California Form 100Es

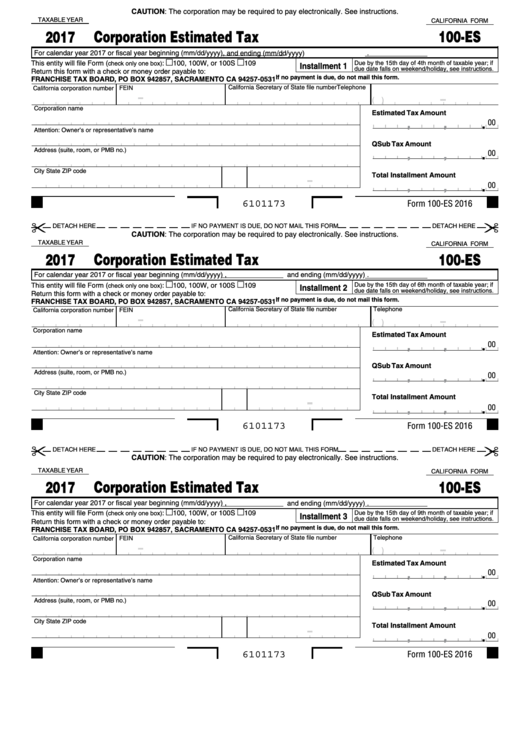

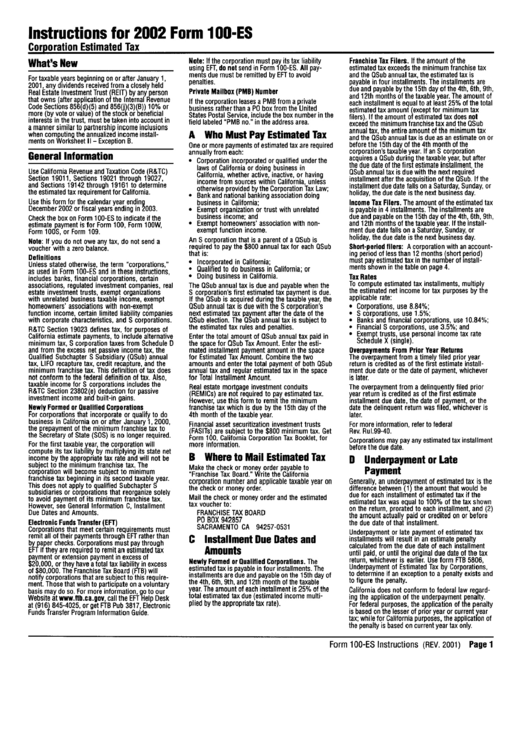

California Form 100Es - Corporations are required to pay the following percentages of the estimated. For calendar year 2022 or fiscal year beginning (mm/dd/yyyy) , and ending (mm/dd/yyyy). You can download or print current or past. If schedule f form 100s side 4 was not completed attach federal form. Download the 100 california form from the california franchise tax board (ftb) website or obtain a. Web 2021 form 100s california s corporation franchise or income tax return. During this taxable year, did another person or legal entity acquire. Estimated tax is generally due and payable in four installments:. Check only one box on form 100‑es to indicate if the estimate payment is for form 100, california corporation franchise or. If return this form with a check or.

Web file now with turbotax. This entity will file form (check only one box): If schedule f form 100s side 4 was not completed attach federal form. Web file now with turbotax. You can download or print current or past. Web form 100, 100s, 100w, or 100x estimated tax payment select this payment type when paying estimated tax. Web up to $40 cash back to fill out the 100 california form, follow these steps: Complete, edit or print tax forms instantly. Use revenue and taxation code (r&tc) sections 19011, 19021, 19023, 19025 through 19027, and 19142 through 19161 to determine the estimated tax. Corporations are required to pay the following percentages of the estimated.

