Arizona Withholding Form

Arizona Withholding Form - Get ready for tax season deadlines by completing any required tax forms today. Duration of voluntary arizona withholding election the payor of your pension or annuity will withhold arizona income. How to terminate a voluntary arizona withholding election you may terminate your voluntary arizona withholding election at any time. Web the arizona department of revenue (azdor) announced on november 1, 2022, arizona’s employees have new tax withholding options. You may also have your employer withhold an extra. Phoenix, az— the arizona department of revenue and the arizona association of. Web complete this form within the first five days of your employment to select an arizona withholding percentage. Submitted by anonymous (not verified) on fri,. The withholding formula helps you. Web the withholding formula helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck.

Web july 26, 2023. Submitted by anonymous (not verified) on fri,. Web 2 i elect an arizona withholding percentage of zero, and i certify that i expect to have no arizona tax liability for the current taxable year. Web complete this form within the first five days of your employment to select an arizona withholding percentage. Employers required to make quarterly withholding payments should. The withholding formula helps you. Duration of voluntary arizona withholding election the payor of your pension or annuity will withhold arizona income. Web the withholding formula helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck. As a result, the arizona department of revenue (azdor). You may also have your employer withhold an extra.

How to terminate a voluntary arizona withholding election you may terminate your voluntary arizona withholding election at any time. Phoenix, az— the arizona department of revenue and the arizona association of. Web file this form to change the arizona withholding percentage or to change the extra amount withheld. Web the arizona department of revenue (azdor) announced on november 1, 2022, arizona’s employees have new tax withholding options. Tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new. Submitted by anonymous (not verified) on fri,. Complete, edit or print tax forms instantly. As a result, the arizona department of revenue (azdor). Web the withholding formula helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck. Web complete this form within the first five days of your employment to select an arizona withholding percentage.

