2023 Form 941 Due Dates

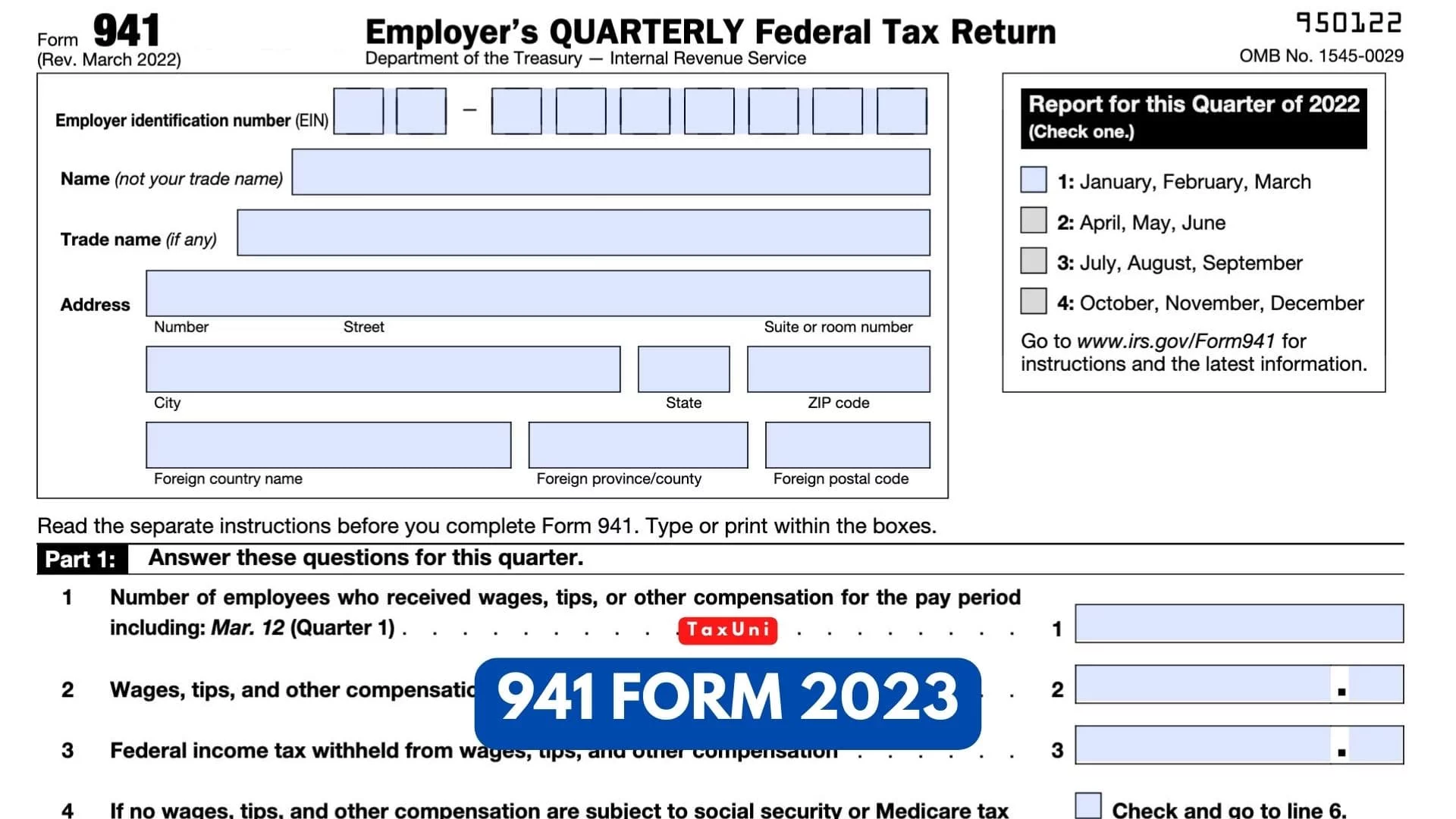

2023 Form 941 Due Dates - Tax deadlines employers must know january 31: Web october 31 what is the penalty for failing to file form 941? As of july 12, 2023. Those returns are processed in the order received. Form 941 is used by organizations that wish to file their payroll and income tax returns quarterly. Reporting income tax withholding and fica taxes for the fourth quarter of 2022 (form 941). Web state zip code foreign country name foreign province/county foreign postal code 950122 omb no. Web payroll tax returns. Web organizations have until january 31 to submit this form, so the due date for reporting 2021 unemployment taxes, is january 31, 2022. Web forms filed quarterly with due dates of april 30, july 31, october 31, and january 31 (for the fourth quarter of the previous calendar year) file form 941, employer’s quarterly federal tax return, if you paid wages subject to employment taxes with the irs for each quarter by the last day of the month that follows the end of the quarter.

Web form 941 for q1, 2023 is due in a week, meet the irs deadline with taxbandits taxbandits april 24, 2023 at 12:30 pm · 3 min read rock hill, sc / accesswire / april 24, 2023 / the. Reporting income tax withholding and fica taxes for the fourth quarter of 2022 (form 941). Web forms filed quarterly with due dates of april 30, july 31, october 31, and january 31 (for the fourth quarter of the previous calendar year) file form 941, employer’s quarterly federal tax return, if you paid wages subject to employment taxes with the irs for each quarter by the last day of the month that follows the end of the quarter. Form 941 (2023 q1) | forms 720 (2023 q1), 730 (mar. 2023) | form 941 (2023 q1) may 15: Those returns are processed in the order received. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. For each month of late filing, a 5% penalty will be charged up to 25%. October, november, december go to www.irs.gov/form941 for instructions and the latest information. Web october 31 what is the penalty for failing to file form 941?

