990 Form Due Date

990 Form Due Date - Web if the original due date of form 990 is may 15, 2020, the organization may either: That may seem complicated, but for organizations whose tax. If your tax year ended on. To use the table, you must know. The 15th day of the. The appropriate 990 form depends upon your organization's gross. Web 990 series forms are due on july 17, 2023! Web the irs filing deadline for organizations with a fiscal year end date of 2/28/2023 is midnight eastern time on monday, july 17, 2023. Web this topic provides electronic filing opening day information and information about relevant due dates for 990 returns. You can find information from the irs in.

Form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. Exempt organizations with a filing obligation. If the due date falls on a saturday, sunday, or. Web the irs filing deadline for organizations with a fiscal year end date of 2/28/2023 is midnight eastern time on monday, july 17, 2023. For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15, 2023. Web accordingly, nonprofits operating on a calendar year that typically involves them submitting a form 8868 to extend their may 15, 2020 form 990 filing deadline for. File an extension of time through november 15, 2020, on or before may 15, 2020. The 15th day of the. Web form 990 return due date: If your tax year ended on.

If the due date falls on a saturday, sunday, or. Web when is form 990 due? 2 the month your tax year ends december 31 (calendar) other than december 31 (fiscal). Web form 990 return due date: Web upcoming 2023 form 990 deadline: For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15, 2023. You can find information from the irs in. Web 990 series forms are due on july 17, 2023! To use the table, you must know. Web accordingly, nonprofits operating on a calendar year that typically involves them submitting a form 8868 to extend their may 15, 2020 form 990 filing deadline for.

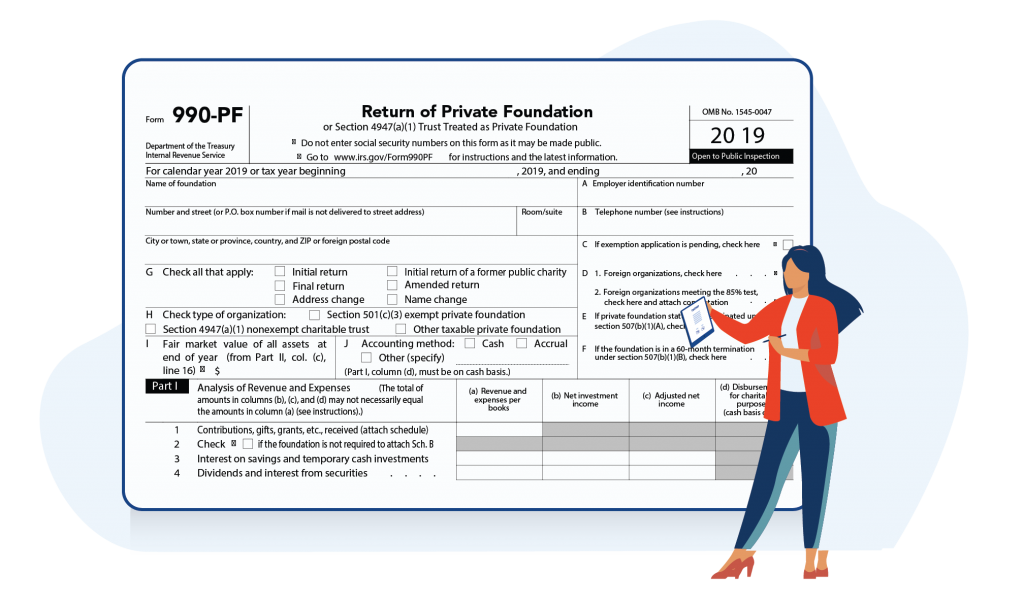

What is Form 990PF?

For organizations on a calendar. Web if an organization is unable to complete its required forms by this year’s may 16 deadline, filing form 8868 can extend the filing date for the 2021 form 990 out to. Web upcoming 2023 form 990 deadline: Web december 31st (calendar year) fiscal year not sure about which form to file for your organization?.

2016 Form 990 Due This Monday for Land Trusts Filing on Calendar Year

Web upcoming 2023 form 990 deadline: Web this topic provides electronic filing opening day information and information about relevant due dates for 990 returns. Web 990 series forms are due on july 17, 2023! For organizations on a calendar. Web form 990 due date calculator 1 choose your appropriate form to find the due date.

Form 990 Preparation Service 501(c)(3) Tax Services in Tampa

Web this topic provides electronic filing opening day information and information about relevant due dates for 990 returns. If your tax year ended on. Web the due date for filing form 990 series returns and most other returns that were due between april 1, 2020 and july 15, 2020 has been extended to july 15, 2020. Web when is form.

