941 Annual Reconciliation Form

941 Annual Reconciliation Form - Complete, edit or print tax forms instantly. Run a payroll register for the quarter. Download your updated document, export it to the cloud, print it from the editor, or share it with other participants using a shareable link. Compare those figures with the totals reported on all four 941s for the year. However, some small employers (those whose annual liability for social security, medicare, and. June 2022) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name. Form 941 asks for the total amount of. Fix discrepancies as soon as you. October, november, december go to www.irs.gov/form941 for instructions and the latest. Web get the form 941 annual tax accomplished.

See the box to the right. June 2022) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name. Form 941 is used by employers. Web the internal revenue service would like to share the benefits of completing a payroll reconciliation prior to filing your final form 941, employer's quarterly tax return or. To the ohio department of. Compare those figures with the totals reported on all four 941s for the year. Form 941 asks for the total amount of. Ad get ready for tax season deadlines by completing any required tax forms today. Use our detailed instructions to fill out and. Use forms for the calendar.

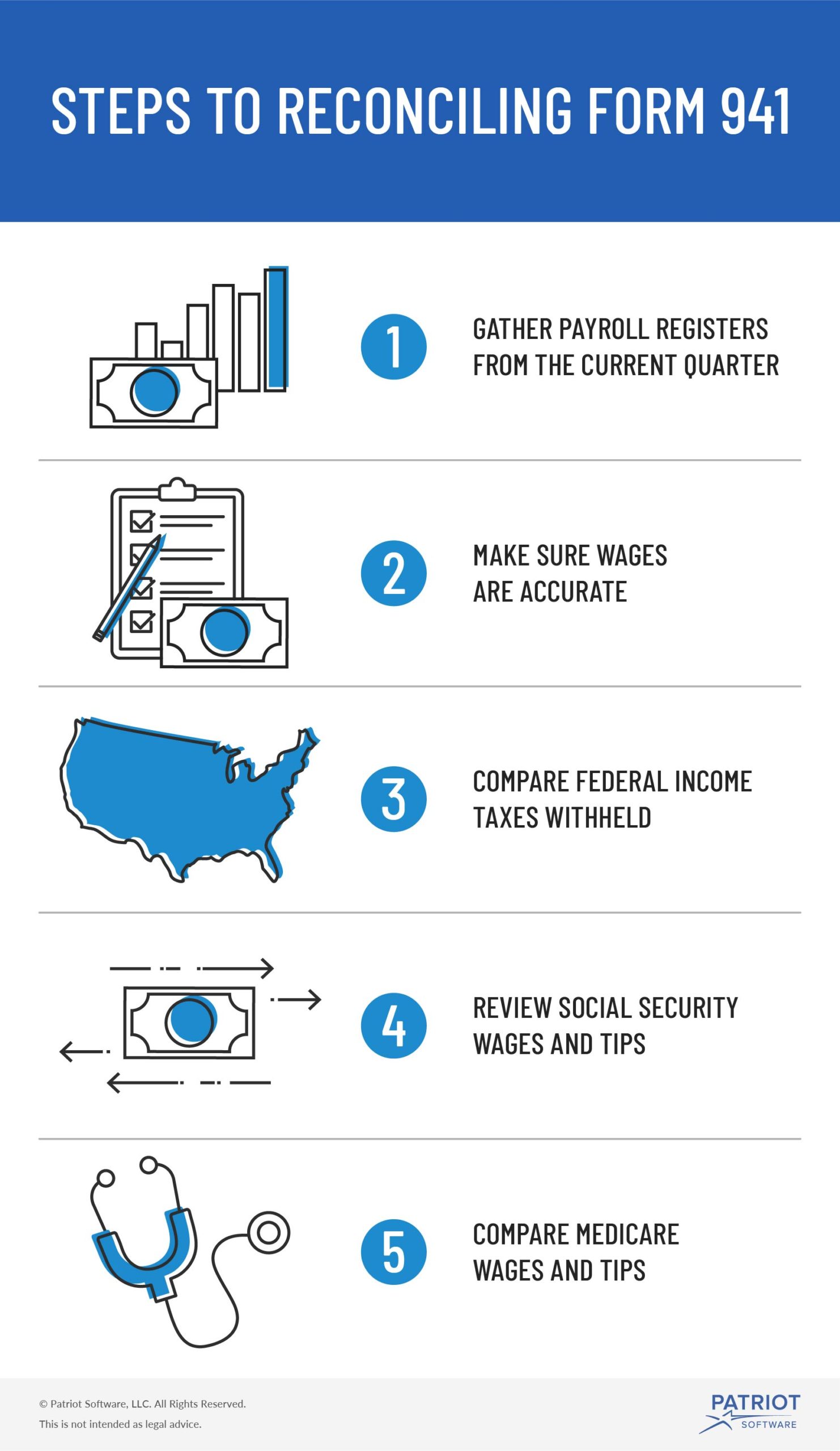

