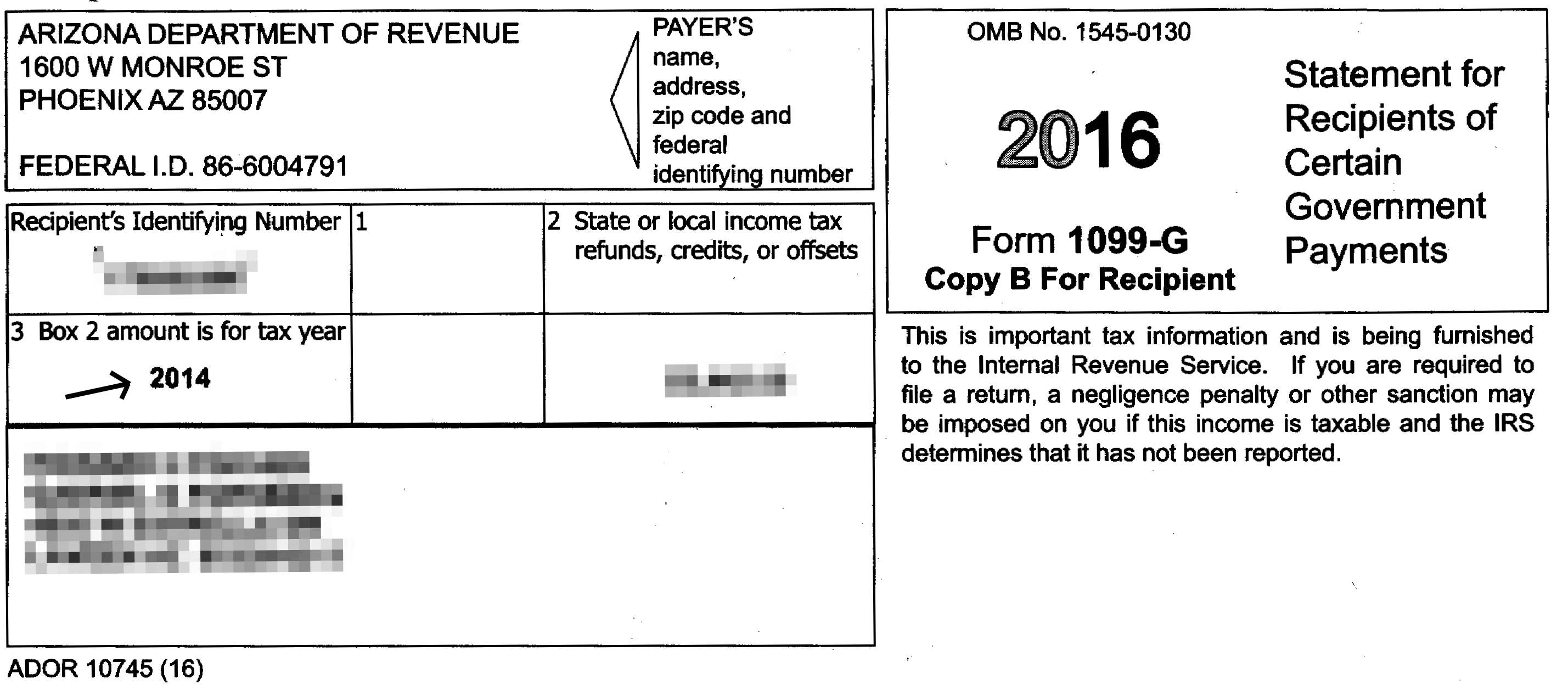

Arizona 1099 G Form

Arizona 1099 G Form - Web january 26, 2022. Web you must notify the department of revenue in writing by completing the business account update (form 10193) and submitting it with payment for applicable fees. Filers can download and print. Filers can download and print. Web compensation payments of $10 or more. Federal tax return was itemized arizona income tax payments for the tax. Web if you received unemployment payments from arizona last year, you should have already receive a copy of the information return sent to the irs, called form 1099. For internal revenue service center. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. These forms serve as confirmation of.

Through aztaxes to use the manual data input method, or to upload the. Web january 26, 2022. Web compensation payments of $10 or more. Web if you received unemployment payments from arizona last year, you should have already receive a copy of the information return sent to the irs, called form 1099. These forms serve as confirmation of. Filers can download and print. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Federal tax return was itemized arizona income tax payments for the tax. For internal revenue service center. Filers can download and print.

