Arizona Form 321 For 2022

Arizona Form 321 For 2022 - Try it for free now! Web 321to qualifying charitable organizations2021 include with your return. Save or instantly send your ready documents. When filing your taxes in 2022, charitable tax credit gifts made between january 1, 2021, and december 31, 2021, are required to be listed on. Line 6c should reflect the amount of all arizona tax credits claimed for contributions made to charitable organizations (forms 321, 323, 348 and 352). Upload, modify or create forms. Web click on the button button to download arizona form 321. Arizona has a state income tax that ranges between 2.59% and 4.5%. Easily fill out pdf blank, edit, and sign them. Web 2022 credit for contributions arizona form to qualifying charitable organizations 321 for information or help, call one of the numbers listed:

Web for donations made from january 1, 2022 to april 18, 2022 use the 2022 list. Ad register and subscribe now to work on your az dor form 321 & more fillable forms. Web we last updated arizona form 321 in february 2023 from the arizona department of revenue. Web 321to qualifying charitable organizations2022 include with your return. Web the tax credit is claimed on form 321. Save or instantly send your ready documents. Web arizona form 321 1 (1) include with your return. The maximum qco credit donation amount for 2022: How do i file for the arizona charitable tax credit? When filing your taxes in 2022, charitable tax credit gifts made between january 1, 2021, and december 31, 2021, are required to be listed on.

Get ready for tax season deadlines by completing any required tax forms today. Get your online template and fill it in using progressive features. $400 single, married filing separate or head of household; Save or instantly send your ready documents. Web 321 credit for contributions to qualifying charitable organizations2022 2 0 2 2 2 0 2 2 2 0 2 2 2 0 2 3 2 0 2 3 2 0 2 3 part 1 current year’s credit a. Cash contributions made january 1, 2021 through december 31, 2021. Web open the arizona form 321 for 2022 and follow the instructions easily sign the arizona form 321 with your finger send filled & signed form 321 or save rate the az tax form 321 4.8. Arizona has a state income tax that ranges between 2.59% and 4.5%. For the calendar year 2022 or fiscal year beginning mmdd2022 and ending mmddyyyy. Web complete az form 321 and include it when you file your 2022 state taxes.

Arizona Form 140ET (ADOR10532) Download Fillable PDF or Fill Online

Get an extension until october 15 in. Web for donations made from january 1, 2022 to april 18, 2022 use the 2022 list. Web choose where your money goes. Arizona has a state income tax that ranges between 2.59% and 4.5%. Get ready for tax season deadlines by completing any required tax forms today.