Form 941 is used by organizations that wish to file their payroll and income tax returns quarterly. Web forms filed quarterly with due dates of april 30, july 31, october 31, and january 31 (for the fourth quarter of the previous calendar year) file form 941, employer’s quarterly federal tax return, if you paid wages subject to employment taxes with the irs for each quarter by the last day of the month that follows the end of the quarter. October, november, december go to www.irs.gov/form941 for instructions and the latest information. 2023) | form 941 (2023 q1) may 15: Failing to file your form 941 on time can result in penalties from the irs. Web state zip code foreign country name foreign province/county foreign postal code 950122 omb no. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. For each month of late filing, a 5% penalty will be charged up to 25%. As of july 12, 2023. Web the deadline to file 941 will be the last day of the month following the end of the quarter.

File 941 Online Efile 941 for 4.95 IRS Form 941 for 2022

Web payroll tax returns. Form 941 is used by organizations that wish to file their payroll and income tax returns quarterly. As of july 12, 2023. Web organizations have until january 31 to submit this form, so the due date for reporting 2021 unemployment taxes, is january 31, 2022. For each month of late filing, a 5% penalty will be.

How to fill out IRS form 941 20222023 PDF Expert

For each month of late filing, a 5% penalty will be charged up to 25%. Web october 31 what is the penalty for failing to file form 941? As of july 12, 2023. Those returns are processed in the order received. Form 941 (2023 q1) | forms 720 (2023 q1), 730 (mar.

Form 941 Employer's Quarterly Federal Tax Return Definition

Reporting income tax withholding and fica taxes for the fourth quarter of 2022 (form 941). Failing to file your form 941 on time can result in penalties from the irs. Form 941 is used by organizations that wish to file their payroll and income tax returns quarterly. Form 941 (2023 q1) | forms 720 (2023 q1), 730 (mar. As of.

How to fill out IRS Form 941 2019 PDF Expert

Failing to file your form 941 on time can result in penalties from the irs. Web october 31 what is the penalty for failing to file form 941? Web state zip code foreign country name foreign province/county foreign postal code 950122 omb no. Web organizations have until january 31 to submit this form, so the due date for reporting 2021.

2023 Payroll Tax & Form 941 Due Dates Paylocity

Web form 941 for q1, 2023 is due in a week, meet the irs deadline with taxbandits taxbandits april 24, 2023 at 12:30 pm · 3 min read rock hill, sc / accesswire / april 24, 2023 / the. Web october 31 what is the penalty for failing to file form 941? Tax deadlines employers must know january 31: 2023).

2021 IRS Form 941 Deposit Rules and Schedule

October, november, december go to www.irs.gov/form941 for instructions and the latest information. Paying the fourth installment of 2023 estimated income taxes. Web organizations have until january 31 to submit this form, so the due date for reporting 2021 unemployment taxes, is january 31, 2022. Reporting income tax withholding and fica taxes for the fourth quarter of 2022 (form 941). Tax.

2023 Form 941 Generator Create Fillable Form 941 Online

2023) | form 941 (2023 q1) may 15: Web october 31 what is the penalty for failing to file form 941? Form 941 is an important document that all employers must complete and submit to the irs. Those returns are processed in the order received. As of july 12, 2023.

2023 Form 941 Generator Create Fillable Form 941 Online

As of july 12, 2023. Those returns are processed in the order received. Web payroll tax returns. Web october 31 what is the penalty for failing to file form 941? Web state zip code foreign country name foreign province/county foreign postal code 950122 omb no.

941 Form 2023

As of july 12, 2023. Web october 31 what is the penalty for failing to file form 941? Form 941 is an important document that all employers must complete and submit to the irs. Form 941 is used by organizations that wish to file their payroll and income tax returns quarterly. Reporting income tax withholding and fica taxes for the.

2020 Form IRS 941PR Fill Online, Printable, Fillable, Blank pdfFiller

Web payroll tax returns. Form 941 is an important document that all employers must complete and submit to the irs. Reporting income tax withholding and fica taxes for the fourth quarter of 2022 (form 941). As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Form 941 is used by organizations that wish.

2023) | Form 941 (2023 Q1) May 15:

Web organizations have until january 31 to submit this form, so the due date for reporting 2021 unemployment taxes, is january 31, 2022. Form 941 (2023 q1) | forms 720 (2023 q1), 730 (mar. Form 941 is an important document that all employers must complete and submit to the irs. Failing to file your form 941 on time can result in penalties from the irs.

Web October 31 What Is The Penalty For Failing To File Form 941?

Form 941 is used by organizations that wish to file their payroll and income tax returns quarterly. Web state zip code foreign country name foreign province/county foreign postal code 950122 omb no. As of july 12, 2023. For each month of late filing, a 5% penalty will be charged up to 25%.

Reporting Income Tax Withholding And Fica Taxes For The Fourth Quarter Of 2022 (Form 941).

Web form 941 for q1, 2023 is due in a week, meet the irs deadline with taxbandits taxbandits april 24, 2023 at 12:30 pm · 3 min read rock hill, sc / accesswire / april 24, 2023 / the. Tax deadlines employers must know january 31: Web forms filed quarterly with due dates of april 30, july 31, october 31, and january 31 (for the fourth quarter of the previous calendar year) file form 941, employer’s quarterly federal tax return, if you paid wages subject to employment taxes with the irs for each quarter by the last day of the month that follows the end of the quarter. Web the deadline to file 941 will be the last day of the month following the end of the quarter.

Those Returns Are Processed In The Order Received.

Paying the fourth installment of 2023 estimated income taxes. October, november, december go to www.irs.gov/form941 for instructions and the latest information. Web payroll tax returns. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)