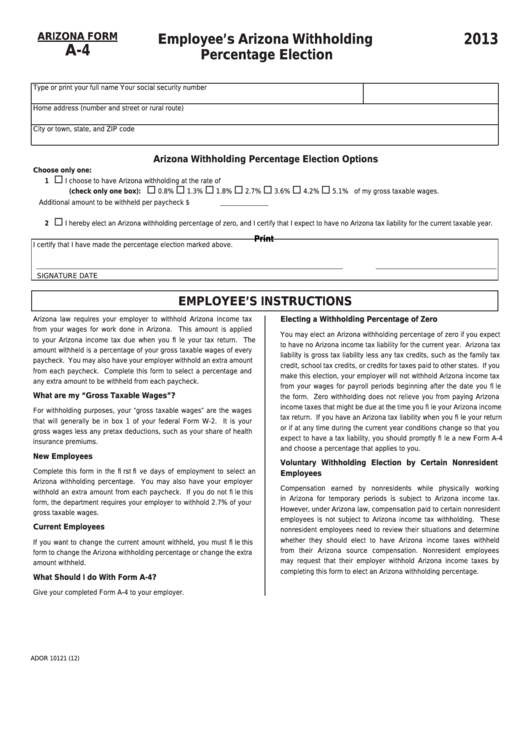

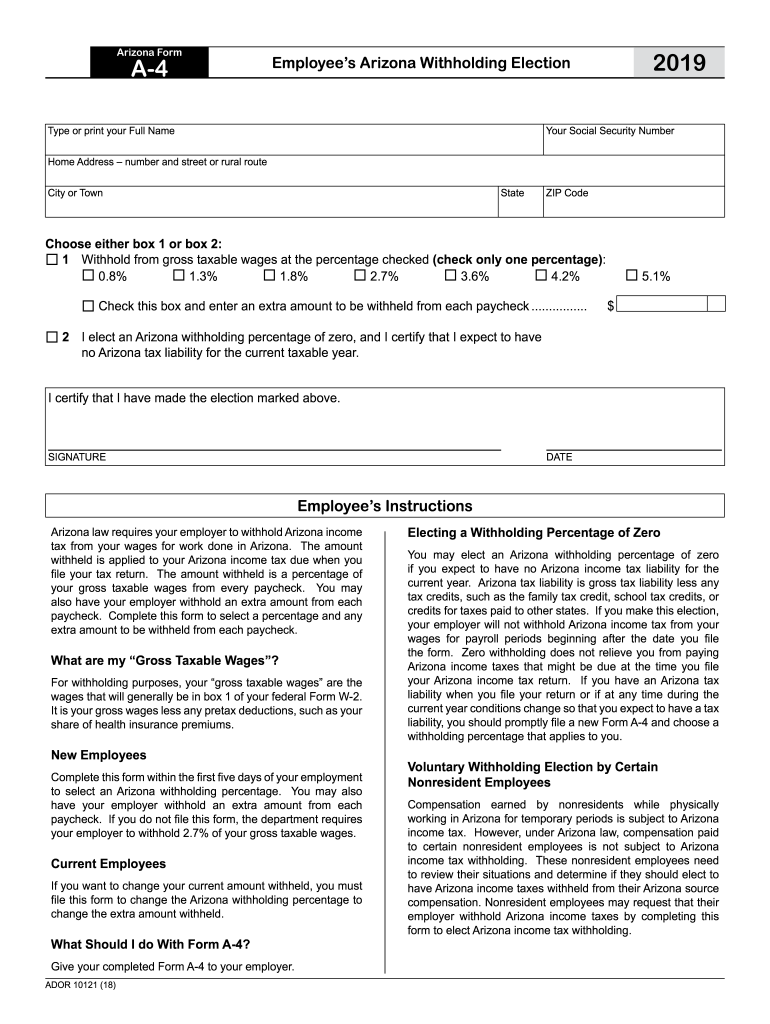

Fillable Arizona Form A4 Employee'S Arizona Withholding Percentage

Web all wages, salaries, bonuses or other compensation paid for services performed in arizona are subject to state income tax withholding, with exceptions. Tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new. Employers required to make quarterly withholding payments should. Web 2 i elect an arizona withholding percentage of zero,.

Fillable Arizona Form A4 Employee'S Arizona Withholding Percentage

Web all wages, salaries, bonuses or other compensation paid for services performed in arizona are subject to state income tax withholding, with exceptions. Web complete this form within the first five days of your employment to select an arizona withholding percentage. Web file this form to change the arizona withholding percentage or to change the extra amount withheld. Web 2.

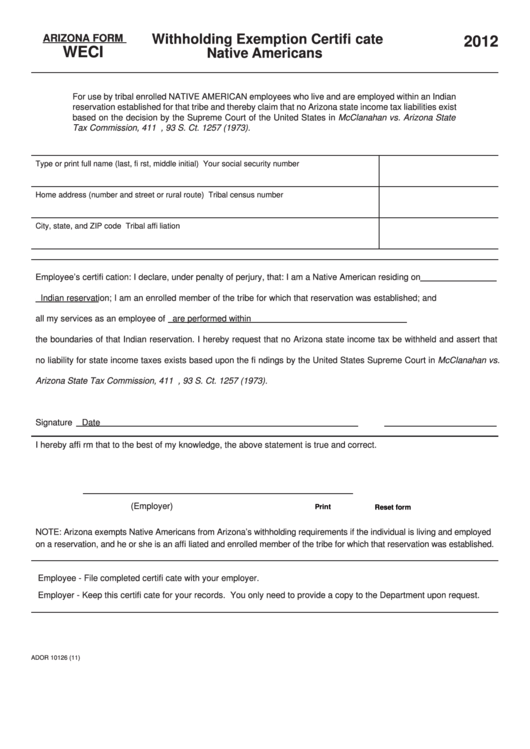

Arizona Form Weci Withholding Exemption Certificate Native Americans

How to terminate a voluntary arizona withholding election you may terminate your voluntary arizona withholding election at any time. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Web all wages, salaries, bonuses or other compensation paid for services performed in arizona are subject to state income tax withholding, with exceptions. You.

