940 Fillable Form 2022

940 Fillable Form 2022 - To complete the 940 tax form, you can either use an irs blank template, download a sample pdf, or file irs form 940 online. Web file this schedule with form 940. However, if you deposited all your futa tax when it was due, you may file form 940 by february 10, 2023. Amended trade name (if any) address 7hvw 6wuhhwdraft number street suite or room number as of b. Web when do i file form 940? June 2022) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county foreign postal code. Unlike your futa payments, which are due every calendar quarter, you must submit form 940 annually. Web how to fill out form 940? Place an “x” in the box of every state in which you had to pay state unemployment tax this year. Web total wages paid in the calendar year 2022 or 2023.

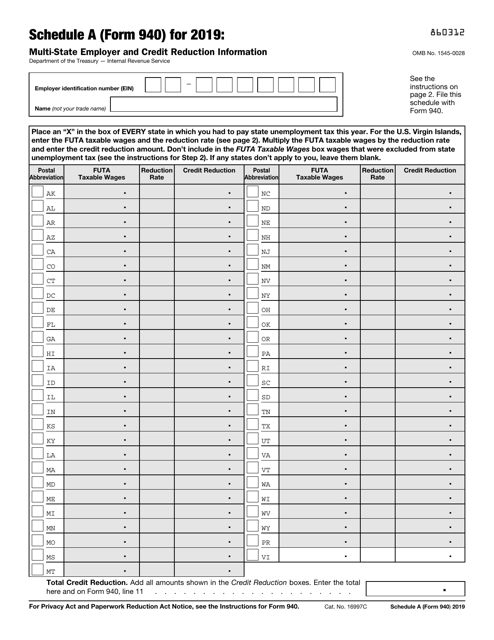

Place an “x” in the box of every state in which you had to pay state unemployment tax this year. (however, if you’re up to date on all your futa payments, you can take an additional ten days and file form 940 by february 10, 2022.) how bench. The due date for filing form 940 for 2021 is january 31, 2022. Adjustments for state exclusions (if applicable) futa tax; Form 940 requires the following information: If your total futa tax after adjustments (form 940, line 12) is more than $500, you must make deposits by electronic funds transfer. For each state with a credit reduction rate greater than zero, enter the futa taxable wages, multiply by the reduction rate, and enter the credit reduction amount. However, if you deposited all your futa tax when it was due, you may file form 940 by february 10, 2023. Total payments to all employees; Amended trade name (if any) address 7hvw 6wuhhwdraft number street suite or room number as of b.

Web how to fill out form 940? The due date for filing form 940 for 2021 is january 31, 2022. Web total wages paid in the calendar year 2022 or 2023. Web making payments with form 940 to avoid a penalty, make your payment with your 2022 form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts from earlier quarters) is $500 or less. Web 940 for 2022: The instructions provided by the irs will help you understand how to fill out the form correctly. Amended trade name (if any) address 7hvw 6wuhhwdraft number street suite or room number as of b. Web when do i file form 940? (however, if you’re up to date on all your futa payments, you can take an additional ten days and file form 940 by february 10, 2022.) how bench. Web file this schedule with form 940.

IRS Form 940 Schedule A Download Fillable PDF or Fill Online Multi

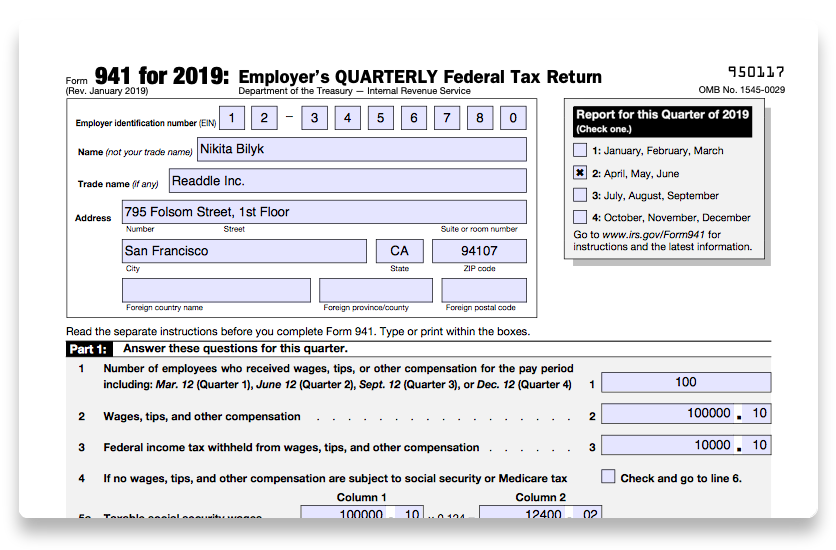

Form 940 requires the following information: Web you must file your 2022 form 940 by january 31, 2023, but if you make all your required futa tax deposits by the dates they are due, this filing deadline will be extended to february 10, 2023. June 2022) employer’s quarterly federal tax return department of the treasury — internal revenue service employer.

