990 Postcard Filing Form

990 Postcard Filing Form - Ad uslegalforms allows users to edit, sign, fill & share all type of documents online. Web open the electronic filing page: Web file form 990 notices and returns securely and safely with simple990. You’ll have the chance to save your. This form is short, straightforward, and completely online—and you. Web click the orange get form option to begin filling out. Click “submit filing” button, then “ok” (when you are ready to submit). If your numbers are at or above. Intended for organizations with gross receipts less. Edit, sign and save return org ept income tax form.

Association of notre dame clubs, inc. File your form 990 series. If your numbers are at or above. You’ll have the chance to save your. Web file form 990 notices and returns securely and safely with simple990. Web open the electronic filing page: Intended for organizations with gross receipts less. Web here is a concise breakdown of the parameters for each of the 990 form variants: Organizations love the speed and simplicity that simple990 offers form 990 filers. Ad uslegalforms allows users to edit, sign, fill & share all type of documents online.

If your numbers are at or above. You’ll have the chance to save your. Web here is a concise breakdown of the parameters for each of the 990 form variants: Ad uslegalforms allows users to edit, sign, fill & share all type of documents online. Intended for organizations with gross receipts less. Activate the wizard mode in the top toolbar to acquire additional pieces of advice. This form is short, straightforward, and completely online—and you. Edit, sign and save return org ept income tax form. Web open the electronic filing page: Click “submit filing” button, then “ok” (when you are ready to submit).

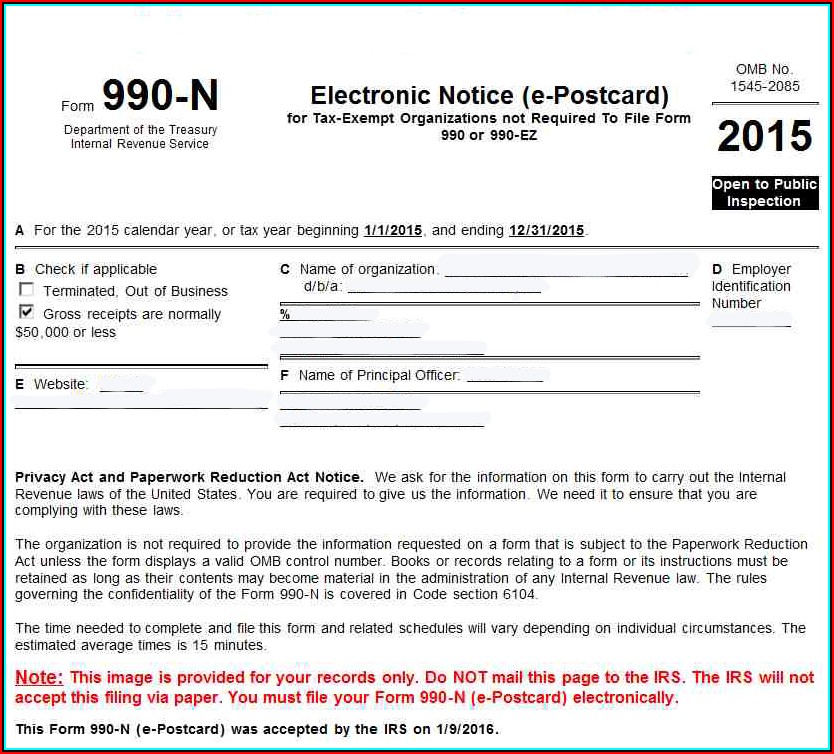

Form 990N (ePostcard) Online View and Print Returnpage001

File your form 990 series. Association of notre dame clubs, inc. Edit, sign and save return org ept income tax form. Organizations love the speed and simplicity that simple990 offers form 990 filers. If your numbers are at or above.