Filers can download and print. Web january 26, 2022. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Web compensation payments of $10 or more. Web if you received unemployment payments from arizona last year, you should have already receive a copy of the information return sent to the irs, called form 1099. These forms serve as confirmation of. Federal tax return was itemized arizona income tax payments for the tax. For internal revenue service center. Filers can download and print. Web you must notify the department of revenue in writing by completing the business account update (form 10193) and submitting it with payment for applicable fees.

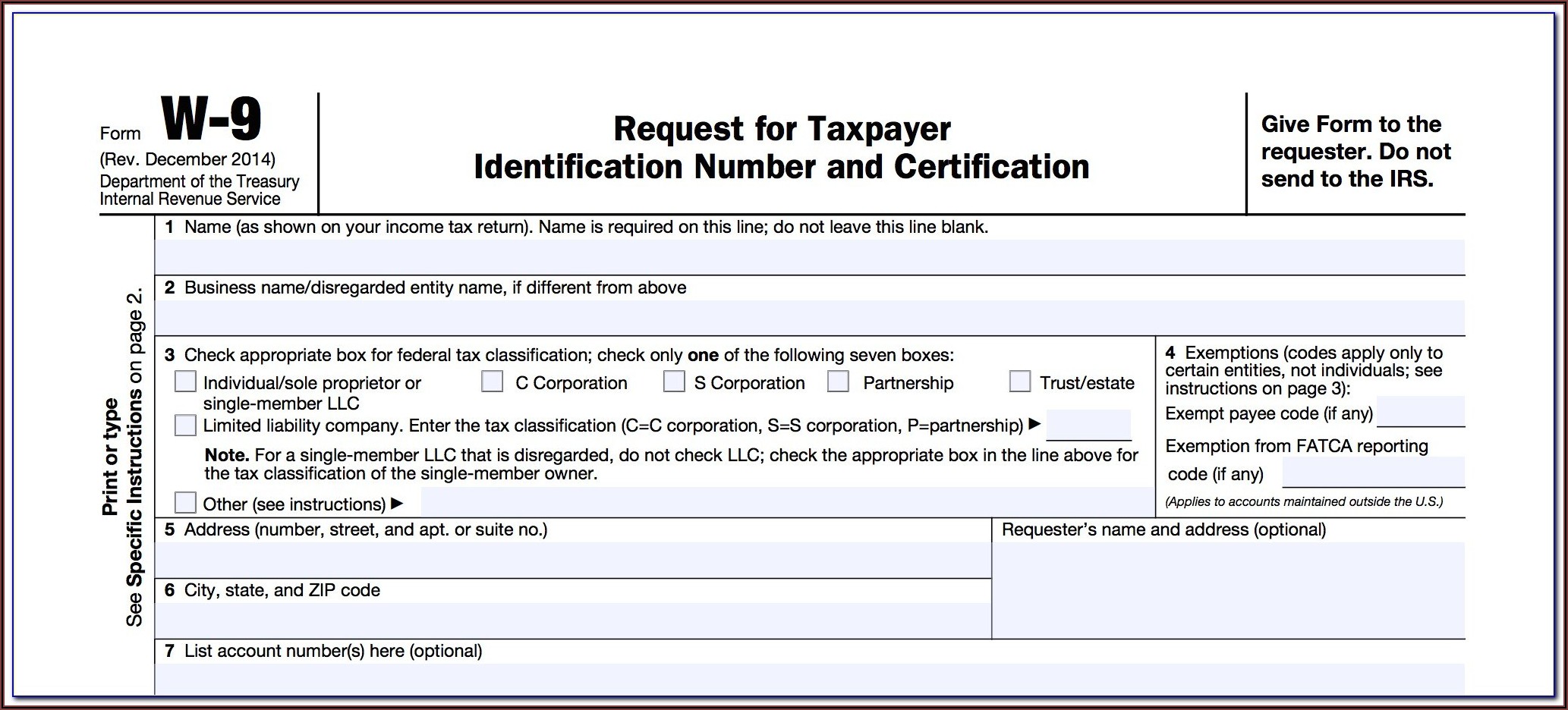

1099 Form Az Form Resume Examples v19xoxb27E

Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Filers can download and print. Filers can download and print. These forms serve as confirmation of. Federal tax return was itemized arizona income tax payments for the tax.