940 Form 2021 IRS Forms TaxUni

Form 940 requires the following information: If your total futa tax after adjustments (form 940, line 12) is more than $500, you must make deposits by electronic funds transfer. The due date for filing form 940 for 2021 is january 31, 2022. Adjustments for state exclusions (if applicable) futa tax; Web you must file your 2022 form 940 by january.

1040 Tax Form Instructions 2021 2022 1040 Forms

Web file this schedule with form 940. Web 940 for 2022: However, if you deposited all your futa tax when it was due, you may file form 940 by february 10, 2023. The instructions provided by the irs will help you understand how to fill out the form correctly. Form 940 requires the following information:

10 Form Irs 10 10 Secrets About 10 Form Irs 10 That Has Never Been

Amended trade name (if any) address 7hvw 6wuhhwdraft number street suite or room number as of b. Unlike your futa payments, which are due every calendar quarter, you must submit form 940 annually. The instructions provided by the irs will help you understand how to fill out the form correctly. The due date for filing form 940 for 2021 is.

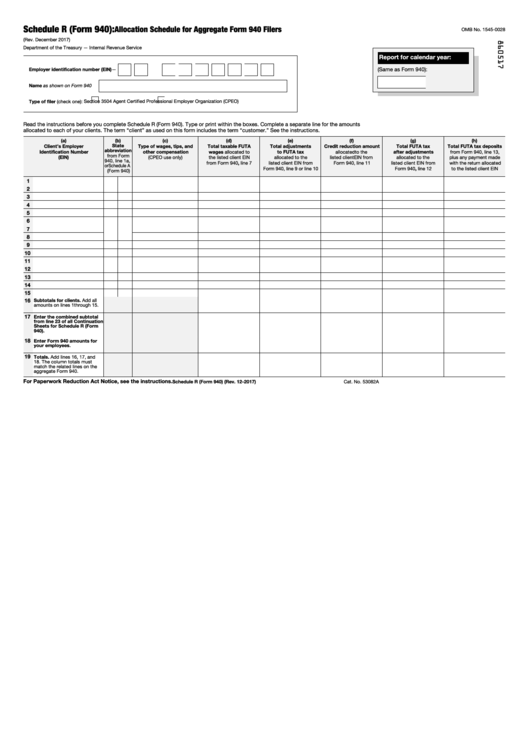

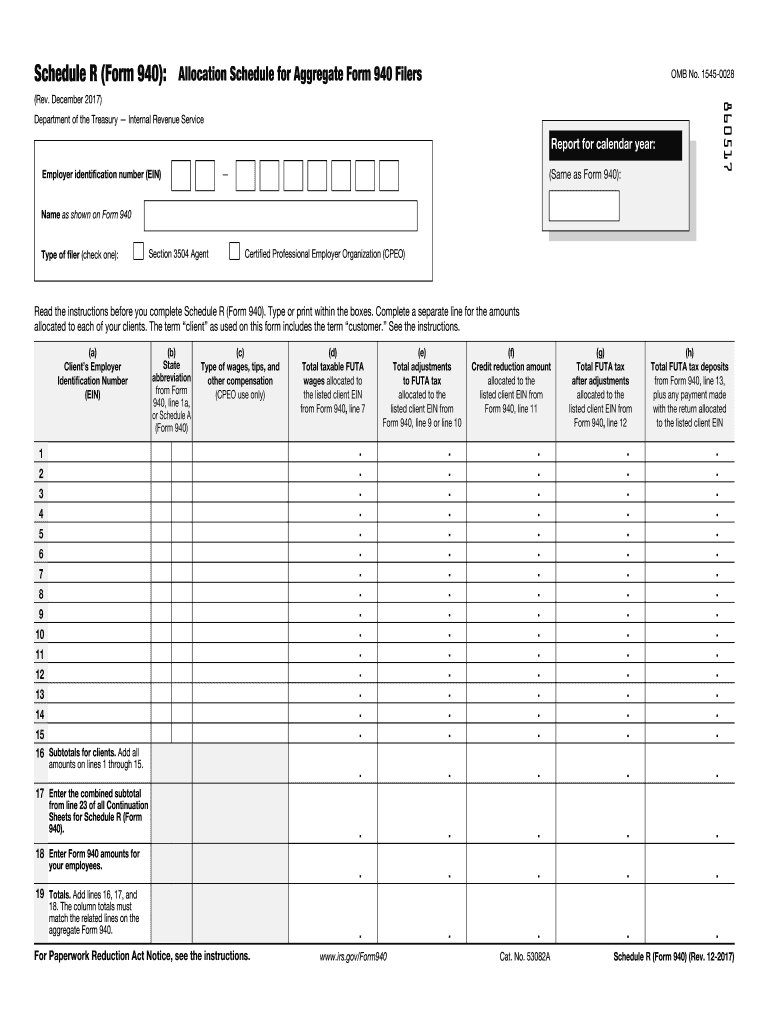

Fillable Schedule R (Form 940) Allocation Schedule For Aggregate Form

Unlike your futa payments, which are due every calendar quarter, you must submit form 940 annually. Form 940 requires the following information: Web total wages paid in the calendar year 2022 or 2023. Total payments to all employees; Web information about form 940, employer's annual federal unemployment (futa) tax return, including recent updates, related forms and instructions on how to.