Ad get ready for tax season deadlines by completing any required tax forms today. However, some small employers (those whose annual liability for social security, medicare, and. Fix discrepancies as soon as you. Compare those figures with the totals reported on all four 941s for the year. Use forms for the calendar. October, november, december go to www.irs.gov/form941 for instructions and the latest. Explore filing plans for single businesses or 3rd parties filing for multiple businesses. Web the internal revenue service would like to share the benefits of completing a payroll reconciliation prior to filing your final form 941, employer's quarterly tax return or. Complete, edit or print tax forms instantly. Gather information needed to complete form 941.

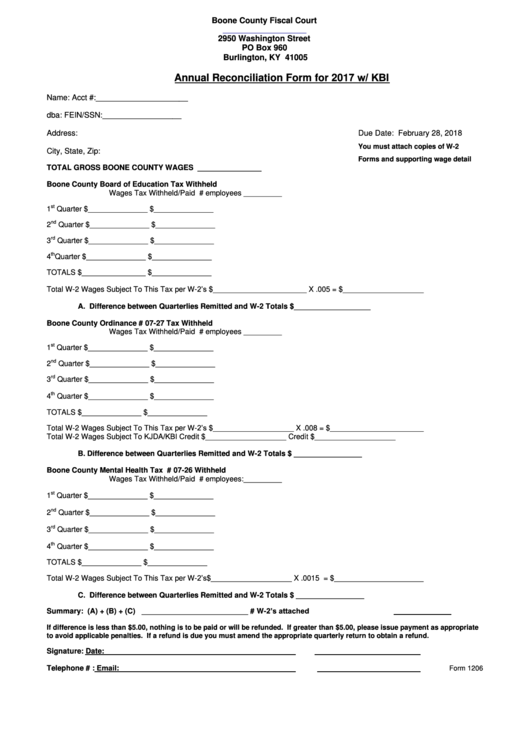

Fillable Form 1206 Annual Reconciliation Form W/ Kbi 2017 printable

Compare those figures with the totals reported on all four 941s for the year. Instead, employers in the u.s. October, november, december go to www.irs.gov/form941 for instructions and the latest. Run a report that shows annual payroll amounts. Run a payroll register for the quarter.

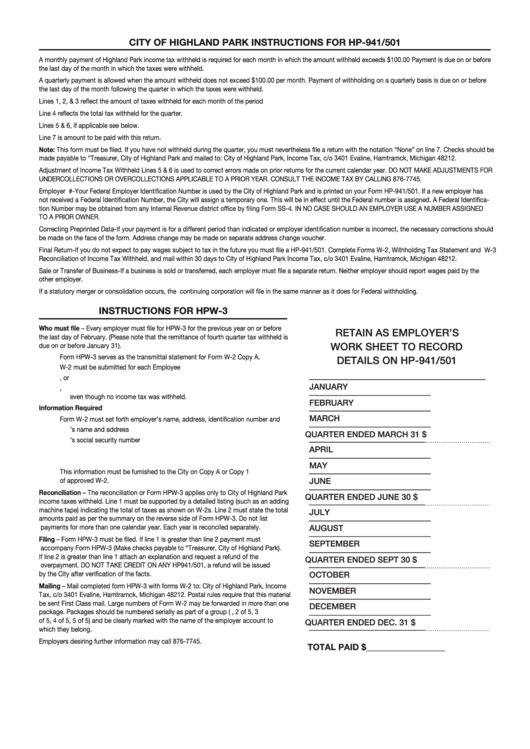

Instructions For Form Hp941/501/form Hpw3 Highland Park Tax

Use forms for the calendar. Web get the form 941 annual tax accomplished. Some small employers are eligible to file an annual form 944 pdf. Explore filing plans for single businesses or 3rd parties filing for multiple businesses. Form 941 asks for the total amount of.

