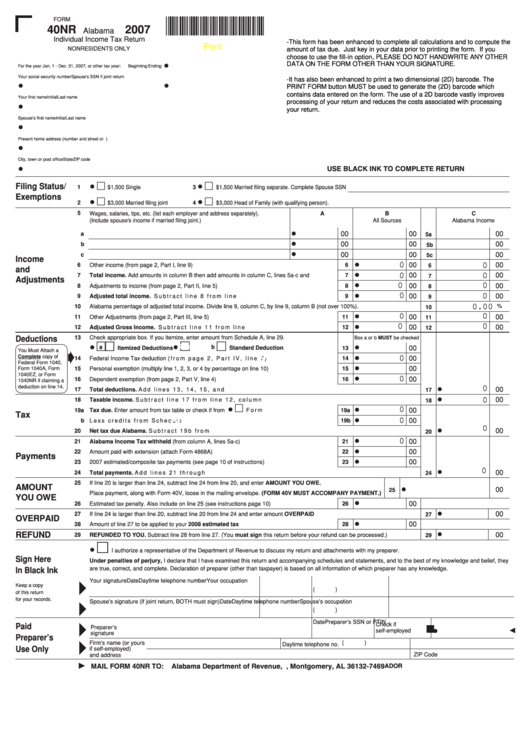

Alabama 40Nr Form

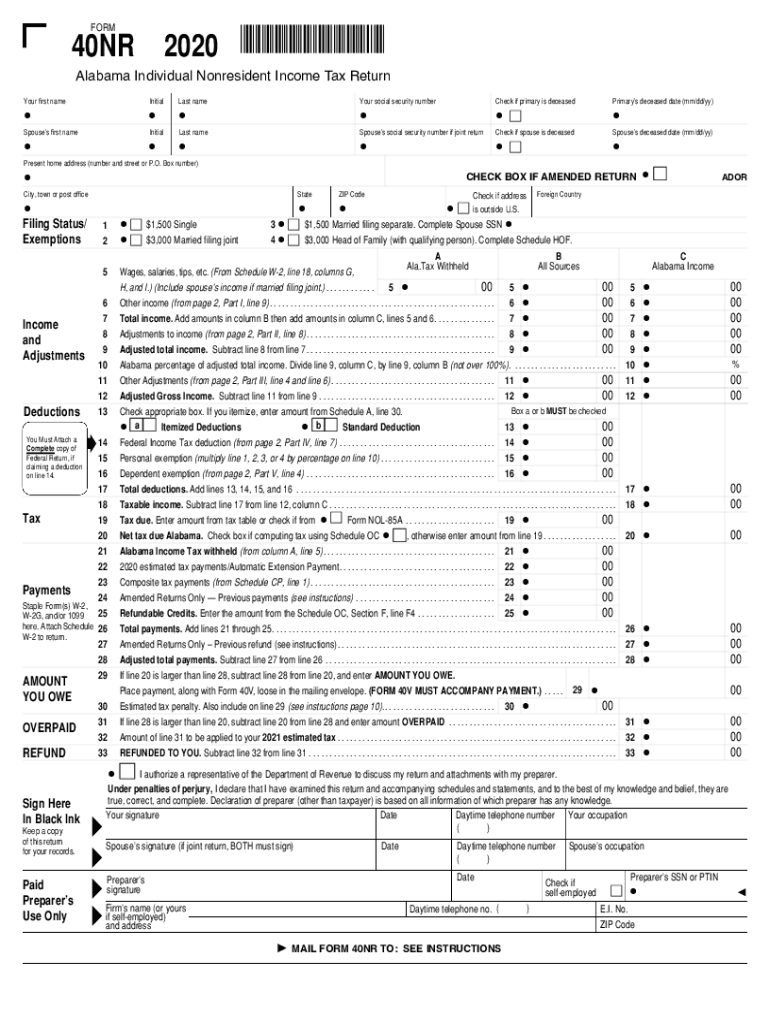

Alabama 40Nr Form - 2020 alabama individual nonresident income tax return. Web 2020 alabama individual nonresident income tax return. All forms will download as a pdf. Turbo tax is saying i need both forms but it is not supported by turbo tax. Schedules a, b, d & e. Easily fill out pdf blank, edit, and sign them. Complete, edit or print tax forms instantly. Income tax return first, before you can prepare the alabama tax return. See instructions ador sign here in black ink keep a copy of this. This form is for income earned in tax year 2022, with tax.

