2022 Form 1042 Instructions

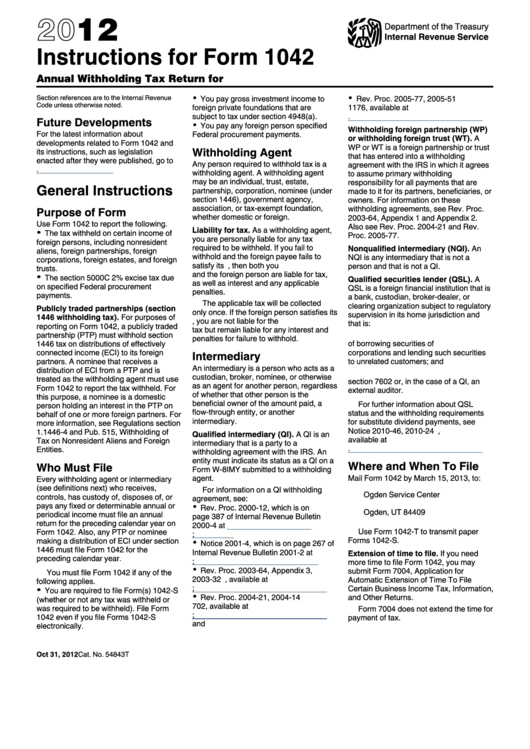

2022 Form 1042 Instructions - Web final instructions for the 2022 form 1042 were released jan. 24 by the internal revenue service. How to file 1042 instructions forquick filing. Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. Source income subject to withholding) for your 2022 tax filing. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Web use form 1042 to report the following. Web up to $3 cash back 70b 71 apply overpayment (sum of lines 70a and 70b) to (check one): Instructions for form 1042, annual withholding tax return for u.s. Use this form to transmit paper.

Web get federal tax return forms and file by mail. The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain. Web information about form 1042, annual withholding tax return for u.s. Web foreign account tax compliance act (fatca). Compared to the draft released nov. Web of course, the form 1042 instructions, publication 515 which explains the withholding of tax on nonresident aliens and foreign entities, form 7004 that's the instructions. Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. Source income of foreign persons, including recent updates, related forms, and instructions on how to file. How to file 1042 instructions forquick filing. Please note that federal regulations mandate that forms be delivered to.

Railroad retirement board (rrb) and represents payments made to you in the tax year. Compared to the draft released nov. How to file 1042 instructions forquick filing. Web information about form 1042, annual withholding tax return for u.s. 24 by the internal revenue service. Web final instructions for the 2022 form 1042 were released jan. The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain. Use this form to transmit paper. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Source income subject to withholding) for your 2022 tax filing.

