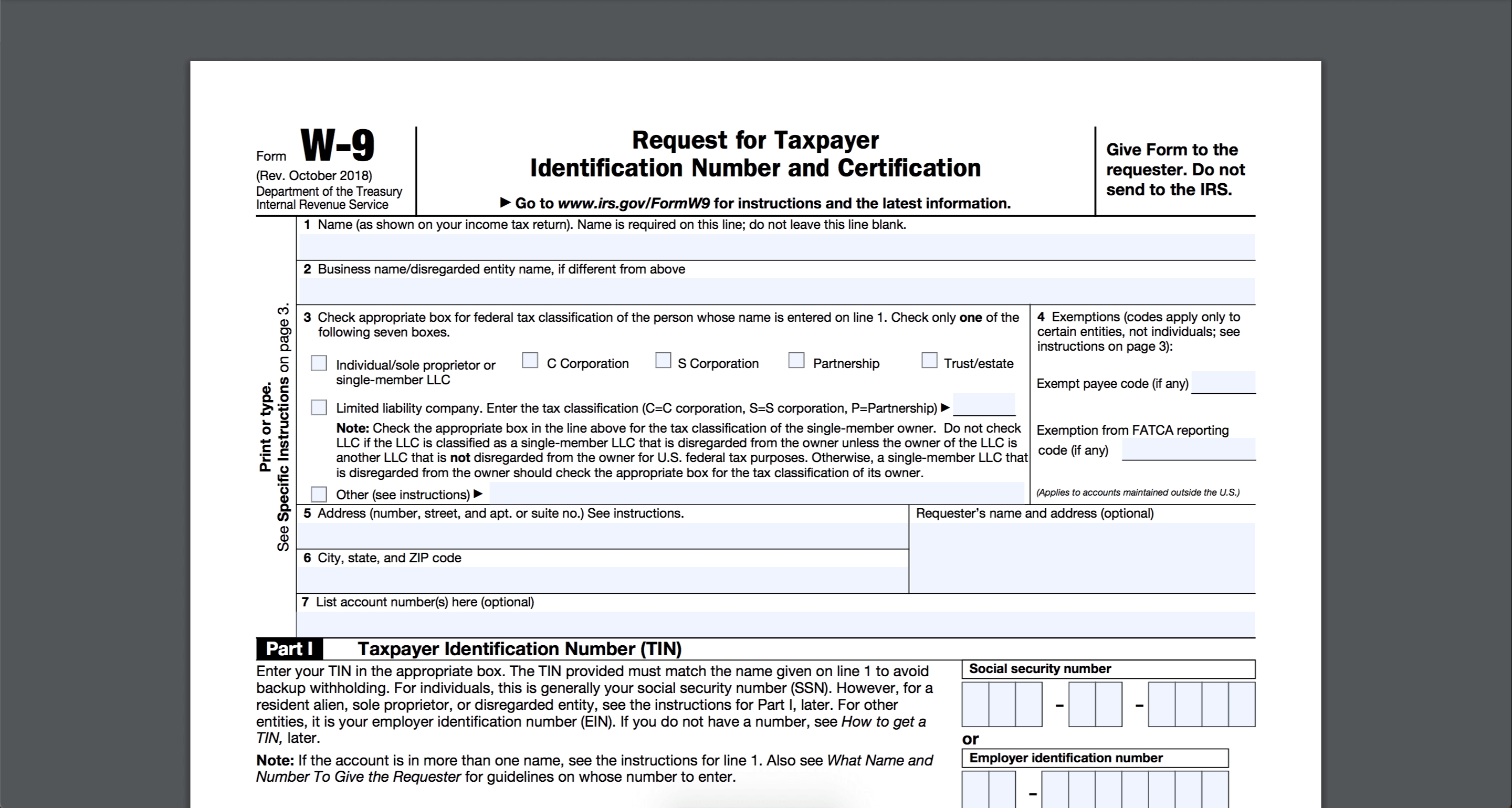

2017 W 9 Printable Form

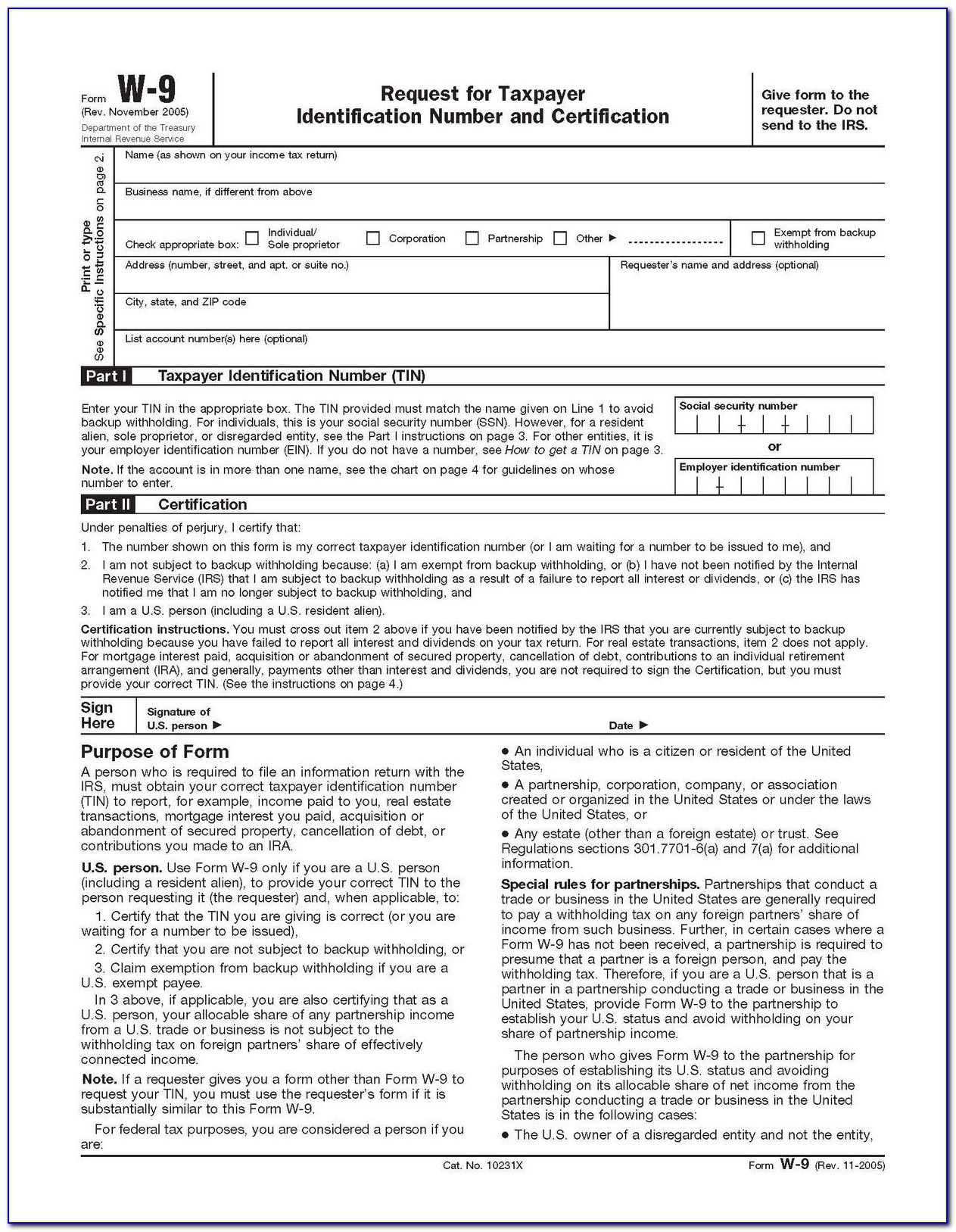

2017 W 9 Printable Form - Name (as shown on your income tax return). Do not send to the irs. Request for taxpayer identification number and certification. Or by state employees who are seeking reimbursement. Exempt recipients to overcome a presumption of foreign status. Once completed you can sign your fillable form or send for signing. Save or instantly send your ready documents. Name (as shown on your income tax return). Web this form is used to provide the correct taxpayer identification number (tin) to the person who is required to file an information return with the irs to report, for example: November 2017) department of the treasury internal revenue service.

November 2017) department of the treasury internal revenue service. Owner of a disregarded entity and not the entity, December 2014) department of the treasury internal revenue service. Name (as shown on your income tax return). If you have changed your last name without informing the social security Exempt recipients to overcome a presumption of foreign status. Name (as shown on your income tax return). November 2017) department of the treasury internal revenue service. Web western university of health sciences Request for taxpayer identification number and certification.