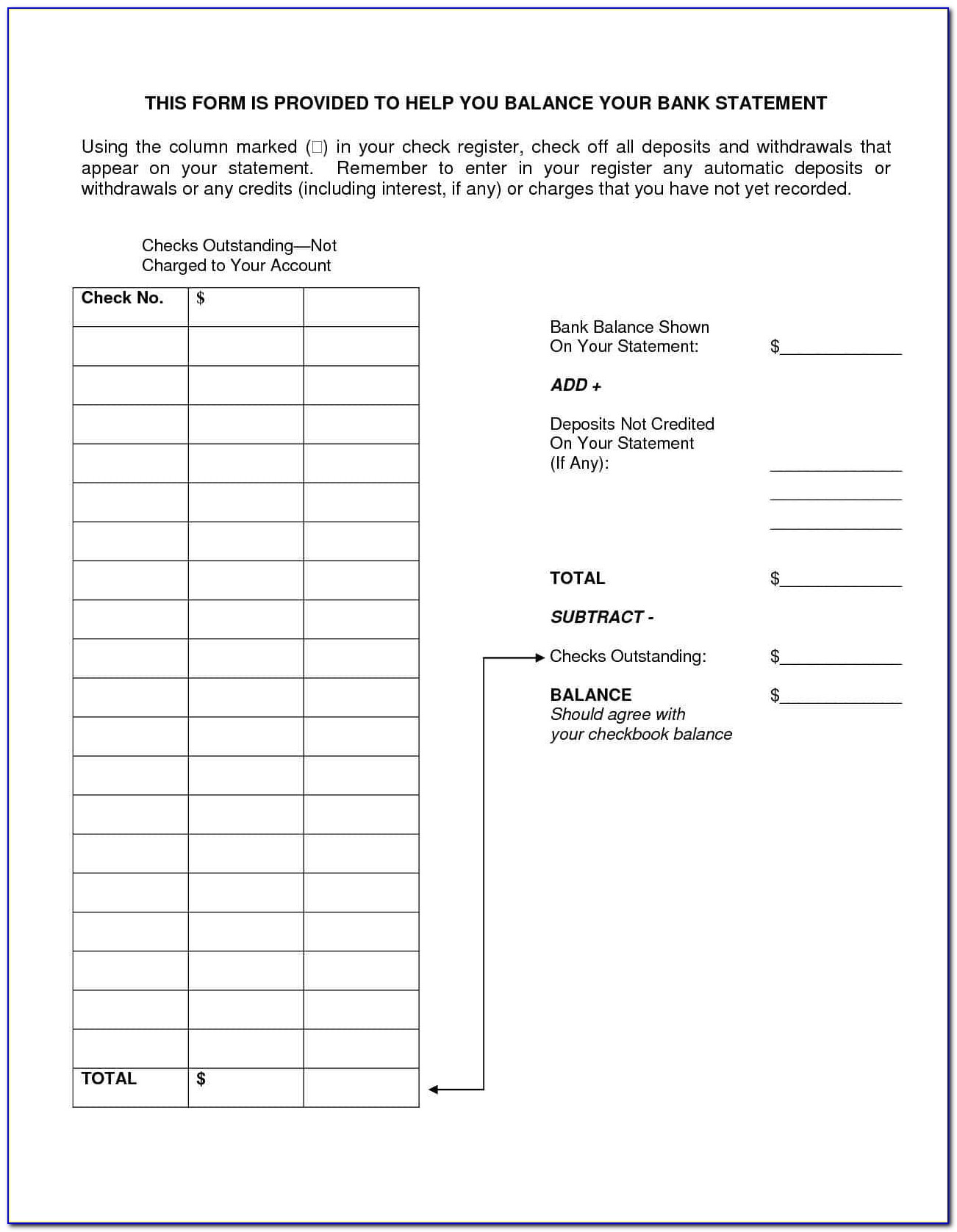

Daily Cash Reconciliation Excel Template

Use our detailed instructions to fill out and. To the ohio department of. October, november, december go to www.irs.gov/form941 for instructions and the latest. Explore filing plans for single businesses or 3rd parties filing for multiple businesses. Web get the form 941 annual tax accomplished.