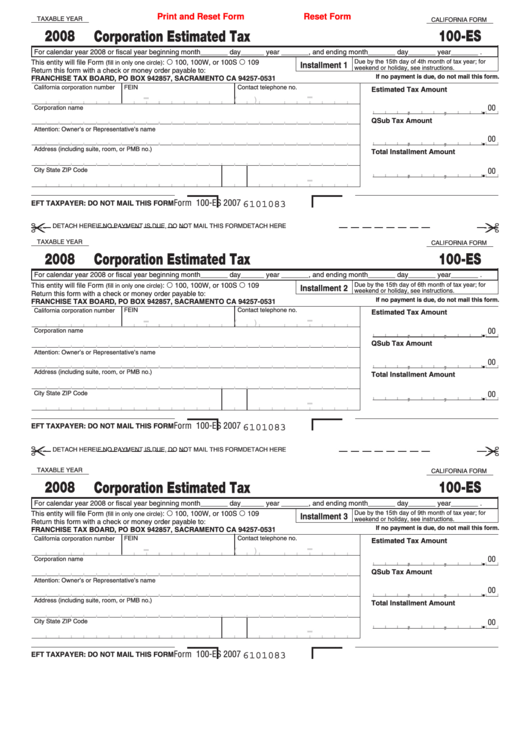

Estimated tax is generally due and payable in four installments:. M 100, 100w, or 100s m 109 installment 2 due by the 15th day of 6th month of taxable year; This entity will file form (check only one box): During this taxable year, did another person or legal entity acquire. Web file now with turbotax. Edit, sign and print tax forms on any device with signnow. Download the 100 california form from the california franchise tax board (ftb) website or obtain a. Web up to $40 cash back to fill out the 100 california form, follow these steps: This entity will file form (check only one box):. 3536 estimated fee for llcs (pdf) (instructions included) federal:

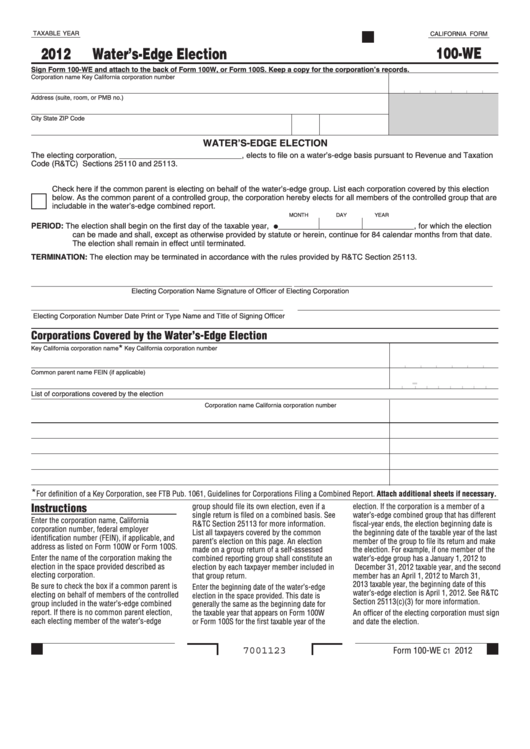

California Form 100We Water'SEdge Election 2012 printable pdf

This form is for income earned in tax year 2022, with. Corporations are required to pay the following percentages of the estimated tax liability. Edit, sign and print tax forms on any device with signnow. 3536 estimated fee for llcs (pdf) (instructions included) federal: If return this form with a check or.

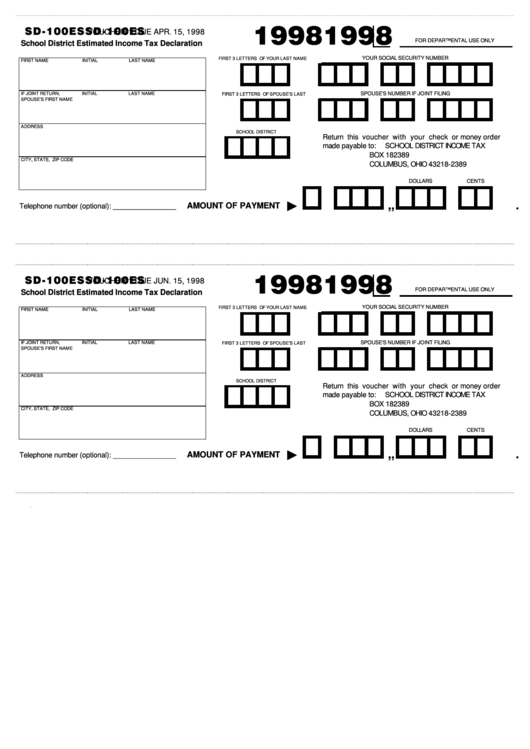

Fillable Form Sd100es School District Estimated Tax

Web up to $40 cash back to fill out the 100 california form, follow these steps: For calendar year 2023 or fiscal year beginning (mm/dd/yyyy) , and ending (mm/dd/yyyy). Check only one box on form 100‑es to indicate if the estimate payment is for form 100, california corporation franchise or. Web this entity will file form (check only one box):.