Or by state employees who are seeking reimbursement. This includes citizens and noncitizens. Easily fill out pdf blank, edit, and sign them. December 2014) department of the treasury internal revenue service. Do not send to the irs. Name (as shown on your income tax return). Internal revenue service go to www.irs.gov/formw9 for instructions and the latest information. Give form to the requester. Person (including a resident alien) and to request certain certifications and claims for exemption. Web western university of health sciences

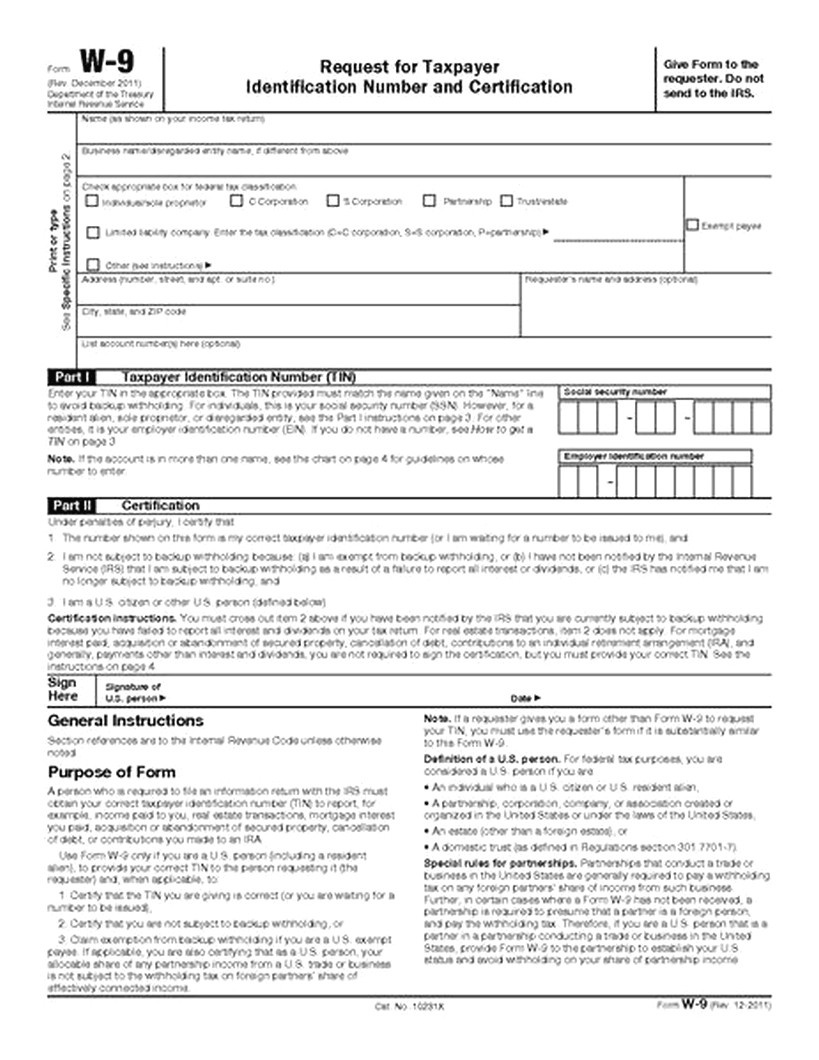

Blank Printable W9 Form Calendar Template Printable

All forms are printable and downloadable. Web this form is used to provide the correct taxpayer identification number (tin) to the person who is required to file an information return with the irs to report, for example: Do not send to the irs. Or by state employees who are seeking reimbursement. Do not send to the irs.

W9 Form Printable 2017 Free Free Printable A to Z

Request for taxpayer identification number and certification. Exempt recipients to overcome a presumption of foreign status. November 2017) department of the treasury internal revenue service. Once completed you can sign your fillable form or send for signing. Give form to the requester.

