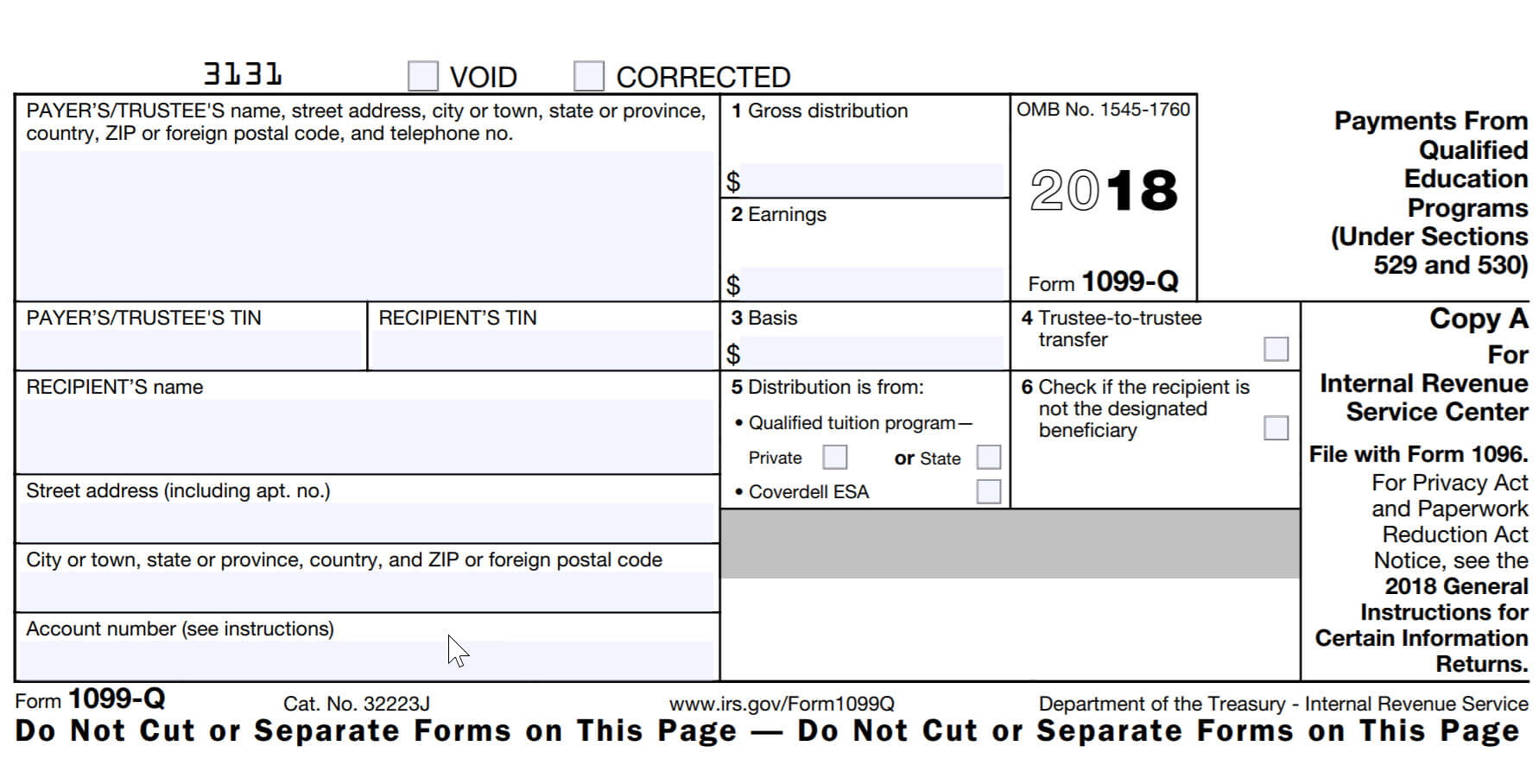

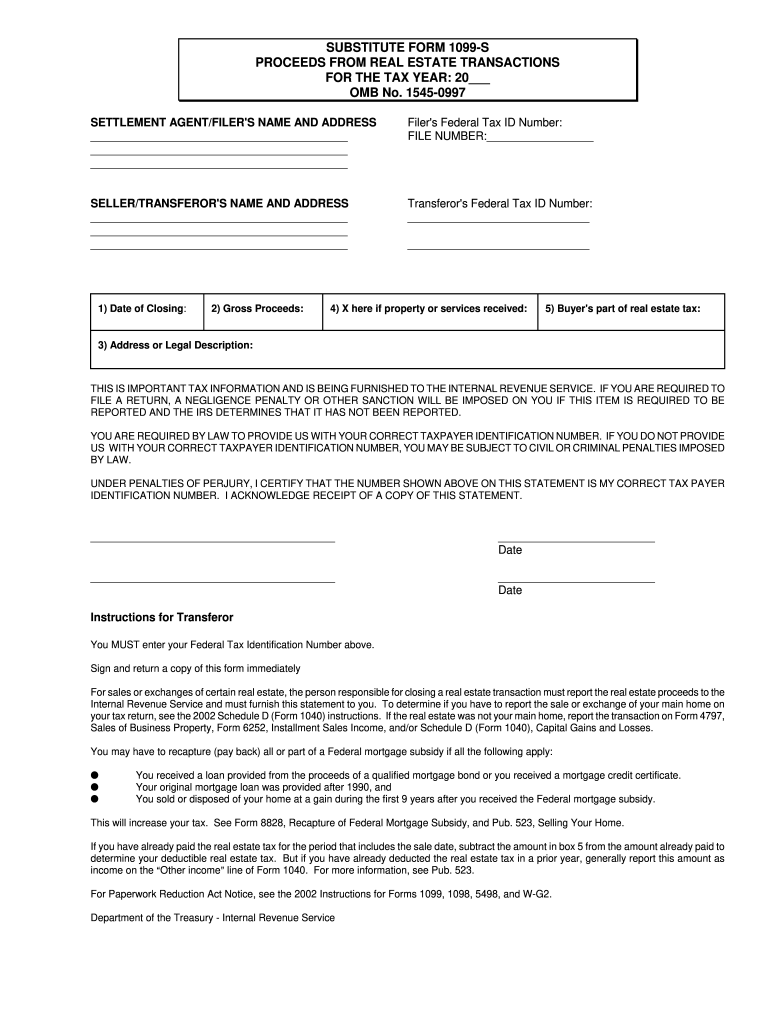

Blank 1099S Form

Blank 1099S Form - The payer fills out the 1099 form and sends copies to you and the irs. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this item is required to be Web a 1099 form is a record that an entity or person other than your employer gave or paid you money. However, report rents on schedule c (form 1040) if you provided significant services to the tenant, sold real estate as a business, or rented personal property as a business. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. There are several kinds of. You can download or print them from forms, instructions & publications. Before you print your 1099s from sage, you’ll need to make sure that all. Here’s how to print your 1099 form: There are more than a dozen different varieties of 1099 forms, and the reporting requirements for each is different.

Both the form and instructions will be updated as needed. The amount shown may be payments received as the beneficiary of a deceased employee, prizes, awards, taxable damages, indian gaming profits, or other taxable income. Both the forms and instructions will be updated as needed. File this form to report the sale or exchange of real estate. This is important tax information and is being furnished to the irs. Web for internal revenue service center file with form 1096. Was missed in earlier 1099 printing. To inform the internal revenue service about the sale or exchange of the particular type of real estate, including inherited property. You can download or print them from forms, instructions & publications. For royalties on timber, coal, and iron ore, see pub.

This is important tax information and is being furnished to the irs. $ for privacy act and paperwork reduction act notice, see the 2023 general instructions for certain information returns. Web a 1099 form is a record that an entity or person other than your employer gave or paid you money. You can download or print them from forms, instructions & publications. Web for internal revenue service center file with form 1096. They don’t cover residence if you got a certification from the seller. The amount shown may be payments received as the beneficiary of a deceased employee, prizes, awards, taxable damages, indian gaming profits, or other taxable income. For examples, see 12.3 list c documents that establish employment authorization. Web report rents from real estate on schedule e (form 1040). Before you print your 1099s from sage, you’ll need to make sure that all.

Free Printable 1099 Form Free Printable

You are required to provide the closing agent with your correct taxpayer identification number. There are several kinds of. Employment authorization document issued by the department of homeland security. This is important tax information and is being furnished to the irs. You can print copies to mail to the federal and state governments, plus print and send a copy to.

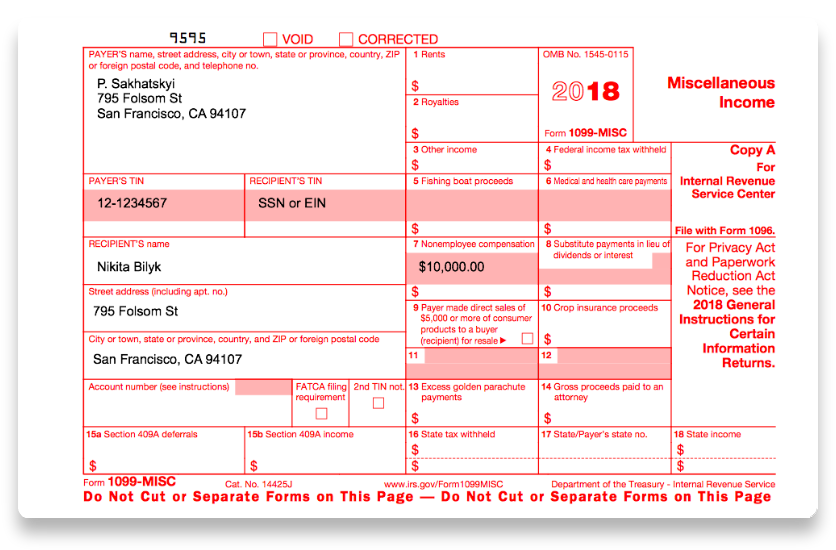

1099 form independent contractor Fill Online, Printable, Fillable

The amount shown may be. Web for internal revenue service center file with form 1096. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Was missed in earlier 1099 printing. Select 1099 wizard >> click get started.