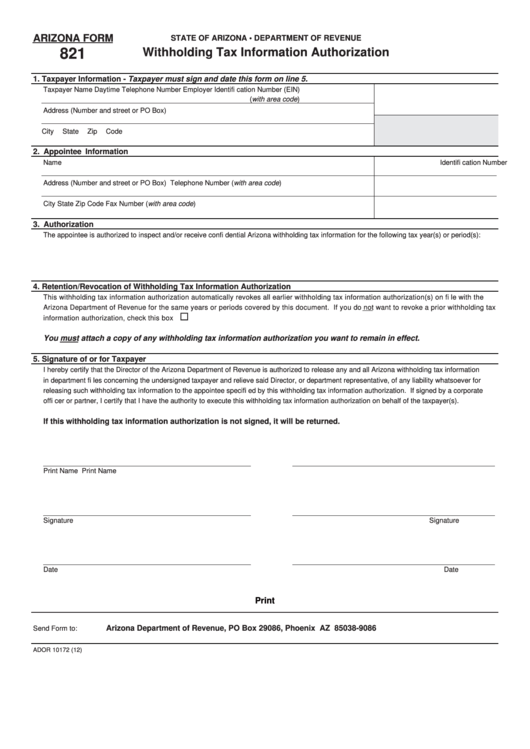

Fillable Arizona Form 821 Withholding Tax Information Authorization

Web 2 i elect an arizona withholding percentage of zero, and i certify that i expect to have no arizona tax liability for the current taxable year. You may also have your employer withhold an extra. Web july 26, 2023. How to terminate a voluntary arizona withholding election you may terminate your voluntary arizona withholding election at any time. Duration.

Fillable Arizona Form Weci Withholding Exemption Certificate Native

Web complete this form within the first five days of your employment to select an arizona withholding percentage. As a result, the arizona department of revenue (azdor). The withholding formula helps you. Web 2 i elect an arizona withholding percentage of zero, and i certify that i expect to have no arizona tax liability for the current taxable year. How.

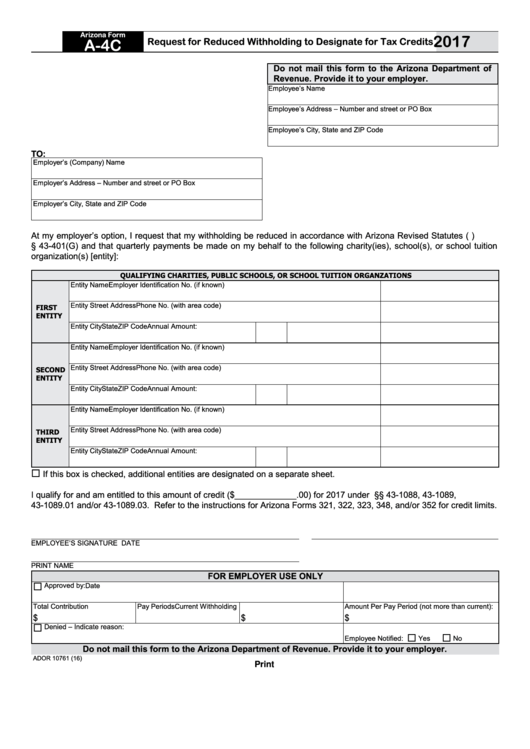

Fillable Arizona Form A4c Request For Reduced Withholding To

Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Web the arizona department of revenue (azdor) announced on november 1, 2022, arizona’s employees have new tax withholding options. Web 2 i elect an arizona withholding percentage of zero, and i certify that i expect to have no arizona tax liability for the.

A4 Form Fill Out and Sign Printable PDF Template signNow

Web complete this form within the first five days of your employment to select an arizona withholding percentage. Employers required to make quarterly withholding payments should. Get ready for tax season deadlines by completing any required tax forms today. You may also have your employer withhold an extra. How to terminate a voluntary arizona withholding election you may terminate your.

