2022 Form 3893

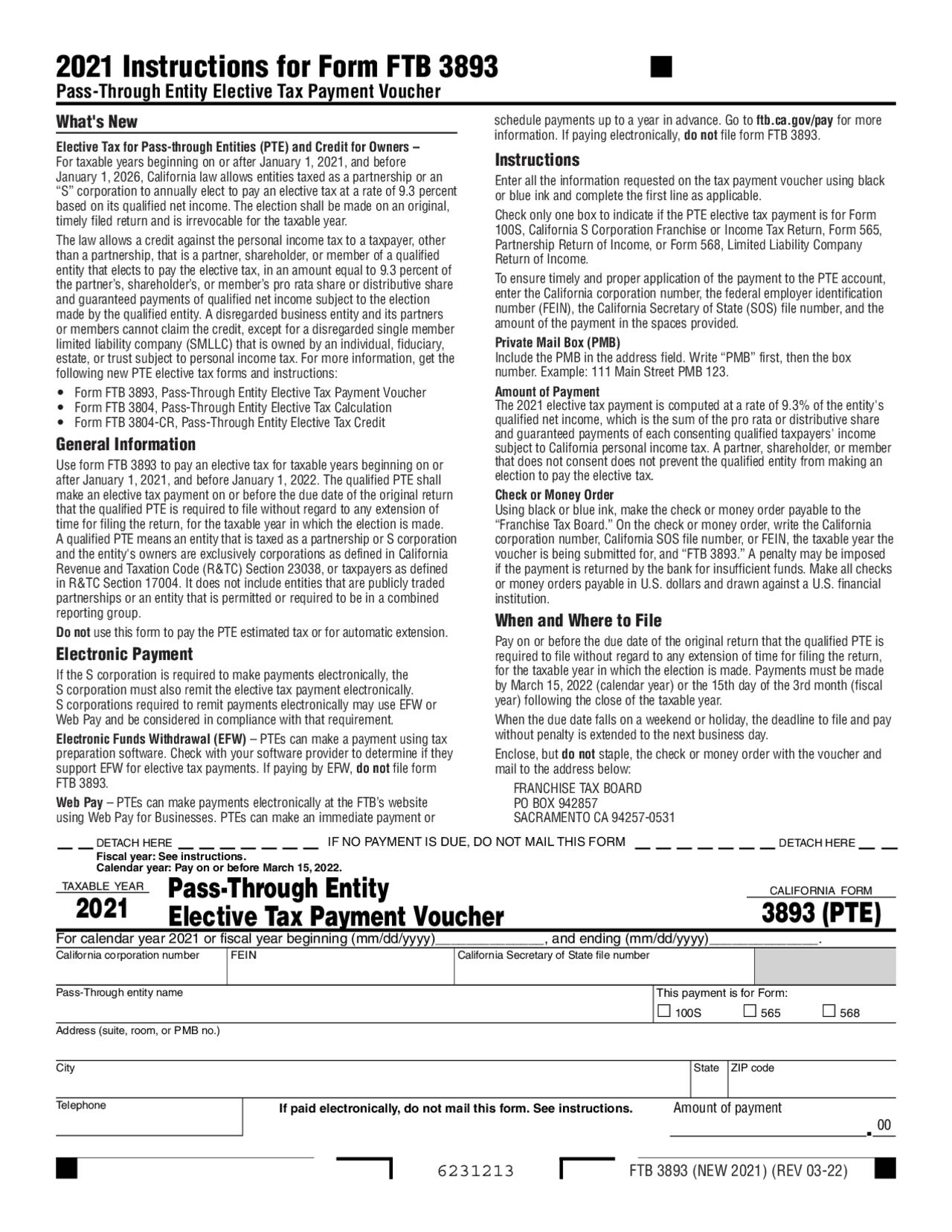

2022 Form 3893 - If an entity does not make that first payment by june 15, it may not make the election for that tax year. Ptes can make an immediate payment or schedule payments up to a year in advance. The rate of social security tax on taxable wages, including qualified sick leave wages and qualified family. Department of the treasury internal revenue service. Web july 28, 2022 due to an issue with some software providers, many passthrough entity tax payments made with 2022 vouchers have been improperly applied to the 2021 tax year. Web form 943 and its instructions, such as legislation enacted after they were published, go to irs.gov/form943. We have our january update. Not paying the $1,000 by 6/15/22 closes the window for making the 2022 election. Web 11/05/2022 objectives prepare and populate california form 3804 and / or form 3893 in an s corporation return using interview forms view. (optional) override income and withholding amount of partners on 3804 go to california > ca29.

