Ca Form 568 Instructions 2022

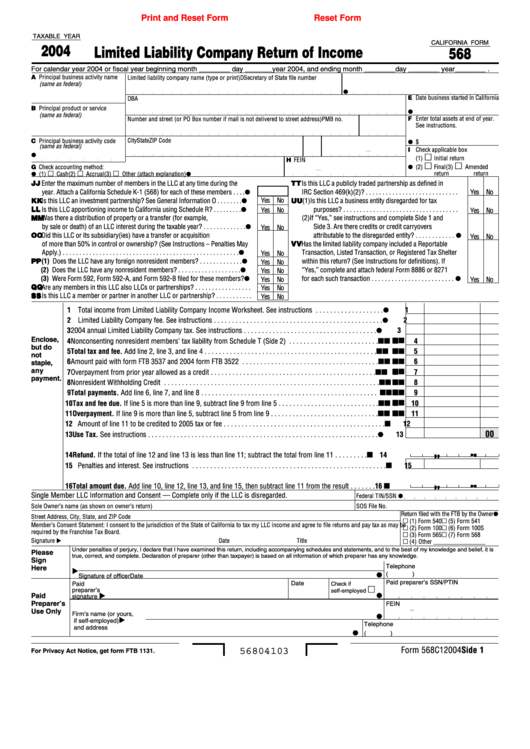

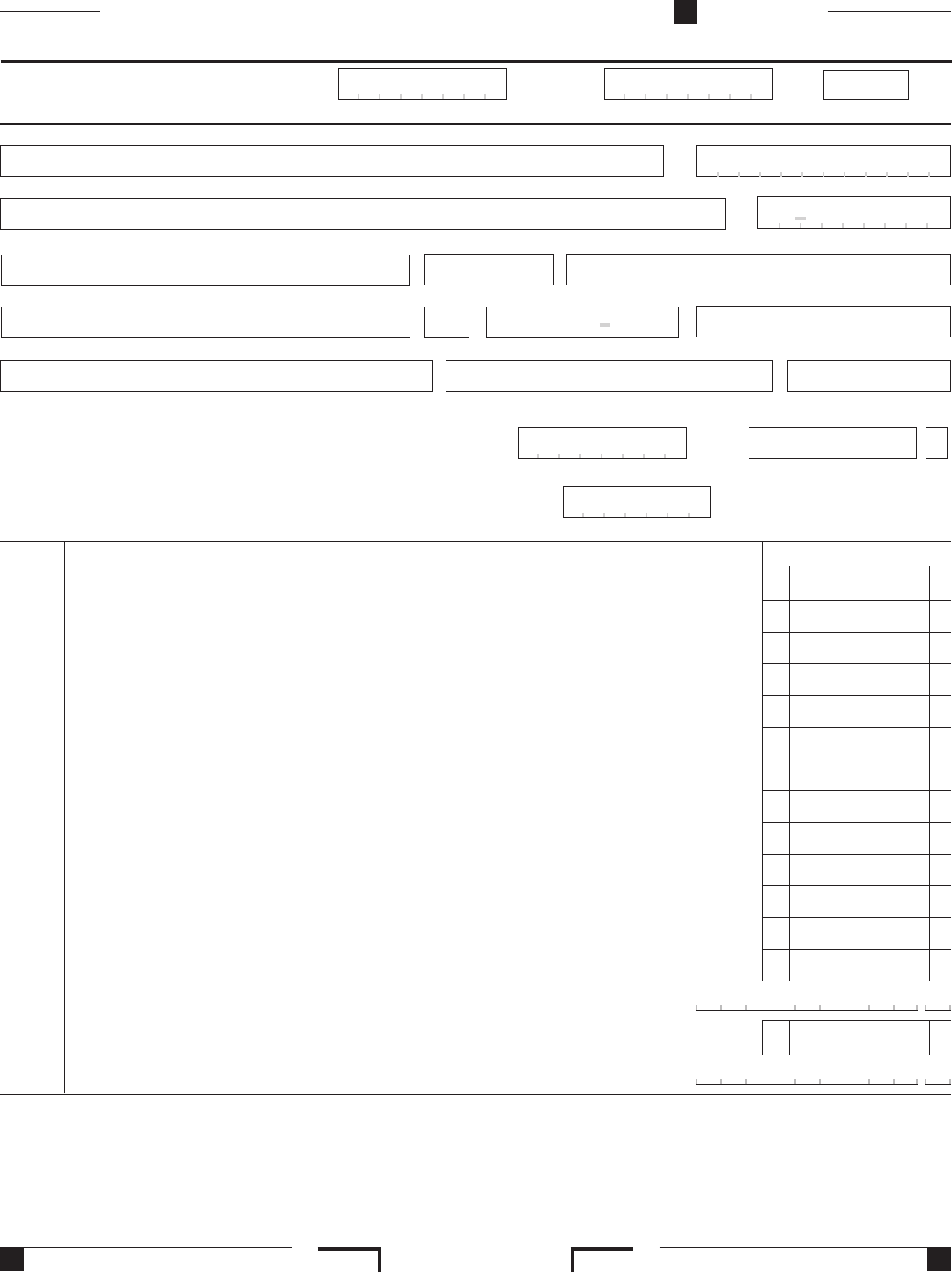

Ca Form 568 Instructions 2022 - Web 2022 instructions for form 568, limited liability company return of income. January 1, 2015, and to the california revenue and taxation code (r&tc). The llc should give you a description and the amount of your share for each item applicable to california in this category. Partnership file form 568, limited liability company return of income. References in these instructions are to the internal revenue code (irc) as of. Web i (1)during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc holds a controlling or majority interest that owned california real property (i.e., land, buildings), leased such property for a term of 35 years or more, or leased su. The llc must file the appropriate california tax return for its classification. Web we last updated the limited liability company return of income in february 2023, so this is the latest version of form 568, fully updated for tax year 2022. This worksheet calculates the california income that is subject to the llc fee assessment. How to fill in california form 568 if you have an llc, here’s how to fill in the california form 568:

Web we last updated the limited liability company return of income in february 2023, so this is the latest version of form 568, fully updated for tax year 2022. The llc income worksheet on form 568, page 7 calculates according to the form 568 instructions booklet and is based on everywhere, total income not including losses or expenses. Web you still have to file form 568 if the llc is registered in california. Web 2022 instructions for form 568, limited liability company return of income. The llc must file the appropriate california tax return for its classification. California grants an automatic extension of time to file a return; You can print other california tax forms here. Web i (1)during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc holds a controlling or majority interest that owned california real property (i.e., land, buildings), leased such property for a term of 35 years or more, or leased su. References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and to the california revenue and taxation code (r&tc). Line 1—total income from schedule iw.

Enter the amount of the llc fee. You can print other california tax forms here. January 1, 2015, and to the california revenue and taxation code (r&tc). How to fill in california form 568 if you have an llc, here’s how to fill in the california form 568: Web an llc return filing requirement (form 568) generally, a disregarded smllc must file a form 568 by the same deadline applicable to the owner's tax return. Web you still have to file form 568 if the llc is registered in california. References in these instructions are to the internal revenue code (irc) as of. Web i (1)during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc holds a controlling or majority interest that owned california real property (i.e., land, buildings), leased such property for a term of 35 years or more, or leased su. This worksheet calculates the california income that is subject to the llc fee assessment. The llc must file the appropriate california tax return for its classification.

Form Ca 568 Fill Out and Sign Printable PDF Template signNow

This worksheet calculates the california income that is subject to the llc fee assessment. Web you still have to file form 568 if the llc is registered in california. References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and to the california revenue and taxation code (r&tc). Web we last updated the limited.

