Arizona Form 355

Arizona Form 355 - Web an arizona tax power of attorney form 285 can be used to elect a person (usually an accountant) to handle another person’s tax filing within the state of. Web 26 rows form number title; Arizona small business income tax return. Web credit for corporate contributions to school tuition organizations. Web election az165, page 1, question a. Web against subsequent years’ income tax liability. Web arizona court forms. Web 101 () you must include form 301 and the corresponding credit form(s) for important which you computed your credit(s) with your individual income tax return. The categories below direct the individual to state and county forms. Beginning with tax year 2021, a taxpayer may elect to file a separate small business income (sbi) tax return.

Web arizona individual form availability schedule a (nr), itemized deductions (for nonresidents) available available form 301, nonrefundable individual tax credits and. Web arizona form 352 include with your return. Web 26 rows arizona corporate or partnership income tax payment voucher: Tax credits forms, individual : Credit for contributions to qualifying foster care charitable organizations2019 for the calendar year 2019 or fiscal year beginning. Web credit for corporate contributions to school tuition organizations. If you are unsure of what forms you need to file,. Credit for increased excise taxes: Web an arizona tax power of attorney form 285 can be used to elect a person (usually an accountant) to handle another person’s tax filing within the state of. Beginning with tax year 2021, a taxpayer may elect to file a separate small business income (sbi) tax return.

Tax credits forms, individual : Beginning with tax year 2021, a taxpayer may elect to file a separate small business income (sbi) tax return. If you are unsure of what forms you need to file,. Credit for increased excise taxes: Web 26 rows form number title; Credit for contributions to qualifying foster care charitable organizations2019 for the calendar year 2019 or fiscal year beginning. Web 26 rows arizona corporate or partnership income tax payment voucher: Web credit for corporate contributions to school tuition organizations. Forms for filing in arizona. Web election az165, page 1, question a.

Arizona Form 140IA Arizona Department Of Revenue Fill and Sign

Web credit for corporate contributions to school tuition organizations. Web the arizona department of revenue presents an overview of form 285 the general disclosure of representation authorization form 285 is used to authorize the department. Beginning with tax year 2021, a taxpayer may elect to file a separate small business income (sbi) tax return. Web 101 () you must include.