This is resulting in refunds of june passthrough entity elective tax. Not paying the $1,000 by 6/15/22 closes the window for making the 2022 election. Web form 3903 department of the treasury internal revenue service moving expenses go to www.irs.gov/form3903 for instructions and the latest information. Added language to clarify on how. Web tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet. For example, the form 1040 page is at irs.gov/form1040; I tried a jump to input on form 3893 but it did not take me anywhere. Web ab 150 form 3893. Environment cch axcess cch axcess tax cch prosystem fx tax 1120s worksheet california form 3804 form. We anticipate the revised form 3893 will be available march 7, 2022.

Web form 3903 department of the treasury internal revenue service moving expenses go to www.irs.gov/form3903 for instructions and the latest information. Web address as shown on form 943. We anticipate the revised form 3893 will be available march 7, 2022. Instructions, page 1, column 2, when and where to file section, payment 2 paragraph. Web 11/05/2022 objectives prepare and populate california form 3804 and / or form 3893 in an s corporation return using worksheet view. For this discussion, ignore the effect of income tax liability (llc or s corp) and estimated tax. 501 page is at irs.gov/pub501; Ptes can make an immediate payment or schedule payments up to a year in advance. How is the tax calculated?. It won’t show up if there is no 2021 pte tax.

ECOHSAT Admission Form 2021/2022 ND, HND, Diploma & Cert.

Web form 3903 department of the treasury internal revenue service moving expenses go to www.irs.gov/form3903 for instructions and the latest information. Employer’s annual federal tax return for agricultural employees. Web tax software 2022 prepare the 3804 go to california > ca29. Added language to clarify on how. The rate of social security tax on taxable wages, including qualified sick leave.

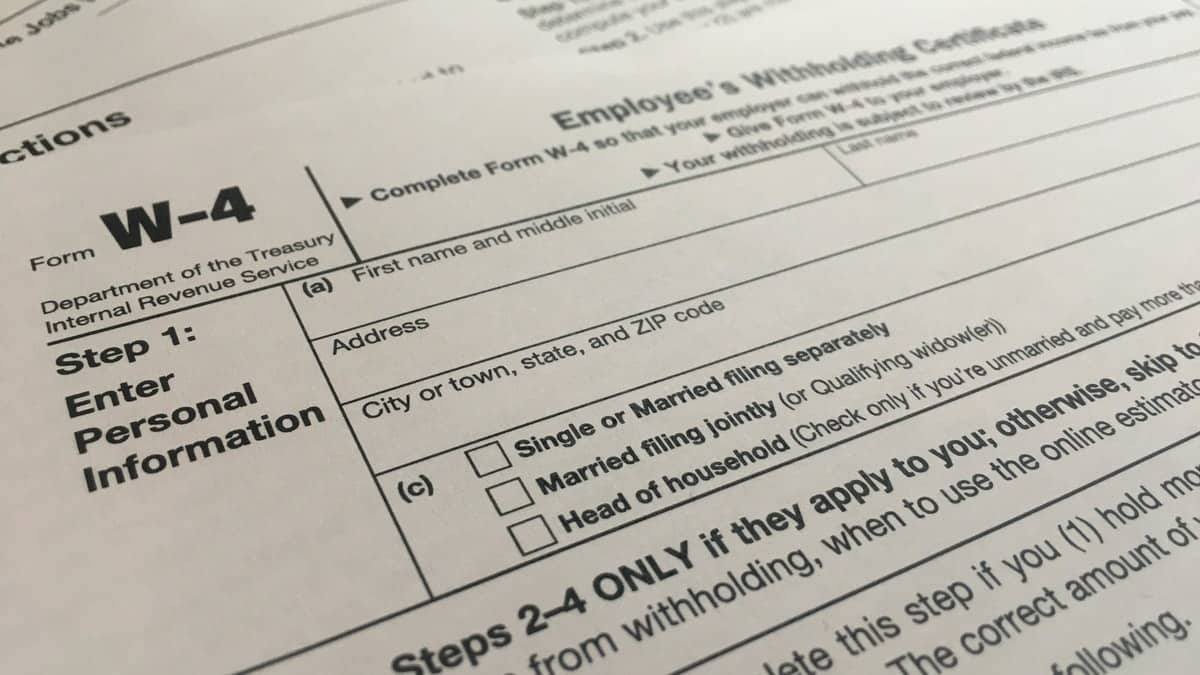

W4 Form 2022 Fillable PDF

But my question is if there is a place yet for the pass through entity tax payment, etc. Environment cch prosystem fx tax 1120s california interview form 3804 form 3893 procedure prepare. 501 page is at irs.gov/pub501; The issue is illustrated below with 100s line welcome back! A list of items being revised due to sb 113 is available on.

