990T Tax Form

990T Tax Form - Complete, edit or print tax forms instantly. Exempt organization business income tax return. An organization must pay estimated tax if. (and proxy tax under section 6033(e)) for calendar year. Luke’s health system is required to file an irs form 990 annually. Tax rate schedule or schedule d (form 1041) proxy tax. See instructions other tax amounts. Web tax filings and audits by year. Nols can be provided using the. Ad access irs tax forms.

Luke’s health system is required to file an irs form 990 annually. Web exempt organization business income tax return. G b total tax (form 4720, part iii, line 1) 7b part ii declaration and signature authorization of officer. (and proxy tax under section 6033(e)) for calendar year. Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w. Department of the treasury internal revenue service. Web information (i.e., loss schedule) could reduce your tax liability, please review eligibility with your tax advisor. Ad access irs tax forms. In a nutshell, the form gives the irs an overview of the. See instructions alternative minimum tax (trusts only).

Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Nols can be provided using the. Web exempt organization business income tax return. This return must also be filed annually. See instructions other tax amounts. Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w. For calendar year 2020 or other. Luke’s health system is required to file an irs form 990 annually. 3a $ b if this application is for.

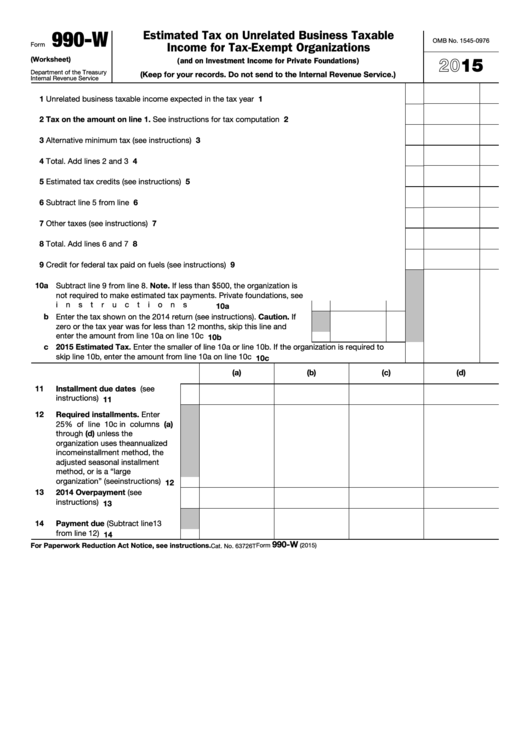

Fillable Form 990W Estimated Tax On Unrelated Business Taxable

See instructions alternative minimum tax (trusts only). See instructions other tax amounts. 3a $ b if this application is for. And form 4720, return of. Nols can be provided using the.

Form Ct990t Ext Application For Extension Of Time To File Unrelated

Check box if reporting two or more periodicals on a consolidated basis. Department of the treasury internal revenue service. Web information (i.e., loss schedule) could reduce your tax liability, please review eligibility with your tax advisor. Ad access irs tax forms. (and proxy tax under section 6033(e)) department of the treasury internal revenue service.

Form 990T by Hawaii Community Foundation Issuu

(and proxy tax under section 6033(e)) for calendar year. Web exempt organization business income tax return. Complete, edit or print tax forms instantly. Exempt organization business income tax return. A quick & easy breakdown.

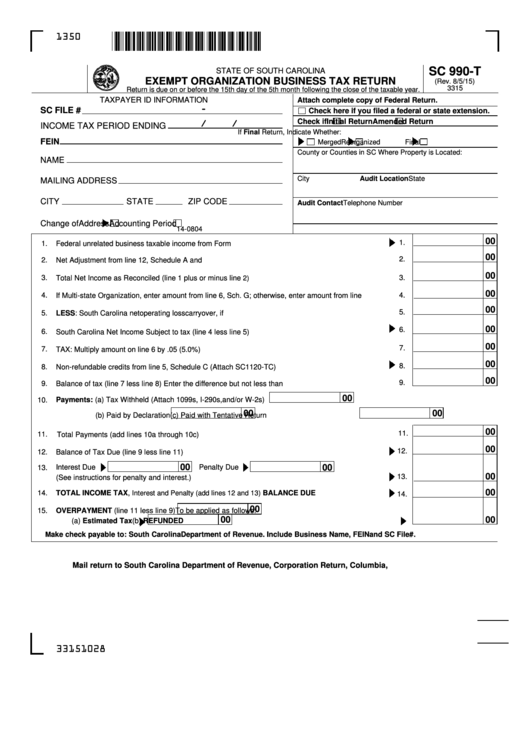

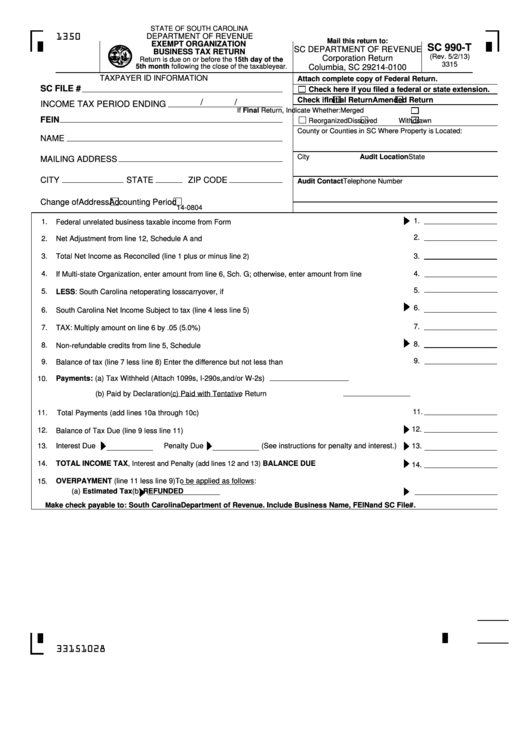

Form Sc 990T Exempt Organization Business Tax Return printable pdf

Generating/preparing a short year return;. 3a $ b if this application is for. See instructions alternative minimum tax (trusts only). In a nutshell, the form gives the irs an overview of the. A quick & easy breakdown.