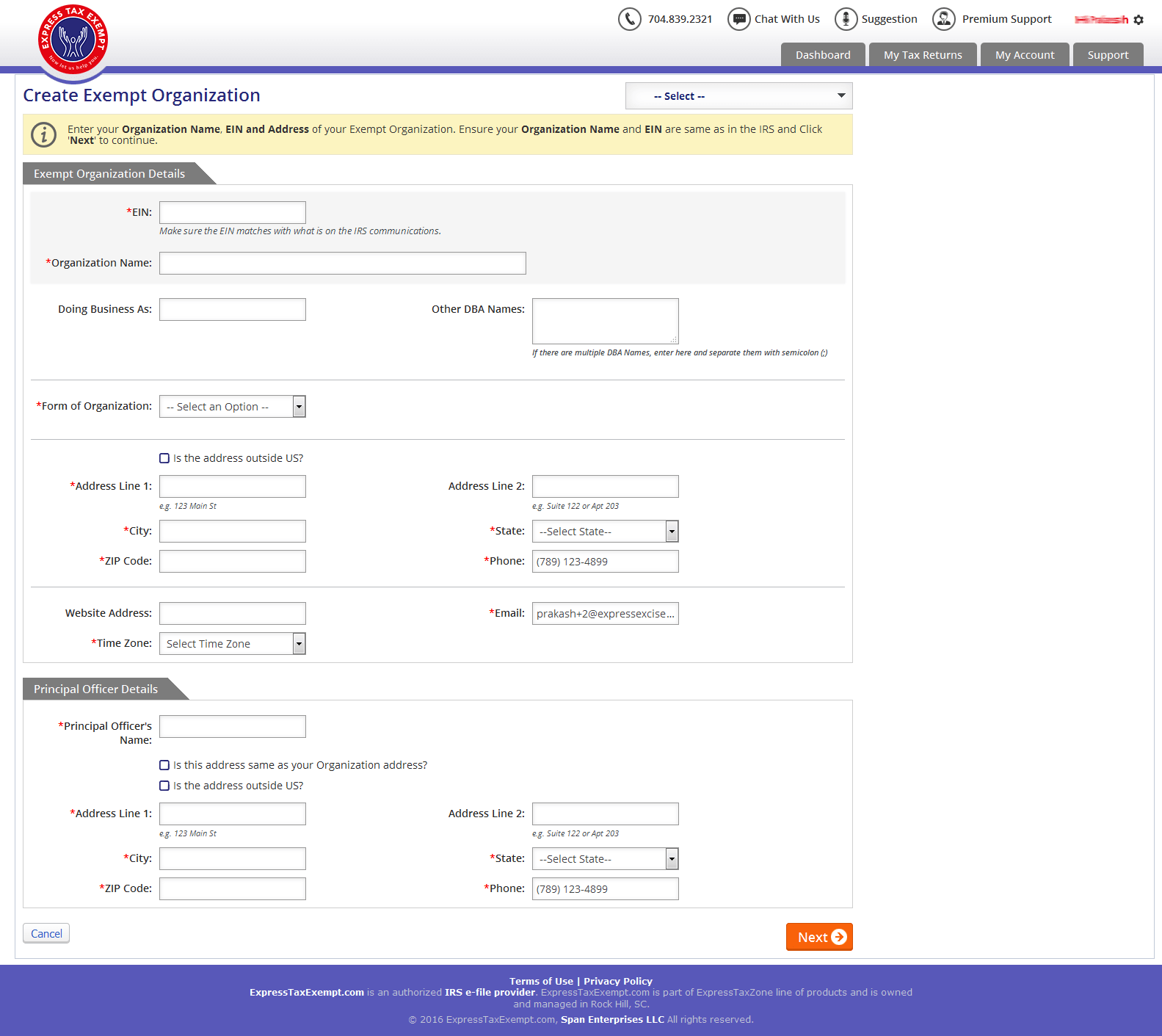

Steps to EFile IRS Form 990N How to file ePostcard with the IRS

If your numbers are at or above. Click “submit filing” button, then “ok” (when you are ready to submit). Edit, sign and save return org ept income tax form. You’ll have the chance to save your. Web click the orange get form option to begin filling out.

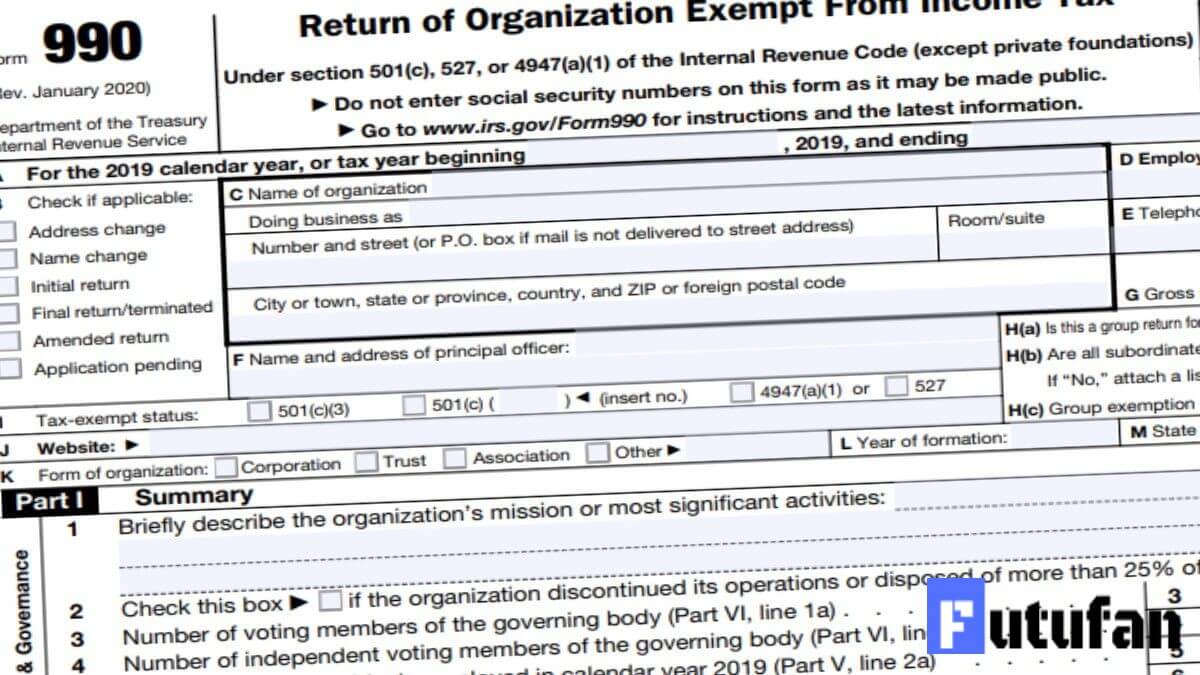

Form 990EZ for nonprofits updated Accounting Today

Web open the electronic filing page: Edit, sign and save return org ept income tax form. Ad uslegalforms allows users to edit, sign, fill & share all type of documents online. This form is short, straightforward, and completely online—and you. Intended for organizations with gross receipts less.

Irs Form 990 N Electronic Filing Form Resume Examples Kw9k44dwYJ

Organizations love the speed and simplicity that simple990 offers form 990 filers. Intended for organizations with gross receipts less. Employer identification number (ein) 2. Web click the orange get form option to begin filling out. Web here is a concise breakdown of the parameters for each of the 990 form variants:

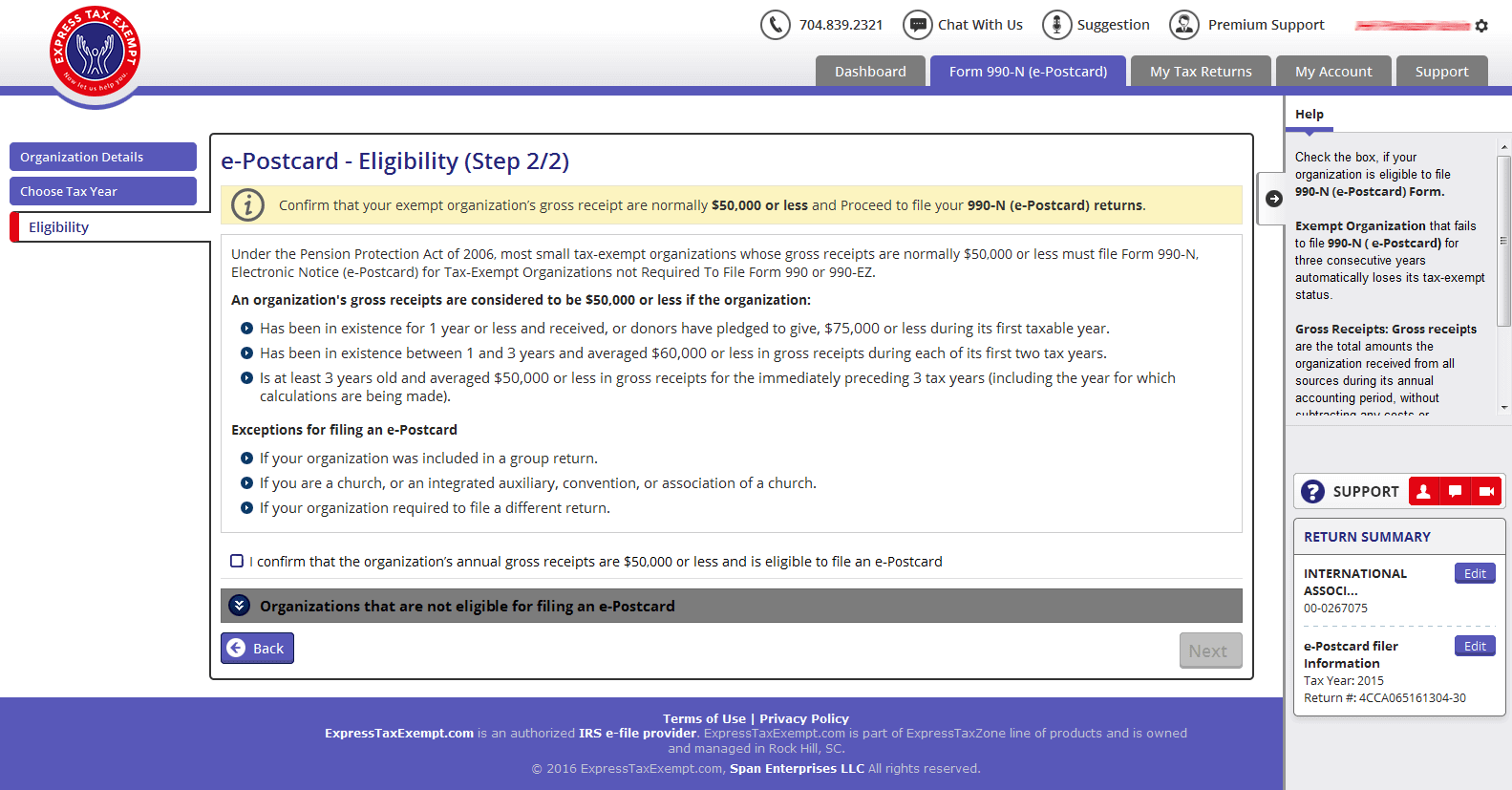

Tax exempt organizations to file form 990N (ePostcard) by express990

Intended for organizations with gross receipts less. Activate the wizard mode in the top toolbar to acquire additional pieces of advice. Web open the electronic filing page: Ad uslegalforms allows users to edit, sign, fill & share all type of documents online. You’ll have the chance to save your.

Form 990N ePostcard

Web file form 990 notices and returns securely and safely with simple990. File your form 990 series. Activate the wizard mode in the top toolbar to acquire additional pieces of advice. Intended for organizations with gross receipts less. Web open the electronic filing page:

Steps to EFile IRS Form 990N How to file ePostcard with the IRS

Web here is a concise breakdown of the parameters for each of the 990 form variants: Association of notre dame clubs, inc. Web file form 990 notices and returns securely and safely with simple990. Edit, sign and save return org ept income tax form. Web open the electronic filing page:

Form 990 N (EPostcard) Filing Instructions printable pdf download

Click “submit filing” button, then “ok” (when you are ready to submit). This form is short, straightforward, and completely online—and you. Activate the wizard mode in the top toolbar to acquire additional pieces of advice. If your numbers are at or above. Web here is a concise breakdown of the parameters for each of the 990 form variants:

Efile Form 990N 2020 IRS Form 990N Online Filing

Click “submit filing” button, then “ok” (when you are ready to submit). Association of notre dame clubs, inc. Intended for organizations with gross receipts less. Organizations love the speed and simplicity that simple990 offers form 990 filers. Web file form 990 notices and returns securely and safely with simple990.

Where to Find the 990 Electronic Postcard File 990

Edit, sign and save return org ept income tax form. Ad uslegalforms allows users to edit, sign, fill & share all type of documents online. Activate the wizard mode in the top toolbar to acquire additional pieces of advice. Organizations love the speed and simplicity that simple990 offers form 990 filers. Web click the orange get form option to begin.

If Your Numbers Are At Or Above.

Web open the electronic filing page: You’ll have the chance to save your. Association of notre dame clubs, inc. Web file form 990 notices and returns securely and safely with simple990.

Web Here Is A Concise Breakdown Of The Parameters For Each Of The 990 Form Variants:

Web click the orange get form option to begin filling out. Ad uslegalforms allows users to edit, sign, fill & share all type of documents online. Employer identification number (ein) 2. File your form 990 series.

Intended For Organizations With Gross Receipts Less.

Click “submit filing” button, then “ok” (when you are ready to submit). Organizations love the speed and simplicity that simple990 offers form 990 filers. Edit, sign and save return org ept income tax form. Activate the wizard mode in the top toolbar to acquire additional pieces of advice.