Form 2022 Fill Online, Printable, Fillable, Blank pdfFiller

For this discussion, ignore the effect of income tax liability (llc or s corp) and estimated tax. A list of items being revised due to sb 113 is available on our forms and publications page at ftb.ca.gov. Environment cch axcess cch axcess tax cch prosystem fx tax 1120s worksheet california form 3804 form. Ptes can make an immediate payment or.

Virginia fprm pte Fill out & sign online DocHub

(optional) override income and withholding amount of partners on 3804 go to california > ca29. This is resulting in refunds of june passthrough entity elective tax. The rate of social security tax on taxable wages, including qualified sick leave wages and qualified family. Go to ftb.ca.gov/pay for more information. Environment cch axcess cch axcess tax cch prosystem fx tax 1120s.

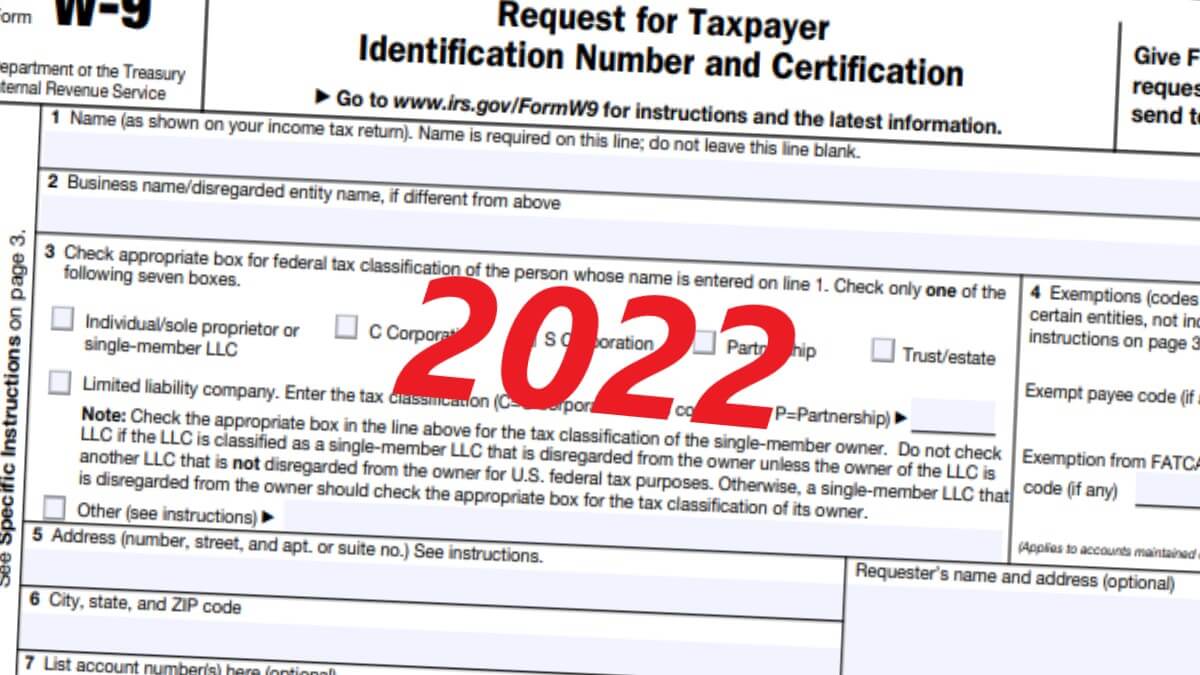

W9 Form 2022

This is only available by request. For instructions and the latest information. It won’t show up if there is no 2021 pte tax. Department of the treasury internal revenue service. Web address as shown on form 943.

W4 Form 2023 Instructions

• enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2022” on your check or money order. Web form 943 and its instructions, such as legislation enacted after they were published, go to irs.gov/form943. 501 page is at irs.gov/pub501; Web tax software 2022 prepare the 3804 go to.

California Form 3893 Passthrough Entity Tax Problems Windes

I tried a jump to input on form 3893 but it did not take me anywhere. Web almost every form and publication has a page on irs.gov with a friendly shortcut. Instructions, page 1, column 2, when and where to file section, payment 2 paragraph. Web form 3903 department of the treasury internal revenue service moving expenses go to www.irs.gov/form3903.

The Great Wave on form

We have our january update. The rate of social security tax on taxable wages, including qualified sick leave wages and qualified family. Ptes can make an immediate payment or schedule payments up to a year in advance. Web almost every form and publication has a page on irs.gov with a friendly shortcut. We anticipate the revised form 3893 will be.

