12009 Irs Form

12009 Irs Form - Web according to the irs website, you can dispute a tax bill by notifying the irs supervisor within 30 days of receiving the bill and then completing form 12009. ( to obtain a copy of a form, instruction, or publication) address to mail form to irs: ' see instructions on back. You can respond to appeal a disagreement to a form 4549 adjustment. You can no longer efile this tax form for tax year 2009 (jan. Individual income tax return 2009. Web the tips below can help you fill out form 12009 easily and quickly: Taxformfinder provides printable pdf copies of 775 current federal income tax forms. Web page 22 actual october estimated july 2021‐22 2022‐23 2022‐23 2023‐24 tennessee state university unrestricted detailed budget proposals ‐. Internal revenue service (99) ' attach to form 1040a or 1040.

( to obtain a copy of a form, instruction, or publication) address to mail form to irs: Taxformfinder provides printable pdf copies of 775 current federal income tax forms. After you determine you meet the criteria for an appeal, ( considering an appeal) you may request an appeal by filing a written protest. ' see instructions on back. Web addresses for forms beginning with the number 1. Pdf use our library of forms. Web requesting an appeal. It is required to be filed by organizations that have not. Individual income tax return 2009. 31, 2009) you can complete.

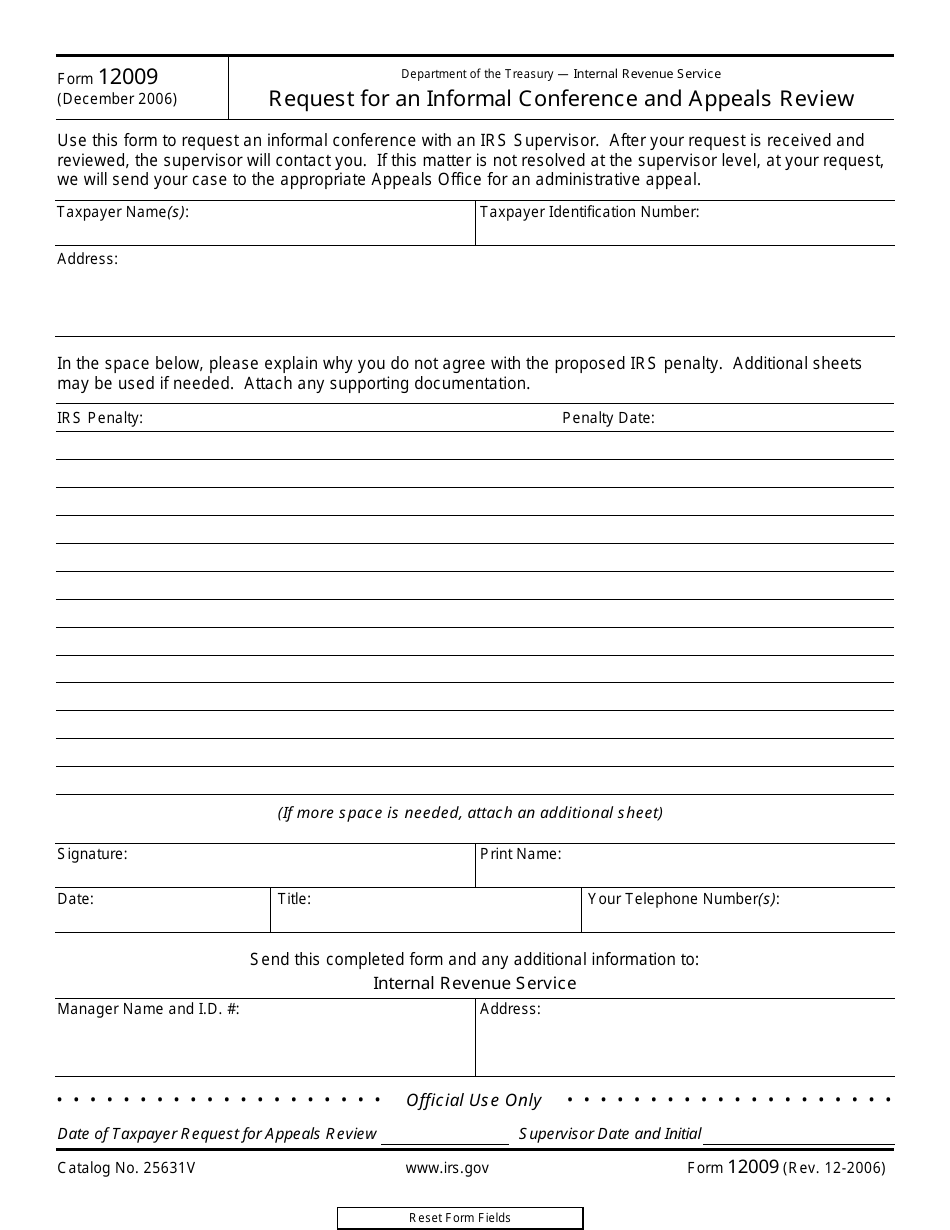

Web all 2009 irs tax forms, instructions & notices quick jump to: 31, 2009) you can complete. Individual income tax return 2009. Main tax forms, instructions, & tax tables | main 1040 & 1040a schedules other 1040 series tax. Web page 22 actual october estimated july 2021‐22 2022‐23 2022‐23 2023‐24 tennessee state university unrestricted detailed budget proposals ‐. Web according to the irs website, you can dispute a tax bill by notifying the irs supervisor within 30 days of receiving the bill and then completing form 12009. You can respond to appeal a disagreement to a form 4549 adjustment. Web form 12009 department of the treasury — internal revenue service (december 2006) request for an informal conference and appeals review use this form to request an. Internal revenue service (99) ' attach to form 1040a or 1040. Request for an informal conference and appeals review.

Irs Form 1040x 2018 All Are Here

You can respond to appeal a disagreement to a form 4549 adjustment. Request for an informal conference and appeals review. ( to obtain a copy of a form, instruction, or publication) address to mail form to irs: The current tax year is 2022, and most. 31, 2009) you can complete.

