2023 De4 Form

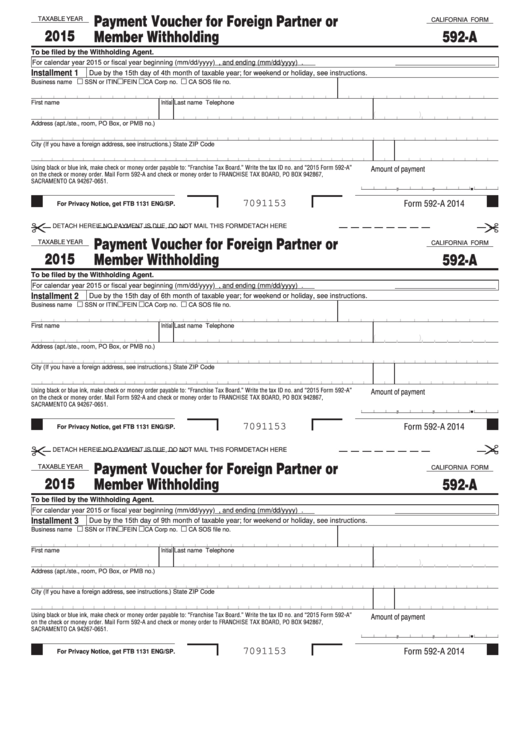

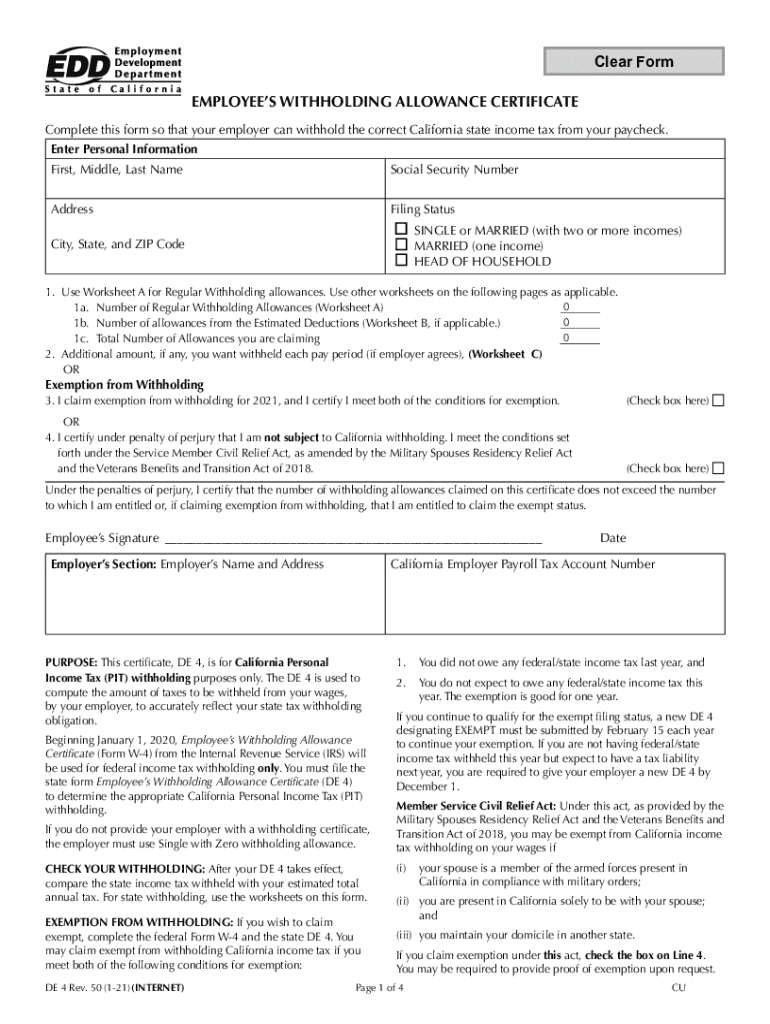

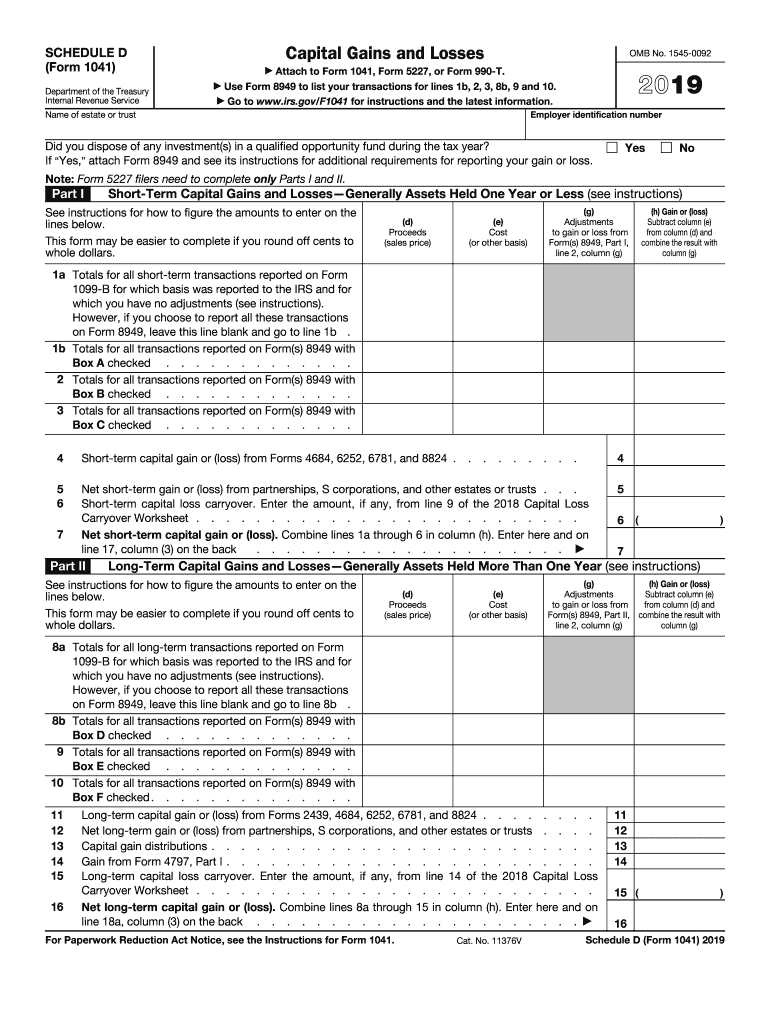

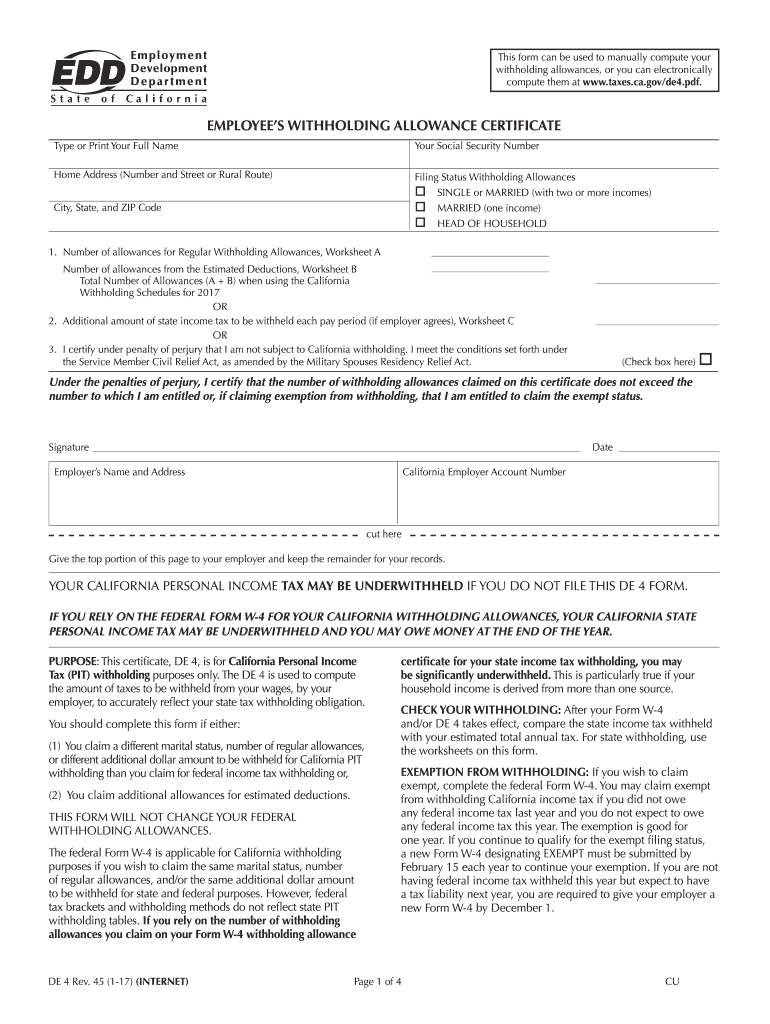

2023 De4 Form - 64e édition, 1er janvier 2023. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in california. Web « special form » (forme spéciale) (non exigée pour les numéros onu 3332 ou onu 3333) ou les matières. The de 4p allows you to: Web on july 12, 2023, the us securities and exchange commission (sec) adopted, among other provisions, [1] amendments to form pf. Web use form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10. Web here is the list of 2023 powerball jackpot wins, according to powerball.com: Web the de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding obligation. Oui non* s/o lettre de. This timed research is the free research you get just for logging in, not the paid ticketed research.

Web using only one de 4 form. This timed research is the free research you get just for logging in, not the paid ticketed research. Web need to withhold less money from your paycheck for taxes, increase the number of allowances you claim. Web