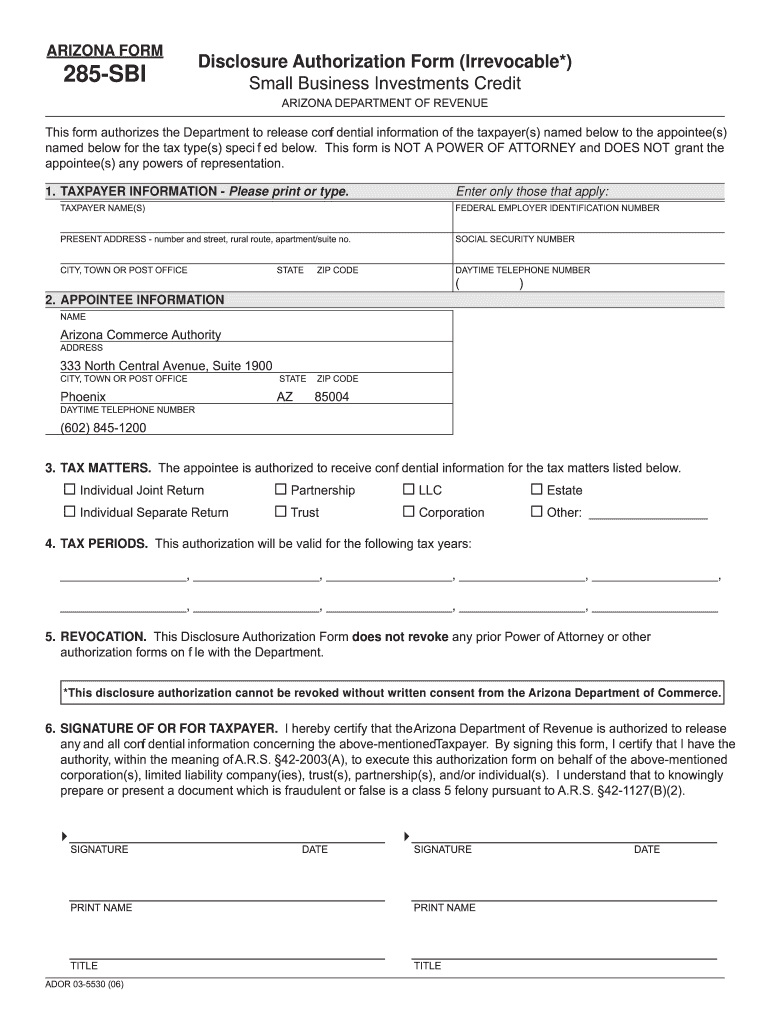

Arizona Form 285Up Fill Out and Sign Printable PDF Template signNow

Get an extension until october 15 in. Try it for free now! Arizona has a state income tax that ranges between 2.59% and 4.5%. Web arizona form 321 1 (1) include with your return. Get your online template and fill it in using progressive features.

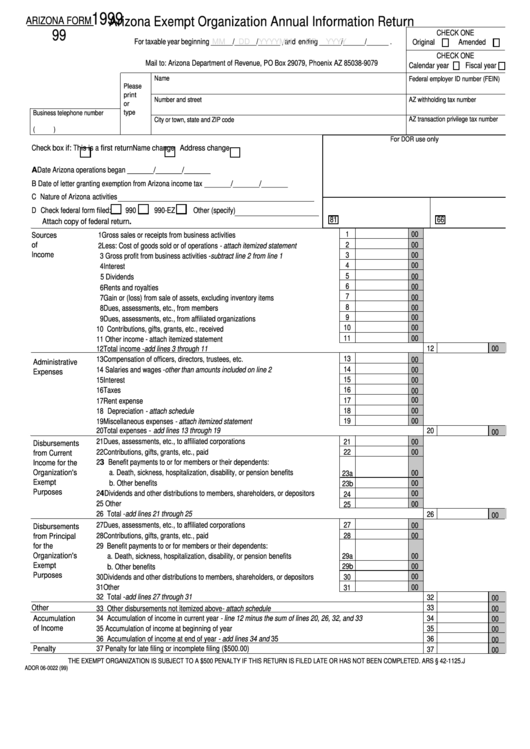

Form 99 Arizona Exempt Organization Annual Information Return 1999

Web click on the button button to download arizona form 321. How do i file for the arizona charitable tax credit? Web 2022 credit for contributions arizona form to qualifying charitable organizations 321 for information or help, call one of the numbers listed: Web you can direct your tax dollars and impact your 2021 tax refund or payment when you.

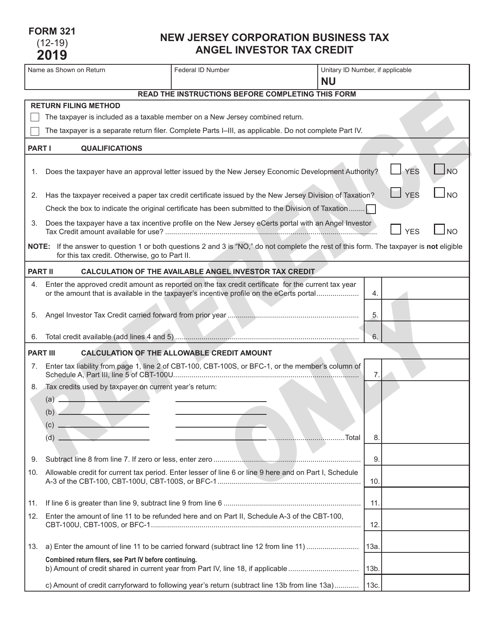

Form 321 Download Printable PDF or Fill Online Angel Investor Tax

Easily fill out pdf blank, edit, and sign them. Web complete az form 321 and include it when you file your 2022 state taxes. Web open the arizona form 321 for 2022 and follow the instructions easily sign the arizona form 321 with your finger send filled & signed form 321 or save rate the az tax form 321 4.8..

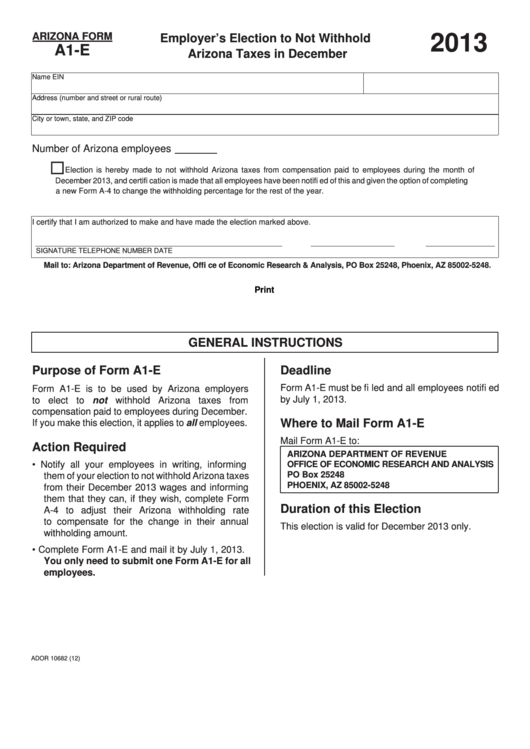

Fillable Arizona Form A1E Employer'S Election To Not Withhold

This form is for income earned in tax year 2022, with tax returns due in april. Web we last updated arizona form 321 in february 2023 from the arizona department of revenue. Web choose where your money goes. Web click on the button button to download arizona form 321. Ad register and subscribe now to work on your az dor.

Donate Southwest Behavioral & Health Services

Ad register and subscribe now to work on your az dor form 321 & more fillable forms. Web the tax credit is claimed on form 321. Web 321to qualifying charitable organizations2021 include with your return. Web 2022 credit for contributions arizona form to qualifying charitable organizations 321 for information or help, call one of the numbers listed: Get an extension.

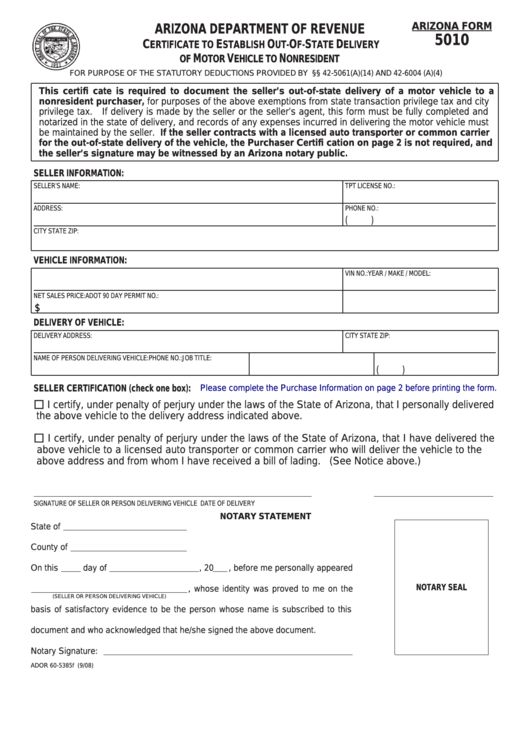

Fillable Arizona Form 5010 Certificate To Establish OutOfState

Web 30 votes how to fill out and sign arizona 321 organizations online? Web complete az form 321 and include it when you file your 2022 state taxes. For tax year 2022, the maximum allowable credit is $800 for married couples filing jointly, or $400 for single, married couples filing separately, and. Web arizona form 321 2018 arizona credit for.

