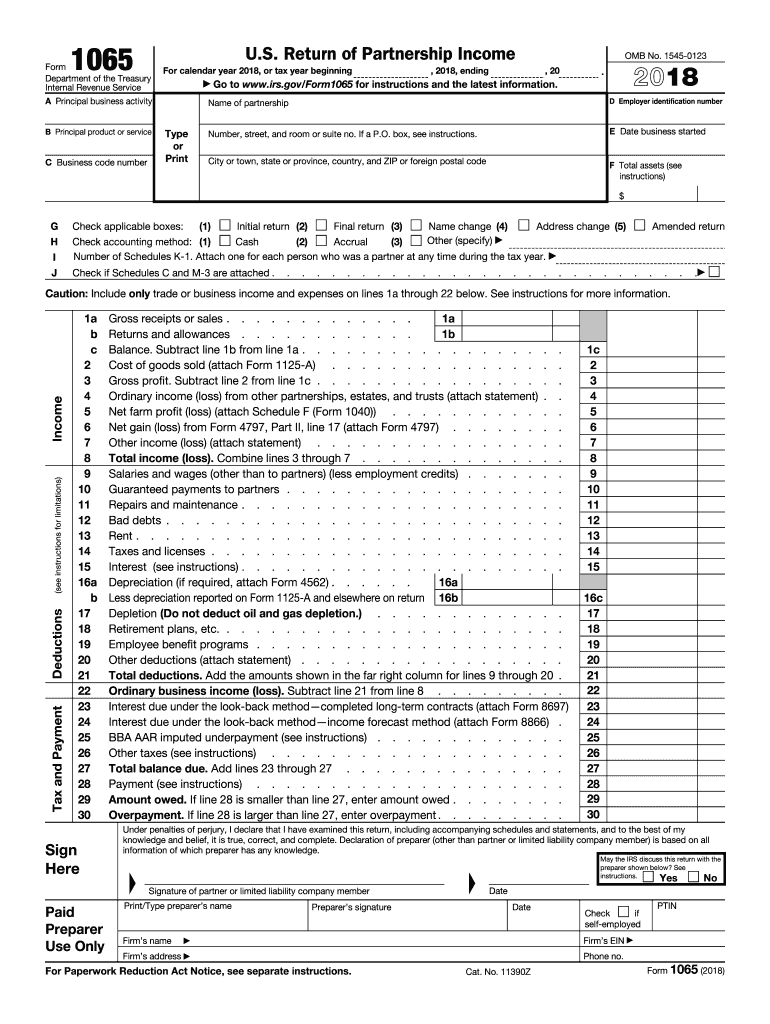

2018 Form 1065

2018 Form 1065 - 9839), the partnership may designate any person (as defined in sec. Essentially, this meant the irs would implement cpar in 2020, which is when 2018. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Web the irs first tightened the requirements with new instructions for reporting negative tax basis capital accounts on the 2018 form 1065. Ad download or email irs 1065 & more fillable forms, register and subscribe now! The irs sought to expand. An aar by a partnership making an election into the. Web back to news. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest.

Web form 1065 2022 u.s. 9839), the partnership may designate any person (as defined in sec. Alabama, district of columbia, kentucky, maine, new jersey,. Essentially, this meant the irs would implement cpar in 2020, which is when 2018. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Ad download or email irs 1065 & more fillable forms, register and subscribe now! 7701 (a) (1)), including an. Web back to news. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web form 1065 (1998) page 2 cost of goods sold (see page 14 of the instructions) 1 inventory at beginning of year 1 2 purchases less cost of items withdrawn for personal use 2 3.

Therefore, starting january 2019, you can. Alabama, district of columbia, kentucky, maine, new jersey,. Essentially, this meant the irs would implement cpar in 2020, which is when 2018. The irs sought to expand. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Web a 1065 form is the annual us tax return filed by partnerships. Web the bba dictated that cpar was first mandatory for the 2018 form 1065. Web tefra partnership (form 1065). 7701 (a) (1)), including an.

