3949 A Form What Does It Mean

3949 A Form What Does It Mean - Ad access irs tax forms. Web form 3949 a (rev. A form that a law enforcement official may file with the irs to receive information on someone alleged to have violated tax laws. A form that a law enforcement official may file with the irs to receive information on someone alleged to have violated tax laws. Use this form to report suspected tax law violations by a person or a business. (from the previous sheet) (accountable units used) (amount from pharmacy) (accountable units. Web thefreedictionary google correct all you're your grammar errors instantly. Get ready for tax season deadlines by completing any required tax forms today. Web complete a separate form 8949, page 1, for each applicable box. Complete, edit or print tax forms instantly.

Complete, edit or print tax forms instantly. I know for a fact this person is and also was involved in tax fraud. Get ready for tax season deadlines by completing any required tax forms today. Web the irs treats identity theft reports on a form 3949‑a as regular correspondence. that means the irs delays action on identity theft cases. Use this form to report suspected tax law violations by a person or a business. Web complete a separate form 8949, page 1, for each applicable box. A form that a law enforcement official may file with the irs to receive information on someone alleged to have violated tax laws. Web form 3949 a (rev. The proponent agency is otsg. Web i filled out a 3949a form on a person involved in a tax fraud ring about a month ago to the irs.

Name street address of residence city,. I know for a fact this person is and also was involved in tax fraud. Web complete a separate form 8949, page 1, for each applicable box. Web form 3949 a (rev. Use this form to report suspected tax law violations by a person or a business. Web thefreedictionary google correct all you're your grammar errors instantly. Complete, edit or print tax forms instantly. 27 percent could not be processed because they didn’t provide. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms.

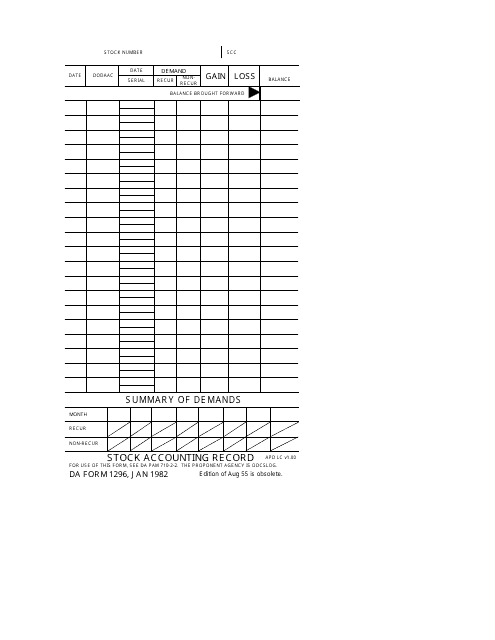

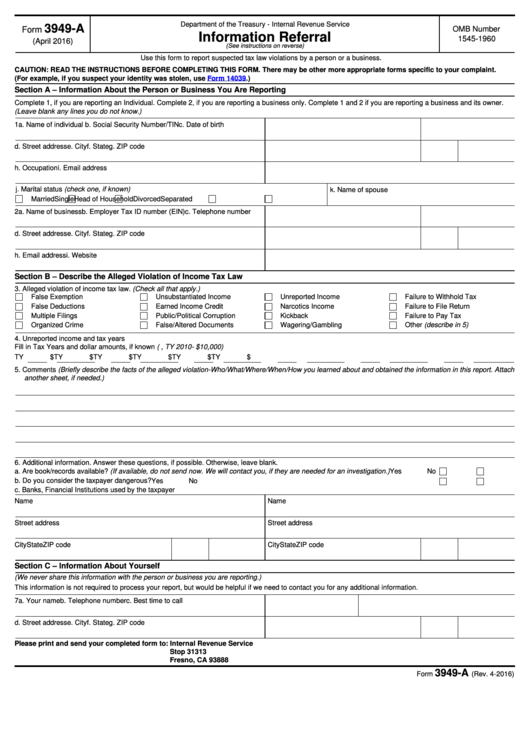

How to Fill Out Form 3949A or Form to Report Alleged Tax Law

Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web complete a separate form 8949, page 1, for each applicable box. I know for a fact this person is and also was involved in tax fraud. Web thefreedictionary google correct all you're your grammar errors instantly. Name street address of residence.