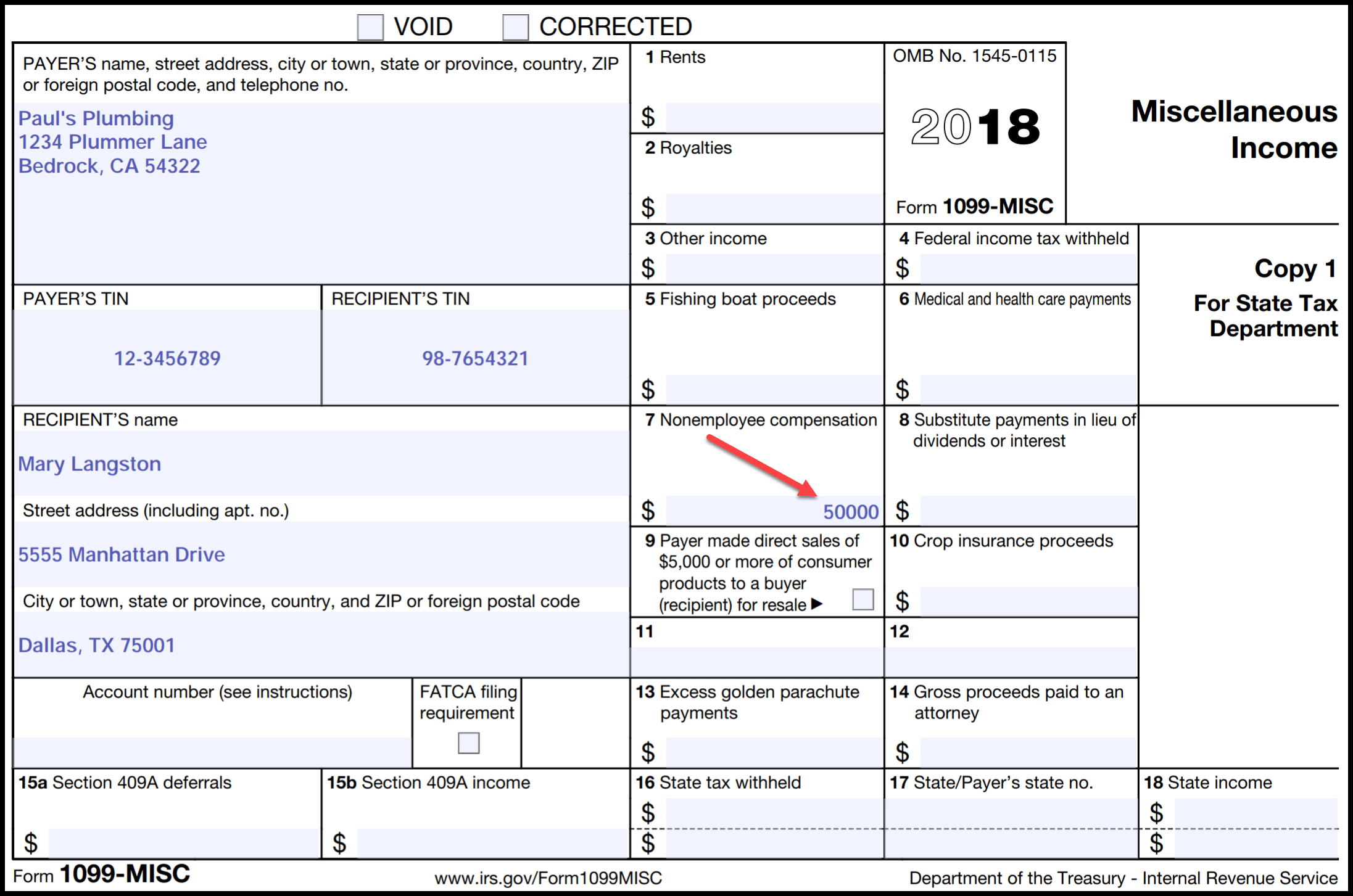

How To File 1099 S Fill Online, Printable, Fillable, Blank pdfFiller

In the select your 1099 vendors window, check off the vendors who: Generally, report this amount on the “other income” line of schedule 1 (form 1040) and identify the payment. The amount shown may be. This is important tax information and is being furnished to the irs. Here’s how to print your 1099 form:

What is a 1099s Form the Form in Seconds Fill Out and Sign Printable

Generally, report this amount on the “other income” line of schedule 1 (form 1040) and identify the payment. They don’t cover residence if you got a certification from the seller. For internal revenue service center. Both the form and instructions will be updated as needed. January 2022) proceeds from real estate transactions copy b.

