2020 1099 Nec Form

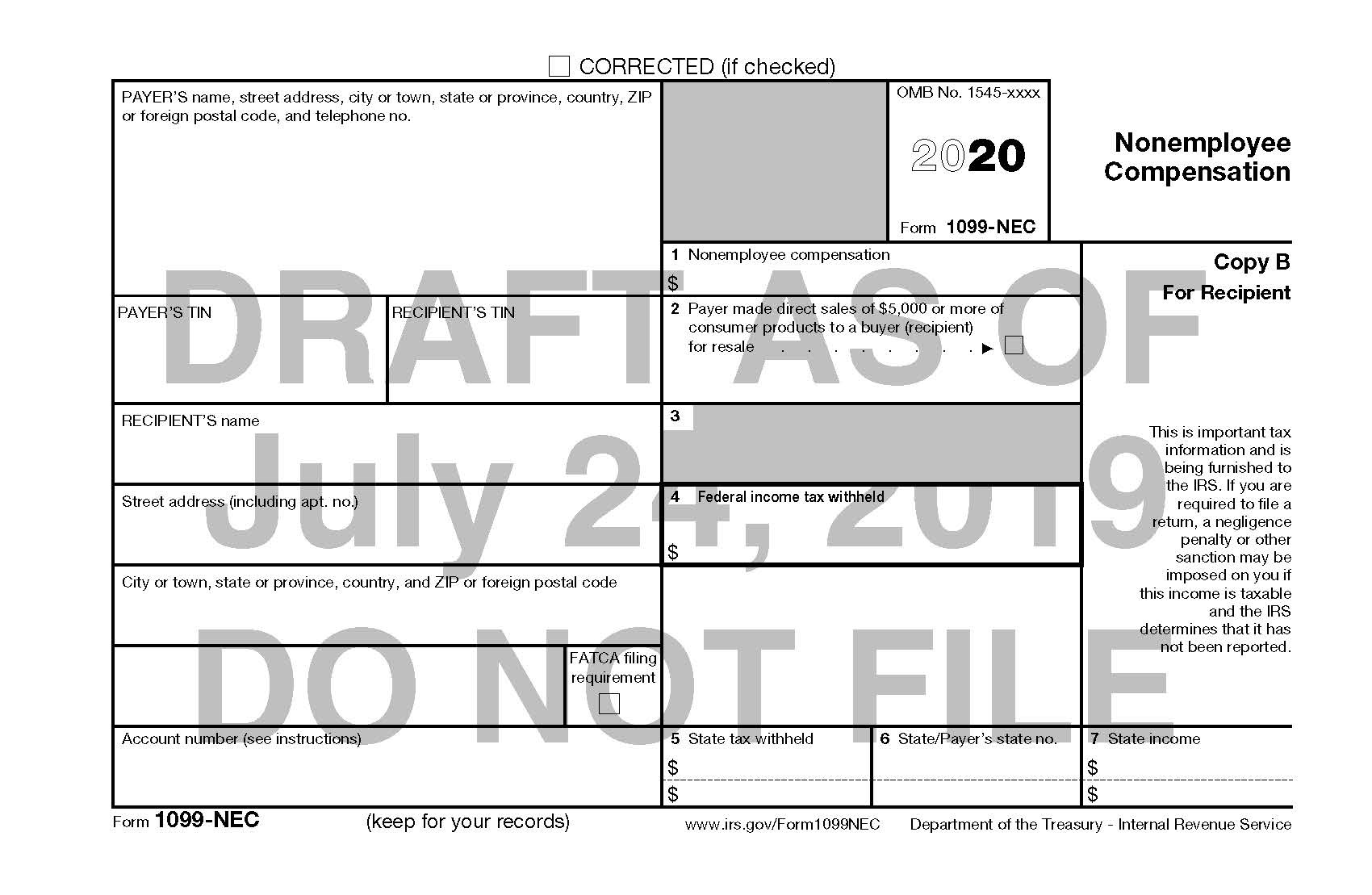

2020 1099 Nec Form - For internal revenue service center. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Web starting in tax year 2020, payers must complete this form to report any payment of $600 or more to a payee. For 2020 tax returns, the due date is february 1, 2021. Businesses will use this form if they made payments totaling $600 or more to certain nonemployees, such as an independent contractor. For privacy act and paperwork reduction act notice, see the. Current general instructions for certain information returns. Any nonemployee or business to whom you paid at least $600 in fees, commissions, or other forms of compensation for services (including parts and materials) they performed for your business. Both the forms and instructions will be updated as needed. Copy a for internal revenue service center.

Both the forms and instructions will be updated as needed. Any nonemployee or business to whom you paid at least $600 in fees, commissions, or other forms of compensation for services (including parts and materials) they performed for your business. Current general instructions for certain information returns. 2020 general instructions for certain information returns. For privacy act and paperwork reduction act notice, see the. Businesses will use this form if they made payments totaling $600 or more to certain nonemployees, such as an independent contractor. For internal revenue service center. For 2020 tax returns, the due date is february 1, 2021. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Copy a for internal revenue service center.

