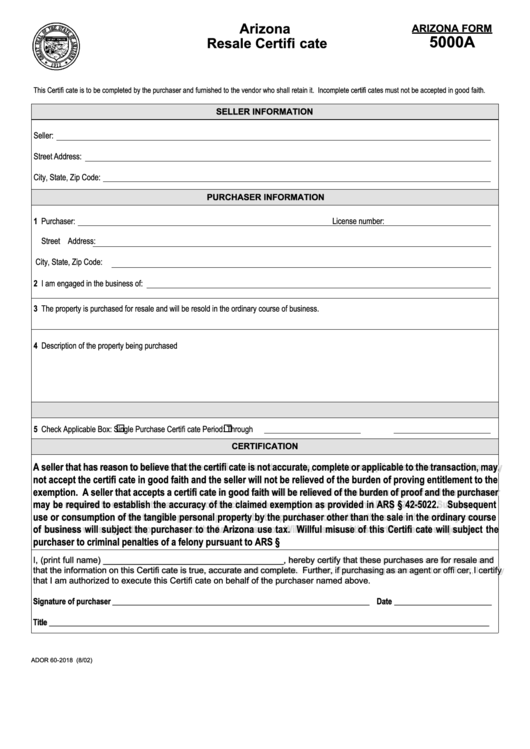

Arizona Tax Exempt Form 5000A

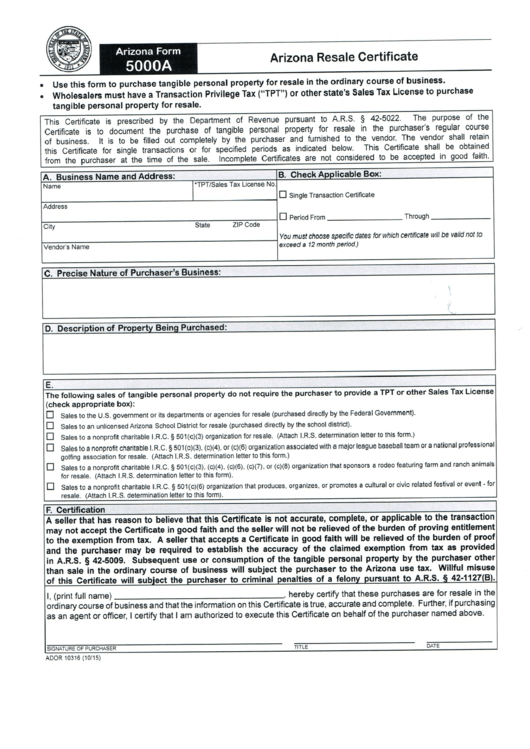

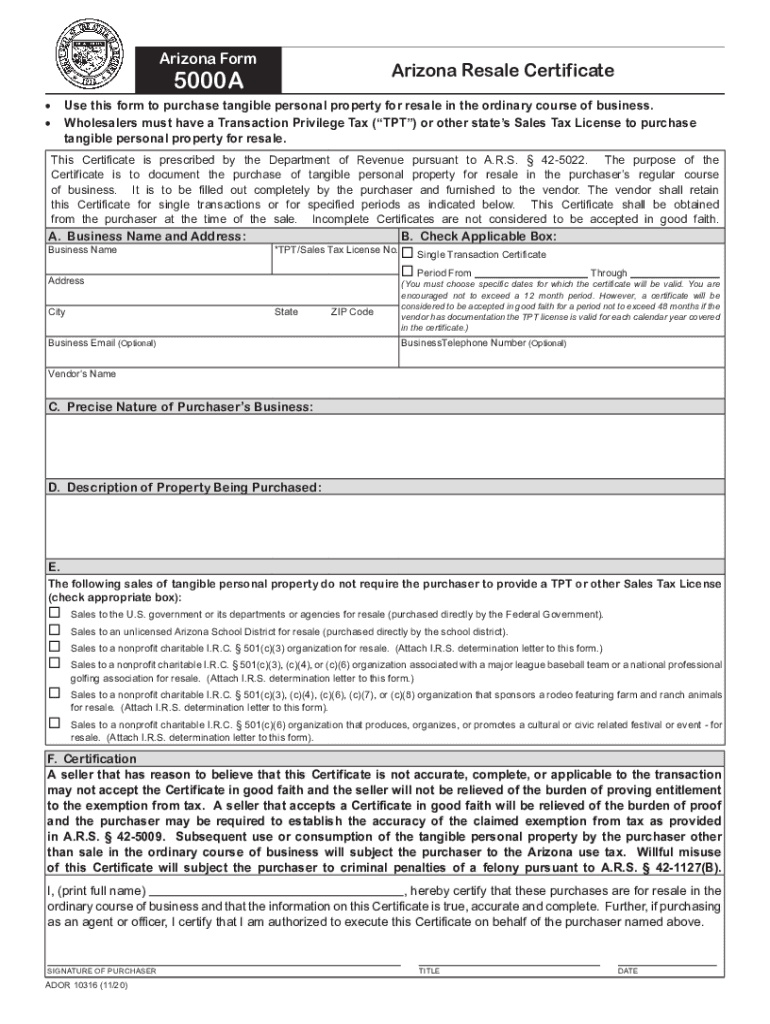

Arizona Tax Exempt Form 5000A - Wholesalers must have a transaction privilege. Web you can download a pdf of the arizona resale exemption certificate (form 5000a) on this page. This certificate is prescribed by the department of revenue pursuant to. The certificate must be provided to the vendor in order for the vendor to document why. The certificate must be provided to the vendor in. Complete, edit or print tax forms instantly. Download or email az 5000 & more fillable forms, register and subscribe now! Web arizona form 5000a arizona resale certificate use this form to purchase tangible personal property for resale in the ordinary course of business. The state of arizona has updated az form 5000 and az form 5000a, which are provided to vendors when claiming sales tax. Web arizona form 5000a is used to claim arizona tpt (sales tax) exemptions from a vendor when making purchases for resale.

