Building Wealth Chapter 3 Lesson 5

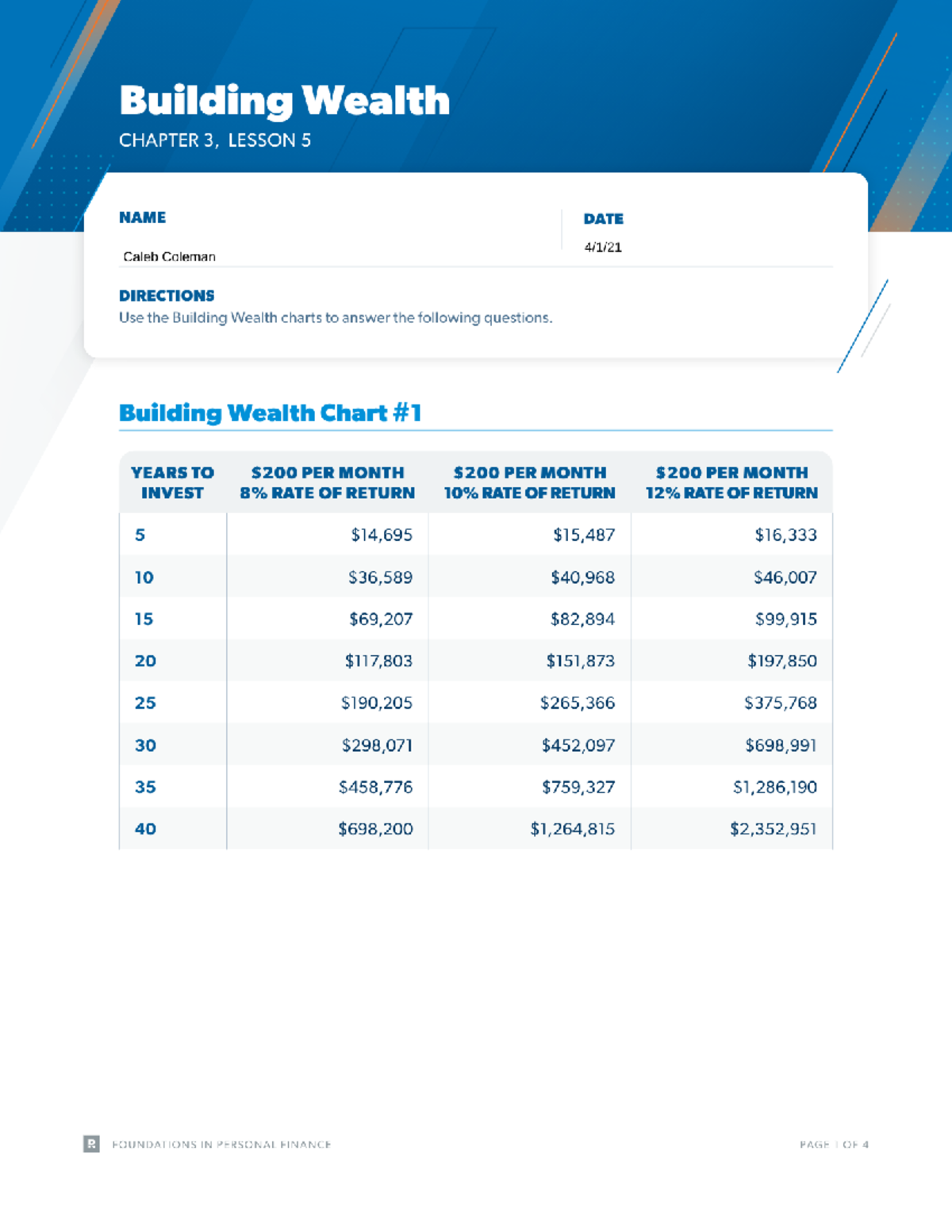

Building Wealth Chapter 3 Lesson 5 - You'll have less freedom with your money if you. Web page 1 of 4date directions use the building wealth charts to answer the following questions.namebuilding wealth chapter 3,lesson 5 building wealth chart #1 years to invest $200 per month 8% rate of return $200 per month 10% rate of return $200 per month 12% rate of return 5. Web 8.6k views 1 month ago level 3 of building wealth! Web building wealth chapter 3, lesson 5 foundations in personal finance the 8% rate of return would leave you short of 1 million 1,048,489 would be the difference spending less automatically builds wealth. Web use a monthly budget. Web 47% of americans have less than $1,000 saved for a (n) __________. A debt that is owed, like a. Which method should catherine use to. Web finally, it is time to invest. Credit and debt chapter 5:

Web building wealth chapter 3, lesson 5 foundations in personal finance the 8% rate of return would leave you short of 1 million 1,048,489 would be the difference spending less automatically builds wealth. (5 levels of wealth) take your finances to the next level ️ subscribe now: Use gifts and extra money wisely. Web 47% of americans have less than $1,000 saved for a (n) __________. Web finally, it is time to invest. If your financial goal is to save at least $40,000 in 10 years, what would be the least amount of money you would need to invest per month—and at what anticipated rate of return on your investments? Building wealth publication 4 an investment in knowledge always pays the best interest. What percent of 10,000 millionaires interviewed said their wealth came from. Credit and debt chapter 5: Web what are two things that it takes to build wealth?