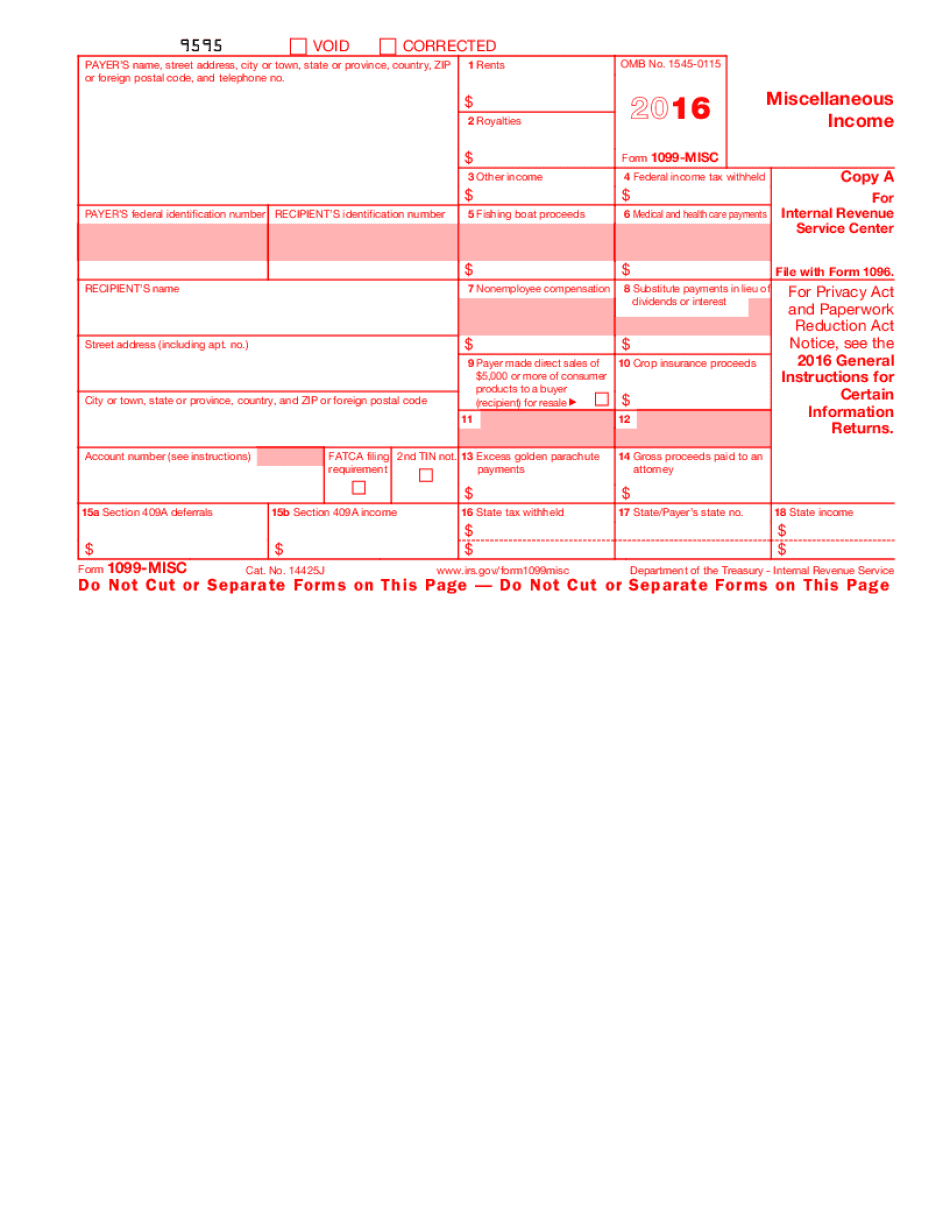

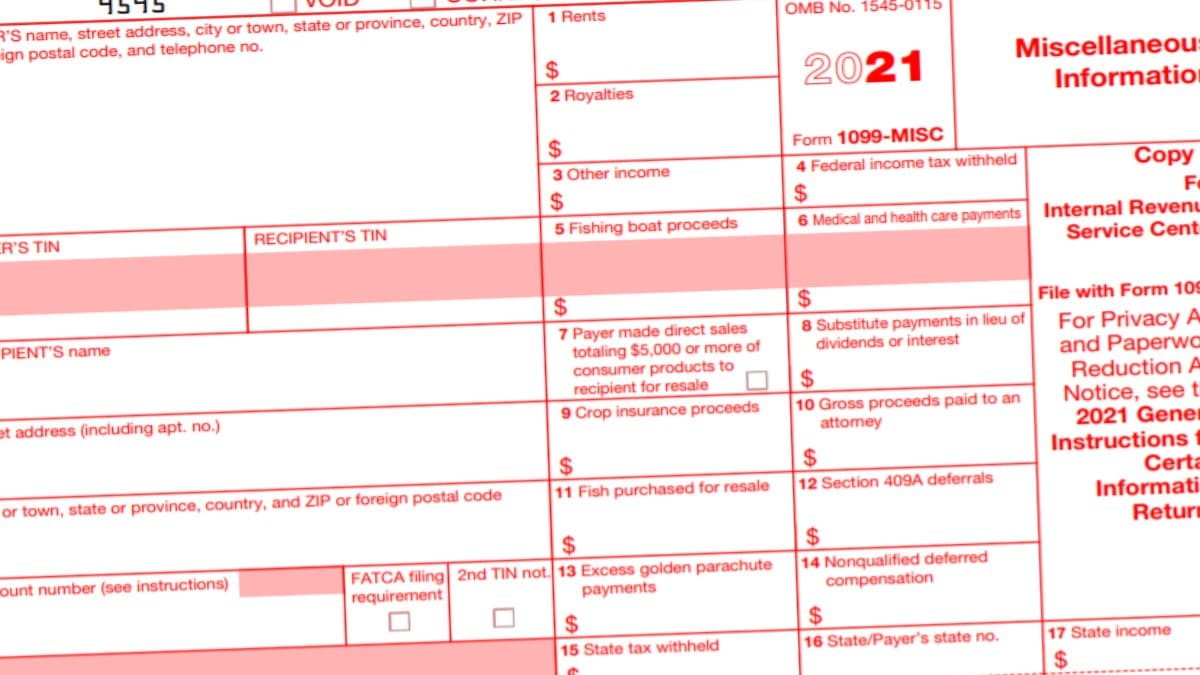

1099 MISC Form 2022 1099 Forms TaxUni

Both the forms and instructions will be updated as needed. Both the form and instructions will be updated as needed. Here’s how to print your 1099 form: Current general instructions for certain information. Report royalties from oil, gas, or mineral properties;

What Are 10 Things You Should Know About 1099s?

The amount shown may be payments received as the beneficiary of a deceased employee, prizes, awards, taxable damages, indian gaming profits, or other taxable income. There are several kinds of. Both the form and instructions will be updated as needed. Web report rents from real estate on schedule e (form 1040). For your protection, this form may show only the.

What Is A 1099? Explaining All Form 1099 Types CPA Solutions

12 fatca filing requirement 13 date of payment cat. Web for internal revenue service center file with form 1096. Web report rents from real estate on schedule e (form 1040). You may also be required to file form 1096. They don’t cover residence if you got a certification from the seller.

1099 Form Printable 2018 MBM Legal

Both the forms and instructions will be updated as needed. This is important tax information and is being furnished to the irs. Web patents on schedule e (form 1040). You can download or print them from forms, instructions & publications. The amount shown may be payments received as the beneficiary of a deceased employee, prizes, awards, taxable damages, indian gaming.

Fillable Form 1099 S Form Resume Examples v19xKBO27E

However, report rents on schedule c (form 1040) if you provided significant services to the tenant, sold real estate as a business, or rented personal property as a business. Generally, report this amount on the “other income” line of schedule 1 (form 1040) and identify the payment. You can download or print them from forms, instructions & publications. File this.

How to fill out IRS 1099 MISC 20172018 form PDF Expert