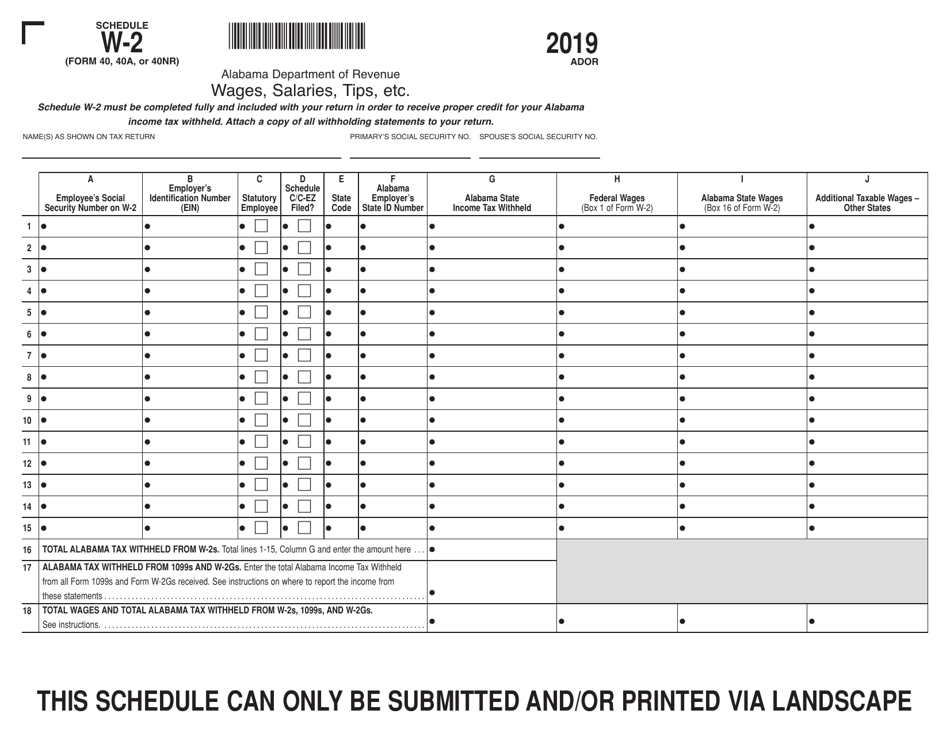

Web edit alabama 40nr form. Web alabama individual nonresident income tax return form 40nr 2021 v mail form 40nr to: Schedules a, b, d, & e (form 40nr) all divisions. Other available credits (form 40 or 40nr) all divisions. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Income tax return first, before you can prepare the alabama tax return. Web alabama individual nonresident income tax return (print only) all divisions. Ad download or email al 40nr & more fillable forms, register and subscribe now! Effortlessly add and highlight text, insert images, checkmarks, and icons, drop new fillable areas, and rearrange or delete pages from your paperwork.

Web we last updated alabama form 40nr in january 2023 from the alabama department of revenue. You are not a resident of alabama and you received taxable income from alabama sources or for performing services within alabama and your. Effortlessly add and highlight text, insert images, checkmarks, and icons, drop new fillable areas, and rearrange or delete pages from your paperwork. Download or email al 40nr & more fillable forms, register and subscribe now! Web alabama individual nonresident income tax return form 40nr 2020 v mail form 40nr to: Web you must use form 40nr if: This form is for income earned in tax year 2022, with tax. Complete, edit or print tax forms instantly. Save or instantly send your ready documents. Schedules a, b, d & e.

