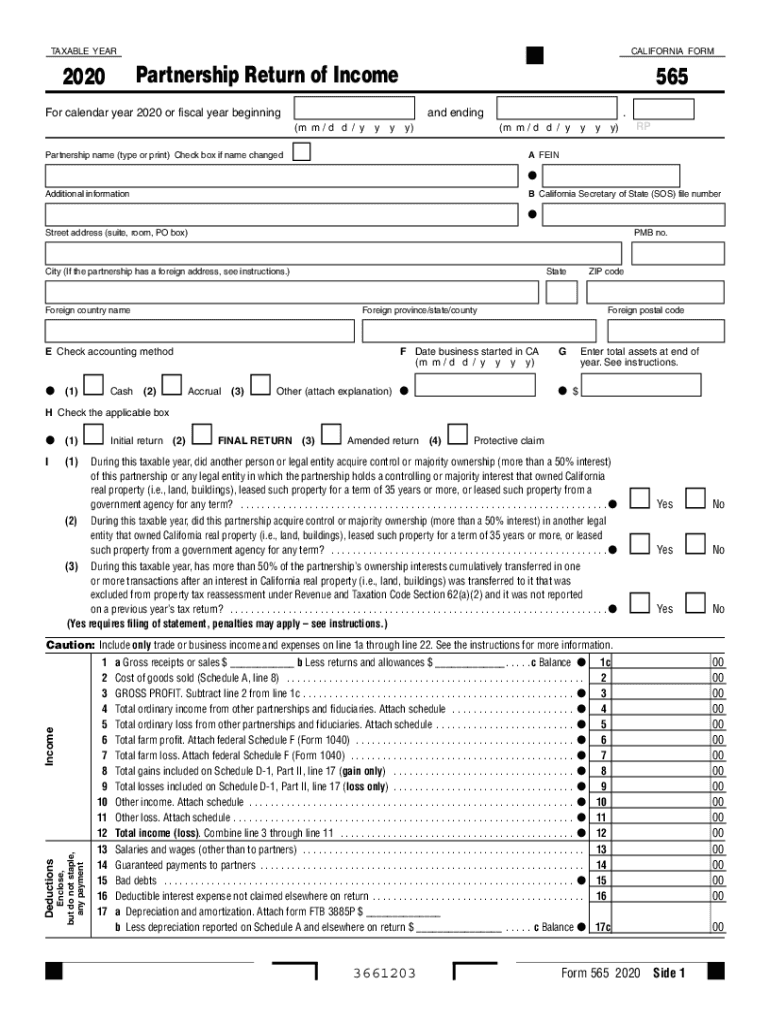

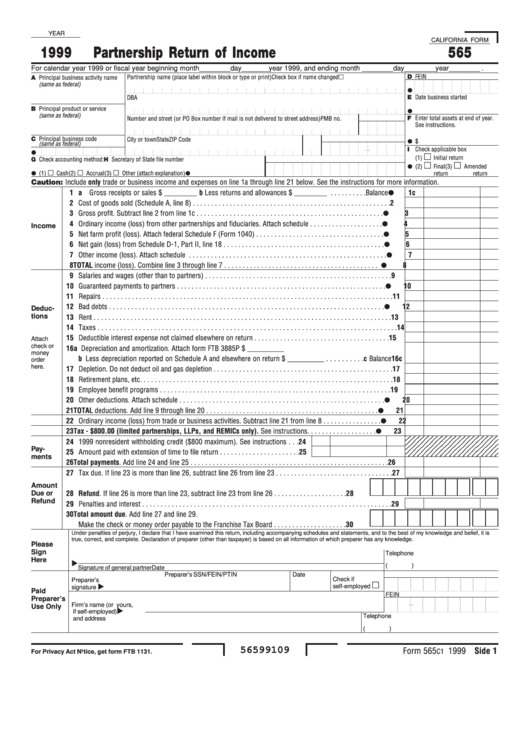

Ca Form 565

Ca Form 565 - Web the notice provides that the 2022 california forms 565 and form 568 instructions, for partnership and limited liability companies, provide methods to compute the beginning tax basis capital account. 2 00 3 gross profit. Web when is form 565 due? For more information, see the line instructions, and get the instructions for federal schedule k. Use this form to apply for a replacement naturalization certificate; Citizen to be recognized by a foreign country. Or to apply for a special certificate of naturalization as a u.s. C reporting information from columns (d) and (e) if the partnership derives income from activities conducted both within and outside california, the partnership will complete schedule r, Form 565 is due on the 15th day of the fourth month after the close of the year. Short accounting period (15 days or less) california does not require a new limited partnership with a short accounting period of 15 days.

Citizen to be recognized by a foreign country. Web we last updated the partnership return of income in january 2023, so this is the latest version of form 565, fully updated for tax year 2022. Web when is form 565 due? Use this form to apply for a replacement naturalization certificate; If the due date falls on a saturday, sunday, or legal holiday, the filing date is the next business day. The methods are similar to those provided in the 2020 irs form 1065 instructions. Produce all photographs taken on or after may 12, 2020 showing any vehicle involved in the collision alleged in the complaint.; Web form 565, partnership return of income, or the instructions for federal form 1065, u.s. Less returns and allowances $ _____. Web the notice provides that the 2022 california forms 565 and form 568 instructions, for partnership and limited liability companies, provide methods to compute the beginning tax basis capital account.