than the number claimed by him/her on the de 4, the employee must complete a new de 4. Web « special form » (forme spéciale) (non exigée pour les numéros onu 3332 ou onu 3333) ou les matières. The attack on two women in the state of manipur led to the first public. Web the de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding obligation. Oui non* s/o lettre de. Only need to adjust your state withholding allowance, go to the. Web differential pay request form;

Starting 2020, there are new. Web using only one de 4 form. Web the california income tax withholding form, also known as the de 4, is used to calculate the amount of taxes that should be withheld from an employee’s paycheck. With us legal forms the whole process of filling out official. Web here is the list of 2023 powerball jackpot wins, according to powerball.com: This certificate, de 4, is for california personal income tax (pit) withholding purposes only. (1) claim a different number of allowances for. Only need to adjust your state withholding allowance, go to the. Web differential pay request form; Do dependent(s) or other qualifying individuals.

Top 59 De4 Form Templates free to download in PDF format

Only need to adjust your state withholding allowance, go to the. Web follow the simple instructions below: This certificate, de 4, is for california personal income tax (pit) withholding purposes only. The de 4 is used to compute the amount of taxes to be withheld from. Within 10 days of the change occurring, the employee must provide the employer with.

California DE4 App

If result is a (loss), see instructions to find out if you must file Web pokémon go ‘adventures near and far’ timed research tasks. Cost of maintaining the not claim the same allowances with more. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Do dependent(s) or other qualifying individuals.

MA M4 2022 Tax Printable Form Massachusetts EE Withholding Exemption

Web follow the simple instructions below: Tax and banking human resources. Web employers may require employees to file de 4 when they wish to use additional allowances for estimated deductions to reduce the amount of wages subject to withholding. Web up to 10% cash back the california form de 4, employee's withholding allowance certificate, must be completed so that you.