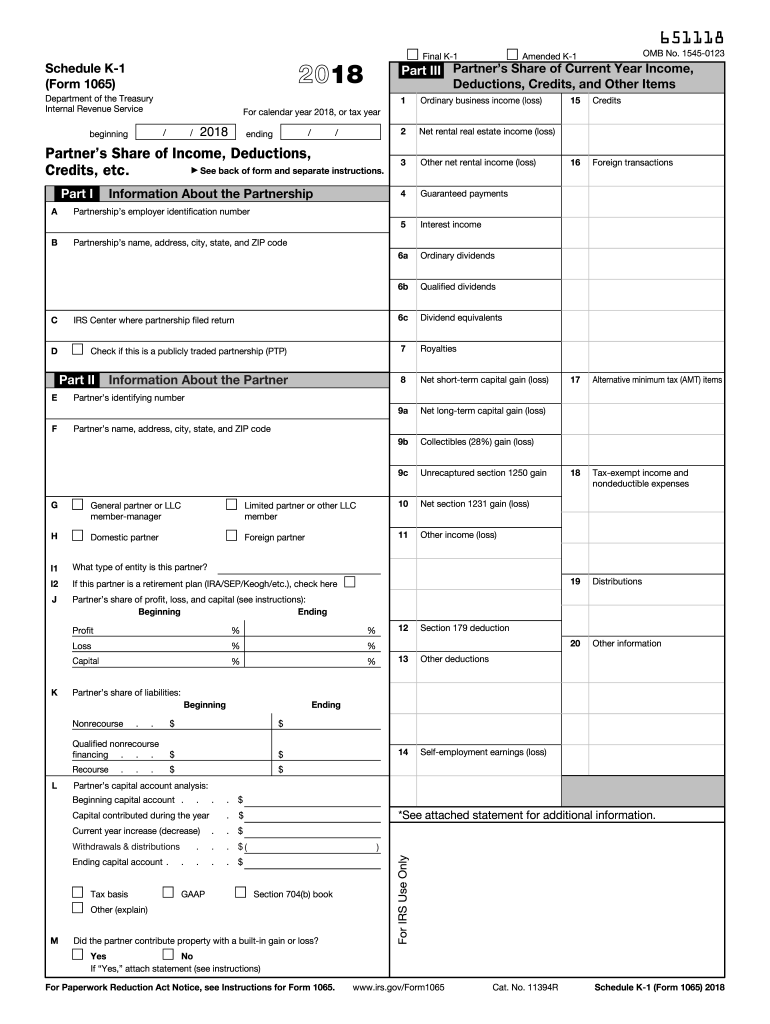

IRS 1065 Schedule K1 2018 Fill out Tax Template Online US Legal

6223 and the recently issued final regulations (t.d. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest. The irs sought to expand. An aar by a partnership making an election into the. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs.

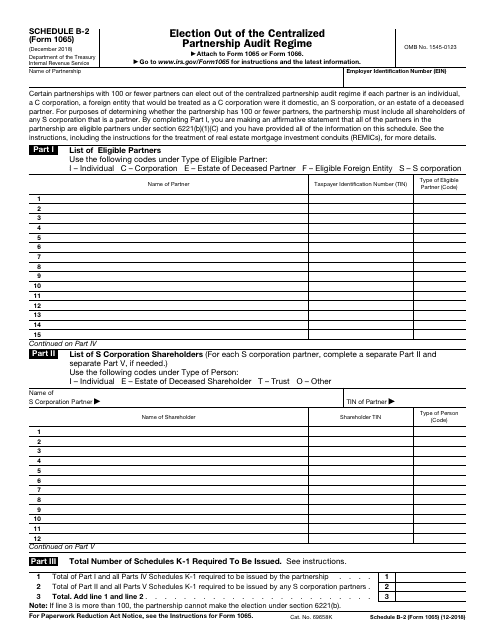

IRS Form 1065 Schedule B2 Download Fillable PDF or Fill Online

Web the irs first tightened the requirements with new instructions for reporting negative tax basis capital accounts on the 2018 form 1065. Alabama, district of columbia, kentucky, maine, new jersey,. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest. 6223 and the recently issued final regulations (t.d. Filed and the.