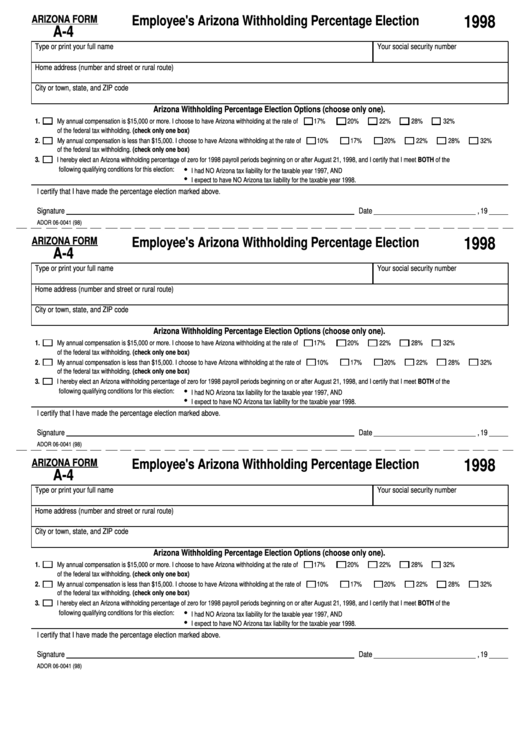

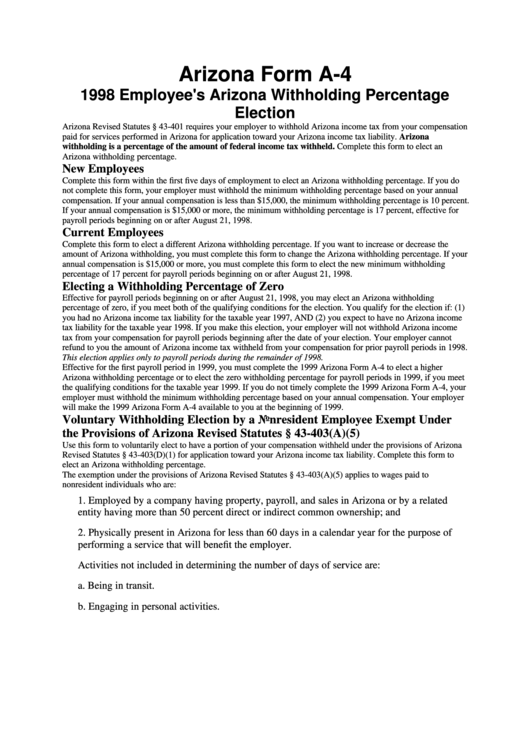

Arizona Form A4 1998 Employee'S Arizona Withholding Percentage

Tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Phoenix, az— the arizona.