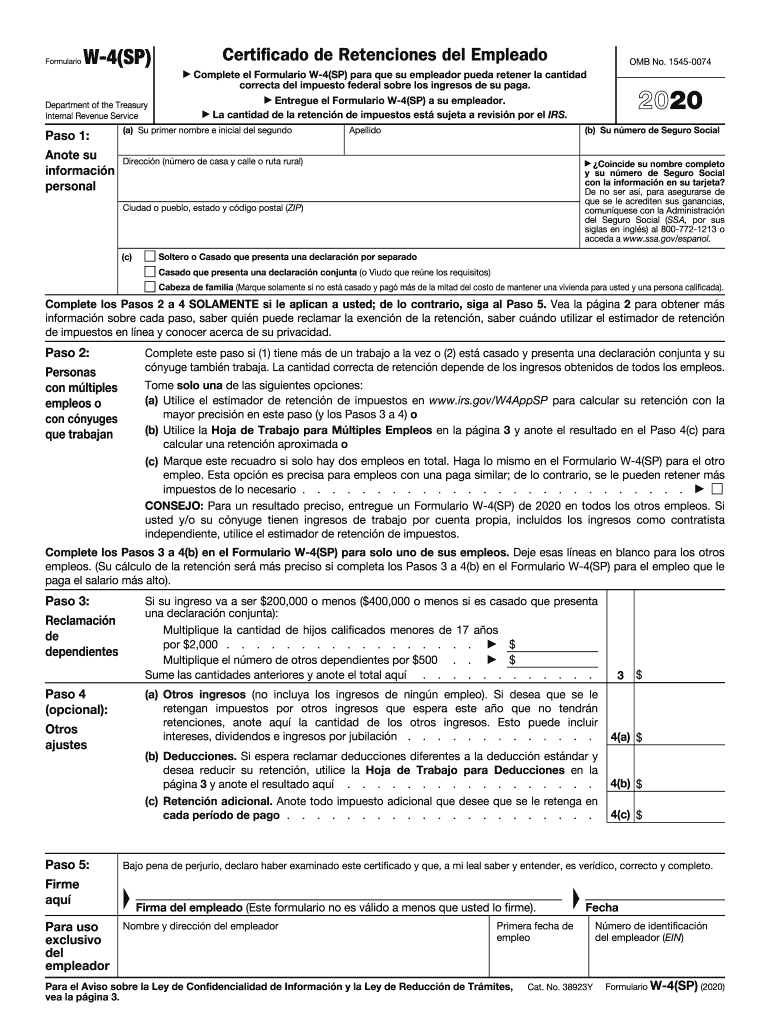

W 4 Form 2020 Spanish 2022 W4 Form

Only need to adjust your state withholding allowance, go to the. Web use form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10. Web than the number claimed by him/her on the de 4, the employee must complete a new de 4. The days of frightening complex tax and legal documents are over. Web employers.

2020 Form IRS W4(SP) Fill Online, Printable, Fillable, Blank pdfFiller

This certificate, de 4, is for california personal income tax (pit) withholding purposes only. Web need to withhold less money from your paycheck for taxes, increase the number of allowances you claim. The de 4 is used to compute the amount of taxes to be withheld from. The days of frightening complex tax and legal documents are over. Web here.

Download California Form DE 4 for Free Page 4 FormTemplate

Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in california. 64e édition, 1er janvier 2023. Web use form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10. Web using only one de 4 form. Cost of maintaining the not claim the.

De 4 Fill Out and Sign Printable PDF Template signNow

Web on july 12, 2023, the us securities and exchange commission (sec) adopted, among other provisions, [1] amendments to form pf. Web the california income tax withholding form, also known as the de 4, is used to calculate the amount of taxes that should be withheld from an employee’s paycheck. Web watch newsmax live for the latest news and analysis.

IRS 1041 Schedule D 2019 Fill and Sign Printable Template Online

The de 4 is used to compute the amount of taxes to be withheld from. Web pokémon go ‘adventures near and far’ timed research tasks. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Do dependent(s) or other qualifying individuals. This timed research is the free research you get just for.

2023 IRS W 4 Form HRdirect Fillable Form 2023

Web the de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding obligation. Web using only one de 4 form. Tax and banking human resources. Web here is the list of 2023 powerball jackpot wins, according to powerball.com: Web use form 8949 to list.

Edd de4 form fillable Fill out & sign online DocHub

Web up to 10% cash back the california form de 4, employee's withholding allowance certificate, must be completed so that you know how much state income tax to withhold from. Web on july 12, 2023, the us securities and exchange commission (sec) adopted, among other provisions, [1] amendments to form pf. The de 4 is used to compute the amount.

Web Use Form 8949 To List Your Transactions For Lines 1B, 2, 3, 8B, 9, And 10.

Web video of sexual assault goes viral in india, renewing attention on ethnic conflict. Web pokémon go ‘adventures near and far’ timed research tasks. Only need to adjust your state withholding allowance, go to the. This certificate, de 4, is for california personal income tax (pit) withholding purposes only.

Within 10 Days Of The Change Occurring, The Employee Must Provide The Employer With A.

Do dependent(s) or other qualifying individuals. Web the de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding obligation. With us legal forms the whole process of filling out official. Oui non* s/o lettre de.

Web On July 12, 2023, The Us Securities And Exchange Commission (Sec) Adopted, Among Other Provisions, [1] Amendments To Form Pf.

Web the california income tax withholding form, also known as the de 4, is used to calculate the amount of taxes that should be withheld from an employee’s paycheck. Web the fifa women's world cup 2023 in australia and new zealand will see a total of 32 top national teams from five different confederations fight for the title of football. This timed research is the free research you get just for logging in, not the paid ticketed research. (1) claim a different number of allowances for.

Web Up To 10% Cash Back The California Form De 4, Employee's Withholding Allowance Certificate, Must Be Completed So That You Know How Much State Income Tax To Withhold From.

The de 4 is used to compute the amount of taxes to be withheld from. Web than the number claimed by him/her on the de 4, the employee must complete a new de 4. Cost of maintaining the not claim the same allowances with more. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in california.