Cost of goods sold (schedule a, line 8). Use this form to apply for a replacement naturalization certificate; Web we last updated the partnership return of income in january 2023, so this is the latest version of form 565, fully updated for tax year 2022. Produce the contract alleged in the complaint.; Citizen to be recognized by a foreign country. Web a partnership (including remics classified as partnerships) that engages in a trade or business in california or has income from a california source must file form 565. Web produce all account statements issued between the dates of january 1, 2019 and july 31, 2020 for the account alleged in the complaint.; 2 00 3 gross profit. For more information, see the line instructions, and get the instructions for federal schedule k. Gross receipts or sales $ _____ b.

California Vehicle Code.pdf DocDroid

2 00 3 gross profit. Citizen to be recognized by a foreign country. See definition of “doing business” in general information a, important information. Web the notice provides that the 2022 california forms 565 and form 568 instructions, for partnership and limited liability companies, provide methods to compute the beginning tax basis capital account. C reporting information from columns (d).

20202022 Form CA LLC5 Fill Online, Printable, Fillable, Blank pdfFiller

For more information, see the line instructions, and get the instructions for federal schedule k. See definition of “doing business” in general information a, important information. Web a partnership (including remics classified as partnerships) that engages in a trade or business in california or has income from a california source must file form 565. C balance • 1c 00 2.

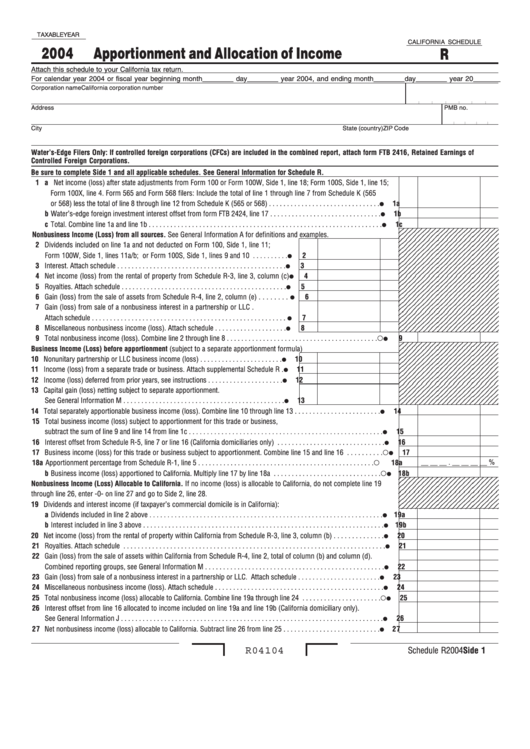

California Schedule R Apportionment And Allocation Of 2004

Or to apply for a special certificate of naturalization as a u.s. C balance • 1c 00 2 cost of goods sold (schedule a, line 8). Produce all photographs taken on or after may 12, 2020 showing any vehicle involved in the collision alleged in the complaint.; If the due date falls on a saturday, sunday, or legal holiday, the.