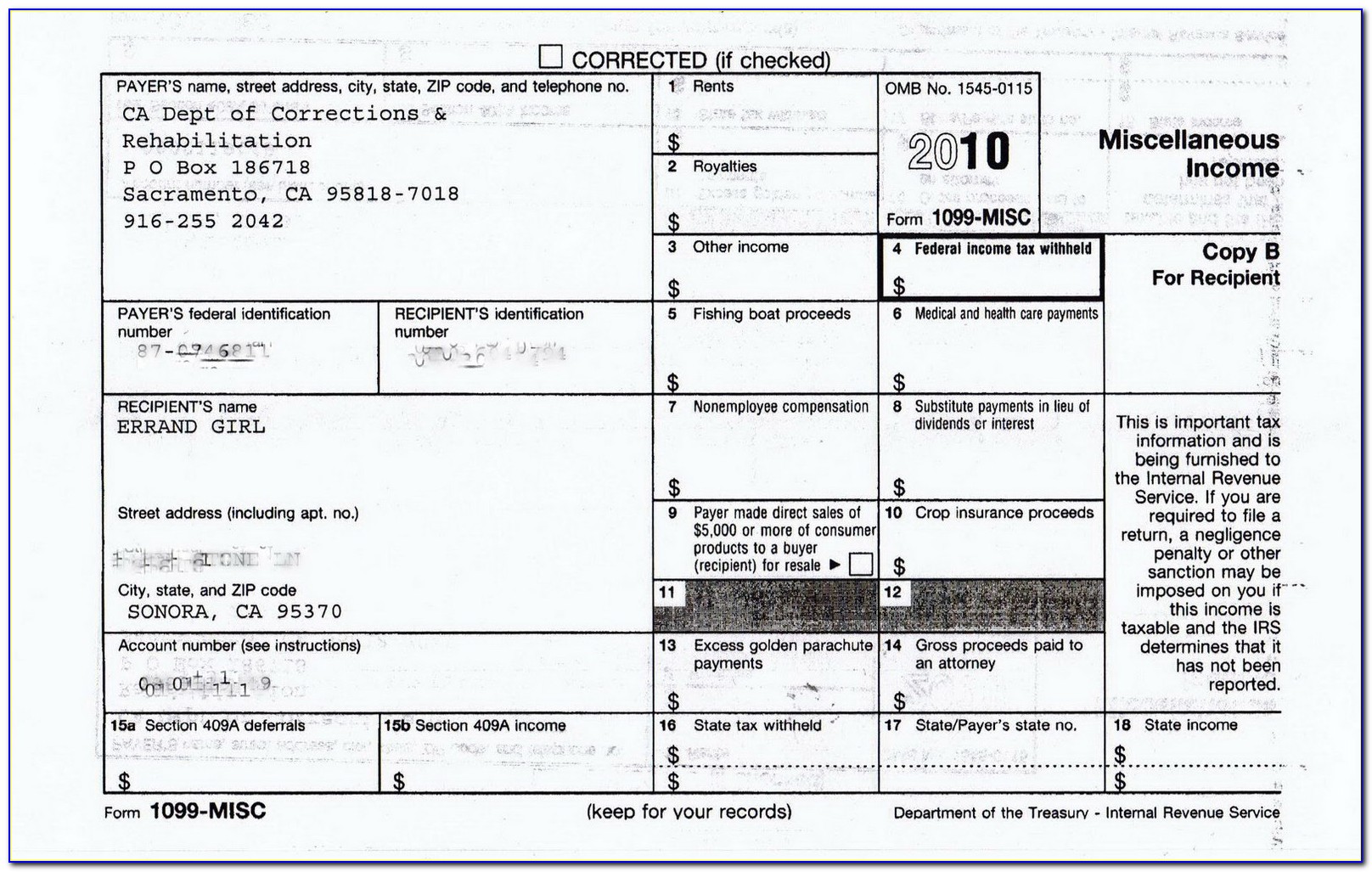

Arizona Unemployment Form 1099 G Form Resume Examples YL5zgqqOzV

Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. For internal revenue service center. Filers can download and print. For internal revenue service center. Filers can download and print.

