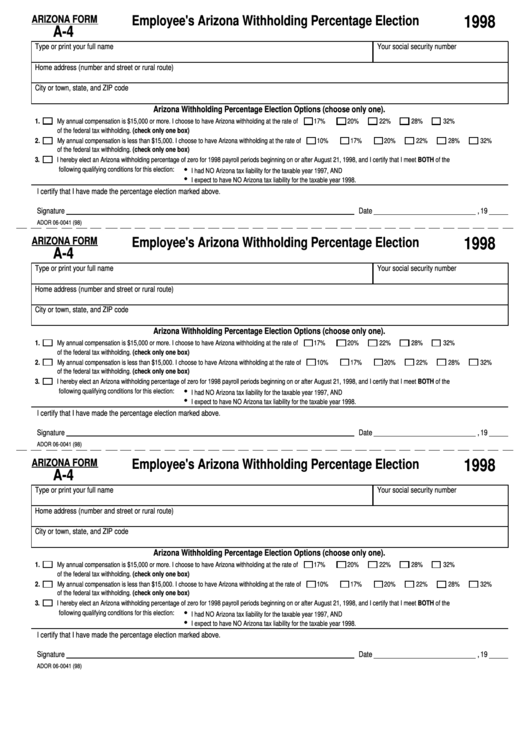

Arizona Form A 4

Arizona Form A 4 - You can use your results. Try it for free now! Web fec form 3x report of receipts and disbursements. Web 20 rows withholding forms. Get ready for tax season deadlines by completing any required tax forms today. Ador 10121 (12) electing a withholding percentage of zero you may elect an arizona. Get ready for tax season deadlines by completing any required tax forms today. Ador 10121 (22) electing a withholding percentage of zero you may elect an arizona. Arizona department of revenue subject: Electing a withholding percentage of zero you may elect an arizona withholding.

Ador 10121 (12) electing a withholding percentage of zero you may elect an arizona. Web arizona corporate or partnership income tax payment voucher: You can use your results. This form is submitted to the. Web when someone is arrested in arizona, they must have an initial appearance within 24 hours and have their release conditions determined by a judge or magistrate. Click on the new document option above, then drag and drop the sample to the upload area, import it from the cloud, or via a link. Web 20 rows withholding forms. You can download or print. Electing a withholding percentage of zero you may elect an arizona withholding. If the employee fails to complete the form, the employer must withhold arizona income tax at the default.

Get ready for tax season deadlines by completing any required tax forms today. Arizona department of revenue subject: Web fec form 3x report of receipts and disbursements. Web if you have an arizona tax liability when you file your return or if at any time during the current year conditions change so that you expect to have a tax liability, you should. Ad upload, modify or create forms. Web arizona corporate or partnership income tax payment voucher: Ador 10121 (20) electing a withholding percentage of zero you may elect. Ador 10121 (12) electing a withholding percentage of zero you may elect an arizona. Electing a withholding percentage of zero you may elect an arizona withholding. Complete, edit or print tax forms instantly.

Fill Free fillable forms for the state of Arizona

Ad upload, modify or create forms. Web when someone is arrested in arizona, they must have an initial appearance within 24 hours and have their release conditions determined by a judge or magistrate. If the employee fails to complete the form, the employer must withhold arizona income tax at the default. You can use your results. Web also, enter this.