Fillable Form 40nr Alabama Individual Nonresident Tax Return

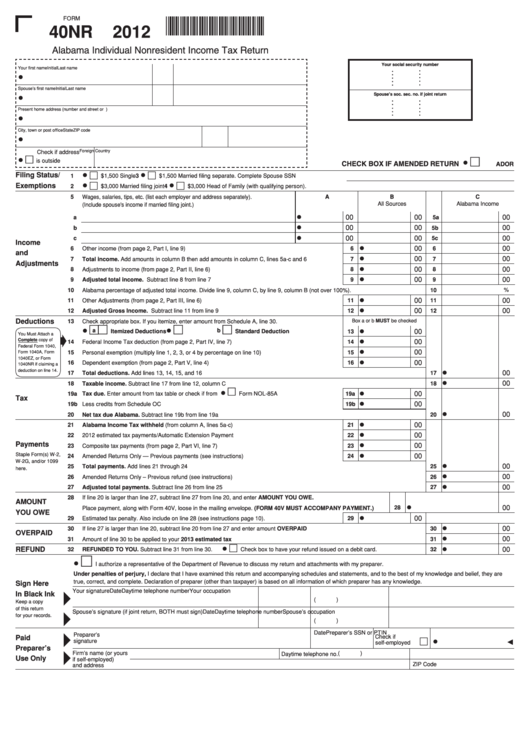

Web edit alabama 40nr form. Download or email al 40nr & more fillable forms, register and subscribe now! All forms will download as a pdf. 2020 alabama individual nonresident income tax return. Web alabama individual nonresident income tax return form 40nr 2021 v mail form 40nr to:

Form 40nr Alabama Individual Nonresident Tax Return 2012

Web alabama individual nonresident income tax return form 40nr 2020 v mail form 40nr to: Web edit alabama 40nr form. Web we last updated the standard deduction chart 40nr in march 2023, so this is the latest version of standard deduction chart 40nr, fully updated for tax year 2022. Ad download or email al 40nr & more fillable forms, register.