The role of insurance chapter 10: Web in the building wealth topic, the students gain a fundamental understanding of the steps they can take to help their money grow and begin planning for life’s financial events. If your financial goal is to save at least $40,000 in 10 years, what would be the least amount of money you would need to invest per month—and at what anticipated rate of return on your investments? Web what are two things that it takes to build wealth? (5 levels of wealth) take your finances to the next level ️ subscribe now: Something you have or something that's owned liability money that someone owes; Web use a monthly budget. Use gifts and extra money wisely. The money you save on investment costs will more than make up for the price of the wine you’ll most definitely need to bribe people to come to this, um, party. Web finally, it is time to invest.

7 Important Keys To Building Wealth In 2021 Transform Your Life

Once you have a $500 emergency fund, you should. What percent of 10,000 millionaires interviewed said their wealth came from. If your financial goal is to save at least $40,000 in 10 years, what would be the least amount of money you would need to invest per month—and at what anticipated rate of return on your investments? Income and taxes.

14 Wealth Building Secrets You Need To Know The Kickass Entrepreneur

Learning objectives briefly describes the. The money you save on investment costs will more than make up for the price of the wine you’ll most definitely need to bribe people to come to this, um, party. Web page 1 of 4date directions use the building wealth charts to answer the following questions.namebuilding wealth chapter 3,lesson 5 building wealth chart #1.

Chapter 3 Lesson 5 Work for Molecular Biology. BP 723 StuDocu

A debt that is owed, like a. Web 8.6k views 1 month ago level 3 of building wealth! Web describe how spending less and investing more can contribute to wealth building.building wealth chapter 3,lesson 5 foundations in personal financean 8% rate of return would keep you from. Building wealth publication 4 an investment in knowledge always pays the best interest..

Your Finance Formulas 5 Great Tips To Manage Your Money And Build Your

Web what are two things that it takes to build wealth? Housing and real estate chapter 12: Web use a monthly budget. Web 8.6k views 1 month ago level 3 of building wealth! Build credit and control debt;

5 Critical Steps to Building Wealth How to build wealth Financial

Web what are two things that it takes to build wealth? The role of insurance chapter 10: Web building wealth chapter 3, lesson 5 foundations in personal finance the 8% rate of return would leave you short of 1 million 1,048,489 would be the difference spending less automatically builds wealth. You'll have less freedom with your money if you. The.

3 ways Anyone can Build more Wealth Squire Wealth Advisors

Web what are two things that it takes to build wealth? Something you have or something that's owned liability money that someone owes; The best way to build wealth. Web building wealth chapter 3, lesson 5 foundations in personal finance the 8% rate of return would leave you short of 1 million 1,048,489 would be the difference spending less automatically.

Wealth Building Strategies millionaires use and broke people don't

Web page 1 of 4date directions use the building wealth charts to answer the following questions.namebuilding wealth chapter 3,lesson 5 building wealth chart #1 years to invest $200 per month 8% rate of return $200 per month 10% rate of return $200 per month 12% rate of return 5. What percent of americans have 0 dollars saved for retirement? Web.

Podcast The NoBS Stages To Building Massive Wealth (Part 3)

If your financial goal is to save at least $40,000 in 10 years, what would be the least amount of money you would need to invest per month—and at what anticipated rate of return on your investments? Web in the building wealth topic, the students gain a fundamental understanding of the steps they can take to help their money grow.

Chapter 16 Lesson 1 (What Is Economics?)

If your financial goal is to save at least $40,000 in 10 years, what would be the least amount of money you would need to invest per month—and at what anticipated rate of return on your investments? A beginner’s guide to securing your financial future may be reproduced in whole or in part for training purposes, provided it includes credit.

5 Important WealthBuilding Lessons Shared By MultiMillionaires

The role of insurance chapter 10: Which method should catherine use to. Web page 1 of 4date directions use the building wealth charts to answer the following questions.namebuilding wealth chapter 3,lesson 5 building wealth chart #1 years to invest $200 per month 8% rate of return $200 per month 10% rate of return $200 per month 12% rate of return.

The Role Of Insurance Chapter 10:

You'll have less freedom with your money if you. Credit and debt chapter 5: Building wealth publication 4 an investment in knowledge always pays the best interest. Web what are two things that it takes to build wealth?

Learning Objectives Briefly Describes The.

Web use a monthly budget. Web 8.6k views 1 month ago level 3 of building wealth! The best way to build wealth. What percent of 10,000 millionaires interviewed said their wealth came from.

Which Method Should Catherine Use To.

A debt that is owed, like a. The money you save on investment costs will more than make up for the price of the wine you’ll most definitely need to bribe people to come to this, um, party. Web 47% of americans have less than $1,000 saved for a (n) __________. The first step you should take when you want to make a large purchase is.

Income And Taxes Chapter 11:

Web in the building wealth topic, the students gain a fundamental understanding of the steps they can take to help their money grow and begin planning for life’s financial events. Web studyer1 terms in this set (30) assets valuable possessions and monetary items that people own; If your financial goal is to save at least $40,000 in 10 years, what would be the least amount of money you would need to invest per month—and at what anticipated rate of return on your investments? Something you have or something that's owned liability money that someone owes;