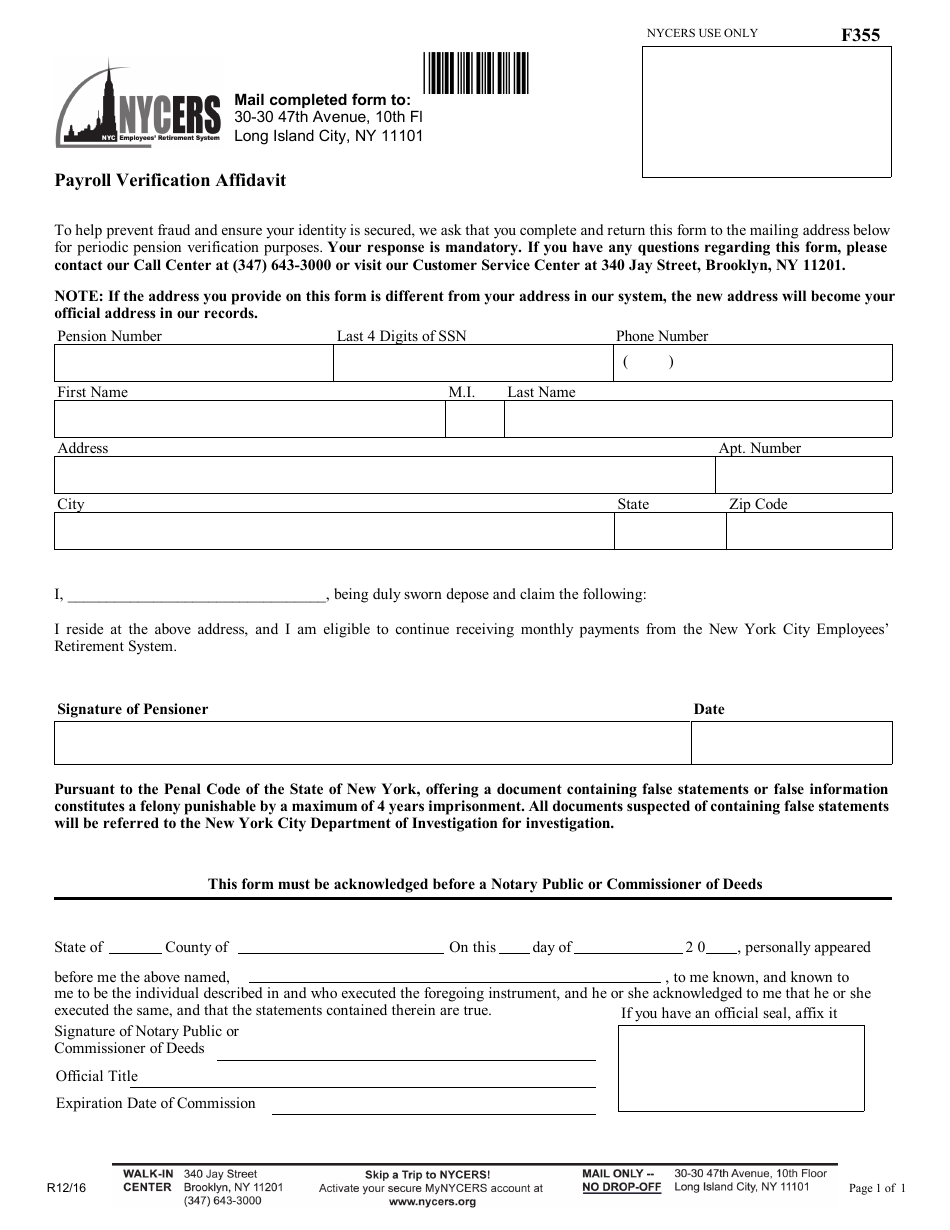

Form 355 Download Printable PDF or Fill Online Payroll Verification

Web an arizona tax power of attorney form 285 can be used to elect a person (usually an accountant) to handle another person’s tax filing within the state of. Arizona small business income tax return. Web election az165, page 1, question a. If you are unsure of what forms you need to file,. Web arizona form 352 include with your.

Download Arizona Form A4 (2013) for Free FormTemplate

Web 101 () you must include form 301 and the corresponding credit form(s) for important which you computed your credit(s) with your individual income tax return. The categories below direct the individual to state and county forms. Web against subsequent years’ income tax liability. Forms for filing in arizona. Web 26 rows form number title;

Form 355 2013 Edit, Fill, Sign Online Handypdf

Application for certification for qualifying charitable organization: Web 26 rows form number title; Web credit for corporate contributions to school tuition organizations. Beginning with tax year 2021, a taxpayer may elect to file a separate small business income (sbi) tax return. The categories below direct the individual to state and county forms.