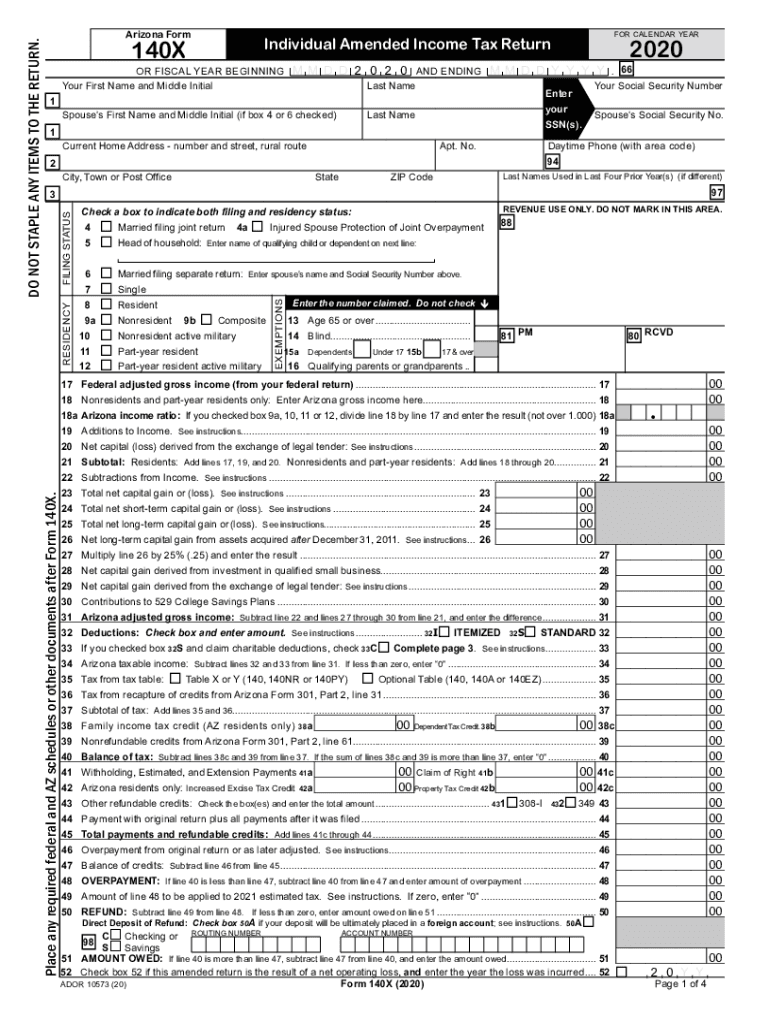

2020 AZ Form 140X Fill Online, Printable, Fillable, Blank pdfFiller

Web complete az form 321 and include it when you file your 2022 state taxes. The maximum qco credit donation amount for 2022: Web 30 votes how to fill out and sign arizona 321 organizations online? How do i file for the arizona charitable tax credit? Arizona has a state income tax that ranges between 2.59% and 4.5%.