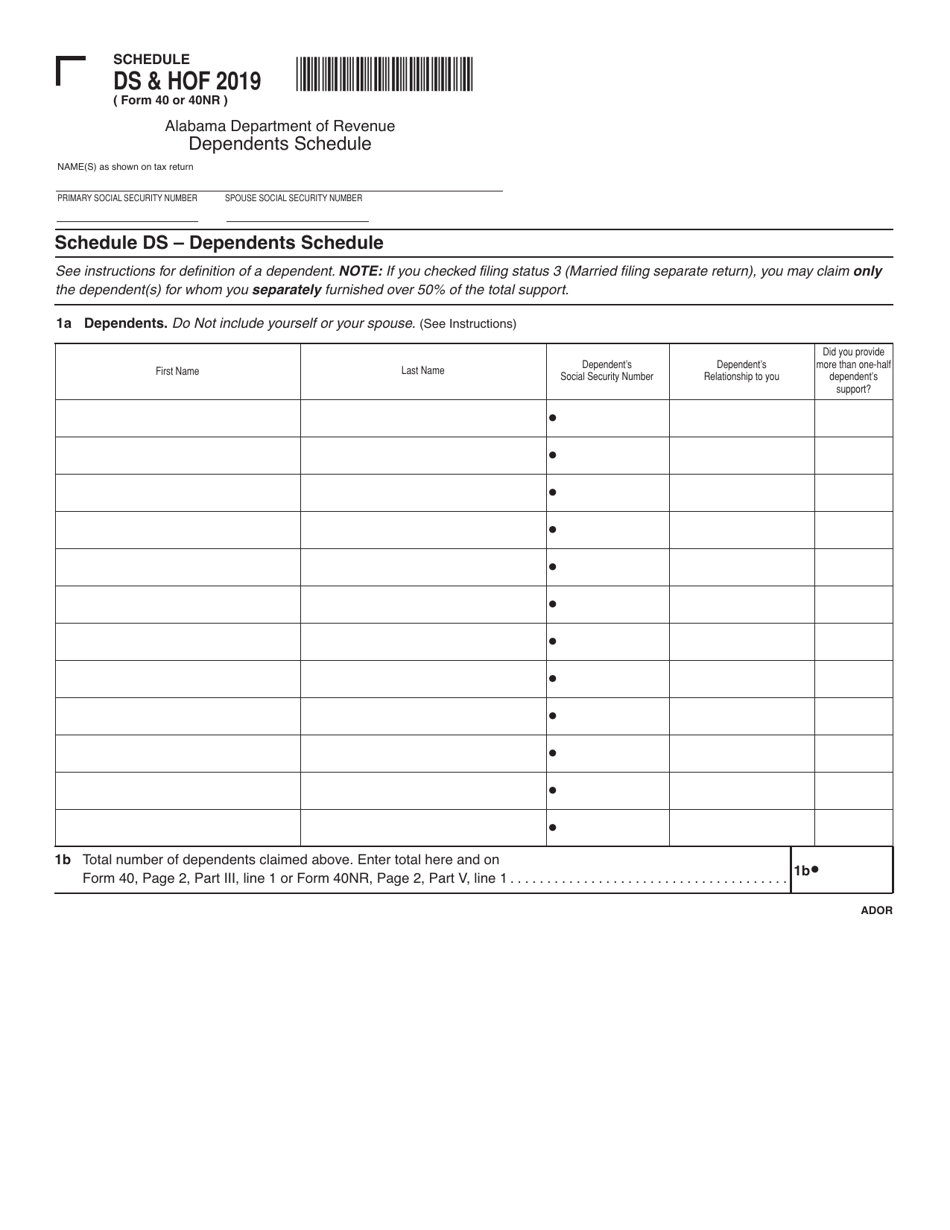

Form 40 (40NR) Schedule DS, HOF Download Printable PDF or Fill Online

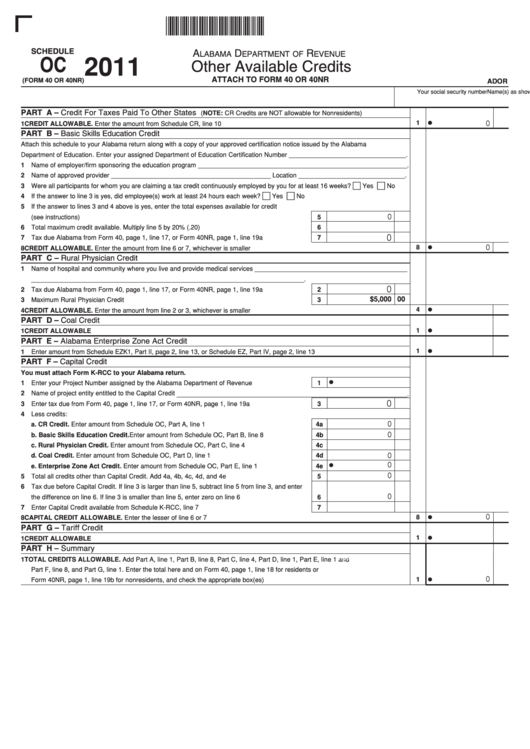

Ad download or email al 40nr & more fillable forms, register and subscribe now! This form is for income earned in tax year 2022, with tax returns due in april. Web alabama individual nonresident income tax return (print only) all divisions. Web other available credits (form 40 or 40nr) download form. Turbo tax is saying i need both forms but.

Alabama Form 40Nr Fill Out and Sign Printable PDF Template signNow

Web edit alabama 40nr form. Complete, edit or print tax forms instantly. This form is for income earned in tax year 2022, with tax. Web alabama individual nonresident income tax return (print only) all divisions. Easily fill out pdf blank, edit, and sign them.