2020 Form CA FTB 565 Fill Online, Printable, Fillable, Blank pdfFiller

Produce the contract alleged in the complaint.; C balance • 1c 00 2 cost of goods sold (schedule a, line 8). Gross receipts or sales $ _____ b. Produce all photographs taken on or after may 12, 2020 showing any vehicle involved in the collision alleged in the complaint.; 2 00 3 gross profit.

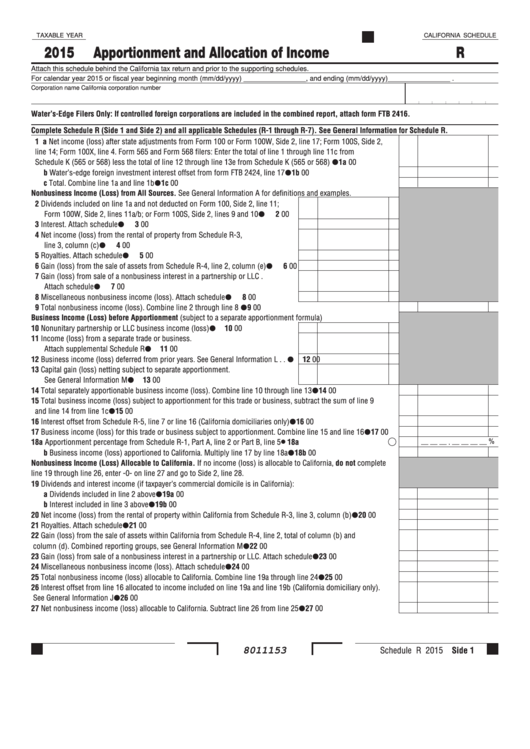

California Schedule R Apportionment And Allocation Of 2015

Use this form to apply for a replacement naturalization certificate; If the due date falls on a saturday, sunday, or legal holiday, the filing date is the next business day. Web the notice provides that the 2022 california forms 565 and form 568 instructions, for partnership and limited liability companies, provide methods to compute the beginning tax basis capital account..

2011 ca form 565 Fill out & sign online DocHub

If the due date falls on a saturday, sunday, or legal holiday, the filing date is the next business day. Or to apply for a special certificate of naturalization as a u.s. Short accounting period (15 days or less) california does not require a new limited partnership with a short accounting period of 15 days. Web we last updated the.

California Form 565 Partnership Return Of 1999 printable pdf

Less returns and allowances $ _____. Web we last updated the partnership return of income in january 2023, so this is the latest version of form 565, fully updated for tax year 2022. Web form 565, partnership return of income, or the instructions for federal form 1065, u.s. Cost of goods sold (schedule a, line 8). C reporting information from.

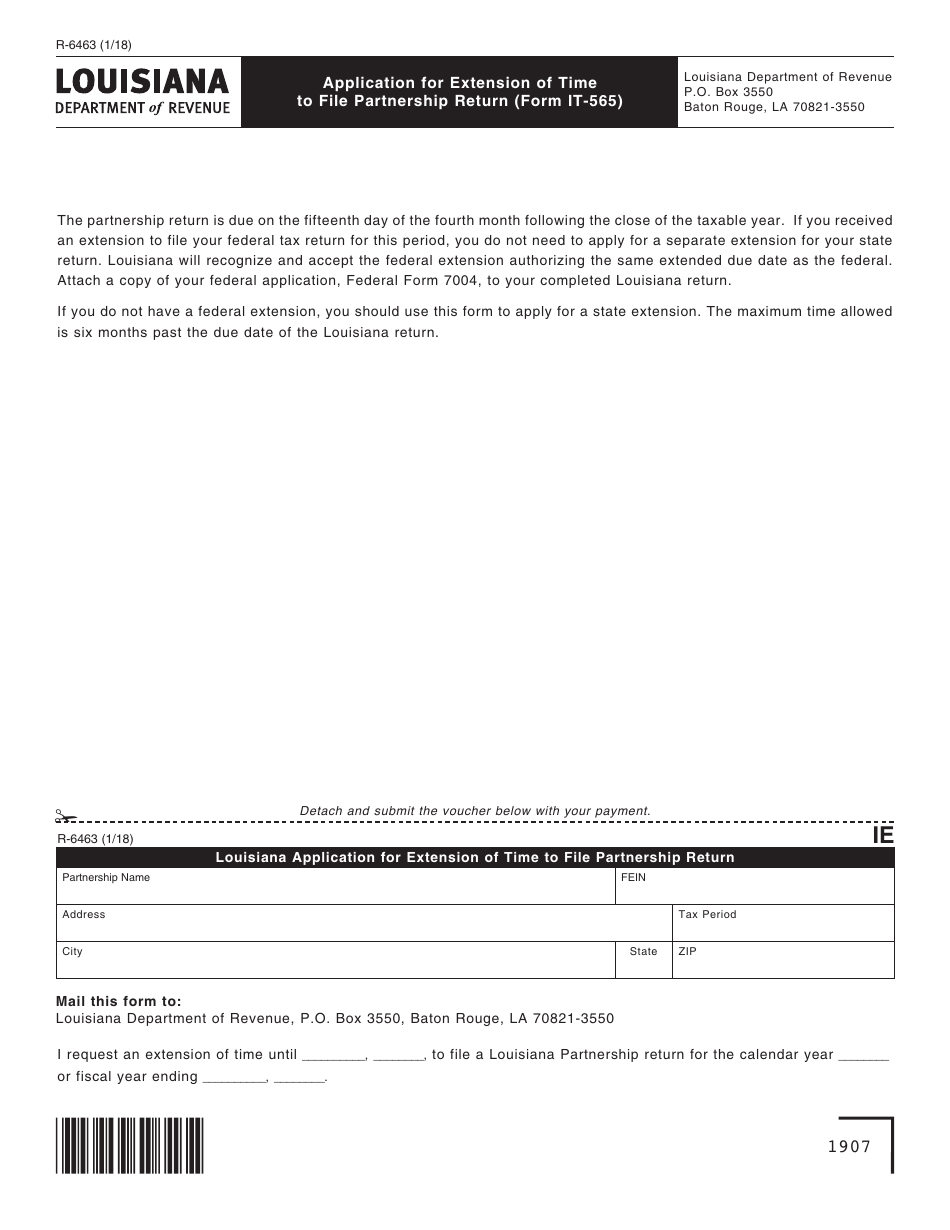

Form R6463 Download Fillable PDF or Fill Online Application for

Produce the contract alleged in the complaint.; Less returns and allowances $ _____. Cost of goods sold (schedule a, line 8). Gross receipts or sales $ _____ b. The methods are similar to those provided in the 2020 irs form 1065 instructions.

California Form 3538 (565) Payment Voucher For Automatic Extension

Produce all photographs taken on or after may 12, 2020 showing any vehicle involved in the collision alleged in the complaint.; Web a partnership (including remics classified as partnerships) that engages in a trade or business in california or has income from a california source must file form 565. Web form 565, partnership return of income, or the instructions for.