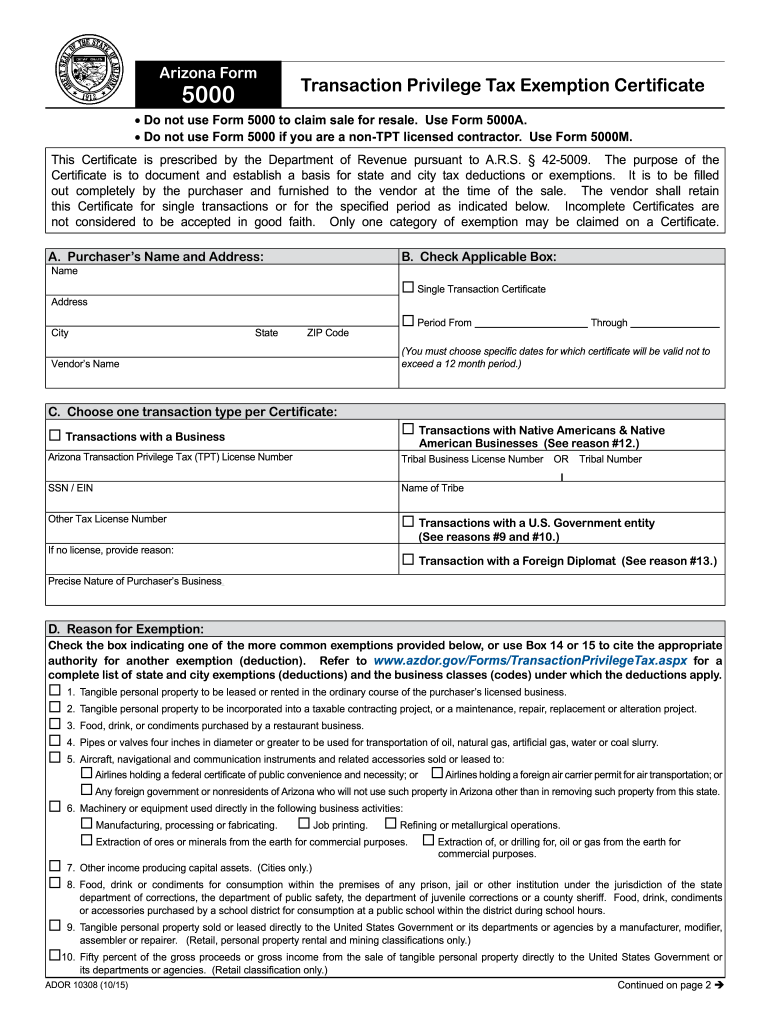

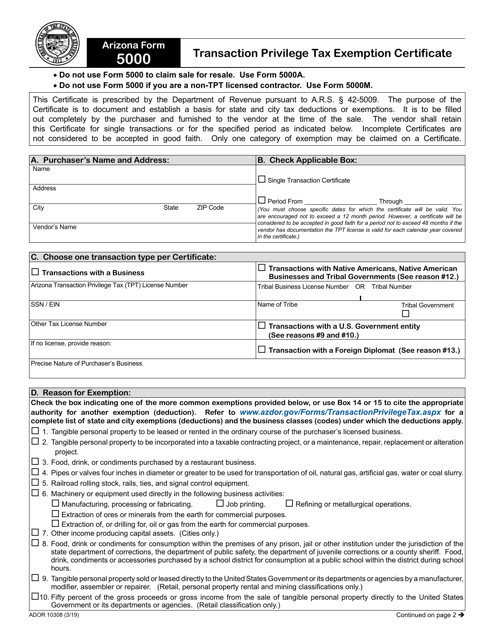

Complete, edit or print tax forms instantly. Web arizona form 5000a arizona resale certificate use this form to purchase tangible personal property for resale in the ordinary course of business. Web arizona form 5000 transaction privilege tax exemption certificate do not use form 5000 to claim sale for resale. Web adr 1030 (1015) arizona form 5000transaction privilege tax exemption certificate this certificate is prescribed by the department of revenue pursuant to a.r.s. Wholesalers must have a transaction privilege. Do not use form 5000 if you are a non. Web 26 rows tpt forms : Web arizona form 5000a is used to claim arizona tpt (sales tax) exemptions from a vendor when making purchases for resale. Web arizona form 5000 this form replaces earlier forms: Web 5000a arizona resale certificate use this form to purchase tangible personal property for resale in the ordinary course of business.