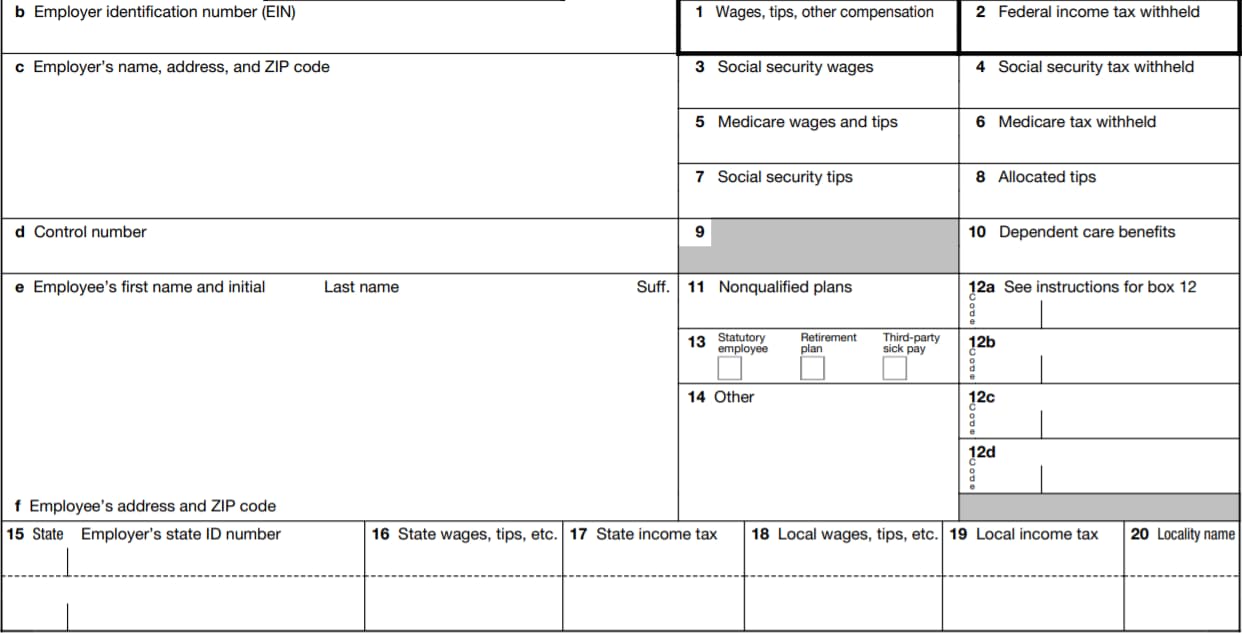

W2 Form 2022 Fillable PDF

Web form 943 and its instructions, such as legislation enacted after they were published, go to irs.gov/form943. For example, the form 1040 page is at irs.gov/form1040; I tried a jump to input on form 3893 but it did not take me anywhere. Ptes can make an immediate payment or schedule payments up to a year in advance. The rate of.

2021 Instructions for Form 3893, PassThrough Entity Elective

Department of the treasury internal revenue service. Web address as shown on form 943. The rate of social security tax on taxable wages, including qualified sick leave wages and qualified family. Please provide your email address and it will be emailed to you. If an entity does not make that first payment by june 15, it may not make the.

(Optional) Override Income And Withholding Amount Of Partners On 3804 Go To California > Ca29.

Ptes can make an immediate payment or schedule payments up to a year in advance. Environment cch axcess cch axcess tax cch prosystem fx tax 1120s worksheet california form 3804 form. Web ab 150 form 3893. And the schedule a (form.

Lacerte Really Needs A Diagnostic For This.

Web form 3903 department of the treasury internal revenue service moving expenses go to www.irs.gov/form3903 for instructions and the latest information. What's new social security and medicare tax for 2022. Web 11/05/2022 objectives prepare and populate california form 3804 and / or form 3893 in an s corporation return using interview forms view. Instructions, page 1, column 2, when and where to file section, payment 2 paragraph.

Added Language To Clarify On How.

Environment cch prosystem fx tax 1120s california interview form 3804 form 3893 procedure prepare. Web tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet. But my question is if there is a place yet for the pass through entity tax payment, etc. This is only available by request.

Web Form 943 And Its Instructions, Such As Legislation Enacted After They Were Published, Go To Irs.gov/Form943.

Web address as shown on form 943. How is the tax calculated?. • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2022” on your check or money order. This is resulting in refunds of june passthrough entity elective tax.