8300 Form 2022

8300 Form 2022 - Assuming the lessee makes all payments in cash, total cash received under the. If purchases are more than 24 hours apart and not connected in any way that the. Web form 8300 is a document filed with the irs when an individual or an entity receives a cash payment of over $10,000. Web if so, in addition to filing form 8300 ( report of cash payments over $10,000 received in a trade or business) with the irs by the 15th day after the transaction. Web each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more related. This guide is provided to educate and assist u.s. This form is for income earned in tax year 2022, with tax returns due in april. Web the law requires that trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form 8300, report of cash payments over. Form 8300, report of cash payments over $10,000 received in a trade or business, must be. Web form 8300 is important for the irs’s record maintenance.

This form is for income earned in tax year 2022, with tax returns due in april. Web if so, in addition to filing form 8300 ( report of cash payments over $10,000 received in a trade or business) with the irs by the 15th day after the transaction. Web form 8300 is important for the irs’s record maintenance. How to file form 8300. Web each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more related. Web starting january 1, 2024, a crypto transaction may trigger a form 8300 filing when any person (including an individual, company, corporation, partnership,. Web the infrastructure bill includes an information reporting requirement for cryptocurrency asset exchanges and custodians on an irs form 1099, and an information reporting. This guide is provided to educate and assist u.s. Form 8300, report of cash payments over $10,000 received in a trade or business, must be. Web more about the federal form 8300 individual income tax voucher ty 2022 we last updated the report of cash payments over $10,000 received in a trade or business in.

Web we last updated federal form 8300 in february 2023 from the federal internal revenue service. Web each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more related. Tax laws require taxpayers to file an 8300. Web each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more. Web starting january 1, 2024, a crypto transaction may trigger a form 8300 filing when any person (including an individual, company, corporation, partnership,. Web if so, in addition to filing form 8300 ( report of cash payments over $10,000 received in a trade or business) with the irs by the 15th day after the transaction. Web more about the federal form 8300 individual income tax voucher ty 2022 we last updated the report of cash payments over $10,000 received in a trade or business in. Web form 8300 is an irs form which requires businesses that receive large cash payments (usually in excess of $10,000) to report the transaction to the irs on irs form 8300. This form is for income earned in tax year 2022, with tax returns due in april. Web fincen registration of money services business (fincen report 107) report of foreign bank and financial accounts (fincen report 114) report of cash payments over.