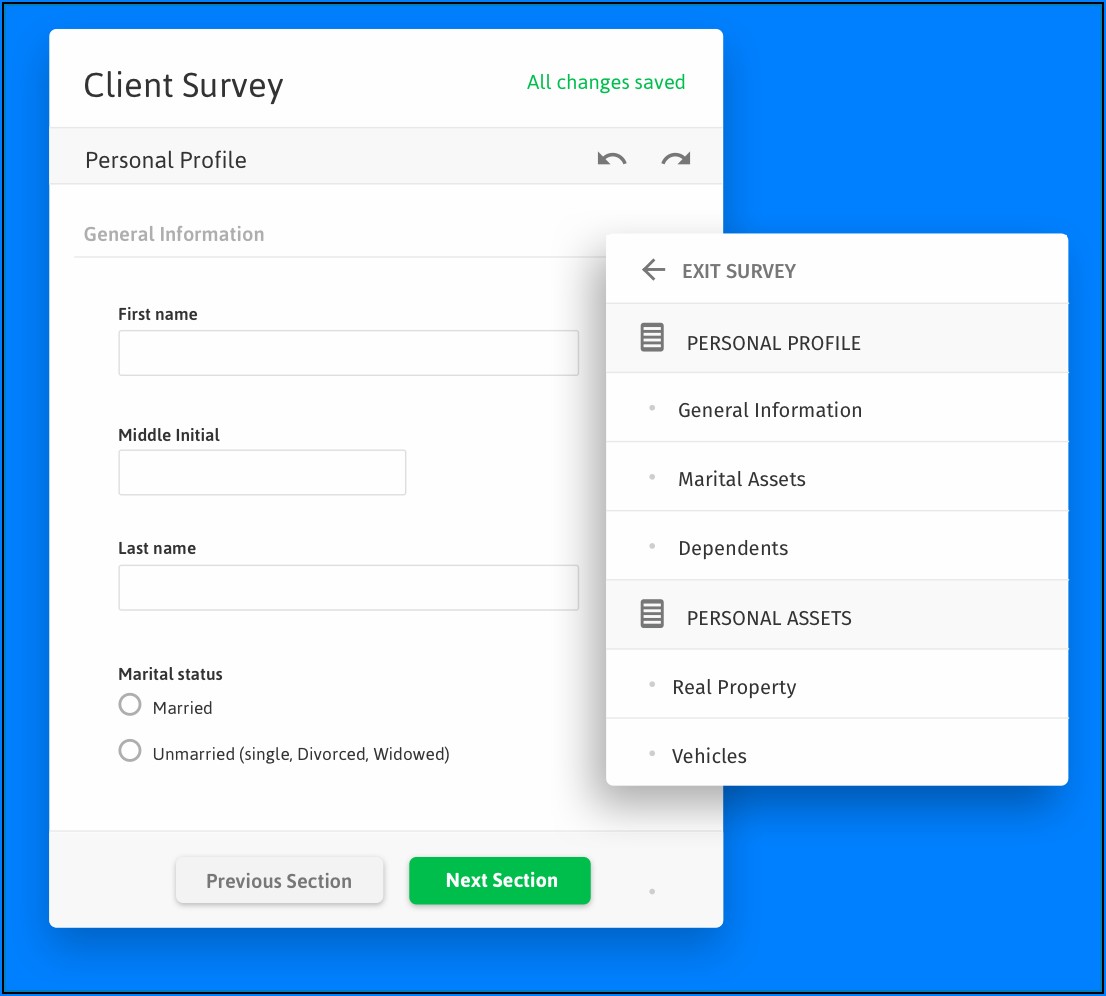

Fillable Form 12009 Request For An Informal Conference And Appeals

Web form 12009 (december 2006) department of the treasury — internal revenue service request for an informal conference and appeals review use this form to request an. Web form 12009 department of the treasury — internal revenue service (december 2006) request for an informal conference and appeals review use this form to request an. Taxformfinder provides printable pdf copies of.

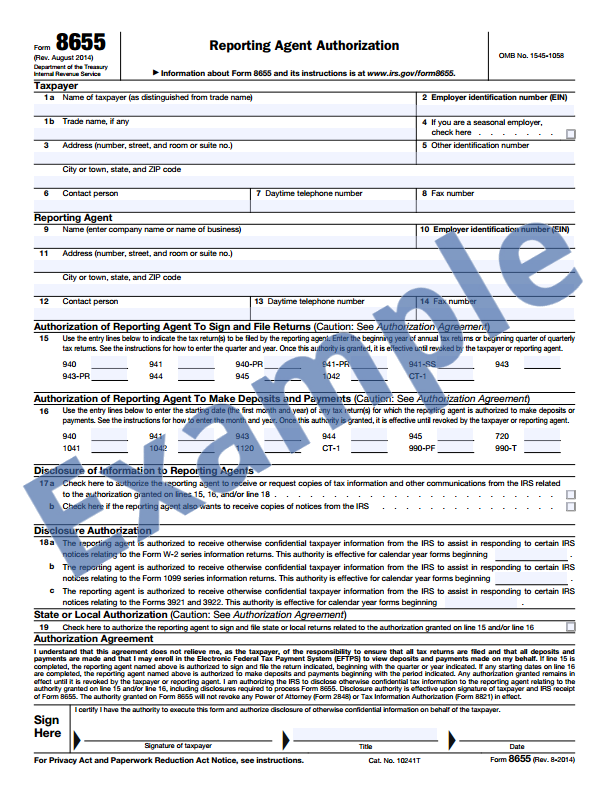

Irs Ein Form Copy Universal Network

Main tax forms, instructions, & tax tables | main 1040 & 1040a schedules other 1040 series tax. Web the f12009 form 12009 (rev. Pdf use our library of forms. The current tax year is 2022, and most. Web addresses for forms beginning with the number 1.