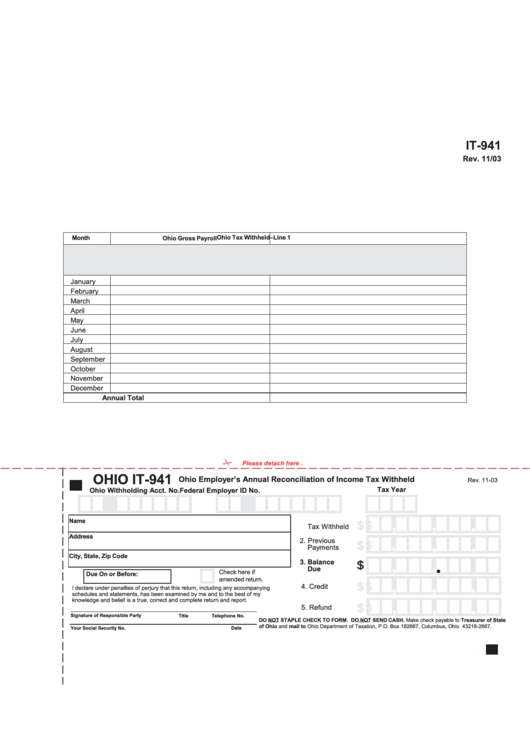

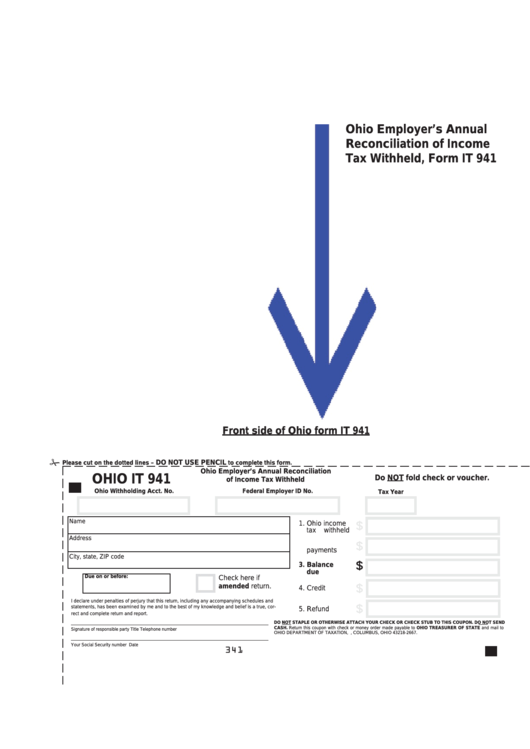

Form It941 Employer'S Annual Reconciliation Of Tax Withheld

Download your updated document, export it to the cloud, print it from the editor, or share it with other participants using a shareable link. Forget about scanning and printing out forms. To the ohio department of. If these forms are not in balance, penalties from the irs and/or ssa could result. October, november, december go to www.irs.gov/form941 for instructions and.