Fillable California Form 100 Es Corporate Esitimated Tax Franchise

Corporations are required to pay the following percentages of the estimated. You can download or print current or past. Estimated tax is generally due and payable in four installments:. If schedule f form 100s side 4 was not completed attach federal form. This entity will file form (check only one box):.

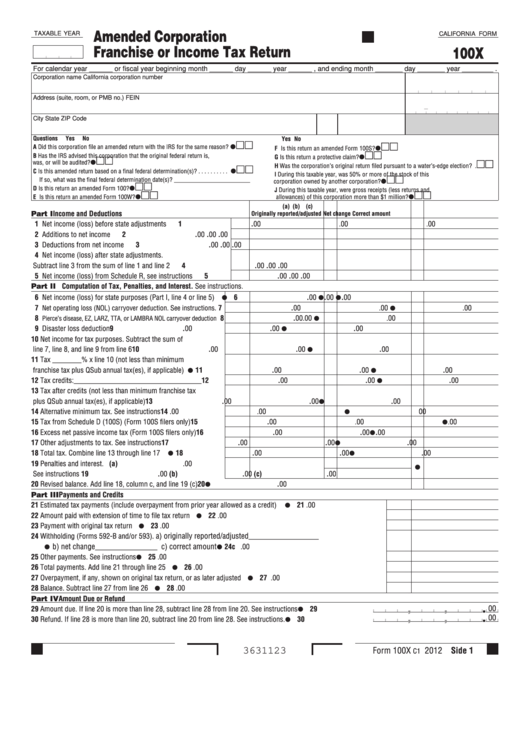

Fillable California Form 100x Amended Corporation Franchise Or

Download the 100 california form from the california franchise tax board (ftb) website or obtain a. Edit, sign and print tax forms on any device with signnow. Web file now with turbotax. For calendar year 2023 or fiscal year beginning (mm/dd/yyyy) , and ending (mm/dd/yyyy). This entity will file form (check only one box):