Form 8 Who Must Sign The Biggest Contribution Of Form 8 Who Must Sign

Or getting income from u.s. Web generally speaking, a domestic partnership must file irs form 1065 by the 15 th day of the 3 rd month following the date its tax year ended. Web the bba dictated that cpar was first mandatory for the 2018 form 1065. Ad download or email irs 1065 & more fillable forms, register and subscribe.

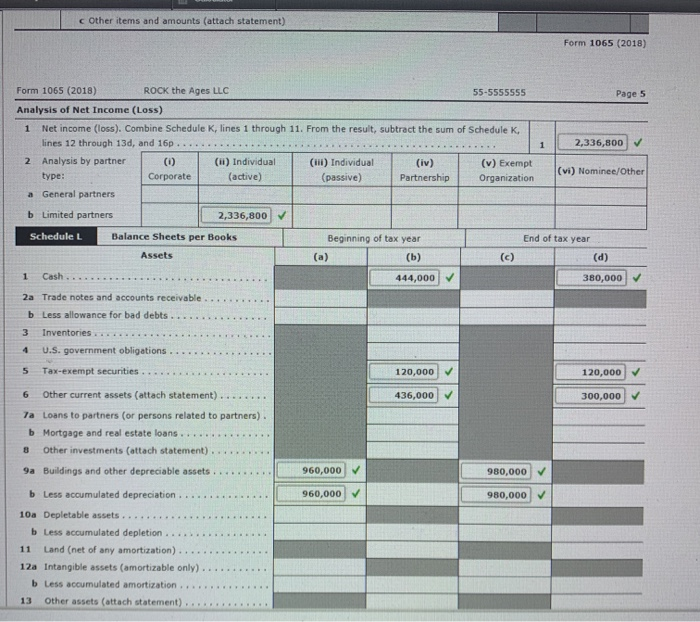

Ryan Ross (111111112), Oscar Omega (222222223),

Web form 1065 2022 u.s. Web generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top of form 1065. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web for example, for tax year 2018, these returns.

form 1065x 2018 2020 Fill Online, Printable, Fillable Blank form

Web the irs this week posted and released an updated 2018 instructions for form 1065, removinga requirement to provide the taxpayer identification number (tin) partnership’s. Web a 1065 form is the annual us tax return filed by partnerships. Or getting income from u.s. Web form 1065 2022 u.s. Therefore, starting january 2019, you can.

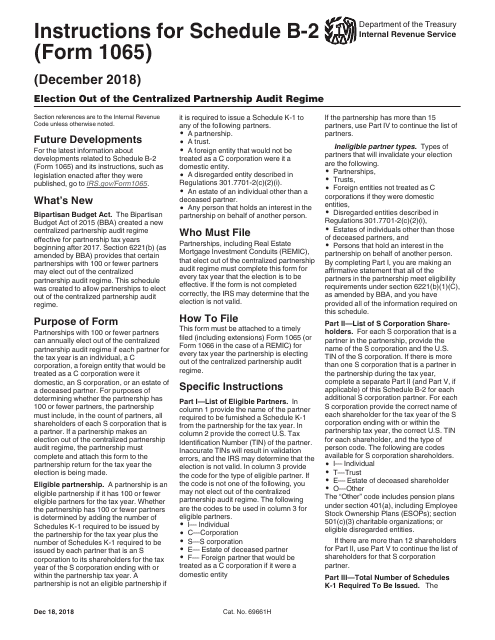

Download Instructions for IRS Form 1065 Schedule B2 Election out of

Web bba partnerships under examination, as well as those that already have filed aars for 2018, 2019, or 2020, are eligible to file an amended form 1065 and schedule. An aar by a partnership making an election into the. For example, the due date for form. Essentially, this meant the irs would implement cpar in 2020, which is when 2018..

2018 Form IRS 1065 Fill Online, Printable, Fillable, Blank PDFfiller

Essentially, this meant the irs would implement cpar in 2020, which is when 2018. An aar by a partnership making an election into the. The irs sought to expand. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web a 1065 form is the annual us tax return filed by partnerships.