940 Form 2022 Fillable Online And Printable Fillable Form 2022

Web the due date for filing form 940 for 2022 is january 31, 2023. Department of the treasury — internal revenue service omb no. Web you must file your 2022 form 940 by january 31, 2023, but if you make all your required futa tax deposits by the dates they are due, this filing deadline will be extended to february.

Schedule R From Fill Out and Sign Printable PDF Template signNow

Web 940 for 2022: The due date for filing form 940 for 2021 is january 31, 2022. Web file this schedule with form 940. Department of the treasury — internal revenue service omb no. Amended trade name (if any) address 7hvw 6wuhhwdraft number street suite or room number as of b.

Fill Free fillable IRS form 940 schedule A 2019 PDF form

Web when do i file form 940? The due date for filing form 940 for 2021 is january 31, 2022. Web information about form 940, employer's annual federal unemployment (futa) tax return, including recent updates, related forms and instructions on how to file. Web 940 for 2022: Web file this schedule with form 940.

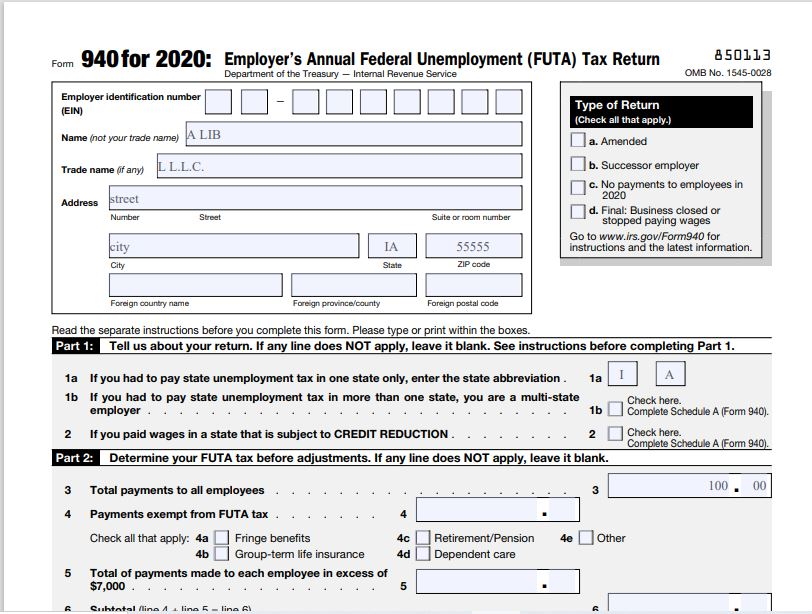

How to Complete 2020 Form 940 FUTA Tax Return Nina's Soap

Web how to fill out form 940? Web making payments with form 940 to avoid a penalty, make your payment with your 2022 form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts from earlier quarters) is $500 or less. The due date for filing form 940 for 2021 is january 31, 2022. If your.

Form 940 pr 2022 Fill online, Printable, Fillable Blank

(however, if you’re up to date on all your futa payments, you can take an additional ten days and file form 940 by february 10, 2022.) how bench. Place an “x” in the box of every state in which you had to pay state unemployment tax this year. For each state with a credit reduction rate greater than zero, enter.

Web 940 For 2022:

To complete the 940 tax form, you can either use an irs blank template, download a sample pdf, or file irs form 940 online. Web how to fill out form 940? Web the due date for filing form 940 for 2022 is january 31, 2023. Web total wages paid in the calendar year 2022 or 2023.

Amended Trade Name (If Any) Address 7Hvw 6Wuhhwdraft Number Street Suite Or Room Number As Of B.

June 2022) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county foreign postal code. Place an “x” in the box of every state in which you had to pay state unemployment tax this year. Web when do i file form 940? Form 940 requires the following information:

(However, If You’re Up To Date On All Your Futa Payments, You Can Take An Additional Ten Days And File Form 940 By February 10, 2022.) How Bench.

Department of the treasury — internal revenue service omb no. Web you must file your 2022 form 940 by january 31, 2023, but if you make all your required futa tax deposits by the dates they are due, this filing deadline will be extended to february 10, 2023. Web information about form 940, employer's annual federal unemployment (futa) tax return, including recent updates, related forms and instructions on how to file. The due date for filing form 940 for 2021 is january 31, 2022.

If Your Total Futa Tax After Adjustments (Form 940, Line 12) Is More Than $500, You Must Make Deposits By Electronic Funds Transfer.

The instructions provided by the irs will help you understand how to fill out the form correctly. Adjustments for state exclusions (if applicable) futa tax; Total payments to all employees; For each state with a credit reduction rate greater than zero, enter the futa taxable wages, multiply by the reduction rate, and enter the credit reduction amount.