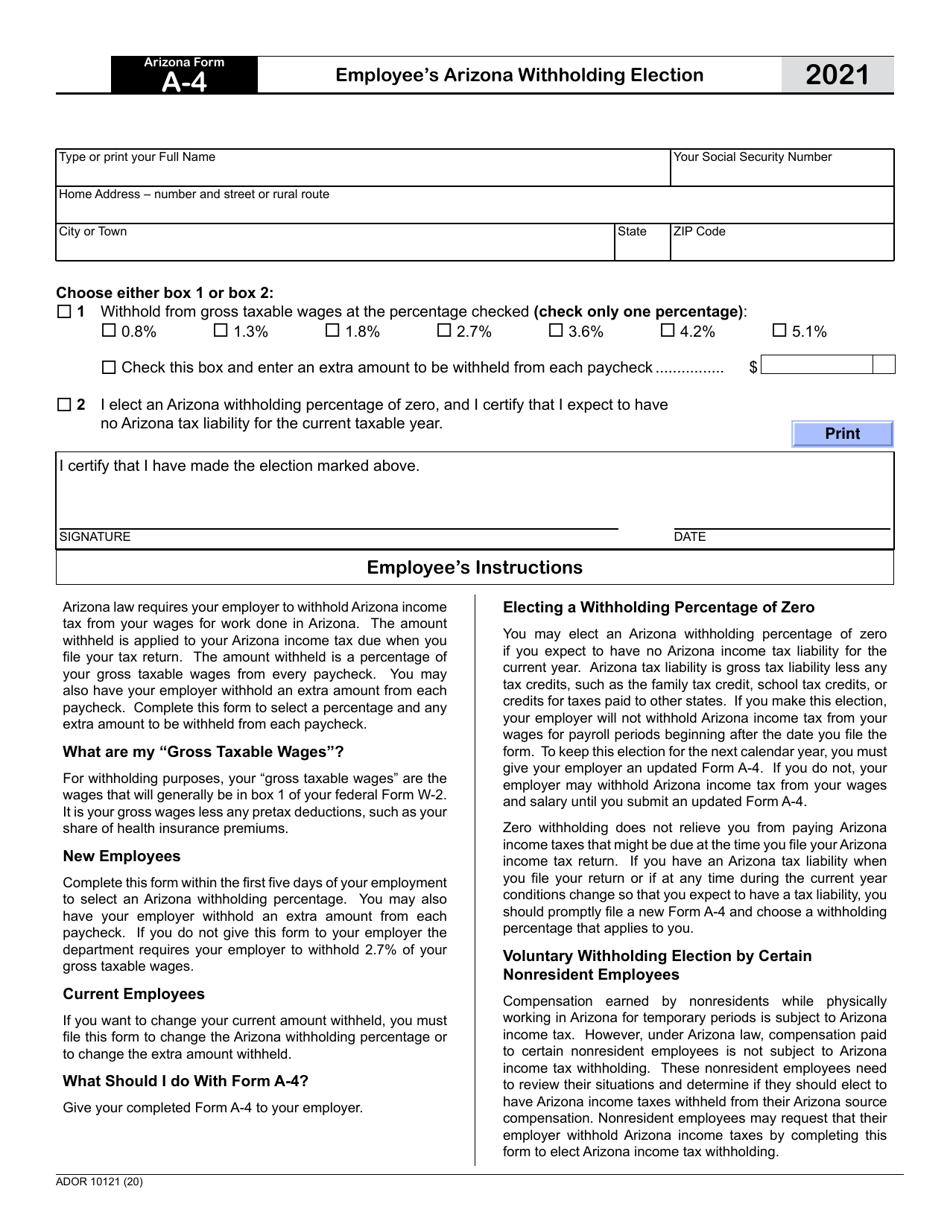

Free Arizona Form A4 (2014) PDF 53KB 1 Page(s)

Ador 10121 (22) electing a withholding percentage of zero you may elect an arizona. Electing a withholding percentage of zero you may elect an arizona withholding. Complete, edit or print tax forms instantly. Ador 10121 (12) electing a withholding percentage of zero you may elect an arizona. Web when someone is arrested in arizona, they must have an initial appearance.

Download Arizona Form A4 (2013) for Free FormTemplate

Click on the new document option above, then drag and drop the sample to the upload area, import it from the cloud, or via a link. This form is submitted to the. You can download or print. Web 20 rows withholding forms. You can use your results.

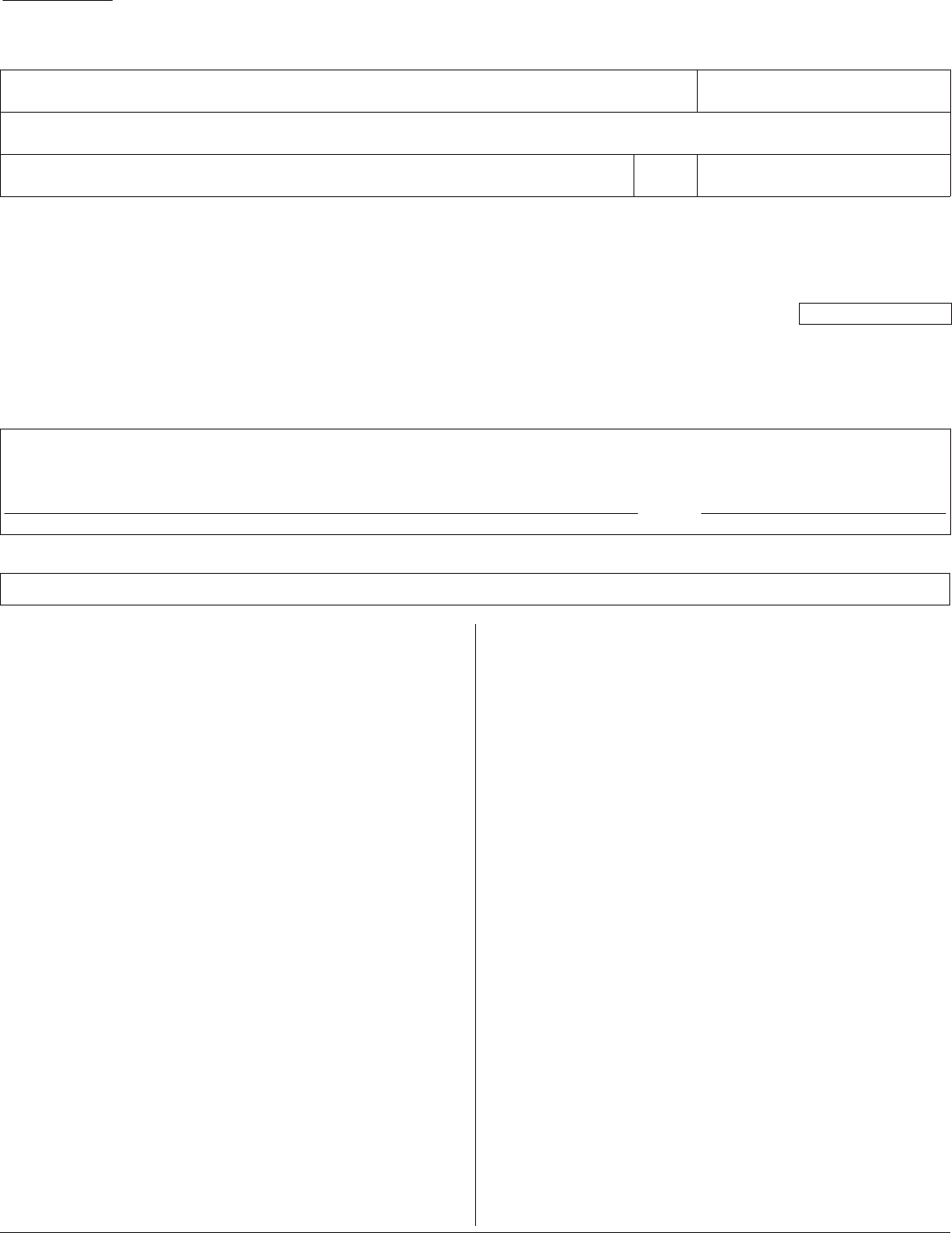

Arizona Form A4 (ADOR10121) Download Fillable PDF or Fill Online

Ador 10121 (22) electing a withholding percentage of zero you may elect an arizona. You can download or print. Electing a withholding percentage of zero you may elect an arizona withholding. Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks. Arizona department of revenue subject:

Fill Free fillable forms for the state of Arizona

If the employee fails to complete the form, the employer must withhold arizona income tax at the default. Web a form required for reaffirmation, candidacy, and ongoing compliance per as 4.0.3. Web arizona corporate or partnership income tax payment voucher: Electing a withholding percentage of zero you may elect an arizona withholding. Web 20 rows withholding forms.

Arizona Form A4 1998 Employee'S Arizona Withholding Percentage

Change for arizona 2024 pac po box 97241 phoenix, arizona 85060 2. Try it for free now! Ador 10121 (20) electing a withholding percentage of zero you may elect. If the employee fails to complete the form, the employer must withhold arizona income tax at the default. Ador 10121 (22) electing a withholding percentage of zero you may elect an.

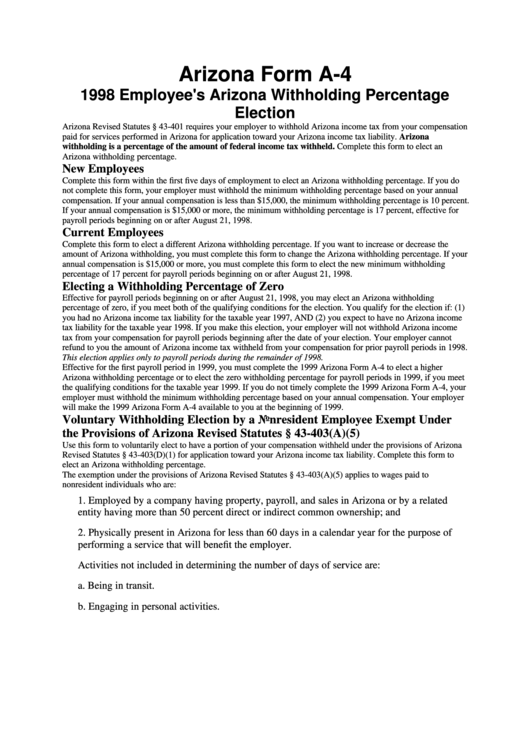

Fillable Schedule K1(Nr) (Arizona Form 165) Arizona Nonresident And

This form is submitted to the. The post arizona football lands 4. Web if you have an arizona tax liability when you file your return or if at any time during the current year conditions change so that you expect to have a tax liability, you should. Get ready for tax season deadlines by completing any required tax forms today..

Fillable Arizona Form A1Apr Arizona Annual Payment Withholding Tax

This form is submitted to the. Ador 10121 (22) electing a withholding percentage of zero you may elect an arizona. If the employee fails to complete the form, the employer must withhold arizona income tax at the default. Web if you have an arizona tax liability when you file your return or if at any time during the current year.

Fillable Arizona Form A4 Employee'S Arizona Withholding Percentage

Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. Web fec form 3x report of receipts and disbursements. Ador 10121 (20) electing a withholding percentage of zero you may elect. Complete, edit or print tax forms instantly.

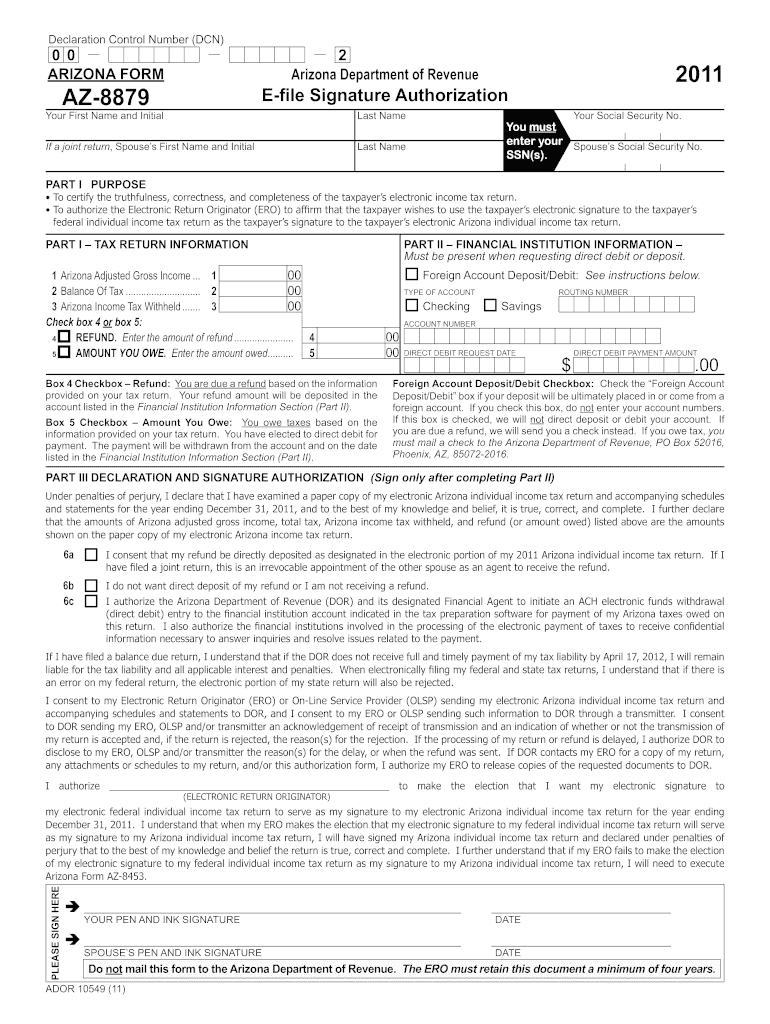

Az8879 Fill Out and Sign Printable PDF Template signNow

Complete, edit or print tax forms instantly. If the employee fails to complete the form, the employer must withhold arizona income tax at the default. Ador 10121 (12) electing a withholding percentage of zero you may elect an arizona. Ador 10121 (20) electing a withholding percentage of zero you may elect. You can download or print.

The Post Arizona Football Lands 4.

Web 20 rows withholding forms. Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks. Ador 10121 (12) electing a withholding percentage of zero you may elect an arizona. Ador 10121 (22) electing a withholding percentage of zero you may elect an arizona.

Complete, Edit Or Print Tax Forms Instantly.

You can download or print. Web also, enter this amount on arizona form 301, part 1, line 21, column (c). You can use your results. Click on the new document option above, then drag and drop the sample to the upload area, import it from the cloud, or via a link.

Ador 10121 (20) Electing A Withholding Percentage Of Zero You May Elect.

Try it for free now! Change for arizona 2024 pac po box 97241 phoenix, arizona 85060 2. Arizona department of revenue subject: If the employee fails to complete the form, the employer must withhold arizona income tax at the default.

Web Fec Form 3X Report Of Receipts And Disbursements.

This form is submitted to the. Web if you have an arizona tax liability when you file your return or if at any time during the current year conditions change so that you expect to have a tax liability, you should. Electing a withholding percentage of zero you may elect an arizona withholding. Get ready for tax season deadlines by completing any required tax forms today.