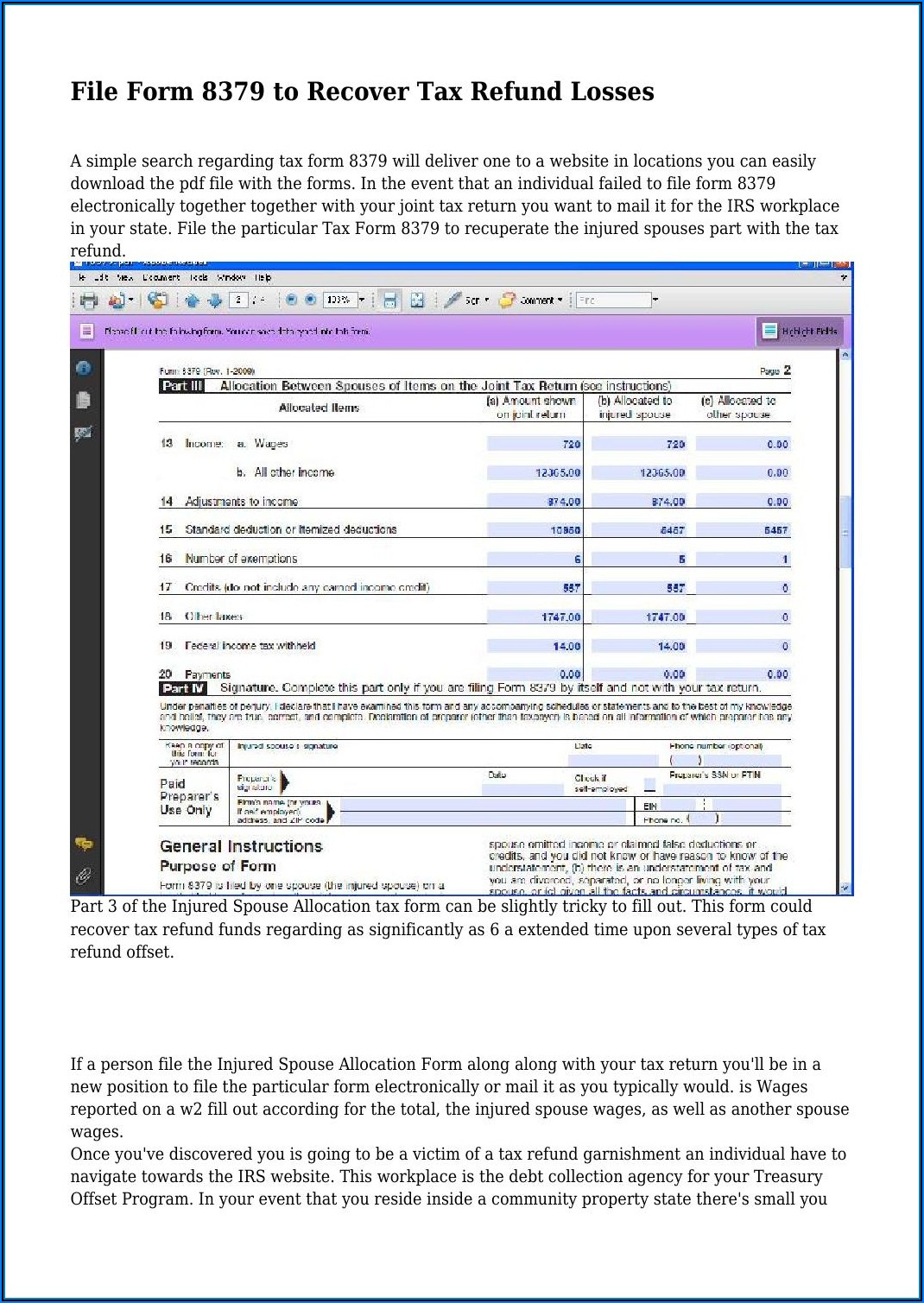

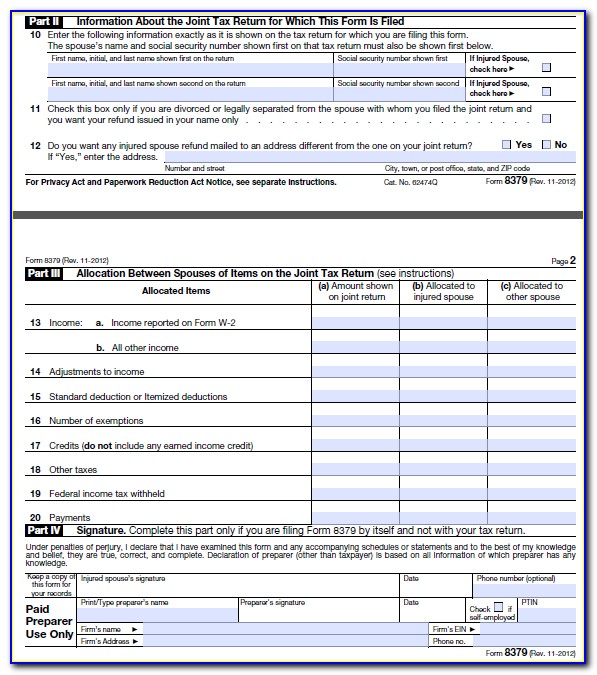

Irs Form 8379 Electronically Universal Network

After you determine you meet the criteria for an appeal, ( considering an appeal) you may request an appeal by filing a written protest. Web all 2009 irs tax forms, instructions & notices quick jump to: Web requesting an appeal. Web form 12009 department of the treasury — internal revenue service (december 2006) request for an informal conference and appeals.

Irs Form 8379 Pdf Form Resume Examples 3q9JkkdgYA

It is required to be filed by organizations that have not. You can no longer efile this tax form for tax year 2009 (jan. Web all 2009 irs tax forms, instructions & notices quick jump to: Taxformfinder provides printable pdf copies of 775 current federal income tax forms. Web federal irs income tax form for tax year 2009 (1/1.

IRS Form 12009 Download Fillable PDF or Fill Online Request for an

Web addresses for forms beginning with the number 1. After you determine you meet the criteria for an appeal, ( considering an appeal) you may request an appeal by filing a written protest. Web form 12009 department of the treasury — internal revenue service (december 2006) request for an informal conference and appeals review use this form to request an..

Funny Programs Network IRS FORM 8655 FREE DOWNLOAD

Web the tips below can help you fill out form 12009 easily and quickly: Main tax forms, instructions, & tax tables | main 1040 & 1040a schedules other 1040 series tax. You can respond to appeal a disagreement to a form 4549 adjustment. Web agent x revealed − and he's a democrat. Web the f12009 form 12009 (rev.

Irs Form 8379 Injured Spouse Allocation Form Resume Examples

The current tax year is 2022, and most. Web all 2009 irs tax forms, instructions & notices quick jump to: You can no longer efile this tax form for tax year 2009 (jan. Taxformfinder provides printable pdf copies of 775 current federal income tax forms. Web federal irs income tax form for tax year 2009 (1/1/2009‐12/31/2009).

Irs Form 8379 File Online Universal Network