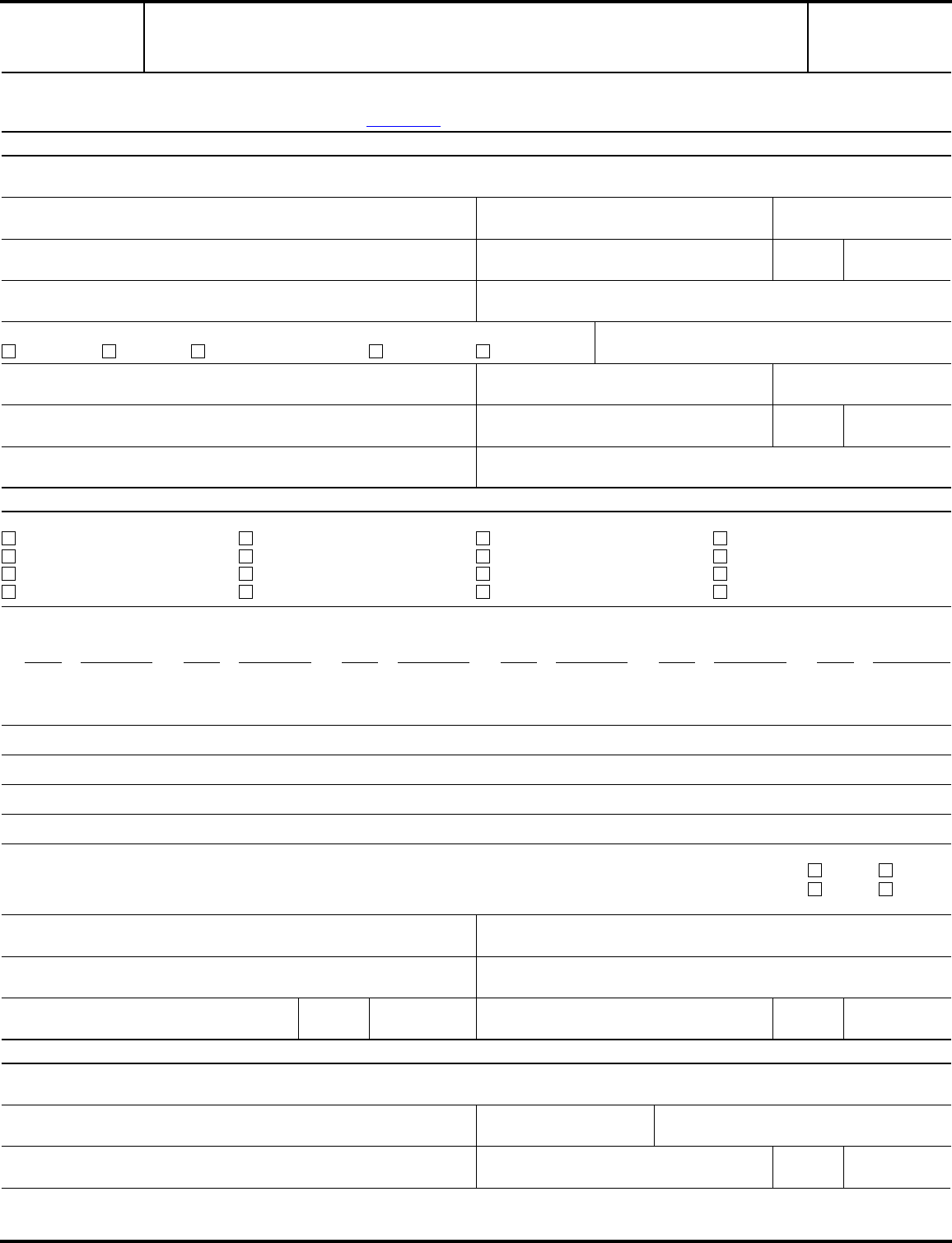

Form 3949A Edit, Fill, Sign Online Handypdf

Web complete a separate form 8949, page 1, for each applicable box. Use this form to report suspected tax law violations by a person or a business. Ad access irs tax forms. Web i filled out a 3949a form on a person involved in a tax fraud ring about a month ago to the irs. A form that a law.