Copy a for internal revenue service center. Current general instructions for certain information returns. For 2020 tax returns, the due date is february 1, 2021. 2020 general instructions for certain information returns. Any nonemployee or business to whom you paid at least $600 in fees, commissions, or other forms of compensation for services (including parts and materials) they performed for your business. For privacy act and paperwork reduction act notice, see the. Businesses will use this form if they made payments totaling $600 or more to certain nonemployees, such as an independent contractor. Both the forms and instructions will be updated as needed. For internal revenue service center. Web starting in tax year 2020, payers must complete this form to report any payment of $600 or more to a payee.

What the 1099NEC Coming Back Means for your Business Chortek

2020 general instructions for certain information returns. Current general instructions for certain information returns. For privacy act and paperwork reduction act notice, see the. Businesses will use this form if they made payments totaling $600 or more to certain nonemployees, such as an independent contractor. Both the forms and instructions will be updated as needed.

The New 1099NEC IRS Form for Second Shooters & Independent Contractors

Web starting in tax year 2020, payers must complete this form to report any payment of $600 or more to a payee. Copy a for internal revenue service center. Businesses will use this form if they made payments totaling $600 or more to certain nonemployees, such as an independent contractor. 2020 general instructions for certain information returns. Any nonemployee or.

IRS to Bring Back Form 1099NEC, Last Used in 1982 — Current Federal

Any nonemployee or business to whom you paid at least $600 in fees, commissions, or other forms of compensation for services (including parts and materials) they performed for your business. For privacy act and paperwork reduction act notice, see the. Web starting in tax year 2020, payers must complete this form to report any payment of $600 or more to.