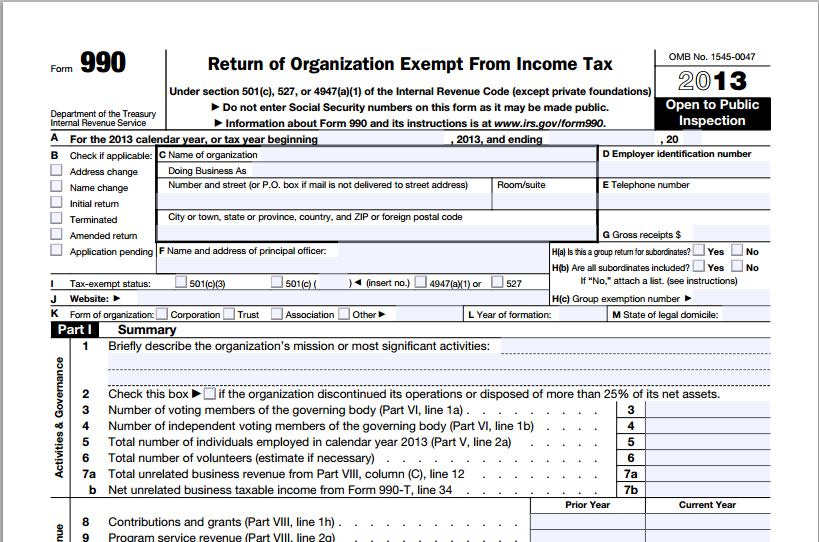

What is Form 990EZ and Who Qualifies for it? Foundation Group, Inc.

Web accordingly, nonprofits operating on a calendar year that typically involves them submitting a form 8868 to extend their may 15, 2020 form 990 filing deadline for. For organizations on a calendar. Web form 990 due date calculator 1 choose your appropriate form to find the due date. The 15th day of the. Web upcoming 2023 form 990 deadline:

990 Form 2021

Web upcoming 2023 form 990 deadline: You can find information from the irs in. Form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. Web if an organization is unable to complete its required forms by this year’s may 16 deadline, filing form 8868 can extend the filing date for.

Form 990 or 990EZ (Sch N) Liquidation, Termination, Dissolution, or

Due to the large volume. The appropriate 990 form depends upon your organization's gross. File an extension of time through november 15, 2020, on or before may 15, 2020. Web december 31st (calendar year) fiscal year not sure about which form to file for your organization? Web form 990 due date calculator 1 choose your appropriate form to find the.

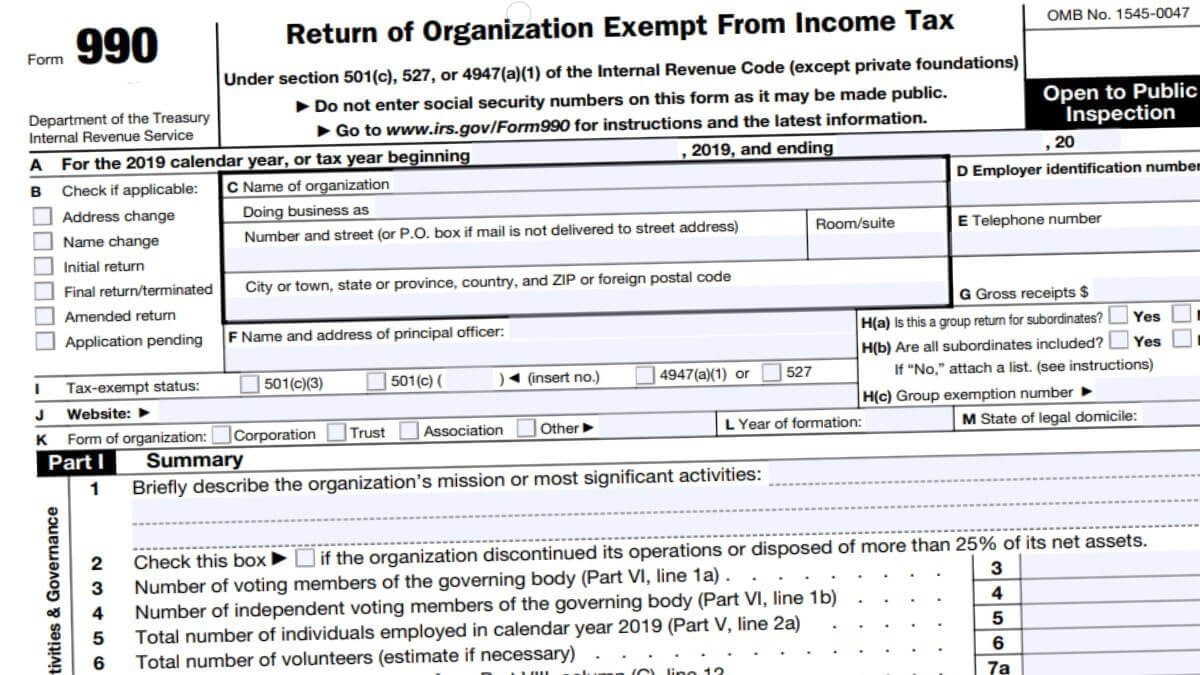

Efile Form 990 2021 IRS Form 990 Online Filing

Web form 990 return due date: To use the table, you must know. Web the irs filing deadline for organizations with a fiscal year end date of 2/28/2023 is midnight eastern time on monday, july 17, 2023. The 15th day of the. If the due date falls on a saturday, sunday, or.