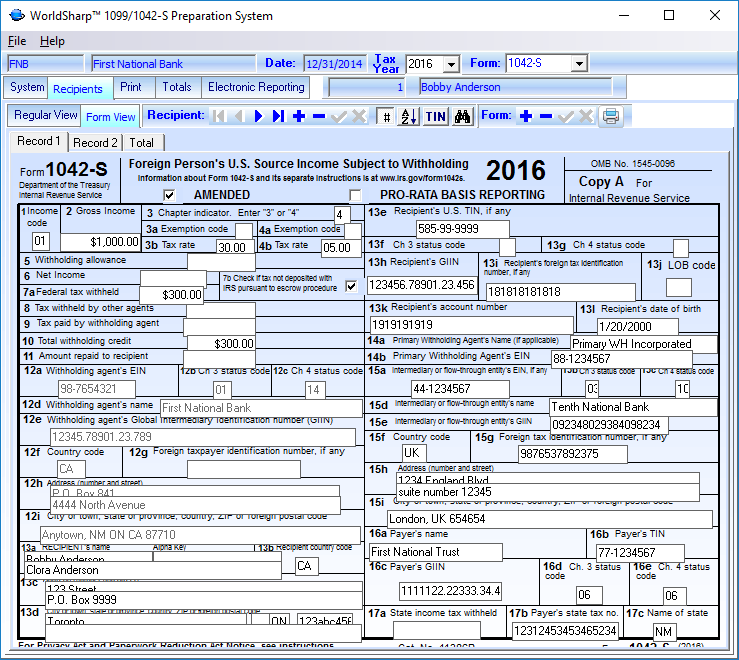

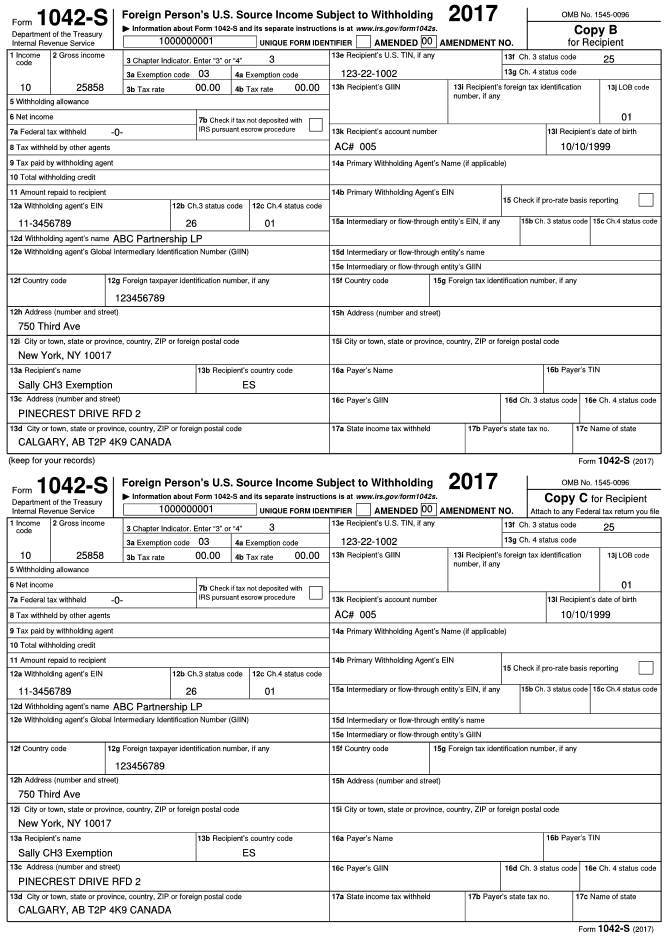

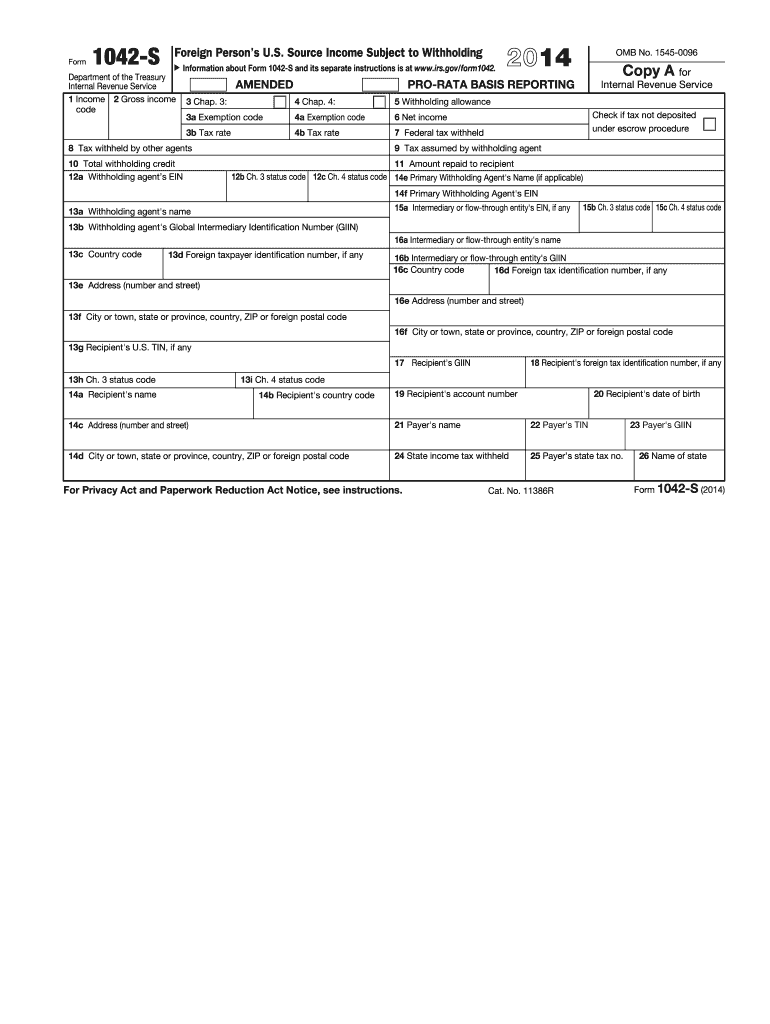

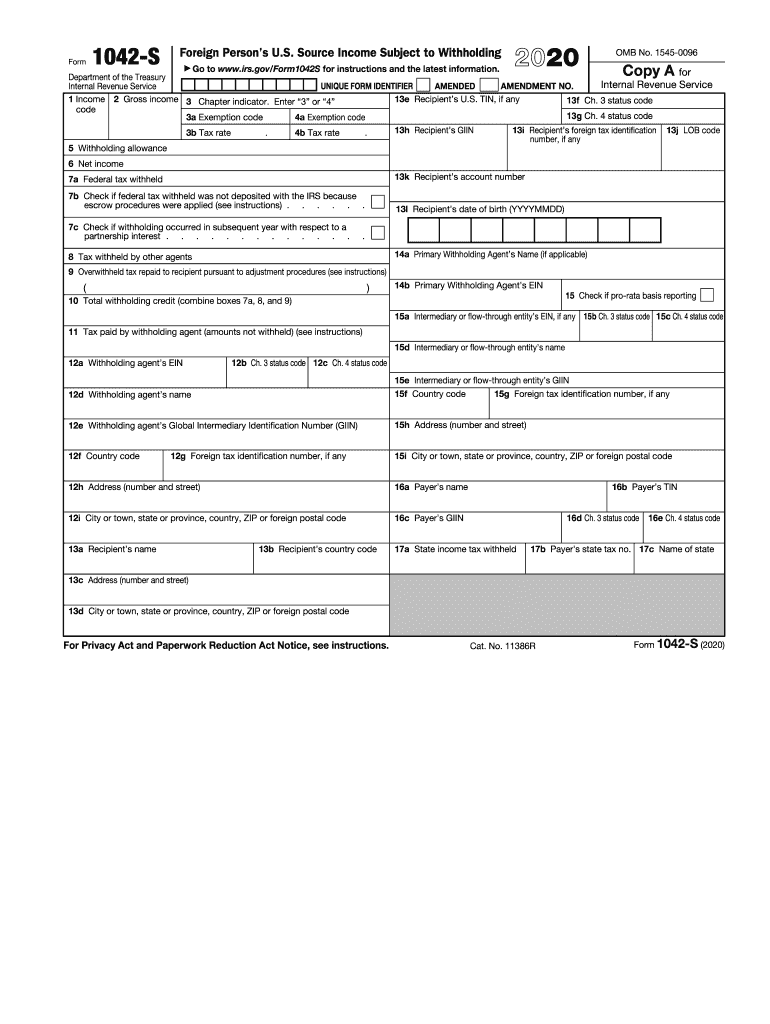

Form 1042s 2022 instructions Fill online, Printable, Fillable Blank

Source income of foreign persons, including recent updates, related forms, and instructions on how to file. Web information about form 1042, annual withholding tax return for u.s. Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. Source income subject to withholding) for your 2022 tax filing. The tax withheld under chapter 3 (excluding.

1042 Form 2023 IRS Forms Zrivo

The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain. Instructions for form 1042, annual withholding tax return for u.s. Web information about form 1042, annual withholding tax return for u.s. This form, which is necessary to. How to file 1042 instructions forquick filing.

1042 S Form slideshare

Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Web up to $3 cash back 70b 71 apply overpayment (sum of lines 70a and 70b) to (check one): Web get federal tax return forms and file by mail. Source income subject to withholding) for your 2022 tax filing. Web form 1042 department.

Instructions For Form 1042 Annual Withholding Tax Return For U.s

The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain. Instructions for form 1042, annual withholding tax return for u.s. Railroad retirement board (rrb) and represents payments made to you in the tax year. Use this form to transmit paper. This form, which is necessary to.

Irs 1042 s instructions 2019

Web final instructions for the 2022 form 1042 were released jan. Web up to $3 cash back 70b 71 apply overpayment (sum of lines 70a and 70b) to (check one): Final sample excel import file: Compared to the draft released nov. Web get federal tax return forms and file by mail.

1099 Form 2019 Printable Form Fill Out and Sign Printable PDF

Web of course, the form 1042 instructions, publication 515 which explains the withholding of tax on nonresident aliens and foreign entities, form 7004 that's the instructions. Web information about form 1042, annual withholding tax return for u.s. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. This form, which is necessary to..

944 Form 2021 2022 IRS Forms Zrivo

Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. Source income subject to withholding) for your 2022 tax filing. Web final instructions for the 2022 form 1042 were released jan. Source income of foreign persons, including recent updates, related forms, and instructions on how to file. Web use form 1042 to report the.

Form 1042 S Fill Out and Sign Printable PDF Template signNow

Web irs release status: Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. 24 by the internal revenue service. Web foreign account tax compliance act (fatca). Source income of foreign persons go to.

1042 S Fill Out and Sign Printable PDF Template signNow

Web final instructions for the 2022 form 1042 were released jan. Compared to the draft released nov. Source income subject to withholding) for your 2022 tax filing. Web up to $3 cash back 70b 71 apply overpayment (sum of lines 70a and 70b) to (check one): Source income of foreign persons, including recent updates, related forms, and instructions on how.

Form 1042S It's Your Yale

Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. Final sample excel import file: How to file 1042 instructions forquick filing. Source income subject to withholding) for your 2022 tax filing. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them.

Web Information About Form 1042, Annual Withholding Tax Return For U.s.

Web get federal tax return forms and file by mail. Web of course, the form 1042 instructions, publication 515 which explains the withholding of tax on nonresident aliens and foreign entities, form 7004 that's the instructions. Web foreign account tax compliance act (fatca). Compared to the draft released nov.

Web Final Instructions For The 2022 Form 1042 Were Released Jan.

Web use form 1042 to report the following. The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain. Source income of foreign persons go to. How to file 1042 instructions forquick filing.

Instructions For Form 1042, Annual Withholding Tax Return For U.s.

Source income of foreign persons, including recent updates, related forms, and instructions on how to file. Source income subject to withholding) for your 2022 tax filing. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Final sample excel import file:

24 By The Internal Revenue Service.

Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. This form, which is necessary to. Credit on 2023 form 1042 or refund section 2 reconciliation of payments of u.s. Railroad retirement board (rrb) and represents payments made to you in the tax year.