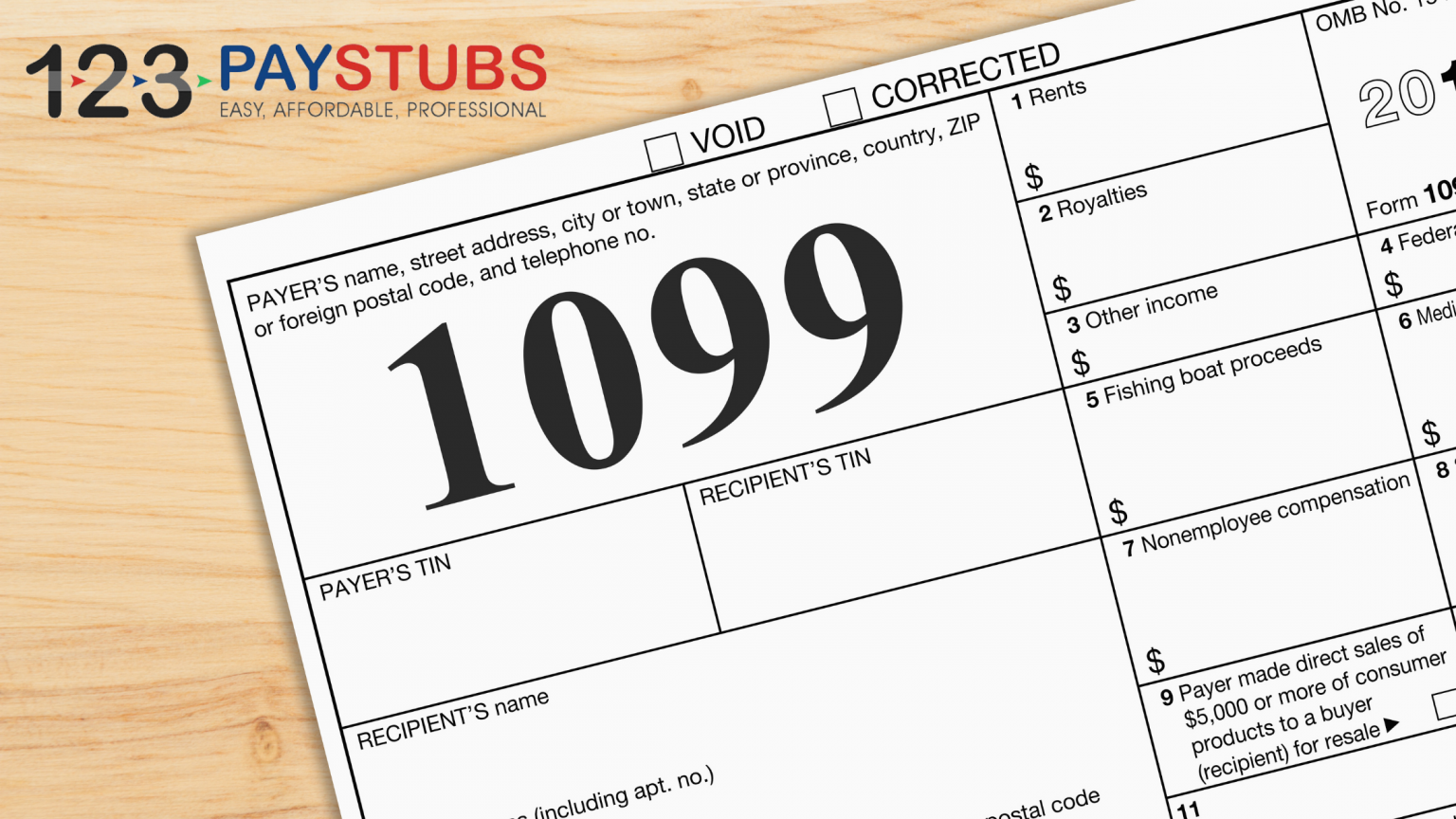

What is Form 1099NEC and Who Needs to File? 123PayStubs Blog

Web starting in tax year 2020, payers must complete this form to report any payment of $600 or more to a payee. Copy a for internal revenue service center. Any nonemployee or business to whom you paid at least $600 in fees, commissions, or other forms of compensation for services (including parts and materials) they performed for your business. Businesses.

IRS 1099NEC 20202022 Fill and Sign Printable Template Online US

Copy a for internal revenue service center. 2020 general instructions for certain information returns. Web starting in tax year 2020, payers must complete this form to report any payment of $600 or more to a payee. Both the forms and instructions will be updated as needed. Any nonemployee or business to whom you paid at least $600 in fees, commissions,.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

Copy a for internal revenue service center. 2020 general instructions for certain information returns. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. For 2020 tax returns, the due date is february 1, 2021. Any nonemployee or business to whom you paid at least $600 in fees, commissions, or other forms of compensation for services (including parts and materials).

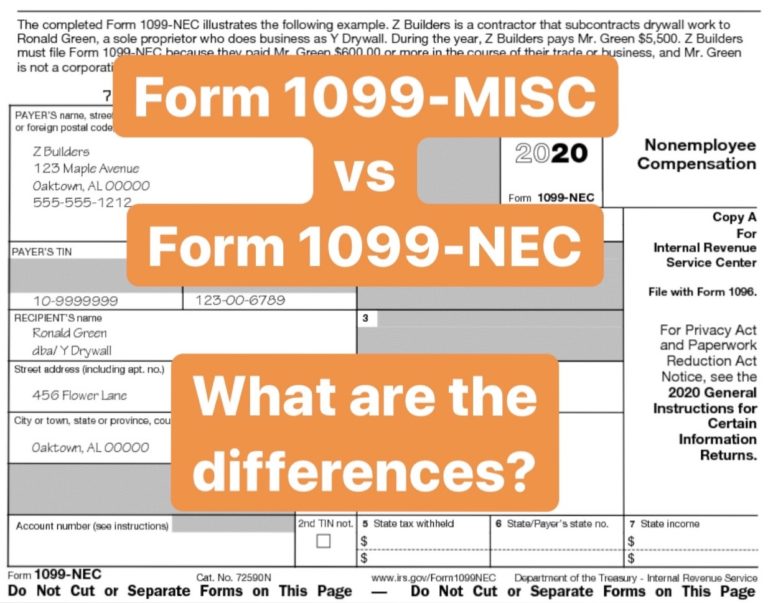

Form 1099MISC vs Form 1099NEC How are they Different?

For privacy act and paperwork reduction act notice, see the. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Web starting in tax year 2020, payers must complete this form to report any payment of $600 or more to a payee. Copy a for internal revenue service center. For 2020 tax returns, the due date is february 1, 2021.

1099NEC or 1099MISC? What has changed and why it matters! Pro News

Any nonemployee or business to whom you paid at least $600 in fees, commissions, or other forms of compensation for services (including parts and materials) they performed for your business. For internal revenue service center. Businesses will use this form if they made payments totaling $600 or more to certain nonemployees, such as an independent contractor. Both the forms and.

There’s A New Tax Form With Some Changes For Freelancers & Gig

For internal revenue service center. Businesses will use this form if they made payments totaling $600 or more to certain nonemployees, such as an independent contractor. Web starting in tax year 2020, payers must complete this form to report any payment of $600 or more to a payee. For privacy act and paperwork reduction act notice, see the. Current general.

What Is A 1099? Explaining All Form 1099 Types CPA Solutions

Web starting in tax year 2020, payers must complete this form to report any payment of $600 or more to a payee. Copy a for internal revenue service center. Both the forms and instructions will be updated as needed. Businesses will use this form if they made payments totaling $600 or more to certain nonemployees, such as an independent contractor..

2020 General Instructions For Certain Information Returns.

For internal revenue service center. Businesses will use this form if they made payments totaling $600 or more to certain nonemployees, such as an independent contractor. For privacy act and paperwork reduction act notice, see the. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec.

Any Nonemployee Or Business To Whom You Paid At Least $600 In Fees, Commissions, Or Other Forms Of Compensation For Services (Including Parts And Materials) They Performed For Your Business.

Both the forms and instructions will be updated as needed. Web starting in tax year 2020, payers must complete this form to report any payment of $600 or more to a payee. Current general instructions for certain information returns. For 2020 tax returns, the due date is february 1, 2021.

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://efile360.com/images/forms-assets/Form 1099-NEC.png)