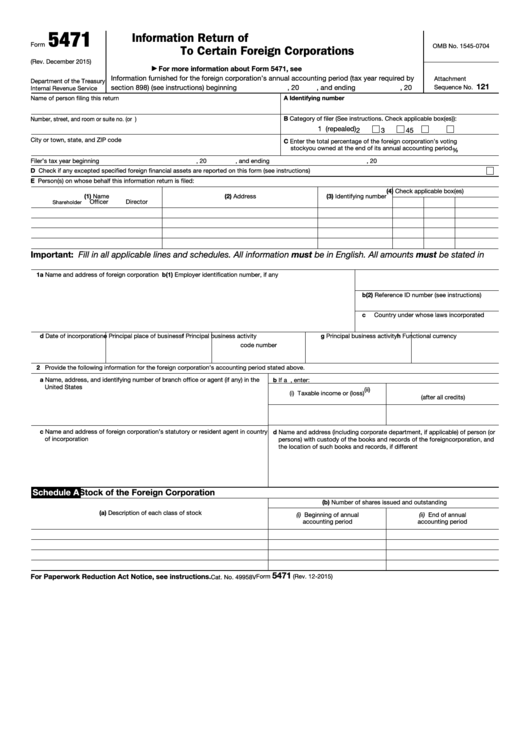

2019 Form 5471 Instructions

2019 Form 5471 Instructions - * the foreign corporation may or may not be. Changes to separate schedule j (form 5471). Web check if any excepted specified foreign financial assets are reported on this form (see instructions) f check the box if this form 5471 has been completed using “alternative. If you’re having trouble sleeping, give this a try. When a us person has an ownership or interest in a foreign corporation, they may be required to file a form 5471. It also describes the exceptions to filing,. | on january 2, 2019 the irs updated its webpage entitled instructions for form 5471 (12/2018) where it lays. Persons with respect to certain foreign corporations, including recent updates, related forms, and. Web officially known as form 5471, information return of us persons with respect to certain foreign corporations, this form is required along with your expat taxes for us citizens. Web the golding & golding form 5471 instructions are designed to simplify your understanding of the reporting requirements.

Instructions for form 5471, information return of u.s. Web the golding & golding form 5471 instructions are designed to simplify your understanding of the reporting requirements. Web officially known as form 5471, information return of us persons with respect to certain foreign corporations, this form is required along with your expat taxes for us citizens. Income, war profits, and excess profits taxes paid or accrued. Web 2019 form 5471 (schedule e) income, war profits, and excess profits taxes paid or accrued 2021 inst 5471: Web information about form 5471, information return of u.s. On january 2, 2019 the irs updated its webpage entitled instructions for form 5471 (12/2018) where it lays out the. Shareholder calculation of global intangible low. When a us person has an ownership or interest in a foreign corporation, they may be required to file a form 5471. Changes to separate schedule j (form 5471).

On january 2, 2019 the irs updated its webpage entitled instructions for form 5471 (12/2018) where it lays out the. If you’re having trouble sleeping, give this a try. Web 2019 form 5471 (schedule e) income, war profits, and excess profits taxes paid or accrued 2021 inst 5471: Persons with respect to certain foreign corporations); Web • form 5471 (information return of u.s. Web check if any excepted specified foreign financial assets are reported on this form (see instructions) f check the box if this form 5471 has been completed using “alternative. Instructions for form 5471, information return of u.s. Web who has to report ownership in a foreign corporation? Web the instructions to form 5471 describes a category 5a filer as a u.s. You’ll be asleep in about five seconds.

The Tax Times IRS Issues Updated New Form 5471 What's New?

Applying the section 318 (a) family. Income, war profits, and excess profits taxes paid or accrued. Persons with respect to certain foreign corporations, including recent updates, related forms, and. Web the golding & golding form 5471 instructions are designed to simplify your understanding of the reporting requirements. Web the form 5471 instructions as laid out by the irs defines the.

Form 5471 Schedule J Instructions 2019 cloudshareinfo

Web examining the new form 5471 categories of filers. Persons with respect to certain foreign corporations, including recent updates, related forms, and. Web the form 5471 instructions as laid out by the irs defines the criteria for each category of filer (5 in total) and the requirements for each. Web information about form 5471, information return of u.s. Persons with.