A very interesting sysastry chart of my ex (outer) and I (inner). Why

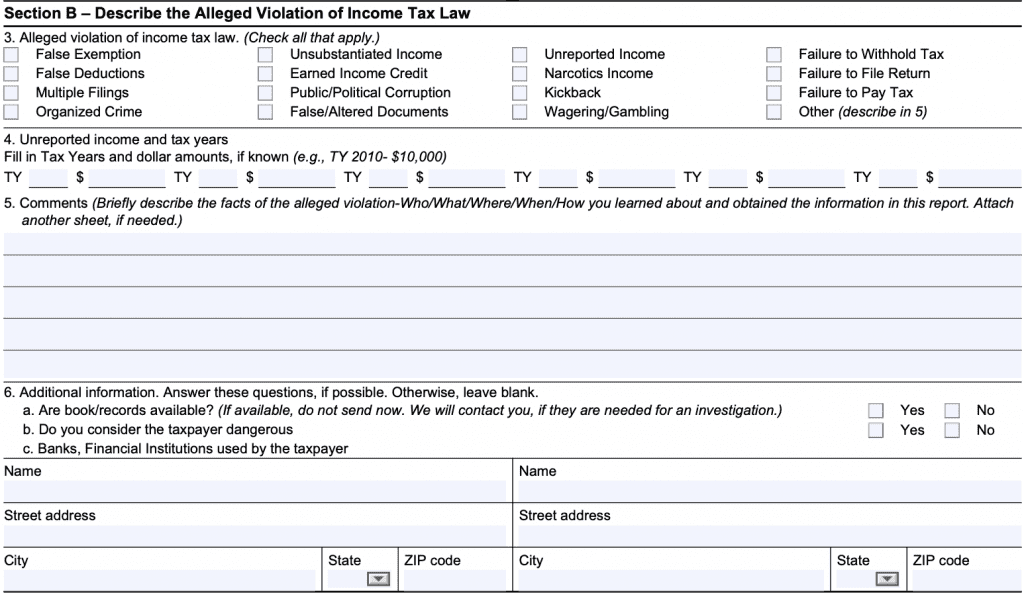

The proponent agency is otsg. Web complete a separate form 8949, page 1, for each applicable box. Web form 3949 a (rev. Get ready for tax season deadlines by completing any required tax forms today. A form that a law enforcement official may file with the irs to receive information on someone alleged to have violated tax laws.

IRS Form 3949A Instructions

Get ready for tax season deadlines by completing any required tax forms today. Web thefreedictionary google correct all you're your grammar errors instantly. Web complete a separate form 8949, page 1, for each applicable box. Name street address of residence city,. A form that a law enforcement official may file with the irs to receive information on someone alleged to.

Form 3949A Information Referral (2014) Free Download

Web the irs treats identity theft reports on a form 3949‑a as regular correspondence. that means the irs delays action on identity theft cases. The proponent agency is otsg. Web form 3949 a (rev. Web thefreedictionary google correct all you're your grammar errors instantly. A form that a law enforcement official may file with the irs to receive information on.

Printable Irs Form 3949 A Master of Documents

Web thefreedictionary google correct all you're your grammar errors instantly. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Ad access irs tax forms. Web complete a separate form 8949, page 1, for each applicable box. A form that a law enforcement official may file with the irs to receive information.

Form 3949 Information Report Referral Department Of The Tressury

I know for a fact this person is and also was involved in tax fraud. The proponent agency is otsg. A form that a law enforcement official may file with the irs to receive information on someone alleged to have violated tax laws. Web thefreedictionary google correct all you're your grammar errors instantly. Web complete a separate form 8949, page.

Form 3949A Information Referral (2014) Free Download

I know for a fact this person is and also was involved in tax fraud. (from the previous sheet) (accountable units used) (amount from pharmacy) (accountable units. Web complete a separate form 8949, page 1, for each applicable box. Get ready for tax season deadlines by completing any required tax forms today. Web i filled out a 3949a form on.

What Does Queen Elizabeth's "Lilibet" Nickname Mean? POPSUGAR Celebrity

Web thefreedictionary google correct all you're your grammar errors instantly. Use this form to report suspected tax law violations by a person or a business. Web complete a separate form 8949, page 1, for each applicable box. (from the previous sheet) (accountable units used) (amount from pharmacy) (accountable units. The proponent agency is otsg.

Fillable Form 3949A Information Referral printable pdf download

Use this form to report suspected tax law violations by a person or a business. Web complete a separate form 8949, page 1, for each applicable box. Name street address of residence city,. 27 percent could not be processed because they didn’t provide. (from the previous sheet) (accountable units used) (amount from pharmacy) (accountable units.

A Form That A Law Enforcement Official May File With The Irs To Receive Information On Someone Alleged To Have Violated Tax Laws.

Web i filled out a 3949a form on a person involved in a tax fraud ring about a month ago to the irs. Web thefreedictionary google correct all you're your grammar errors instantly. Use this form to report suspected tax law violations by a person or a business. Web complete a separate form 8949, page 1, for each applicable box.

Web Form 3949 A (Rev.

Get ready for tax season deadlines by completing any required tax forms today. 27 percent could not be processed because they didn’t provide. Name street address of residence city,. (from the previous sheet) (accountable units used) (amount from pharmacy) (accountable units.

The Proponent Agency Is Otsg.

A form that a law enforcement official may file with the irs to receive information on someone alleged to have violated tax laws. Web complete a separate form 8949, page 1, for each applicable box. Web the irs treats identity theft reports on a form 3949‑a as regular correspondence. that means the irs delays action on identity theft cases. Ad access irs tax forms.

Web Watch Newsmax Live For The Latest News And Analysis On Today's Top Stories, Right Here On Facebook.

Complete, edit or print tax forms instantly. I know for a fact this person is and also was involved in tax fraud.