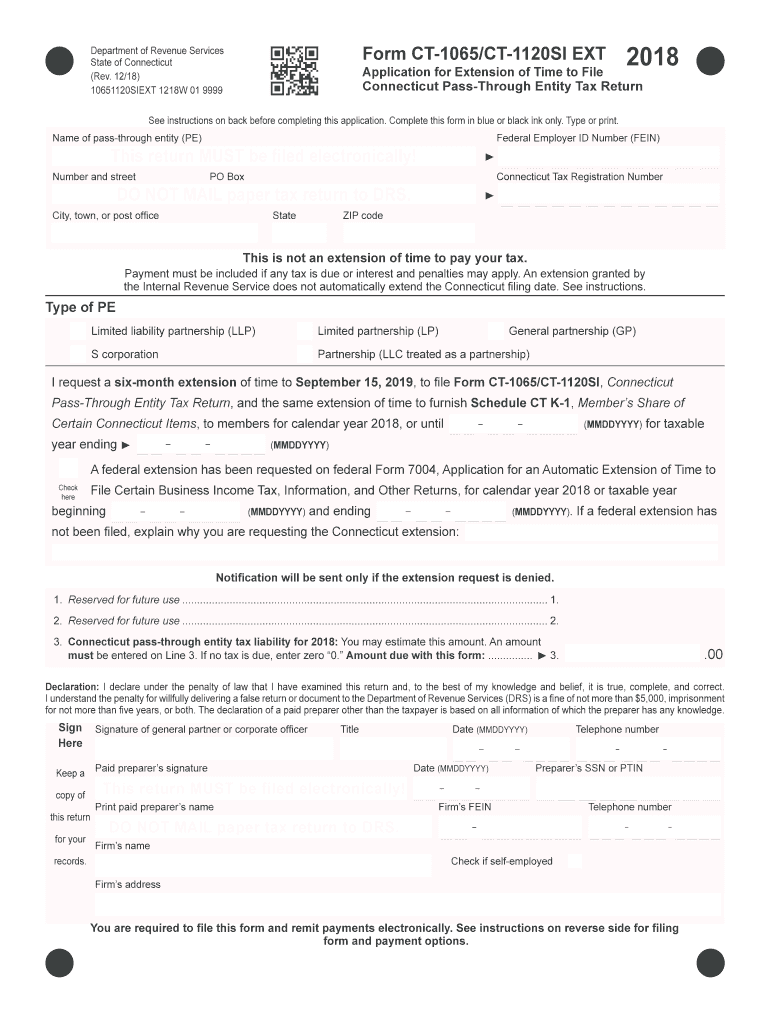

Ct 1065 Instructions 2019 Fill Out and Sign Printable PDF Template

It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Web a 1065 form is the annual us tax return filed by partnerships. Web generally speaking, a domestic partnership must file irs.

How To Complete Form 1065 With Instructions

Alabama, district of columbia, kentucky, maine, new jersey,. For example, the due date for form. 7701 (a) (1)), including an. Essentially, this meant the irs would implement cpar in 2020, which is when 2018. The irs sought to expand.