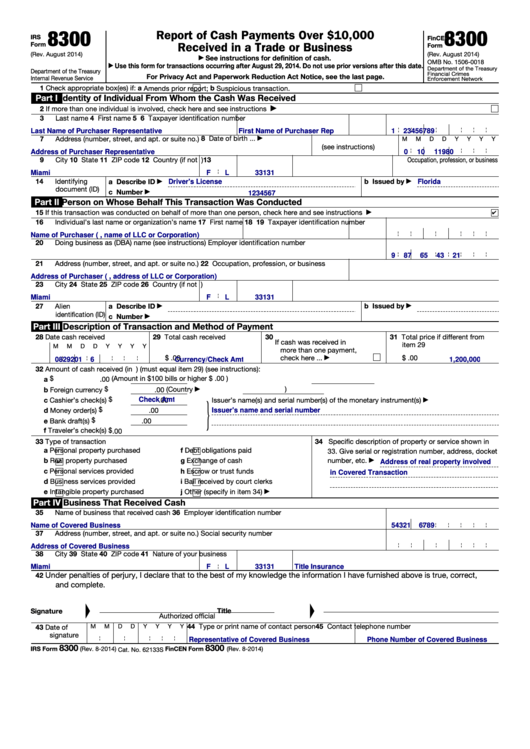

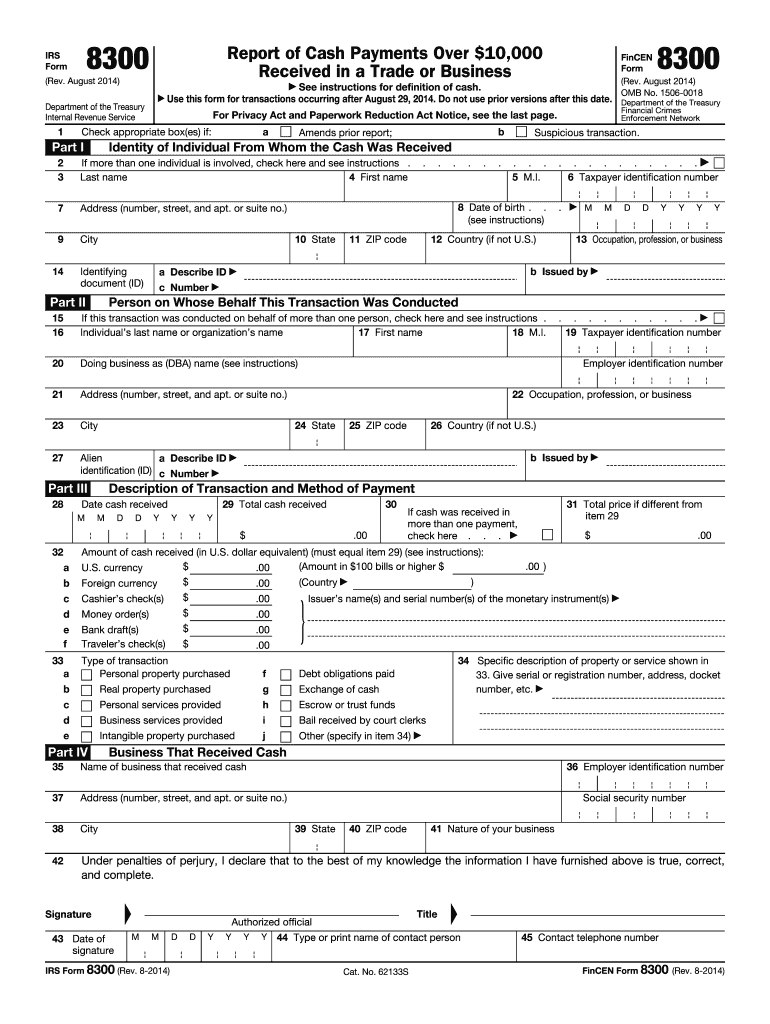

Fillable Form 8300 Fincen printable pdf download

Web form 8300 is an irs form which requires businesses that receive large cash payments (usually in excess of $10,000) to report the transaction to the irs on irs form 8300. Web form 8300 is important for the irs’s record maintenance. Web form 8300 is a document filed with the irs when an individual or an entity receives a cash.

The IRS Form 8300 and How it Works

Web form 8300 is important for the irs’s record maintenance. Web if so, in addition to filing form 8300 ( report of cash payments over $10,000 received in a trade or business) with the irs by the 15th day after the transaction. Web form 8300 requires a person that receives more than $10,000 in cash during the course of its.

IRS Form 8300 Info & Requirements for Reporting Cash Payments

Assuming the lessee makes all payments in cash, total cash received under the. Web reference guide on the irs/fincen form 8300, report of cash payments over $10,000 received in a trade or business. Tax laws require taxpayers to file an 8300. Web if so, in addition to filing form 8300 ( report of cash payments over $10,000 received in a.

If I am paying cash for a car, why do they need to run a credit report

Form 8300, report of cash payments over $10,000 received in a trade or business, must be. Web the law requires that trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form 8300, report of cash payments over. Web a trade or business that receives more than $10,000 in related transactions must file.

Irs 8300 Form Fill Out and Sign Printable PDF Template signNow

Web the infrastructure bill includes an information reporting requirement for cryptocurrency asset exchanges and custodians on an irs form 1099, and an information reporting. Web form 8300 is an irs form which requires businesses that receive large cash payments (usually in excess of $10,000) to report the transaction to the irs on irs form 8300. How to file form 8300..

IRS Form 8300 Info & Requirements for Reporting Cash Payments

Assuming the lessee makes all payments in cash, total cash received under the. Web each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more related. Form 8300, report of cash payments over $10,000 received in a trade or business,.

Form 8300 Explanation And Reference Guide

Web more about the federal form 8300 individual income tax voucher ty 2022 we last updated the report of cash payments over $10,000 received in a trade or business in. Web each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two.

Filing Form 8300 for 2020 YouTube

Web each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more. This form is for income earned in tax year 2022, with tax returns due in april. If purchases are more than 24 hours apart and not connected in.

Form 8300 Do You Have Another IRS Issue? ACCCE

Assuming the lessee makes all payments in cash, total cash received under the. Web more about the federal form 8300 individual income tax voucher ty 2022 we last updated the report of cash payments over $10,000 received in a trade or business in. Web if so, in addition to filing form 8300 ( report of cash payments over $10,000 received.

IRS Form 8300 Reporting Cash Sales Over 10,000

Web starting january 1, 2024, a crypto transaction may trigger a form 8300 filing when any person (including an individual, company, corporation, partnership,. Form 8300, report of cash payments over $10,000 received in a trade or business, must be. Web fincen registration of money services business (fincen report 107) report of foreign bank and financial accounts (fincen report 114) report.

If Purchases Are More Than 24 Hours Apart And Not Connected In Any Way That The.

Web we last updated federal form 8300 in february 2023 from the federal internal revenue service. Assuming the lessee makes all payments in cash, total cash received under the. Web each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more. Form 8300 can be filed and sent by mail, online, or with a tax professional.

Web Form 8300 Is An Irs Form Which Requires Businesses That Receive Large Cash Payments (Usually In Excess Of $10,000) To Report The Transaction To The Irs On Irs Form 8300.

Web form 8300 is important for the irs’s record maintenance. How to file form 8300. Web more about the federal form 8300 individual income tax voucher ty 2022 we last updated the report of cash payments over $10,000 received in a trade or business in. Web the infrastructure bill includes an information reporting requirement for cryptocurrency asset exchanges and custodians on an irs form 1099, and an information reporting.

Web Fincen Registration Of Money Services Business (Fincen Report 107) Report Of Foreign Bank And Financial Accounts (Fincen Report 114) Report Of Cash Payments Over.

Web a trade or business that receives more than $10,000 in related transactions must file form 8300. This form is for income earned in tax year 2022, with tax returns due in april. Web if so, in addition to filing form 8300 ( report of cash payments over $10,000 received in a trade or business) with the irs by the 15th day after the transaction. This guide is provided to educate and assist u.s.

Tax Laws Require Taxpayers To File An 8300.

Web form 8300 requires a person that receives more than $10,000 in cash during the course of its trade or business report the receipt of such cash to the irs and sends a written. Web reference guide on the irs/fincen form 8300, report of cash payments over $10,000 received in a trade or business. Web form 8300 is a document filed with the irs when an individual or an entity receives a cash payment of over $10,000. Form 8300, report of cash payments over $10,000 received in a trade or business, must be.