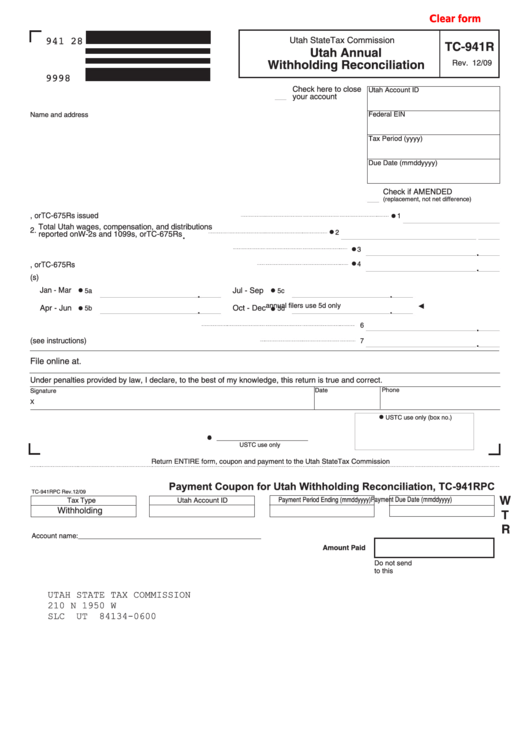

Fillable Form Tc941r Utah Annual Withholding Reconciliation

However, some small employers (those whose annual liability for social security, medicare, and. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. 2022 withholding income tax payment and filing due dates. Instead, employers in the u.s. Web get the form 941 annual tax accomplished.