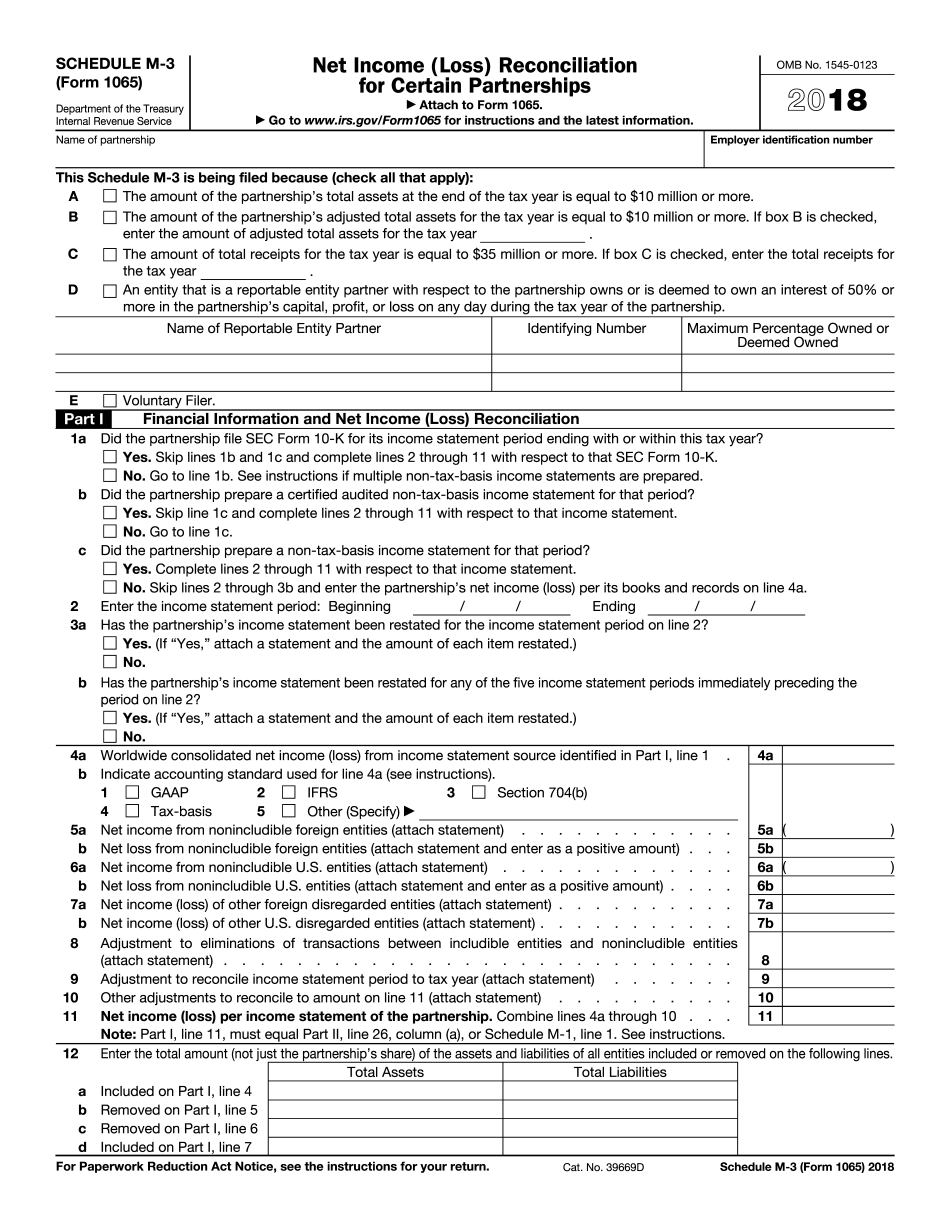

IRS Form 1065 (Schedule M3) 2018 2019 Fill out and Edit Online PDF

Web generally speaking, a domestic partnership must file irs form 1065 by the 15 th day of the 3 rd month following the date its tax year ended. Web back to news. The irs supports the current year and two prior tax years for regular, superseded, or amended electronic returns. Therefore, starting january 2019, you can. 6223 and the recently.

The Irs Supports The Current Year And Two Prior Tax Years For Regular, Superseded, Or Amended Electronic Returns.

Ad download or email irs 1065 & more fillable forms, register and subscribe now! Or getting income from u.s. Therefore, starting january 2019, you can. Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s.

An Aar By A Partnership Making An Election Into The.

Alabama, district of columbia, kentucky, maine, new jersey,. Web tefra partnership (form 1065). 7701 (a) (1)), including an. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest.

6223 And The Recently Issued Final Regulations (T.d.

Web form 1065 2022 u.s. 9839), the partnership may designate any person (as defined in sec. Web back to news. Essentially, this meant the irs would implement cpar in 2020, which is when 2018.

Ad File Partnership And Llc Form 1065 Fed And State Taxes With Taxact® Business.

It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Filed and the partnership has (1) a partner that is a missouri resident. Web bba partnerships under examination, as well as those that already have filed aars for 2018, 2019, or 2020, are eligible to file an amended form 1065 and schedule. Web generally speaking, a domestic partnership must file irs form 1065 by the 15 th day of the 3 rd month following the date its tax year ended.