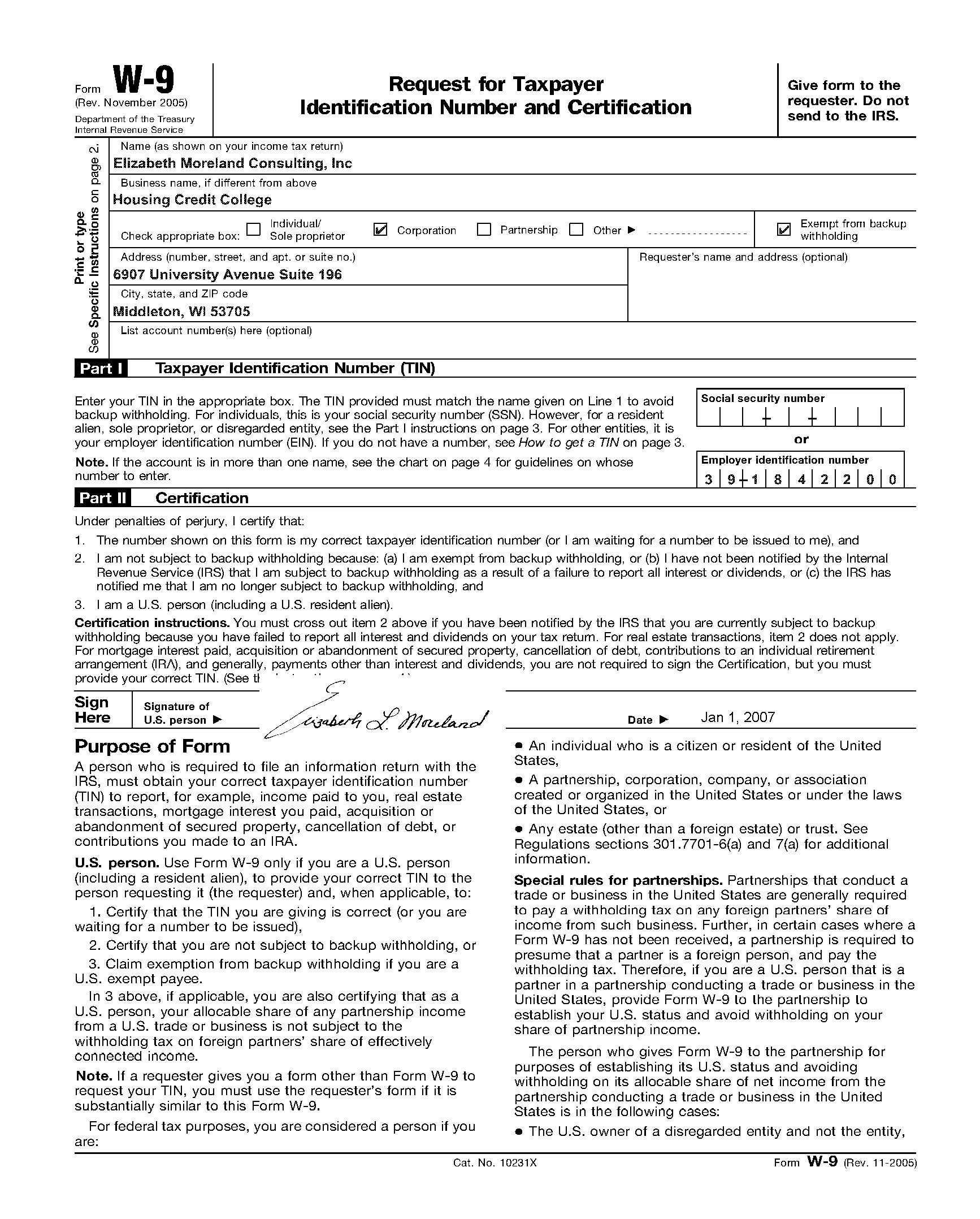

W9 Usa Federal Tax Form throughout Free W 9 Blank Form Calendar

Printing and scanning is no longer the best way to manage documents. Give form to the requester. Save or instantly send your ready documents. See what is backup withholding later. Do not send to the irs.

Blank W 9 Printable Form Template Calendar Printable Free

Name is required on this line; And contributions to an ira. Request for taxpayer identification number and certification. Owner of a disregarded entity and not the entity, Also see special rules for partnerships earlier.