CPA Worldwide Tax Service PC Just another WordPress site Chandler, AZ

| on january 2, 2019 the irs updated its webpage entitled instructions for form 5471 (12/2018) where it lays. Income, war profits, and excess profits taxes paid or accrued. Web form 5471 instructions, requirements, and deadlines determine your filing obligations. Web information about form 5471, information return of u.s. On january 2, 2019 the irs updated its webpage entitled instructions.

Form 5471 Schedule J Instructions 2019 cloudshareinfo

Web information about form 5471, information return of u.s. Web • form 5471 (information return of u.s. Web the instructions to form 5471 describes a category 5a filer as a u.s. Shareholder calculation of global intangible low. First, let’s clarify what a foreign corporation is.

Form 5471 Schedule J Instructions 2019 cloudshareinfo

Web who has to report ownership in a foreign corporation? * the foreign corporation may or may not be. When a us person has an ownership or interest in a foreign corporation, they may be required to file a form 5471. Shareholder calculation of global intangible low. December 2020) department of the treasury internal revenue service.

2012 form 5471 instructions Fill out & sign online DocHub

Web the golding & golding form 5471 instructions are designed to simplify your understanding of the reporting requirements. Web the instructions to form 5471 describes a category 5a filer as a u.s. Web examining the new form 5471 categories of filers. Web who has to report ownership in a foreign corporation? Web the form 5471 instructions as laid out by.

Fillable Form 5471 Information Return Of U.s. Persons With Respect To

Persons with respect to certain foreign corporations); Web form 5471 instructions, requirements, and deadlines determine your filing obligations. Web examining the new form 5471 categories of filers. Web • form 5471 (information return of u.s. Shareholder who doesn't qualify as either a category 5b or 5c filer.

Fill Free fillable F5471 Form 5471 (Rev. December 2019) PDF form

It also describes the exceptions to filing,. * the foreign corporation may or may not be. Web form 5471 instructions, requirements, and deadlines determine your filing obligations. If you’re having trouble sleeping, give this a try. Web who has to report ownership in a foreign corporation?

Form 5471 Schedule J Instructions 2019 cloudshareinfo

If you’re having trouble sleeping, give this a try. 341, the treasury department and the irs announced that the irs intended to amend the instructions for form 5471 to provide. Web information about form 5471, information return of u.s. Web 2019 form 5471 (schedule e) income, war profits, and excess profits taxes paid or accrued 2021 inst 5471: Web here.

Form 5471 Schedule J Instructions 2019 cloudshareinfo

* the foreign corporation may or may not be. Web who has to report ownership in a foreign corporation? 341, the treasury department and the irs announced that the irs intended to amend the instructions for form 5471 to provide. Web the golding & golding form 5471 instructions are designed to simplify your understanding of the reporting requirements. Web check.

Web Information About Form 5471, Information Return Of U.s.

If you’re having trouble sleeping, give this a try. Web officially known as form 5471, information return of us persons with respect to certain foreign corporations, this form is required along with your expat taxes for us citizens. On january 2, 2019 the irs updated its webpage entitled instructions for form 5471 (12/2018) where it lays out the. | on january 2, 2019 the irs updated its webpage entitled instructions for form 5471 (12/2018) where it lays.

Web Examining The New Form 5471 Categories Of Filers.

Use the december 2019 revision. There have been revisions to the form in both 2017 and. 341, the treasury department and the irs announced that the irs intended to amend the instructions for form 5471 to provide. Changes to separate schedule j (form 5471).

Web The Golding & Golding Form 5471 Instructions Are Designed To Simplify Your Understanding Of The Reporting Requirements.

Shareholder who doesn't qualify as either a category 5b or 5c filer. December 2020) department of the treasury internal revenue service. You’ll be asleep in about five seconds. Persons with respect to certain foreign corporations, including recent updates, related forms, and.

Web Form 5471 Instructions, Requirements, And Deadlines Determine Your Filing Obligations.

Web check if any excepted specified foreign financial assets are reported on this form (see instructions) f check the box if this form 5471 has been completed using “alternative. Web • form 5471 (information return of u.s. Shareholder calculation of global intangible low. * the foreign corporation may or may not be.