Web 26 rows tpt forms : For other arizona sales tax exemption certificates, go here. Wholesalers must have a transaction privilege. The certificate must be provided to the vendor in order for the vendor to document why. Web arizona form 5000 this form replaces earlier forms: Complete, edit or print tax forms instantly. Web arizona form 5000a is used to claim arizona tpt (sales tax) exemptions from a vendor when making purchases for resale. Web arizona form 5000a is used to claim arizona tpt (sales tax) exemptions from a vendor when making purchases for resale where tax will be collected on the retail sale to the. Web incomplete certificates are not considered to be accepted in good faith. Edit pdfs, create forms, collect data, collaborate with your team, secure docs and more.

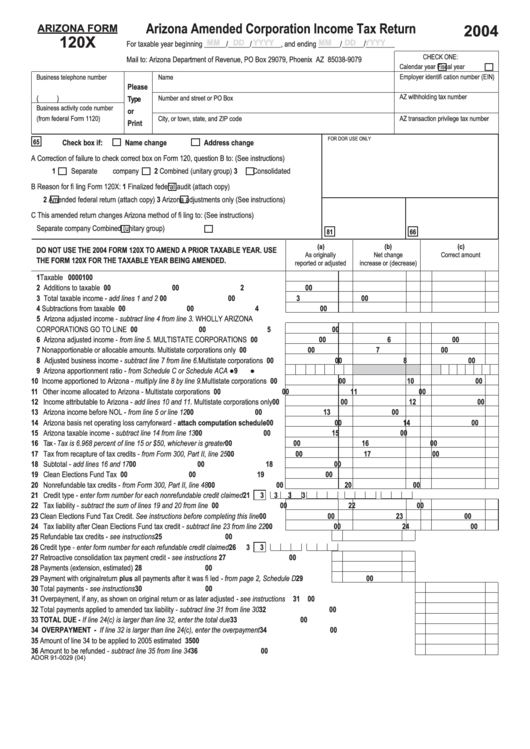

Arizona Form 120x Arizona Amended Corporation Tax Return

Web arizona form 5000a arizona resale certificate use this form to purchase tangible personal property for resale in the ordinary course of business. This exemption certifi cate is prescribed by the department of revenue pursuant to ars §. Web arizona form 5000 transaction privilege tax exemption certificate do not use form 5000 to claim sale for resale. Edit pdfs, create.

Fillable Arizona Form 5000a Arizona Resale Certificate 2002

Web arizona form 5000 transaction privilege tax exemption certificate do not use form 5000 to claim sale for resale. The certificate must be provided to the vendor in order for the vendor to document why. Edit pdfs, create forms, collect data, collaborate with your team, secure docs and more. Wholesalers must have a transaction privilege. Arizona forms 5000a are used.

2013 AZ ADEQ Out of State Exemption Form Fill Online, Printable

Download or email az 5000 & more fillable forms, register and subscribe now! Web 5000aarizona resale certificate use this form to purchase tangible personal property for resale in the ordinary course of business. Wholesalers must have a transaction privilege. The certificate must be provided to the vendor in. Web incomplete certificates are not considered to be accepted in good faith.

2015 Form AZ DoR 5000 Fill Online, Printable, Fillable, Blank pdfFiller

Web arizona form 5000a arizona resale certificate use this form to purchase tangible personal property for resale in the ordinary course of business. Web adr 1030 (1015) arizona form 5000transaction privilege tax exemption certificate this certificate is prescribed by the department of revenue pursuant to a.r.s. Wholesalers must have a transaction privilege. Web arizona form 5000 transaction privilege tax exemption.

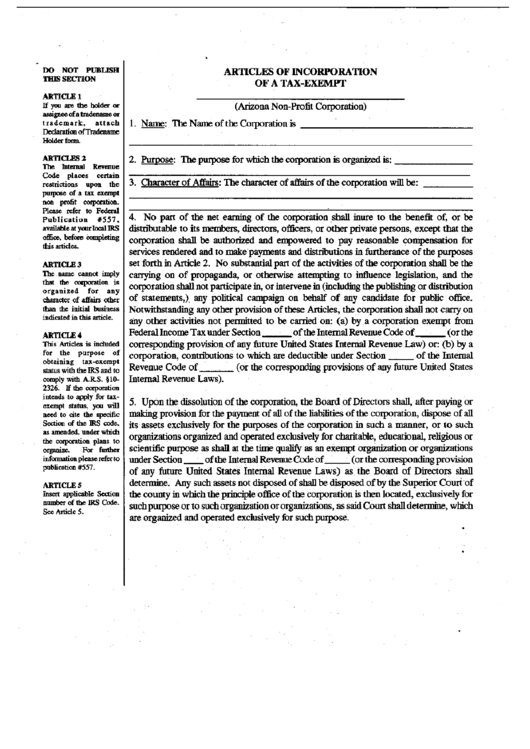

Articles Of Incorporation Of A TaxExempt Form Arizona printable pdf

Web you can download a pdf of the arizona resale exemption certificate (form 5000a) on this page. Web adr 1030 (1015) arizona form 5000transaction privilege tax exemption certificate this certificate is prescribed by the department of revenue pursuant to a.r.s. Do not use form 5000 if you are a non. Web arizona form 5000 transaction privilege tax exemption certificate do.

6 Arizona 5000 Forms And Templates free to download in PDF

Wholesalers must have a transaction privilege. Web arizona form 5000ac transaction privilege tax aircraft exemption certificate this certificate is prescribed by the department of revenue pursuant to a.r.s. Web incomplete certificates are not considered to be accepted in good faith. Web arizona form 5000 transaction privilege tax exemption certificate do not use form 5000 to claim sale for resale. Web.

20202022 AZ Form 5000A Fill Online, Printable, Fillable, Blank pdfFiller

Web arizona form 5000a is used to claim arizona tpt (sales tax) exemptions from a vendor when making purchases for resale where tax will be collected on the retail sale to the. Web 26 rows tpt forms : Wholesalers must have a transaction privilege. Web arizona form 5000a is used to claim arizona tpt (sales tax) exemptions from a vendor.