Fillable California Form 568 Limited Liability Company Return Of

Line 1—total income from schedule iw. Web an llc return filing requirement (form 568) generally, a disregarded smllc must file a form 568 by the same deadline applicable to the owner's tax return. However, an extension of time to file is not an extension of time to pay the llc tax or fee. Web 2022 instructions for form 568, limited.

Form 568 Instructions 2022 State And Local Taxes Zrivo

Web an llc return filing requirement (form 568) generally, a disregarded smllc must file a form 568 by the same deadline applicable to the owner's tax return. You can print other california tax forms here. The llc must file the appropriate california tax return for its classification. Enter the amount of the llc fee. Web 2022 instructions for form 568,.

Ca Form 568 Instructions 2021 Mailing Address To File manyways.top 2021

Web i (1)during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc holds a controlling or majority interest that owned california real property (i.e., land, buildings), leased such property for a term of 35 years or more, or leased.

2013 Form 568 Limited Liability Company Return Of Edit, Fill

You can print other california tax forms here. Line 1—total income from schedule iw. In general, for taxable years beginning on or after january 1, 2015, california law conforms to the internal revenue. Web 2022 instructions for form 568, limited liability company return of income. Partnership file form 568, limited liability company return of income.

CA Form 568 Due Dates 2023 State And Local Taxes Zrivo

Web an llc return filing requirement (form 568) generally, a disregarded smllc must file a form 568 by the same deadline applicable to the owner's tax return. Web i (1)during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc.

Ca schedule r instructions 2017

Line 1—total income from schedule iw. Web i (1)during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc holds a controlling or majority interest that owned california real property (i.e., land, buildings), leased such property for a term of.

Form 568 Instructions 2022 State And Local Taxes Zrivo

California grants an automatic extension of time to file a return; Web 2022 instructions for form 568, limited liability company return of income. In general, for taxable years beginning on or after january 1, 2015, california law conforms to the internal revenue. Web we last updated the limited liability company return of income in february 2023, so this is the.

2002 Form CA FTB 568BK Fill Online, Printable, Fillable, Blank pdfFiller

You can print other california tax forms here. The llc income worksheet on form 568, page 7 calculates according to the form 568 instructions booklet and is based on everywhere, total income not including losses or expenses. References in these instructions are to the internal revenue code (irc) as of. Partnership file form 568, limited liability company return of income..

Notice of Unavailability for Annual Form Updates DocHub

References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and to the california revenue and taxation code (r&tc). January 1, 2015, and to the california revenue and taxation code (r&tc). Web 2022 instructions for form 568, limited liability company return of income. You can print other california tax forms here. In general, for.

Web You Still Have To File Form 568 If The Llc Is Registered In California.

Web 2022 instructions for form 568, limited liability company return of income. The llc income worksheet on form 568, page 7 calculates according to the form 568 instructions booklet and is based on everywhere, total income not including losses or expenses. How to fill in california form 568 if you have an llc, here’s how to fill in the california form 568: Web we last updated the limited liability company return of income in february 2023, so this is the latest version of form 568, fully updated for tax year 2022.

Web 2022 Instructions For Form 568, Limited Liability Company Return Of Income.

This worksheet calculates the california income that is subject to the llc fee assessment. Line 1—total income from schedule iw. You can print other california tax forms here. Web i (1)during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc holds a controlling or majority interest that owned california real property (i.e., land, buildings), leased such property for a term of 35 years or more, or leased su.

References In These Instructions Are To The Internal Revenue Code (Irc) As Of.

In general, for taxable years beginning on or after january 1, 2015, california law conforms to the internal revenue. Web an llc return filing requirement (form 568) generally, a disregarded smllc must file a form 568 by the same deadline applicable to the owner's tax return. Enter the amount of the llc fee. California grants an automatic extension of time to file a return;

The Llc Must File The Appropriate California Tax Return For Its Classification.

The llc should give you a description and the amount of your share for each item applicable to california in this category. However, an extension of time to file is not an extension of time to pay the llc tax or fee. January 1, 2015, and to the california revenue and taxation code (r&tc). Partnership file form 568, limited liability company return of income.