Before you print your 1099s from sage, you’ll need to make sure that all. The amount shown may be payments received as the beneficiary of a deceased employee, prizes, awards, taxable damages, indian gaming profits, or other taxable income. File this form to report the sale or exchange of real estate. Both the form and instructions will be updated as.

12 Fatca Filing Requirement 13 Date Of Payment Cat.

However, report payments for a working interest as explained in the schedule e (form 1040) instructions. You can print copies to mail to the federal and state governments, plus print and send a copy to each of your contractors. Within 5 years 11 1st year of desig. Report royalties from oil, gas, or mineral properties;

For Internal Revenue Service Center.

Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Generally, report this amount on the “other income” line of schedule 1 (form 1040) and identify the payment. $ for privacy act and paperwork reduction act notice, see the 2023 general instructions for certain information returns. Employment authorization document issued by the department of homeland security.

File This Form To Report The Sale Or Exchange Of Real Estate.

If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this item is required to be There are more than a dozen different varieties of 1099 forms, and the reporting requirements for each is different. Web patents on schedule e (form 1040). For examples, see 12.3 list c documents that establish employment authorization.

Web Instructions For Transferor For Sales Or Exchanges Of Certain Real Estate, The Person Responsible For Closing Real Estate Transaction Must Report The Real Estate Proceeds To The Irs And Must Furnish This Statement To You.

Web a 1099 form is a record that an entity or person other than your employer gave or paid you money. Both the form and instructions will be updated as needed. The amount shown may be payments received as the beneficiary of a deceased employee, prizes, awards, taxable damages, indian gaming profits, or other taxable income. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein).

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)