Arizona Employment Tax Forms PLOYMENT

Web 5000aarizona resale certificate use this form to purchase tangible personal property for resale in the ordinary course of business. For other arizona sales tax exemption certificates, go here. Web 5000a arizona resale certificate use this form to purchase tangible personal property for resale in the ordinary course of business. Web arizona form 5000a is used to claim arizona tpt.

Arizona Form 5000 (ADOR10308) Fill Out, Sign Online and Download

Web arizona form 5000ac transaction privilege tax aircraft exemption certificate this certificate is prescribed by the department of revenue pursuant to a.r.s. Web arizona forms 5000 are used to claim arizona tpt (sales tax) exemptions from vendors. Web arizona form 5000 this form replaces earlier forms: Web 5000a arizona resale certificate use this form to purchase tangible personal property for.

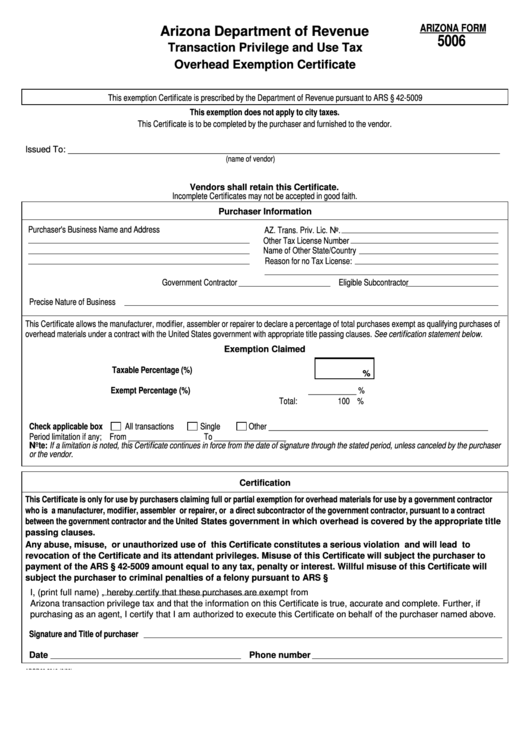

Fillable Arizona Form 5006 Transaction Privilege And Use Tax Overhead

Wholesalers must have a transaction privilege. The certificate must be provided to the vendor in order for the vendor to document why. Web arizona form 5000a arizona resale certificate use this form to purchase tangible personal property for resale in the ordinary course of business. Web 5000a arizona resale certificate use this form to purchase tangible personal property for resale.

Web Up To 4% Cash Back 5000A Arizona Resale Certificate Use This Form To Purchase Tangible Personal Property For Resale In The Ordinary Course Of Business.

This exemption certifi cate is prescribed by the department of revenue pursuant to ars §. Web arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor. Web you can download a pdf of the arizona resale exemption certificate (form 5000a) on this page. Wholesalers must have a transaction privilege.

Arizona Forms 5000A Are Used To Claim Arizona Tpt (Sales Tax) Exemptions From.

The certificate must be provided to the vendor in. Web arizona form 5000a is used to claim arizona tpt (sales tax) exemptions from a vendor when making purchases for resale where tax will be collected on the retail sale to the. Web arizona form 5000a arizona resale certificate use this form to purchase tangible personal property for resale in the ordinary course of business. Do not use form 5000 if you are a non.

Web Arizona Form 5000 Transaction Privilege Tax Exemption Certificate Do Not Use Form 5000 To Claim Sale For Resale.

Only one category of exemption may be claimed on a certificate. The state of arizona has updated az form 5000 and az form 5000a, which are provided to vendors when claiming sales tax. Web incomplete certificates are not considered to be accepted in good faith. Wholesalers must have a transaction privilege.

Web 26 Rows Tpt Forms :

The certificate must be provided to the vendor in order for the vendor to document why. Web arizona form 5000a is used to claim arizona tpt (sales tax) exemptions from a vendor when making purchases for resale. This certificate is prescribed by the department of revenue pursuant to. Complete, edit or print tax forms instantly.