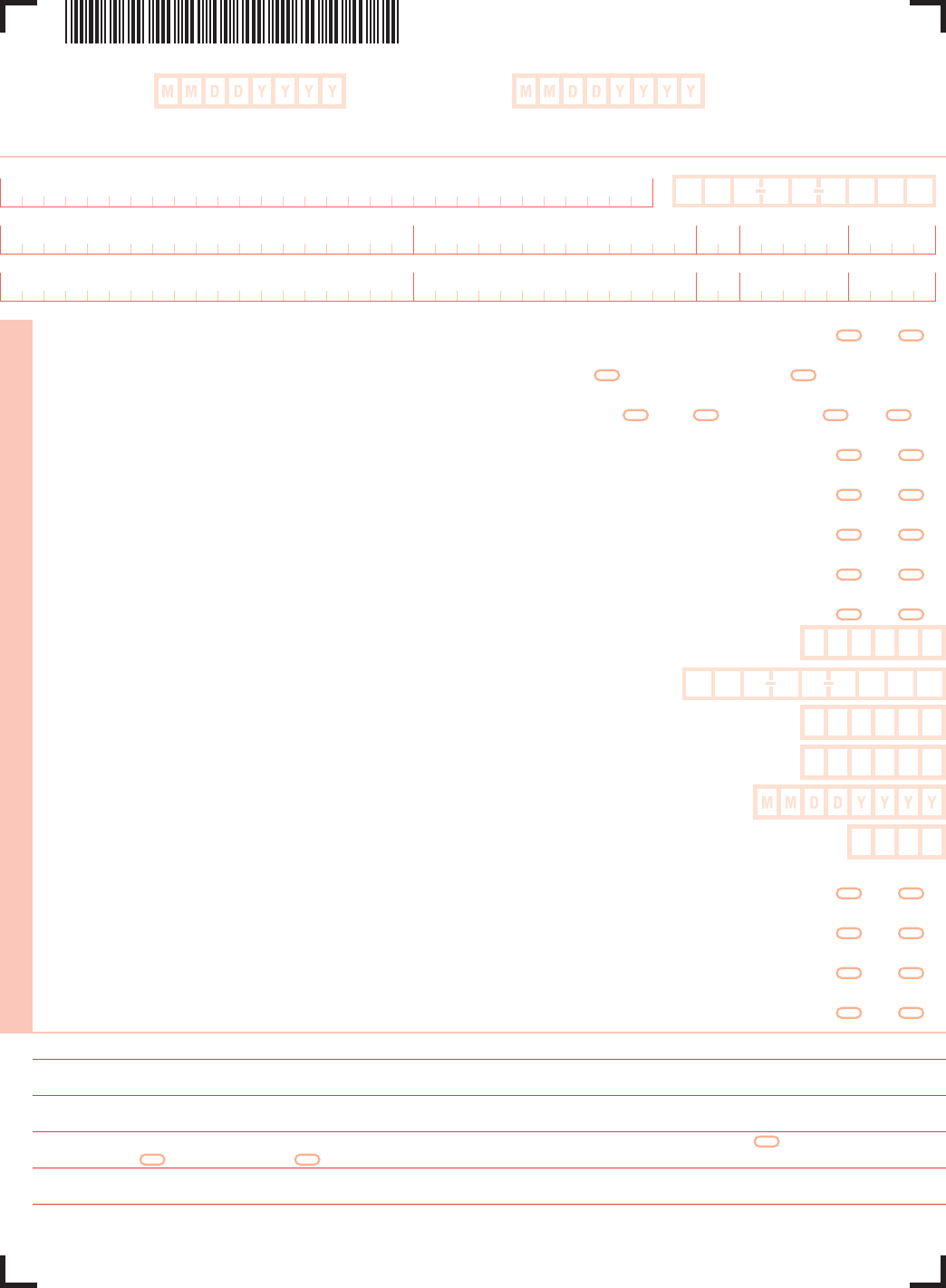

AETC Form 355 Fill Out, Sign Online and Download Fillable PDF

Web credit for corporate contributions to school tuition organizations. Web an arizona tax power of attorney form 285 can be used to elect a person (usually an accountant) to handle another person’s tax filing within the state of. Credit for increased excise taxes: Filed by corporations and partnerships passing the credit through to corporate partners to claim. Web 26 rows.

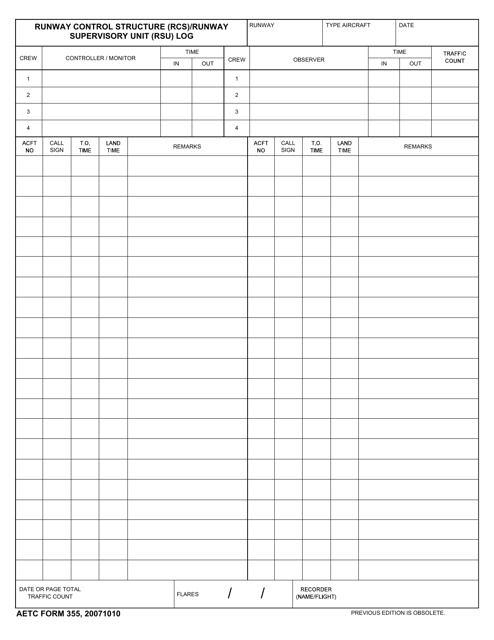

Instructions For Arizona Form 51t printable pdf download

Web arizona court forms. If you are unsure of what forms you need to file,. Web 26 rows arizona corporate or partnership income tax payment voucher: Web 101 () you must include form 301 and the corresponding credit form(s) for important which you computed your credit(s) with your individual income tax return. Beginning with tax year 2021, a taxpayer may.

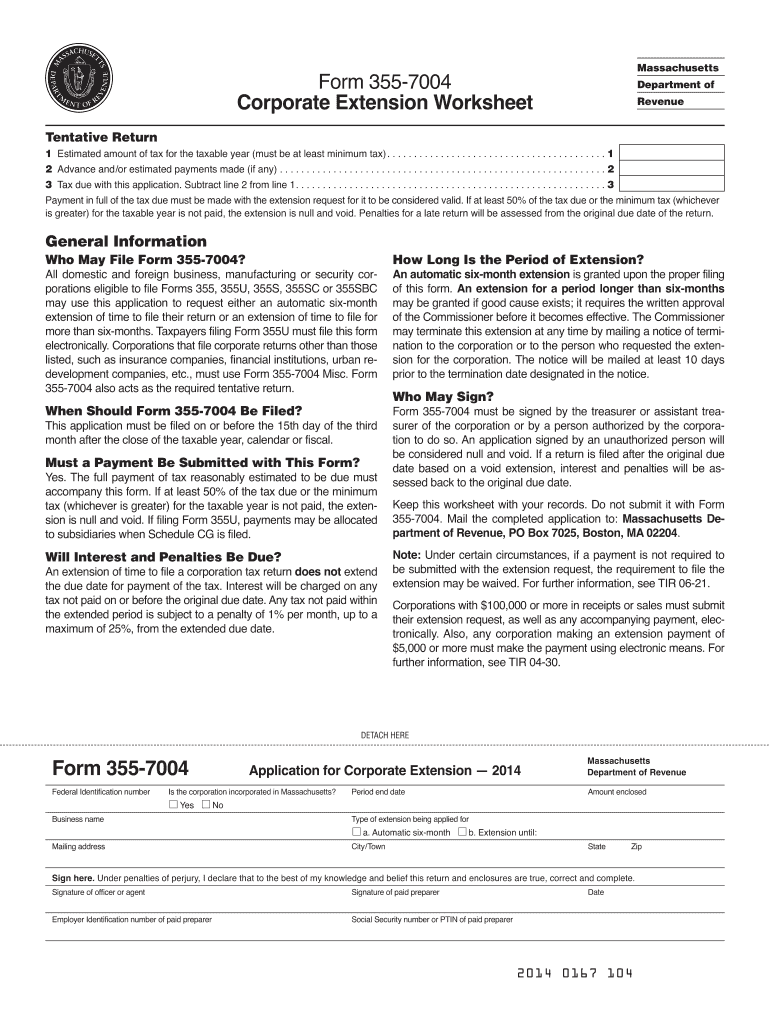

2019 Form 355 7004 Fill Out and Sign Printable PDF Template signNow

Credit for contributions to qualifying foster care charitable organizations2019 for the calendar year 2019 or fiscal year beginning. Web an arizona tax power of attorney form 285 can be used to elect a person (usually an accountant) to handle another person’s tax filing within the state of. Arizona small business income tax return. Application for certification for qualifying charitable organization:.

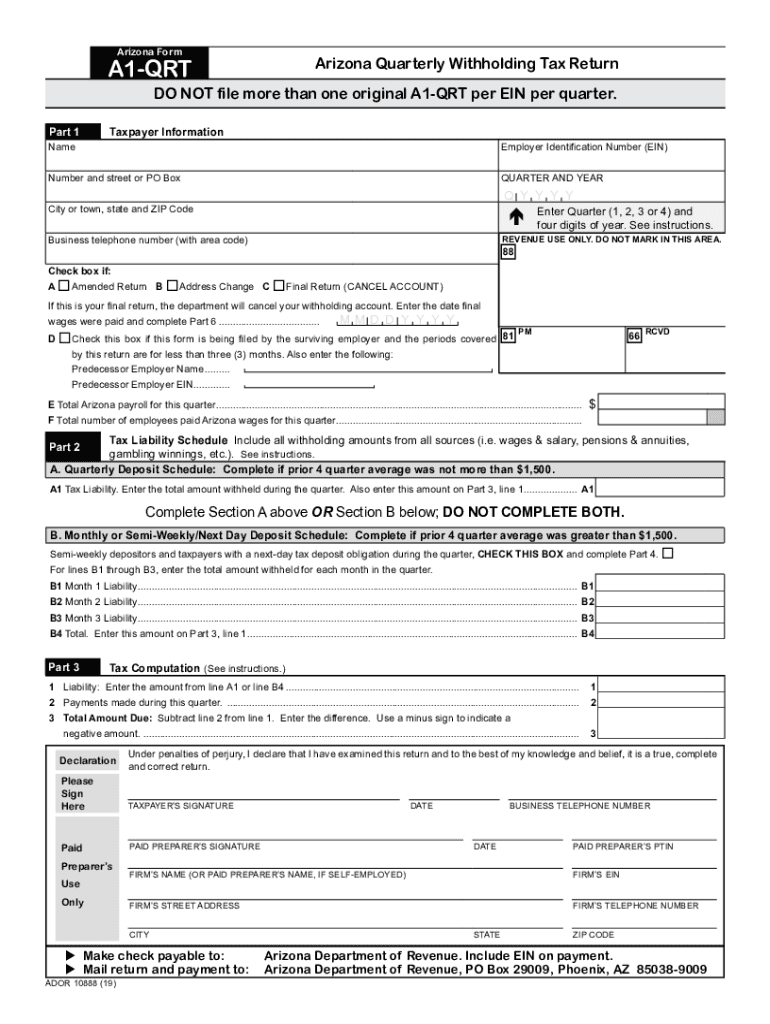

A1 qrt 2019 Fill out & sign online DocHub

Web election az165, page 1, question a. Web arizona form 352 include with your return. Beginning with tax year 2021, a taxpayer may elect to file a separate small business income (sbi) tax return. Forms for filing in arizona. Web 26 rows arizona corporate or partnership income tax payment voucher:

SBA Form 355 A StepbyStep Guide to How to Fill It Out

Beginning with tax year 2021, a taxpayer may elect to file a separate small business income (sbi) tax return. Web against subsequent years’ income tax liability. Web arizona court forms. Forms for filing in arizona. Web 101 () you must include form 301 and the corresponding credit form(s) for important which you computed your credit(s) with your individual income tax.

20152022 AK Form 355 Fill Online, Printable, Fillable, Blank pdfFiller

Web arizona court forms. Web the arizona department of revenue presents an overview of form 285 the general disclosure of representation authorization form 285 is used to authorize the department. Filed by corporations and partnerships passing the credit through to corporate partners to claim. Tax credits forms, individual : Web arizona individual form availability schedule a (nr), itemized deductions (for.

Application For Certification For Qualifying Charitable Organization:

Beginning with tax year 2021, a taxpayer may elect to file a separate small business income (sbi) tax return. If you are unsure of what forms you need to file,. Web 26 rows form number title; Web credit for corporate contributions to school tuition organizations.

Credit For Increased Excise Taxes:

The categories below direct the individual to state and county forms. Forms for filing in arizona. Web the arizona department of revenue presents an overview of form 285 the general disclosure of representation authorization form 285 is used to authorize the department. Web 26 rows form number title;

Web 26 Rows Arizona Corporate Or Partnership Income Tax Payment Voucher:

Credit for contributions to qualifying foster care charitable organizations2019 for the calendar year 2019 or fiscal year beginning. Web election az165, page 1, question a. Web arizona individual form availability schedule a (nr), itemized deductions (for nonresidents) available available form 301, nonrefundable individual tax credits and. Web an arizona tax power of attorney form 285 can be used to elect a person (usually an accountant) to handle another person’s tax filing within the state of.

Web 101 () You Must Include Form 301 And The Corresponding Credit Form(S) For Important Which You Computed Your Credit(S) With Your Individual Income Tax Return.

Arizona small business income tax return. Web arizona court forms. Tax credits forms, individual : Web arizona form 352 include with your return.