941 X Form 2020

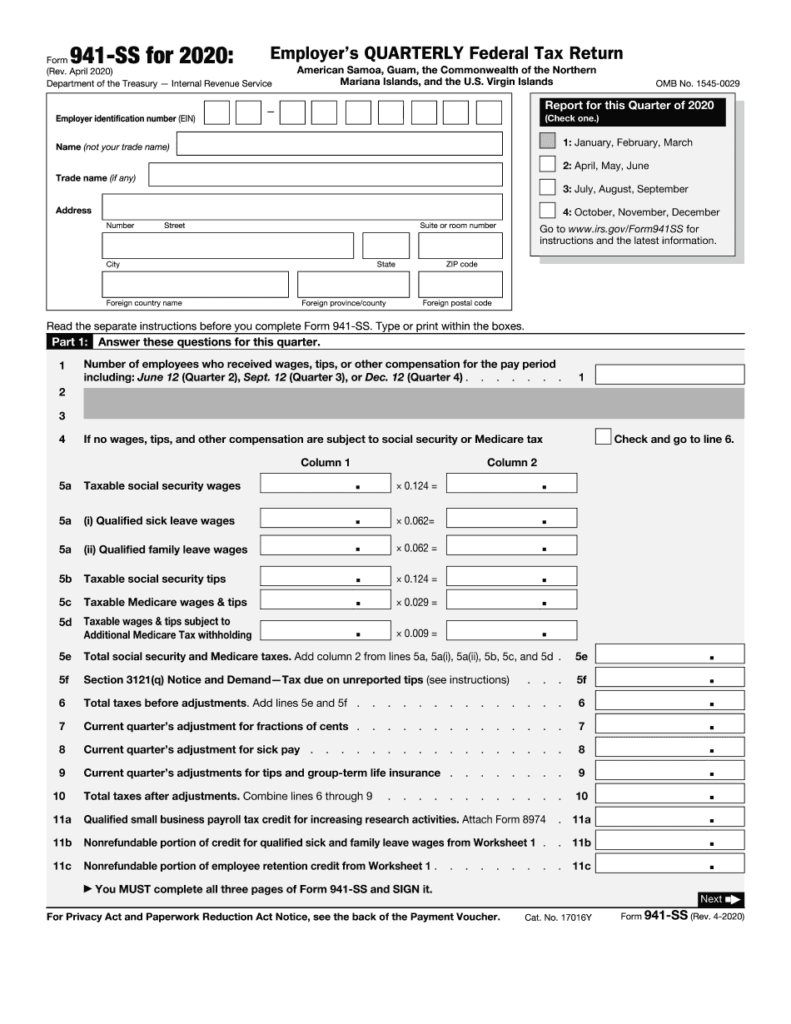

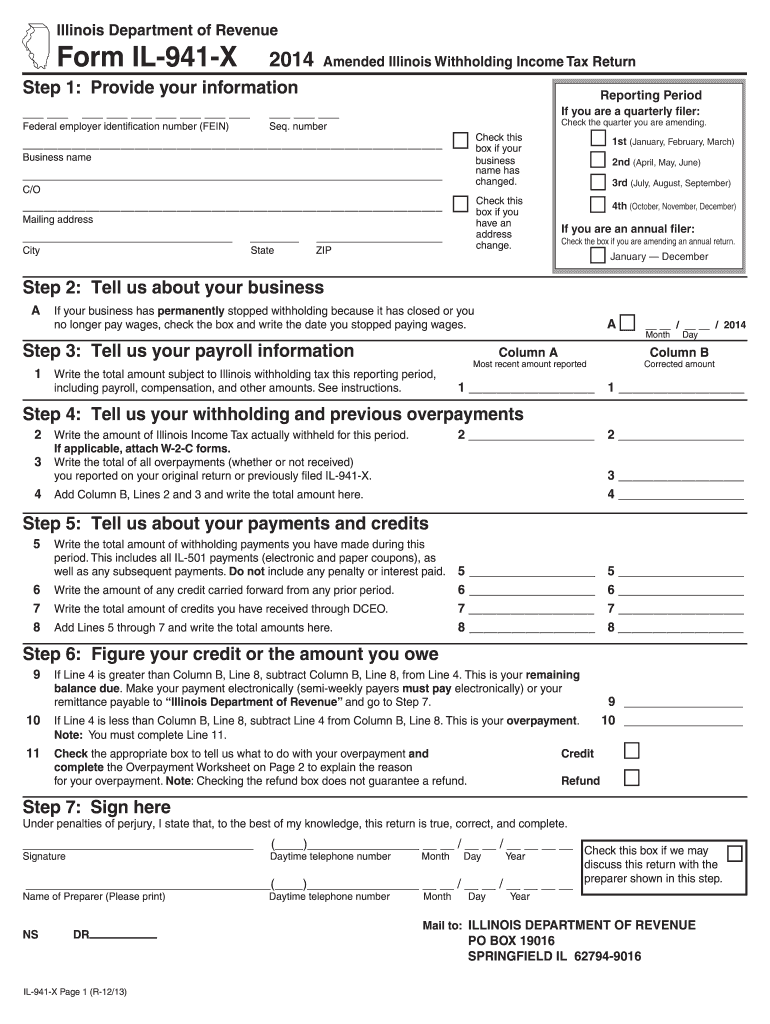

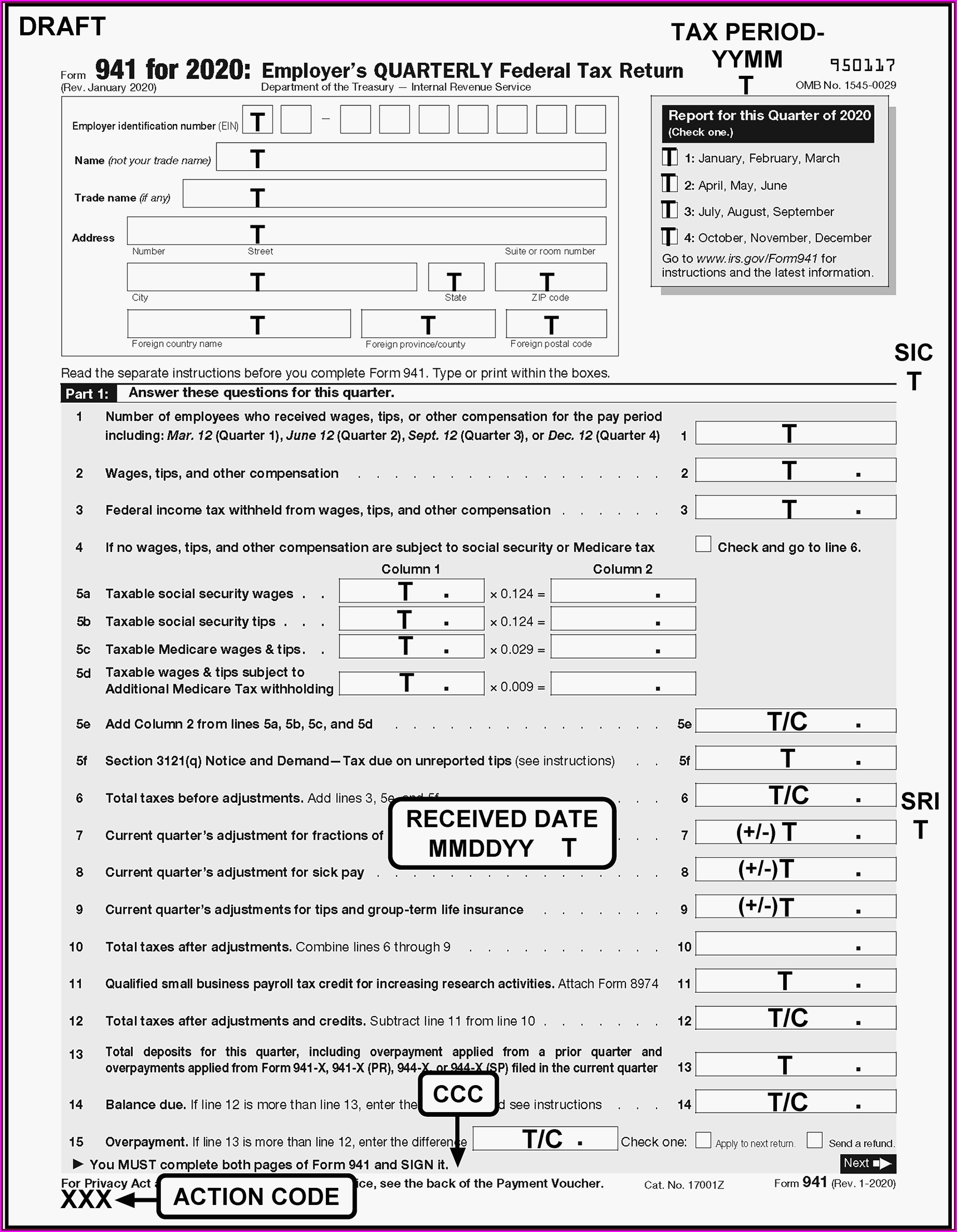

941 X Form 2020 - Type or print within the boxes. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine,. If you are located in. Try it for free now! January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Adjusted employer’s quarterly federal tax return or claim for refund (rev. You must complete all five pages. Upload, modify or create forms. July 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) name.

Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine,. Reported more than $50,000 of employment taxes in the. Complete, edit or print tax forms instantly. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Web file schedule b (form 941) if you are a semiweekly schedule depositor. Try it for free now! January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. You must complete all five pages. October 2020) employer identification number (ein) department of the treasury —. Web there is a draft version of the irs form 941x (rev.

Ad complete irs tax forms online or print government tax documents. Form 941 instructions, december 2021 revision pdf for additional information related. Complete, edit or print tax forms instantly. Web file schedule b (form 941) if you are a semiweekly schedule depositor. Try it for free now! Adjusted employer’s quarterly federal tax return or claim for refund (rev. July 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) name. Reported more than $50,000 of employment taxes in the. You must complete all five pages. The final version is expected to be available by the end of september 2020.

2020 Form IRS Instructions 941 Fill Online, Printable, Fillable, Blank

July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Form 941 instructions, december 2021 revision pdf for additional information related. Type or print within the boxes. Web file schedule b (form 941) if you are a semiweekly schedule depositor. You are a semiweekly depositor if you:

CT DRS CT941X 2009 Fill out Tax Template Online US Legal Forms

October 2020) employer identification number (ein) department of the treasury —. January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine,. Form 941 instructions, december 2021 revision pdf for additional information related. Ad complete irs tax forms online or print government.

941 Fillable 2020 Fill Online Printable Fillable Blank Printable Form

Try it for free now! Type or print within the boxes. Complete, edit or print tax forms instantly. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Web file schedule b (form 941) if you are a semiweekly schedule depositor.

Complete Form 941X for 2020 with TaxBandits YouTube

July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Upload, modify or create forms. Complete, edit or print tax forms instantly. The final version is expected to be available by the end of september 2020. July 2020) employer’s quarterly federal tax return department of the treasury —.

941 X Form Fill Out and Sign Printable PDF Template signNow

Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine,. Form 941 instructions, december 2021 revision pdf for additional information related. You are a semiweekly depositor if you: Type or print within the boxes. Web file schedule b (form 941) if you are a semiweekly schedule depositor.

Printable 941 For 2020 Printable World Holiday

You must complete all five pages. Web file schedule b (form 941) if you are a semiweekly schedule depositor. Reported more than $50,000 of employment taxes in the. Web there is a draft version of the irs form 941x (rev. October 2020) employer identification number (ein) department of the treasury —.

How to fill out IRS Form 941 2019 PDF Expert

Ad complete irs tax forms online or print government tax documents. You must complete all five pages. The final version is expected to be available by the end of september 2020. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. January 2020) employer’s quarterly federal tax return.

Worksheet 1 941x

If you are located in. Web file schedule b (form 941) if you are a semiweekly schedule depositor. Upload, modify or create forms. Type or print within the boxes. Web there is a draft version of the irs form 941x (rev.

Irs.gov Form 941 X Instructions Form Resume Examples 1ZV8dX3V3X

Web file schedule b (form 941) if you are a semiweekly schedule depositor. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine,. July 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) name. Complete, edit or print tax forms instantly. You must complete all five pages.

What You Need to Know About Just Released IRS Form 941X Blog

You must complete all five pages. The final version is expected to be available by the end of september 2020. Try it for free now! Web there is a draft version of the irs form 941x (rev. Reported more than $50,000 of employment taxes in the.

July 2020) Employer’s Quarterly Federal Tax Return Department Of The Treasury — Internal Revenue Service Employer Identification Number (Ein) Name.

Try it for free now! Complete, edit or print tax forms instantly. Web file schedule b (form 941) if you are a semiweekly schedule depositor. You are a semiweekly depositor if you:

January 2020) Employer’s Quarterly Federal Tax Return Department Of The Treasury — Internal Revenue Service 950117 Omb No.

The final version is expected to be available by the end of september 2020. Reported more than $50,000 of employment taxes in the. Web there is a draft version of the irs form 941x (rev. Type or print within the boxes.

Connecticut, Delaware, District Of Columbia, Florida, Georgia, Illinois, Indiana, Kentucky, Maine,.

You must complete all five pages. Complete, edit or print tax forms instantly. Ad complete irs tax forms online or print government tax documents. October 2020) employer identification number (ein) department of the treasury —.

Upload, Modify Or Create Forms.

Adjusted employer’s quarterly federal tax return or claim for refund (rev. If you are located in. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Form 941 instructions, december 2021 revision pdf for additional information related.