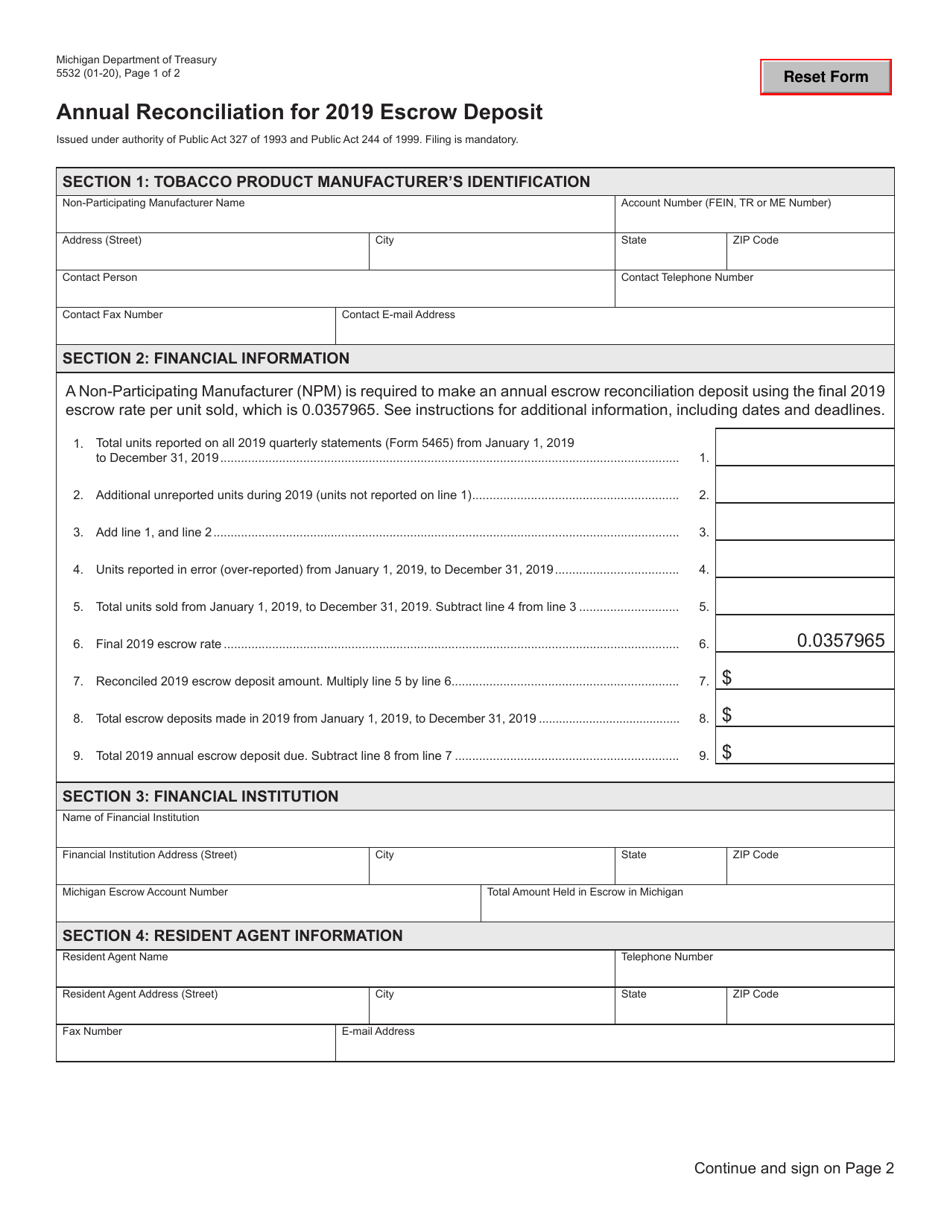

Form 5532 Download Fillable PDF or Fill Online Annual Reconciliation

Use forms for the calendar. Some small employers are eligible to file an annual form 944 pdf. Web get the form 941 annual tax accomplished. Compare those figures with the totals reported on all four 941s for the year. Web annual reconciliation is required.

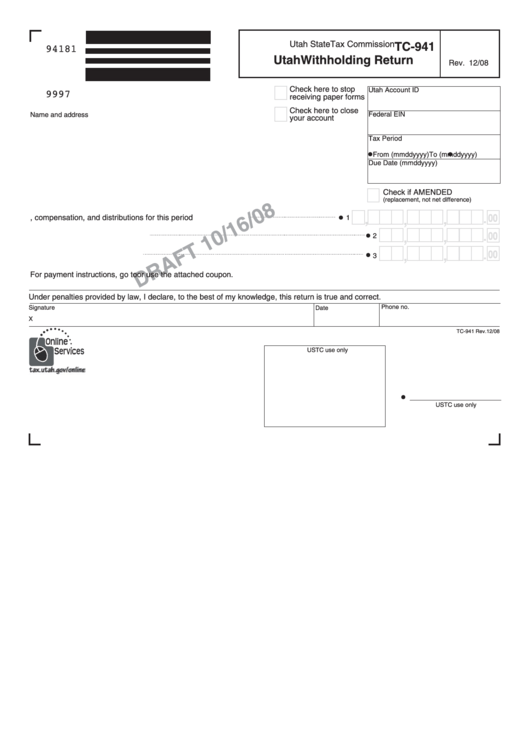

Form Tc941 Draft Utah Withholding Return, Form Tc941r Utah Annual

If these forms are not in balance, penalties from the irs and/or ssa could result. Web get the form 941 annual tax accomplished. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web generally, employers are required to file forms 941 quarterly. See the box to the right.

Fillable Ohio Form It 941 Ohio Employer'S Annual Reconciliation Of

Download your updated document, export it to the cloud, print it from the editor, or share it with other participants using a shareable link. Compare the data on the payroll register with your 941 for the quarterly period. Explore filing plans for single businesses or 3rd parties filing for multiple businesses. Web generally, employers are required to file forms 941.

What to Know About Form 941 Reconciliation Steps, Due Dates, & More

See the box to the right. Use forms for the calendar. Forget about scanning and printing out forms. Run a report that shows annual payroll amounts. Form 941 is used by employers.

Form TC941D Download Fillable PDF or Fill Online Discrepancy Report

Use forms for the calendar. Compare those figures with the totals reported on all four 941s for the year. Download your updated document, export it to the cloud, print it from the editor, or share it with other participants using a shareable link. Run a payroll register for the quarter. To the ohio department of.

If These Forms Are Not In Balance, Penalties From The Irs And/Or Ssa Could Result.

Fix discrepancies as soon as you. Form 941 is used by employers. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web get the form 941 annual tax accomplished.

Gather Information Needed To Complete Form 941.

Compare those figures with the totals reported on all four 941s for the year. To the ohio department of. June 2022) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name. However, some small employers (those whose annual liability for social security, medicare, and.

Ad Just Import, Validate, & File.

Web the internal revenue service would like to share the benefits of completing a payroll reconciliation prior to filing your final form 941, employer's quarterly tax return or. October, november, december go to www.irs.gov/form941 for instructions and the latest. Run a payroll register for the quarter. Use forms for the calendar.

Instead, Employers In The U.s.

Form 941 asks for the total amount of. Download your updated document, export it to the cloud, print it from the editor, or share it with other participants using a shareable link. Use our detailed instructions to fill out and. Forget about scanning and printing out forms.