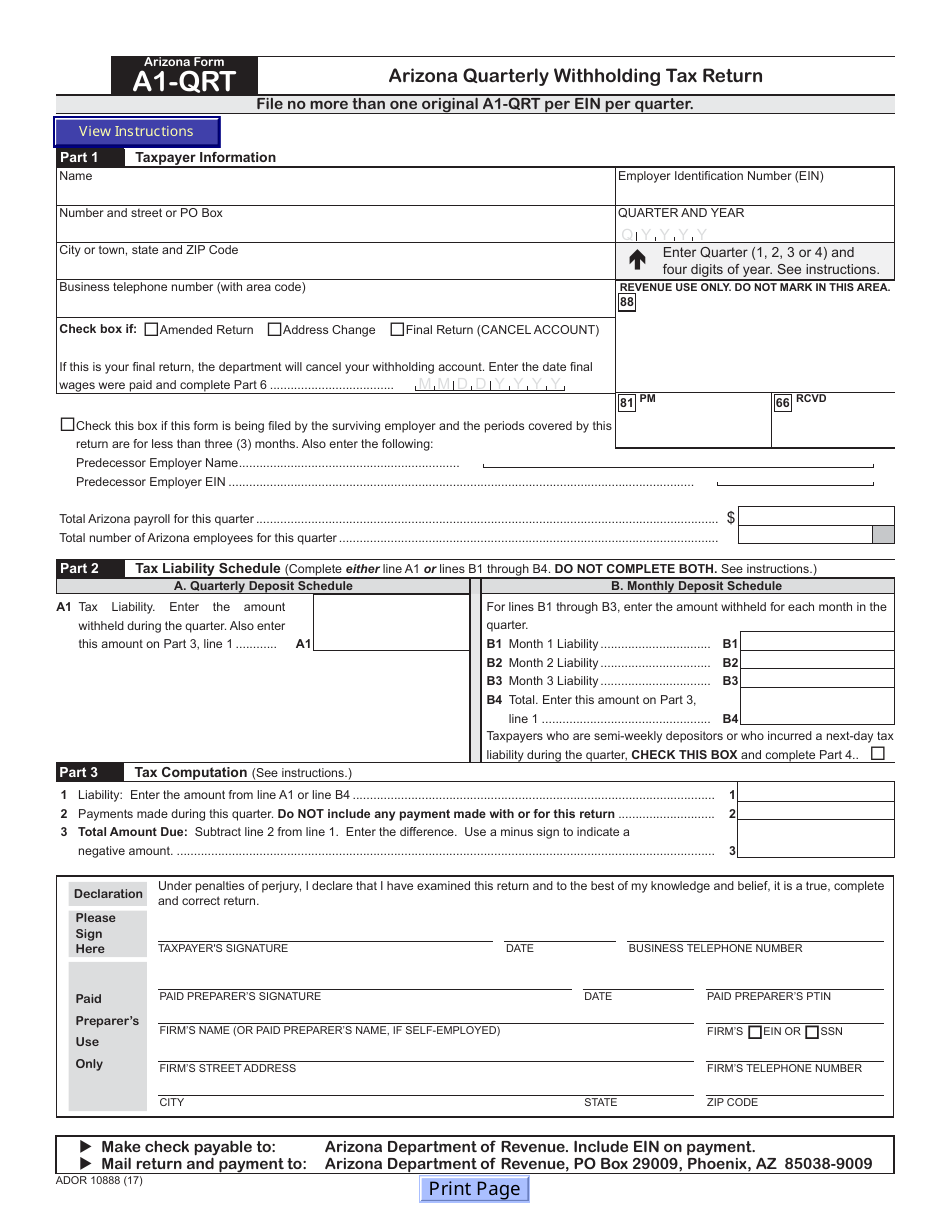

Arizona Form A1QRT (ADOR10888) Download Fillable PDF or Fill Online

Web all wages, salaries, bonuses or other compensation paid for services performed in arizona are subject to state income tax withholding, with exceptions. Web 2 i elect an arizona withholding percentage of zero, and i certify that i expect to have no arizona tax liability for the current taxable year. Web july 26, 2023. Web the withholding formula helps you.

Arizona State Tax Withholding Form

You may also have your employer withhold an extra. Phoenix, az— the arizona department of revenue and the arizona association of. As a result, the arizona department of revenue (azdor). Web 2 i elect an arizona withholding percentage of zero, and i certify that i expect to have no arizona tax liability for the current taxable year. Web complete this.

The Withholding Formula Helps You.

Web complete this form within the first five days of your employment to select an arizona withholding percentage. Web all wages, salaries, bonuses or other compensation paid for services performed in arizona are subject to state income tax withholding, with exceptions. Web july 26, 2023. As a result, the arizona department of revenue (azdor).

You May Also Have Your Employer Withhold An Extra.

Web the arizona department of revenue (azdor) announced on november 1, 2022, arizona’s employees have new tax withholding options. Submitted by anonymous (not verified) on fri,. Tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new. Phoenix, az— the arizona department of revenue and the arizona association of.

Web Aztaxes.gov Allows Electronic Filing And Payment Of Transaction Privilege Tax (Tpt), Use Taxes, And Withholding Taxes.

Duration of voluntary arizona withholding election the payor of your pension or annuity will withhold arizona income. How to terminate a voluntary arizona withholding election you may terminate your voluntary arizona withholding election at any time. Web file this form to change the arizona withholding percentage or to change the extra amount withheld. Get ready for tax season deadlines by completing any required tax forms today.

Employers Required To Make Quarterly Withholding Payments Should.

Complete, edit or print tax forms instantly. Web 2 i elect an arizona withholding percentage of zero, and i certify that i expect to have no arizona tax liability for the current taxable year. Web the withholding formula helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck.