401K Beneficiary Form

401K Beneficiary Form - Completing and submitting the form successfully changes your 401(k)'s beneficiary. Log in to your netbenefits ®. The plan administrator should provide the. Web beneficiary(ies), you must fill out two separate forms. • be sure to review and sign Web most importantly, you can feel confident that your loved ones will receive the assets you intend for them to have. If you have a workplace plan, like a 401 (k), that's serviced by fidelity; It does not affect the right of any person who is eligible for survivor benefits. Web update your annuity beneficiaries online; Web when you set up a company 401 (k), you're faced with a beneficiary form that asks for both the primary and the contingent beneficiary or beneficiaries.

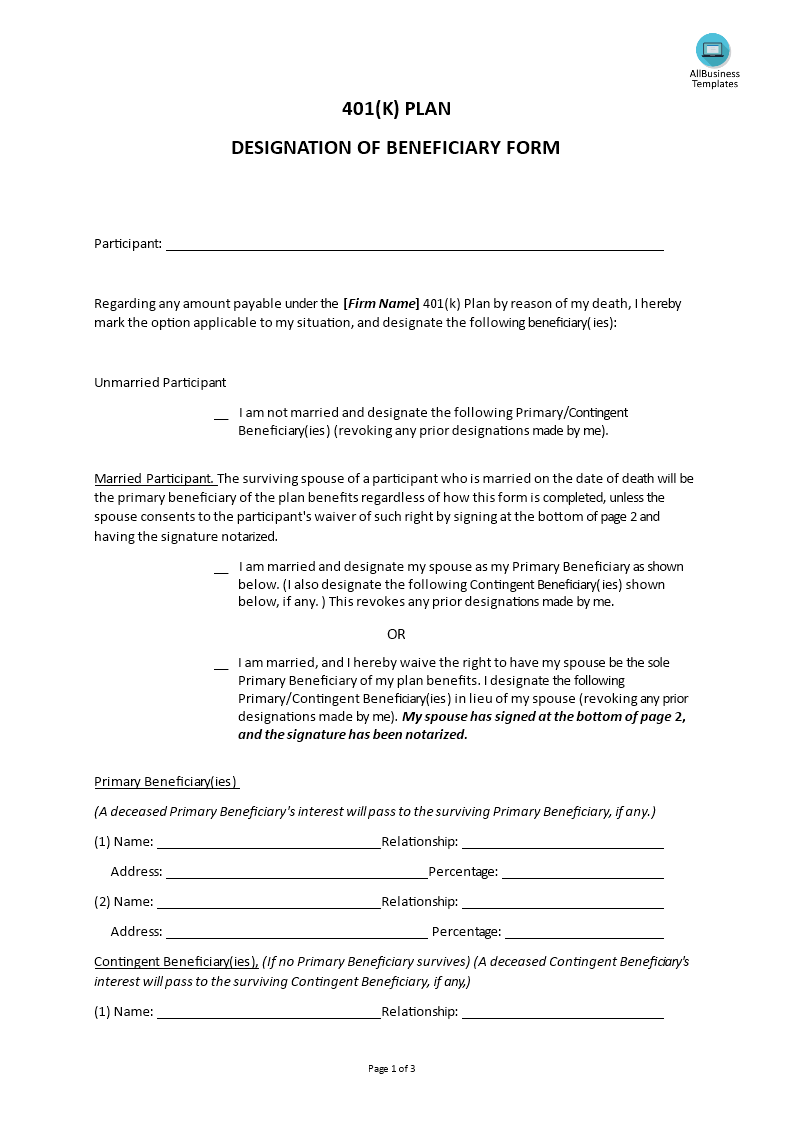

To designate beneficiaries for a qualified retirement plan (qrp), use the qualified retirement plan (qrp)/individual 401(k) beneficiary designation form. Web update your annuity beneficiaries online; Web to designate a new beneficiary, simply request a beneficiary form from your 401(k) administrator. If you have a workplace plan, like a 401 (k), that's serviced by fidelity; If you should die with that 401. Web this form may be used to designate one or more beneficiaries for an ira or a 403(b)(7) account. Web beneficiary(ies), you must fill out two separate forms. It does not affect the right of any person who is eligible for survivor benefits. Web when you set up a company 401 (k), you're faced with a beneficiary form that asks for both the primary and the contingent beneficiary or beneficiaries. Web updated august 25, 2022 reviewed by david kindness fact checked by vikki velasquez when you sign up for a 401 (k) plan at work, you’ll be asked to name beneficiaries:

It does not affect the right of any person who is eligible for survivor benefits. If you have a workplace plan, like a 401 (k), that's serviced by fidelity; Web when you set up a company 401 (k), you're faced with a beneficiary form that asks for both the primary and the contingent beneficiary or beneficiaries. This form may not be used and will not be effective in any way to elect, The beneficiaries you designate will receive payment of the value of your account(s) following your death. Web beneficiary(ies), you must fill out two separate forms. Web this form may be used to designate one or more beneficiaries for an ira or a 403(b)(7) account. Completing and submitting the form successfully changes your 401(k)'s beneficiary. Web most importantly, you can feel confident that your loved ones will receive the assets you intend for them to have. Web to designate a new beneficiary, simply request a beneficiary form from your 401(k) administrator.

Massmutual 401k Beneficiary Form Universal Network

Web beneficiary(ies), you must fill out two separate forms. Log in to your netbenefits ®. If you have a workplace plan, like a 401 (k), that's serviced by fidelity; Pick a beneficiary for your 401 (k) plan if you have more than one person in mind as a beneficiary, you can select primary beneficiaries and have the assets. The beneficiaries.

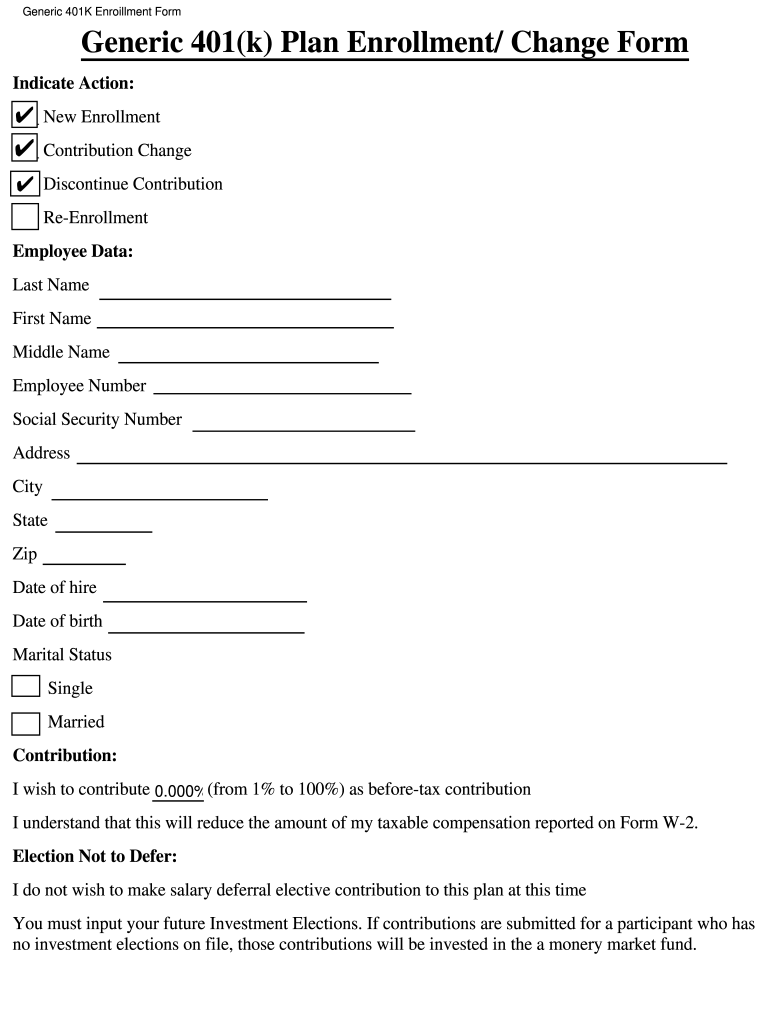

401k Enrollment Form Fill Out and Sign Printable PDF Template signNow

Web updated august 25, 2022 reviewed by david kindness fact checked by vikki velasquez when you sign up for a 401 (k) plan at work, you’ll be asked to name beneficiaries: The plan administrator should provide the. Web beneficiary(ies), you must fill out two separate forms. Completing and submitting the form successfully changes your 401(k)'s beneficiary. Web june 8, 2020,.

Paychex 401k Beneficiary Form Universal Network

Log in to your netbenefits ®. Web updated august 25, 2022 reviewed by david kindness fact checked by vikki velasquez when you sign up for a 401 (k) plan at work, you’ll be asked to name beneficiaries: Completing and submitting the form successfully changes your 401(k)'s beneficiary. Web to designate a new beneficiary, simply request a beneficiary form from your.

Paychex 401k beneficiary designation form Fill out & sign online DocHub

Log in to your netbenefits ®. If you have a workplace plan, like a 401 (k), that's serviced by fidelity; • be sure to review and sign Web this form may be used to designate one or more beneficiaries for an ira or a 403(b)(7) account. Web beneficiary(ies), you must fill out two separate forms.

401k Beneficiary Designation form Best Of Ira Designation Of

Web most importantly, you can feel confident that your loved ones will receive the assets you intend for them to have. Web june 8, 2020, at 9:00 a.m. Log in to your netbenefits ®. If you should die with that 401. • be sure to review and sign

401K Designation Of Beneficiary Templates at

The plan administrator should provide the. This form may not be used and will not be effective in any way to elect, If you should die with that 401. Web june 8, 2020, at 9:00 a.m. Log in to your netbenefits ®.

Empower 401k Beneficiary Form Universal Network

Pick a beneficiary for your 401 (k) plan if you have more than one person in mind as a beneficiary, you can select primary beneficiaries and have the assets. Log in to your netbenefits ®. Completing and submitting the form successfully changes your 401(k)'s beneficiary. If you have a workplace plan, like a 401 (k), that's serviced by fidelity; This.

Prudential 401k Beneficiary Form Universal Network

Web june 8, 2020, at 9:00 a.m. Log in to your netbenefits ®. It does not affect the right of any person who is eligible for survivor benefits. Web this form may be used to designate one or more beneficiaries for an ira or a 403(b)(7) account. • be sure to review and sign

Voya 401k Withdrawal Form Universal Network

The plan administrator should provide the. If you have a workplace plan, like a 401 (k), that's serviced by fidelity; The beneficiaries you designate will receive payment of the value of your account(s) following your death. Web to designate a new beneficiary, simply request a beneficiary form from your 401(k) administrator. Pick a beneficiary for your 401 (k) plan if.

401k Beneficiary Form Fidelity Universal Network

Completing and submitting the form successfully changes your 401(k)'s beneficiary. This form may not be used and will not be effective in any way to elect, Web to designate a new beneficiary, simply request a beneficiary form from your 401(k) administrator. Web when you set up a company 401 (k), you're faced with a beneficiary form that asks for both.

Web Updated August 25, 2022 Reviewed By David Kindness Fact Checked By Vikki Velasquez When You Sign Up For A 401 (K) Plan At Work, You’ll Be Asked To Name Beneficiaries:

Web june 8, 2020, at 9:00 a.m. Web this form may be used to designate one or more beneficiaries for an ira or a 403(b)(7) account. Completing and submitting the form successfully changes your 401(k)'s beneficiary. To designate beneficiaries for a qualified retirement plan (qrp), use the qualified retirement plan (qrp)/individual 401(k) beneficiary designation form.

The Plan Administrator Should Provide The.

• be sure to review and sign Web to designate a new beneficiary, simply request a beneficiary form from your 401(k) administrator. The beneficiaries you designate will receive payment of the value of your account(s) following your death. Web when you set up a company 401 (k), you're faced with a beneficiary form that asks for both the primary and the contingent beneficiary or beneficiaries.

This Form May Not Be Used And Will Not Be Effective In Any Way To Elect,

If you should die with that 401. Web most importantly, you can feel confident that your loved ones will receive the assets you intend for them to have. Pick a beneficiary for your 401 (k) plan if you have more than one person in mind as a beneficiary, you can select primary beneficiaries and have the assets. Web update your annuity beneficiaries online;

It Does Not Affect The Right Of Any Person Who Is Eligible For Survivor Benefits.

Web beneficiary(ies), you must fill out two separate forms. If you have a workplace plan, like a 401 (k), that's serviced by fidelity; Log in to your netbenefits ®.