Arizona Unemployment Form 1099 G Form Resume Examples YL5zgqqOzV

These forms serve as confirmation of. For internal revenue service center. Filers can download and print. Through aztaxes to use the manual data input method, or to upload the. Federal tax return was itemized arizona income tax payments for the tax.

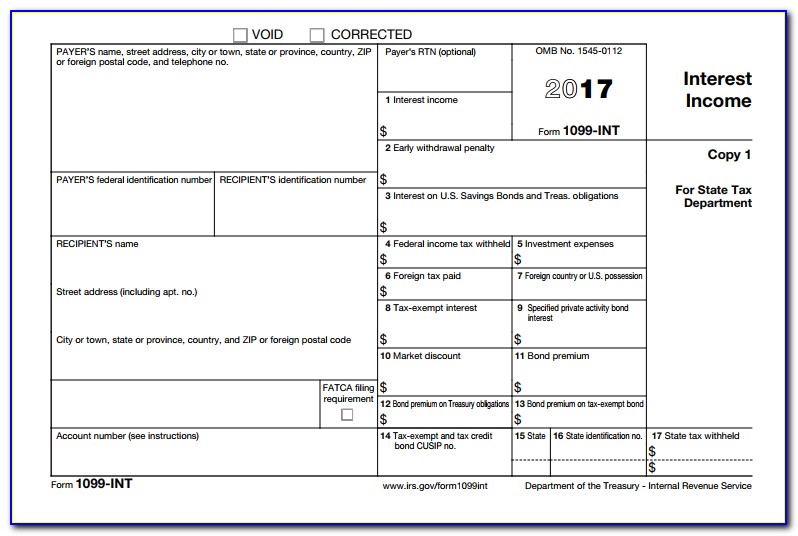

Where To Find 1099 G Form For Unemployment

For internal revenue service center. Web if you received unemployment payments from arizona last year, you should have already receive a copy of the information return sent to the irs, called form 1099. For internal revenue service center. Filers can download and print. Filers can download and print.

Form 1099 Fillable Form Resume Examples yKVBbLrgVM

Web you must notify the department of revenue in writing by completing the business account update (form 10193) and submitting it with payment for applicable fees. Through aztaxes to use the manual data input method, or to upload the. These forms serve as confirmation of. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and.

Hold up on doing your taxes; Arizona tax form 1099G is flawed The

These forms serve as confirmation of. For internal revenue service center. Filers can download and print. Web compensation payments of $10 or more. Web january 26, 2022.

Arizona Form 1099 G Form Resume Examples MW9pB7W7VA

Web compensation payments of $10 or more. Web you must notify the department of revenue in writing by completing the business account update (form 10193) and submitting it with payment for applicable fees. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. For internal revenue service center. Web if you received unemployment.

Arizona Form 1099 G Form Resume Examples EVKYl5ko10

Filers can download and print. Filers can download and print. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Web if you received unemployment payments from arizona last year, you should have already receive a copy of the information return sent to the irs, called form 1099. Web compensation payments of $10.

Arizona Unemployment Form 1099 G Form Resume Examples YL5zgqqOzV

Web compensation payments of $10 or more. Web if you received unemployment payments from arizona last year, you should have already receive a copy of the information return sent to the irs, called form 1099. These forms serve as confirmation of. Filers can download and print. For internal revenue service center.

Arizona Unemployment Form 1099 G Form Resume Examples YL5zgqqOzV

For internal revenue service center. Web if you received unemployment payments from arizona last year, you should have already receive a copy of the information return sent to the irs, called form 1099. Web you must notify the department of revenue in writing by completing the business account update (form 10193) and submitting it with payment for applicable fees. For.

For Internal Revenue Service Center.

These forms serve as confirmation of. Web you must notify the department of revenue in writing by completing the business account update (form 10193) and submitting it with payment for applicable fees. Through aztaxes to use the manual data input method, or to upload the. Web january 26, 2022.

Web Aztaxes.gov Allows Electronic Filing And Payment Of Transaction Privilege Tax (Tpt), Use Taxes, And Withholding Taxes.

Web compensation payments of $10 or more. For internal revenue service center. Web if you received unemployment payments from arizona last year, you should have already receive a copy of the information return sent to the irs, called form 1099. Filers can download and print.

Federal Tax Return Was Itemized Arizona Income Tax Payments For The Tax.

Filers can download and print.