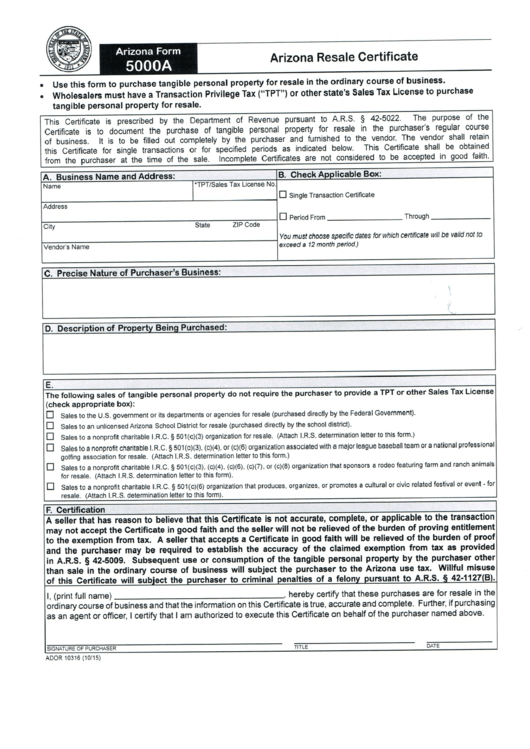

Arizona Form 5000a Arizona Resale Certificate printable pdf download

Web click on the button button to download arizona form 321. Try it for free now! Easily fill out pdf blank, edit, and sign them. Web 321 credit for contributions to qualifying charitable organizations2022 2 0 2 2 2 0 2 2 2 0 2 2 2 0 2 3 2 0 2 3 2 0 2 3 part 1.

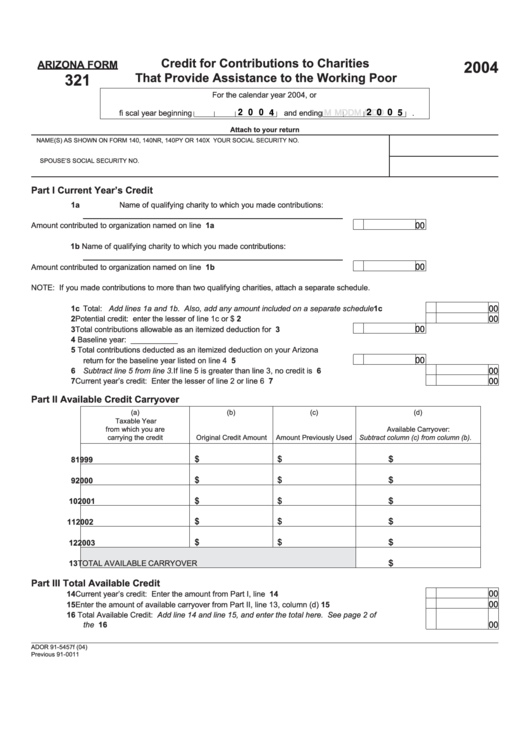

Fillable Arizona Form 321 Credit For Contributions To Charities That

Web complete az form 321 and include it when you file your 2022 state taxes. Web choose where your money goes. How do i file for the arizona charitable tax credit? Web click on the button button to download arizona form 321. Web open the arizona form 321 for 2022 and follow the instructions easily sign the arizona form 321.

Web You Can Direct Your Tax Dollars And Impact Your 2021 Tax Refund Or Payment When You Make A Contribution To Fsl Or Another Qualified Charitable Organization By April.

Try it for free now! Upload, modify or create forms. Get your online template and fill it in using progressive features. Web 321to qualifying charitable organizations2022 include with your return.

Ad Register And Subscribe Now To Work On Your Az Dor Form 321 & More Fillable Forms.

Web open the arizona form 321 for 2022 and follow the instructions easily sign the arizona form 321 with your finger send filled & signed form 321 or save rate the az tax form 321 4.8. Line 6c should reflect the amount of all arizona tax credits claimed for contributions made to charitable organizations (forms 321, 323, 348 and 352). For the calendar year 2021 or fiscal year beginning mmdd2021 and ending mmddyyyy. $400 single, married filing separate or head of household;

Web Arizona Form 321 1 (1) Include With Your Return.

When filing your taxes in 2022, charitable tax credit gifts made between january 1, 2021, and december 31, 2021, are required to be listed on. Web 321 credit for contributions to qualifying charitable organizations2022 2 0 2 2 2 0 2 2 2 0 2 2 2 0 2 3 2 0 2 3 2 0 2 3 part 1 current year’s credit a. Web we last updated arizona form 321 in february 2023 from the arizona department of revenue. Arizona has a state income tax that ranges between 2.59% and 4.5%.

Ad Register And Subscribe Now To Work On Your Az Dor Form 321 & More Fillable Forms.

Web 321to qualifying charitable organizations2021 include with your return. Web arizona form 321 2018 arizona credit for contributions to charities that provide assistance to the working poor. Part 1 current year’s credit a. Cash contributions made january 1, 2021 through december 31, 2021.