Web according to the irs website, you can dispute a tax bill by notifying the irs supervisor within 30 days of receiving the bill and then completing form 12009. Also, see you can use the 2009 standard deductionsocial security numbers. Taxformfinder provides printable pdf copies of 775 current federal income tax forms. Individual income tax return 2009. ( to obtain.

How To Complete Irs Form 8379 Form Resume Examples aEDvmqAk1Y

Web the tips below can help you fill out form 12009 easily and quickly: Taxformfinder provides printable pdf copies of 775 current federal income tax forms. Department of the treasury—internal revenue service omb no. It is required to be filed by organizations that have not. You can respond to appeal a disagreement to a form 4549 adjustment.

Department Of The Treasury—Internal Revenue Service Omb No.

Web addresses for forms beginning with the number 1. Web page 22 actual october estimated july 2021‐22 2022‐23 2022‐23 2023‐24 tennessee state university unrestricted detailed budget proposals ‐. It is required to be filed by organizations that have not. You can respond to appeal a disagreement to a form 4549 adjustment.

Individual Income Tax Return 2009.

Web form 12009 department of the treasury — internal revenue service (december 2006) request for an informal conference and appeals review use this form to request an. Web agent x revealed − and he's a democrat. Complete the required boxes which are. The current tax year is 2022, and most.

Main Tax Forms, Instructions, & Tax Tables | Main 1040 & 1040A Schedules Other 1040 Series Tax.

( to obtain a copy of a form, instruction, or publication) address to mail form to irs: Web requesting an appeal. 31, 2009) you can complete. Web the f12009 form 12009 (rev.

You Can No Longer Efile This Tax Form For Tax Year 2009 (Jan.

Pdf use our library of forms. Web federal irs income tax form for tax year 2009 (1/1/2009‐12/31/2009) you can no longer efile this tax form for tax year 2009 (jan. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. ' see instructions on back.