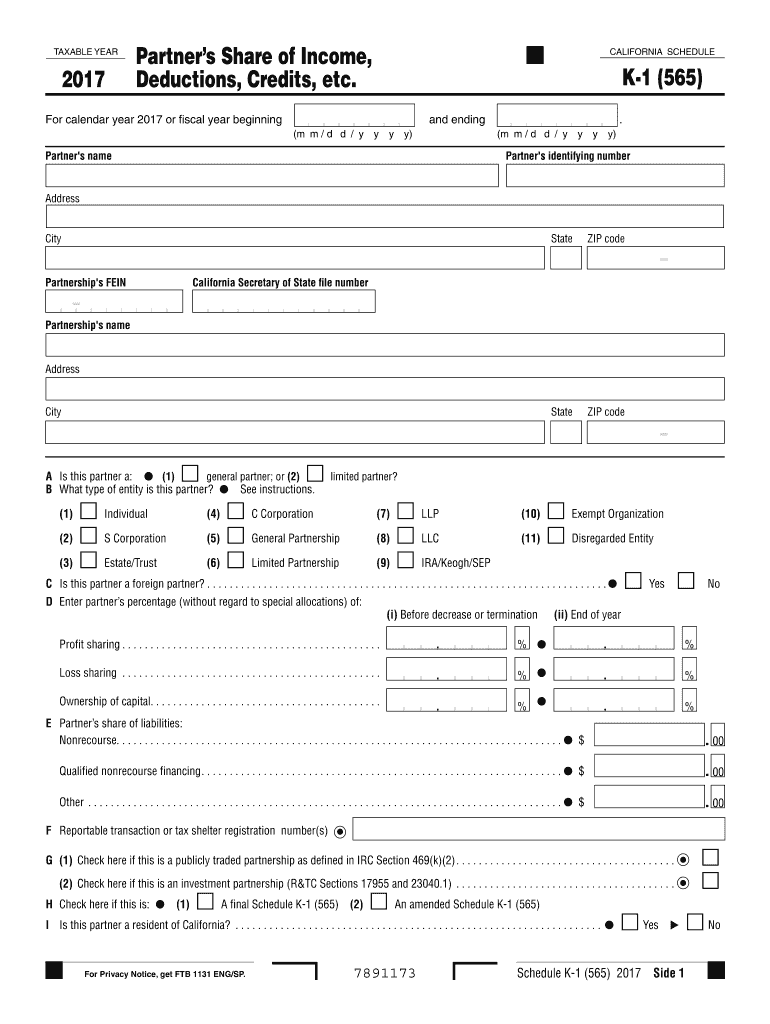

CA Schedule K1 (565) 2017 Fill out Tax Template Online US Legal Forms

Web when is form 565 due? See definition of “doing business” in general information a, important information. Web we last updated the partnership return of income in january 2023, so this is the latest version of form 565, fully updated for tax year 2022. If the due date falls on a saturday, sunday, or legal holiday, the filing date is.

2 00 3 Gross Profit.

C reporting information from columns (d) and (e) if the partnership derives income from activities conducted both within and outside california, the partnership will complete schedule r, Web a partnership (including remics classified as partnerships) that engages in a trade or business in california or has income from a california source must file form 565. Or to apply for a special certificate of naturalization as a u.s. Produce the contract alleged in the complaint.;

For More Information, See The Line Instructions, And Get The Instructions For Federal Schedule K.

Web we last updated the partnership return of income in january 2023, so this is the latest version of form 565, fully updated for tax year 2022. Web produce all account statements issued between the dates of january 1, 2019 and july 31, 2020 for the account alleged in the complaint.; See definition of “doing business” in general information a, important information. Web when is form 565 due?

Use This Form To Apply For A Replacement Naturalization Certificate;

Form 565 is due on the 15th day of the fourth month after the close of the year. C balance • 1c 00 2 cost of goods sold (schedule a, line 8). Less returns and allowances $ _____. Citizen to be recognized by a foreign country.

Short Accounting Period (15 Days Or Less) California Does Not Require A New Limited Partnership With A Short Accounting Period Of 15 Days.

Web the notice provides that the 2022 california forms 565 and form 568 instructions, for partnership and limited liability companies, provide methods to compute the beginning tax basis capital account. Web form 565, partnership return of income, or the instructions for federal form 1065, u.s. Gross receipts or sales $ _____ b. The methods are similar to those provided in the 2020 irs form 1065 instructions.