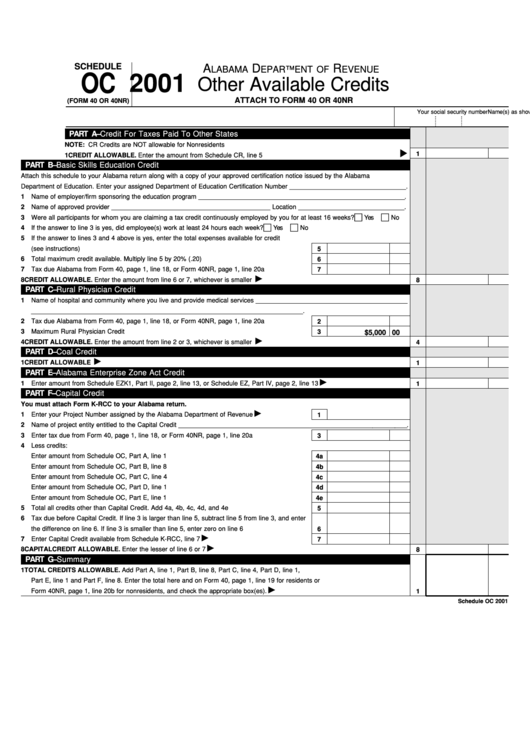

Schedule Oc (Form 40 Or 40nr) Other Available Credits Alabama

Web alabama individual nonresident income tax return (print only) all divisions. Web edit alabama 40nr form. See instructions ador sign here in black ink keep a copy of this. Web we last updated alabama form 40nr in january 2023 from the alabama department of revenue. Download or email al 40nr & more fillable forms, register and subscribe now!

Alabama Form 40 Instructions 2019

Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. You are not a resident of alabama and you received taxable income from alabama sources or for performing services within alabama and your. Web we last updated the standard deduction chart 40nr in march 2023, so this is the latest version of standard deduction.