Today is Your Form 990 Deadline! It's Your Last Chance to Extend Your

Exempt organizations with a filing obligation. For organizations on a calendar. File an extension of time through november 15, 2020, on or before may 15, 2020. If the due date falls on a saturday, sunday, or. Web this topic provides electronic filing opening day information and information about relevant due dates for 990 returns.

Meet the May 17, 2021 EPostcard Form 990N Deadline In 3 Simple Steps

To use the table, you must know. Web 990 series forms are due on july 17, 2023! The appropriate 990 form depends upon your organization's gross. Form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. Due to the large volume.

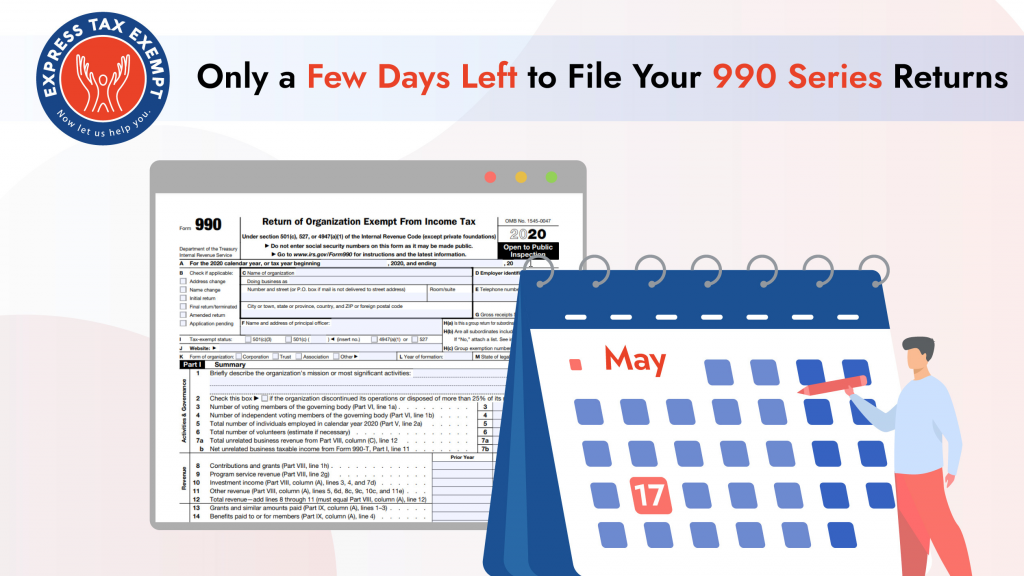

There Are Only a Few Days Left to File Your 990 Series Returns

Form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15, 2023. Web the irs filing deadline for organizations with a fiscal year end date of.

Form 990 Is Due On The 15Th Day Of The 5Th Month Following The End Of The Organization's Taxable Year.

Web if the original due date of form 990 is may 15, 2020, the organization may either: If the due date falls on a saturday, sunday, or. Web when is form 990 due? Web this topic provides electronic filing opening day information and information about relevant due dates for 990 returns.

Web Form 990 Due Date Calculator 1 Choose Your Appropriate Form To Find The Due Date.

Web the irs filing deadline for organizations with a fiscal year end date of 2/28/2023 is midnight eastern time on monday, july 17, 2023. Web the form 990 deadline is the 15th day of the 5th month after the end of an organization’s tax period. 2 the month your tax year ends december 31 (calendar) other than december 31 (fiscal). That may seem complicated, but for organizations whose tax.

If Your Tax Year Ended On.

File an extension of time through november 15, 2020, on or before may 15, 2020. Web december 31st (calendar year) fiscal year not sure about which form to file for your organization? Web the due date for filing form 990 series returns and most other returns that were due between april 1, 2020 and july 15, 2020 has been extended to july 15, 2020. The appropriate 990 form depends upon your organization's gross.

You Can Find Information From The Irs In.

Web if an organization is unable to complete its required forms by this year’s may 16 deadline, filing form 8868 can extend the filing date for the 2021 form 990 out to. For organizations on a calendar. Web upcoming 2023 form 990 deadline: Web accordingly, nonprofits operating on a calendar year that typically involves them submitting a form 8868 to extend their may 15, 2020 form 990 filing deadline for.