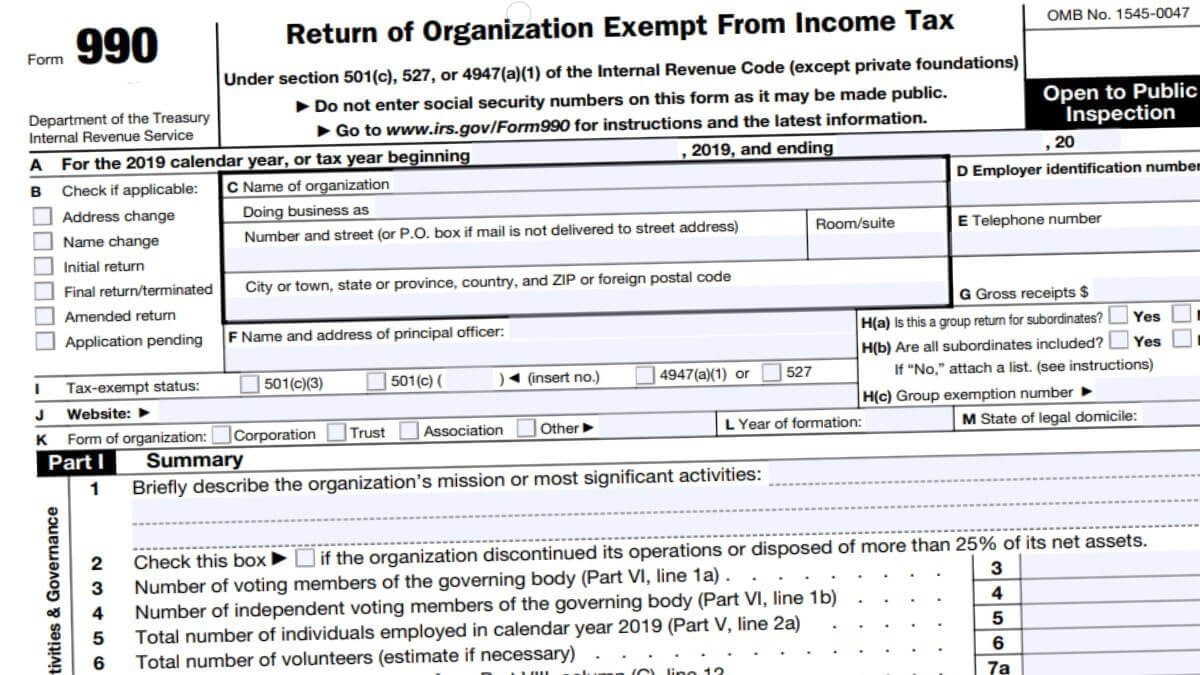

990 Form 2021

See instructions alternative minimum tax (trusts only). Complete, edit or print tax forms instantly. Generating/preparing a short year return;. For calendar year 2020 or other. Web information (i.e., loss schedule) could reduce your tax liability, please review eligibility with your tax advisor.

Top 16 Form 990t Templates free to download in PDF format

Generating/preparing a short year return;. Tax rate schedule or schedule d (form 1041) proxy tax. Exempt organization business income tax return. Ad access irs tax forms. The custodian of your ira files it.

Form Sc 990T Exempt Organization Business Tax Return printable pdf

Web federal form 1120 (such as federal forms 1120pol, 1120h, 1120sf, 1120reit, 990t, or 1120c), shall attach a copy of the appropriate federal form and make the computations. (and proxy tax under section 6033(e)) for calendar year. Nols can be provided using the. This return must also be filed annually. Complete, edit or print tax forms instantly.

What Is A 990T bmpspatula

An organization must pay estimated tax if. Generating/preparing a short year return;. Exempt organization business income tax return. Web information (i.e., loss schedule) could reduce your tax liability, please review eligibility with your tax advisor. Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees.

Blog 1 Tips on How to Read Form 990

This return must also be filed annually. (and proxy tax under section 6033(e)) department of the treasury internal revenue service. Luke’s health system is required to file an irs form 990 annually. Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form.

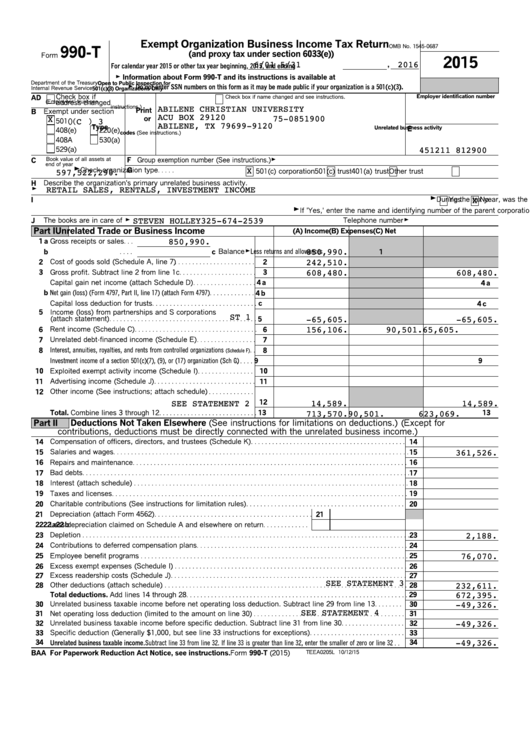

Form 990T Exempt Organization Business Tax Return (and proxy…

Web part i, line 11 from: Web federal form 1120 (such as federal forms 1120pol, 1120h, 1120sf, 1120reit, 990t, or 1120c), shall attach a copy of the appropriate federal form and make the computations. This return must also be filed annually. For calendar year 2020 or other. In a nutshell, the form gives the irs an overview of the.

Complete, Edit Or Print Tax Forms Instantly.

The custodian of your ira files it. G b total tax (form 4720, part iii, line 1) 7b part ii declaration and signature authorization of officer. Get ready for tax season deadlines by completing any required tax forms today. For calendar year 2020 or other.

Web Tax Filings And Audits By Year.

Exempt organization business income tax return. (and proxy tax under section 6033(e)) department of the treasury internal revenue service. This return must also be filed annually. Supports current & prior year filings.

3A $ B If This Application Is For.

Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w. Web exempt organization business income tax return. See instructions other tax amounts. Department of the treasury internal revenue service.

Ad Access Irs Tax Forms.

Web part i, line 11 from: A quick & easy breakdown. In a nutshell, the form gives the irs an overview of the. See instructions alternative minimum tax (trusts only).