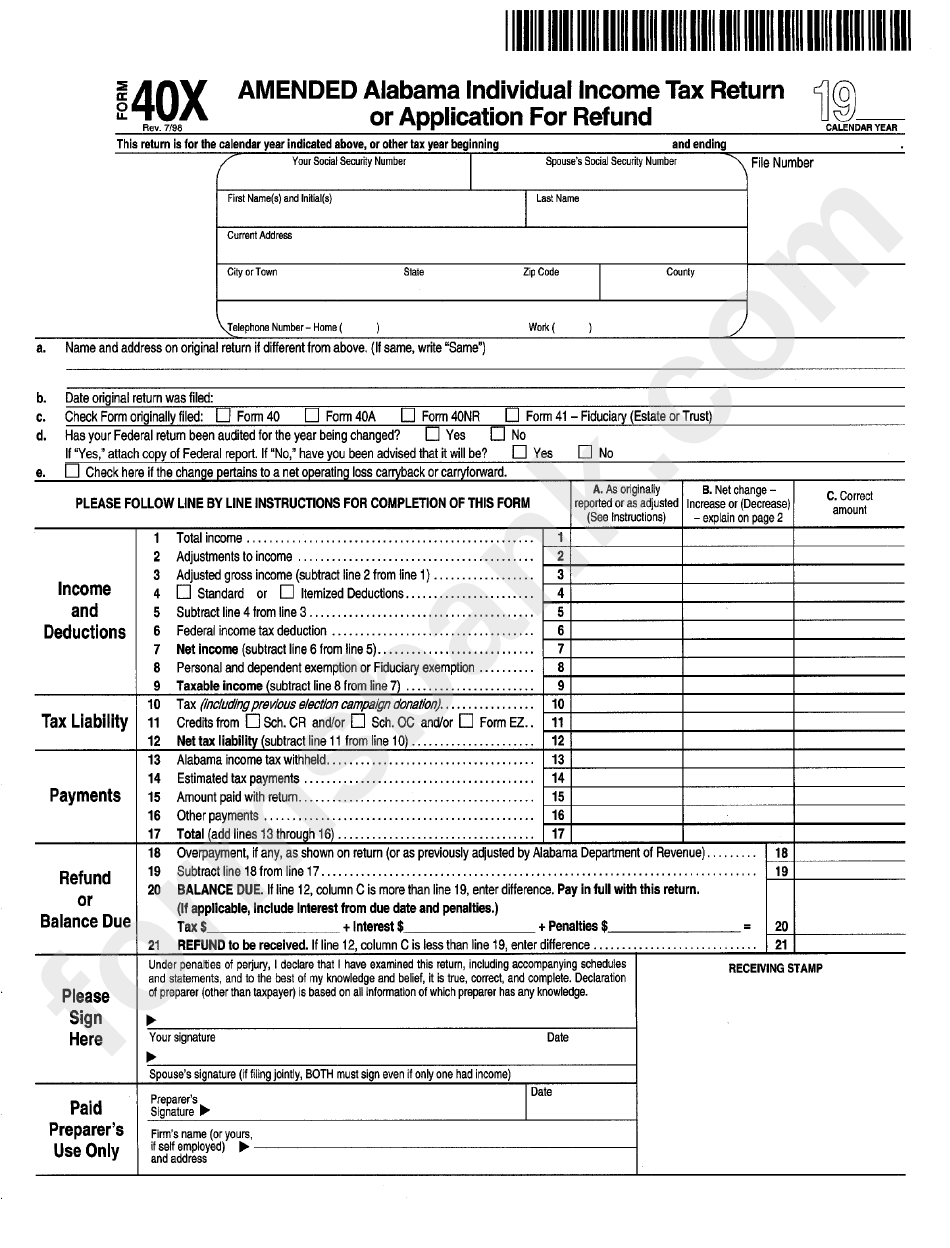

Fillable Form 40x Amended Alabama Individual Tax Return Or

This form is for income earned in tax year 2022, with tax returns due in april. See instructions ador sign here in black ink keep a copy of this. Web other available credits (form 40 or 40nr) download form. Income tax return first, before you can prepare the alabama tax return. Complete, edit or print tax forms instantly.

Estimated Tax Form Alabama Free Download

Easily fill out pdf blank, edit, and sign them. You are not a resident of alabama and you received taxable income from alabama sources or for performing services within alabama and your. Web you must use form 40nr if: Save yourself time and money using our fillable web templates. See instructions ador sign here in black ink keep a copy.

Fillable Schedule Oc (Form 40 Or 40nr) Other Available Credits

Schedules a, b, d & e. See instructions ador sign here in black ink keep a copy of this. Web alabama individual nonresident income tax return form 40nr 2020 v mail form 40nr to: Web 2020 alabama individual nonresident income tax return. Complete, edit or print tax forms instantly.

2016 Form AL DoR 40 Booklet Fill Online, Printable, Fillable, Blank

Please refer to the list of mailing. Web alabama individual nonresident income tax return form 40nr 2021 v mail form 40nr to: Web we last updated the standard deduction chart 40nr in march 2023, so this is the latest version of standard deduction chart 40nr, fully updated for tax year 2022. Other available credits (form 40 or 40nr) all divisions..

Turbo Tax Is Saying I Need Both Forms But It Is Not Supported By Turbo Tax.

Web we last updated the standard deduction chart 40nr in march 2023, so this is the latest version of standard deduction chart 40nr, fully updated for tax year 2022. Please refer to the list of mailing. Web other available credits (form 40 or 40nr) download form. 2020 alabama individual nonresident income tax return.

Schedules A, B, D & E.

Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. You are not a resident of alabama and you received taxable income from alabama sources or for performing services within alabama and your. Web alabama individual nonresident income tax return (print only) all divisions.

Prepare And Report Accurate Taxes With Signnow Remotely.

Schedules a, b, d, & e (form 40nr) all divisions. This form is for income earned in tax year 2022, with tax. Effortlessly add and highlight text, insert images, checkmarks, and icons, drop new fillable areas, and rearrange or delete pages from your paperwork. Save or instantly send your ready documents.

Web Alabama Form 40 And 40Nr Required By Alabama Special Rules???

Web alabama individual nonresident income tax return form 40nr 2021 v mail form 40nr to: Web get an extension until october 15 in just 5 minutes. Web we last updated alabama form 40nr in january 2023 from the alabama department of revenue. Income tax return first, before you can prepare the alabama tax return.