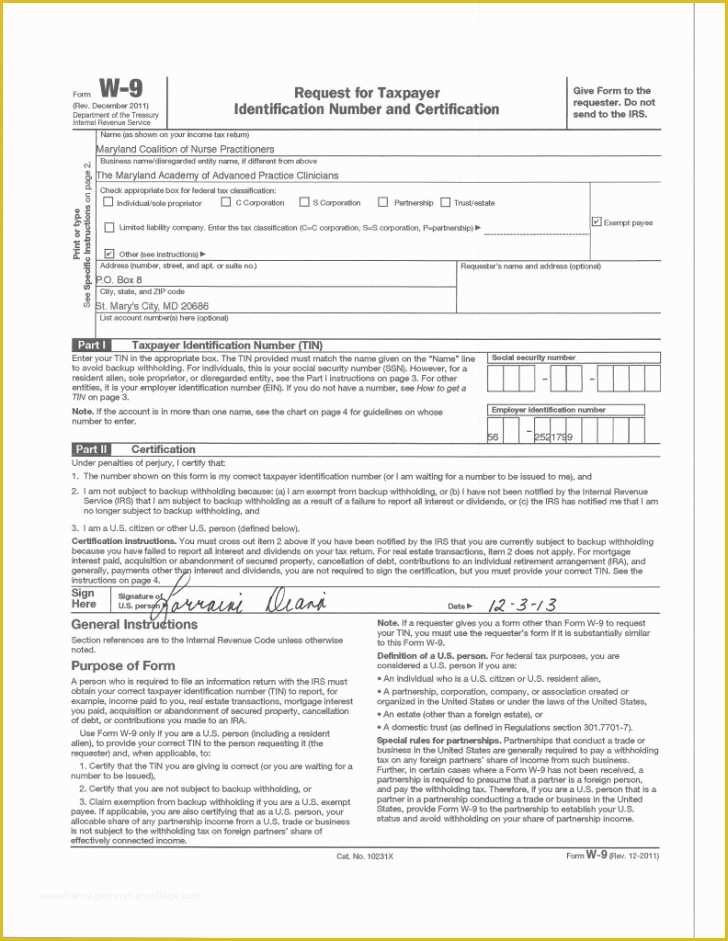

Blank W 9 Forms Printable Example Calendar Printable

Web this form is used to provide the correct taxpayer identification number (tin) to the person who is required to file an information return with the irs to report, for example: Exempt recipients to overcome a presumption of foreign status. Easily fill out pdf blank, edit, and sign them. Once completed you can sign your fillable form or send for.

Free 2016 W2 Template Of Printable W 9 Tax form 2017 W 9 form

Name (as shown on your income tax return). If you have changed your last name without informing the social security Easily fill out pdf blank, edit, and sign them. Name (as shown on your income tax return). Exempt recipients to overcome a presumption of foreign status.

Fillable And Printable W 9 Form Form Resume Examples

This includes citizens and noncitizens. Create custom documents by adding smart fillable fields. Once completed you can sign your fillable form or send for signing. Owner of a disregarded entity and not the entity, Generally, enter the name shown on your tax return.

Free Printable W 9 Forms Calendar Template Printable Monthly Yearly

Status and avoiding withholding on its allocable share of net income from the partnership conducting a trade or business in the united states is in the following cases: Create custom documents by adding smart fillable fields. Do not send to the irs. Name (as shown on your income tax return). November 2017) identification number and certification requester.

Downloadable Form W 9 Printable W9 In 2020 Doctors Note inside Free

Give form to the requester. Request for taxpayer identification number and certification. November 2017) identification number and certification requester. For instructions and the latest information. Exempt recipients to overcome a presumption of foreign status.

W9 Form Printable 2017 Free Free Printable

For instructions and the latest information. Give form to the requester. And contributions to an ira. Internal revenue service go to www.irs.gov/formw9 for instructions and the latest information. Person (including a resident alien) and to request certain certifications and claims for exemption.

Acquisition Or Abandonment Of Secured Property;

Easily fill out pdf blank, edit, and sign them. Name (as shown on your income tax return). This includes citizens and noncitizens. Create custom documents by adding smart fillable fields.

Web Western University Of Health Sciences

For instructions and the latest information. Exempt recipients to overcome a presumption of foreign status. Save or instantly send your ready documents. For instructions and the latest information.

Or By State Employees Who Are Seeking Reimbursement.

Owner of a disregarded entity and not the entity, Do not send to the irs. See what is backup withholding later. Person (including a resident alien) and to request certain certifications and claims for exemption.

Do Not Send To The Irs.

Do not send to the irs. Request for taxpayer identification number and certification. All forms are printable and downloadable. Give form to the requester.