within 5 years 11 1st year of desig. Web for internal revenue service center file with form 1096.

What Is A 1099? Explaining All Form 1099 Types CPA Solutions

Copy a for internal revenue service center. Copy a for internal revenue service center. Within 5 years 11 1st year of desig. This helps to prevent them from underreporting their taxable income. If your annuity starting date is after 1997, you must use the simplified method to figure your taxable amount if your payer didn’t show the taxable amount in.

You Don't Have To Determine On Your Own The Taxable Amount, Turbotax Will Help You With This.

For privacy act and paperwork reduction act notice, see. Web for internal revenue service center file with form 1096. Any individual retirement arrangements (iras). If your annuity starting date is after 1997, you must use the simplified method to figure your taxable amount if your payer didn’t show the taxable amount in box 2a.

Anyone Who Receives A Distribution Over $10 Should.

If the taxable amount isn’t calculated in box 2 the simplified method must be used. Aren't available to you by january 31, 2023, or if your information is incorrect on these forms, contact your employer/payer. See the instructions for your tax return. $ for privacy act and paperwork reduction act notice, see the 2023 general instructions for certain information returns.

Copy A For Internal Revenue Service Center.

Copies b, c, and 2 will be on one page. Qualified plans and section 403(b) plans. Web 1 best answer margaretl expert alumni it is actually very common for a broker/administrator to check the box taxable amount not determined and not have taxable amount filled out. Within 5 years 11 1st year of desig.

This Helps To Prevent Them From Underreporting Their Taxable Income.

Enter the payer ein, name, and address. Copy a for internal revenue service center. 12 fatca filing requirement 13 date of payment cat. For privacy act and paperwork reduction act notice, see.