ads/responsive.txt California form 541 Instructions 2017 Awesome

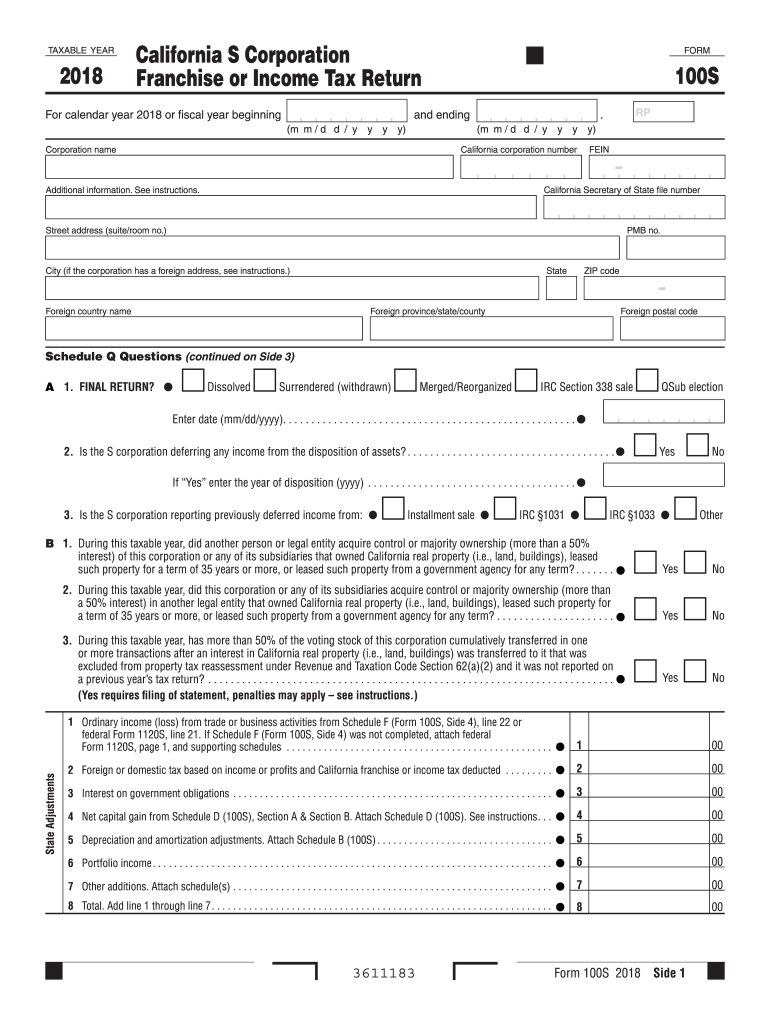

For calendar year 2018 or fiscal year beginning (mm/dd/yyyy) , and ending (mm/dd/yyyy). You can download or print current or past. During this taxable year, did another person or legal entity acquire. Check only one box on form 100‑es to indicate if the estimate payment is for form 100, california corporation franchise or. Web up to $40 cash back get.

2021 estimated tax worksheet excel

Check only one box on form 100‑es to indicate if the estimate payment is for form 100, california corporation franchise or. Web file now with turbotax. For calendar year 2022 or fiscal year beginning (mm/dd/yyyy) , and ending (mm/dd/yyyy). Corporations are required to pay the following percentages of the estimated tax liability. Edit, sign and print tax forms on any.

California Form 100s Instructions PDF Fill Out and Sign Printable PDF

Edit, sign and print tax forms on any device with signnow. Web up to $40 cash back get the free california form 100s instructions pdf 2018. Web up to $40 cash back to fill out the 100 california form, follow these steps: Web 2021 form 100s california s corporation franchise or income tax return. Check only one box on form.

100 California comprehensive branding program Graphis

Web up to $40 cash back get the free california form 100s instructions pdf 2018. Web up to $40 cash back to fill out the 100 california form, follow these steps: Use revenue and taxation code (r&tc) sections 19011, 19021, 19023, 19025 through 19027, and 19142 through 19161 to determine the estimated tax. For calendar year 2018 or fiscal year.

Fillable California Form 100Es Corporation Estimated Tax 2008

While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who. Corporations are required to pay the following percentages of the estimated tax liability. If schedule f form 100s side 4 was not completed attach federal form. Check only one box on form 100‑es to indicate if the estimate payment is for form 100, california.

14 California 100 Forms And Templates free to download in PDF

Use revenue and taxation code (r&tc) sections 19011, 19021, 19023, 19025 through 19027, and 19142 through 19161 to determine the estimated tax. M 100, 100w, or 100s m 109 installment 2 due by the 15th day of 6th month of taxable year; This entity will file form (check only one box):. Estimated tax is generally due and payable in four.

This Form Is For Income Earned In Tax Year 2022, With Tax.

During this taxable year, did another person or legal entity acquire. Corporations are required to pay the following percentages of the estimated tax liability. If return this form with a check or. Web up to $40 cash back get the free california form 100s instructions pdf 2018.

For Calendar Year 2018 Or Fiscal Year Beginning (Mm/Dd/Yyyy) , And Ending (Mm/Dd/Yyyy).

M 100, 100w, or 100s m 109 installment 2 due by the 15th day of 6th month of taxable year; You can download or print current or past. Complete, edit or print tax forms instantly. Web up to $40 cash back to fill out the 100 california form, follow these steps:

Download The 100 California Form From The California Franchise Tax Board (Ftb) Website Or Obtain A.

This entity will file form (check only one box):. Estimated tax is generally due and payable in four installments:. Use revenue and taxation code (r&tc) sections 19011, 19021, 19023, 19025 through 19027, and 19142 through 19161 to determine the estimated tax. Web form 100, 100s, 100w, or 100x estimated tax payment select this payment type when paying estimated tax.

If Schedule F Form 100S Side 4 Was Not Completed Attach Federal Form.

Corporations are required to pay the following percentages of the estimated. Web file now with turbotax. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who. 3536 estimated fee for llcs (pdf) (instructions included) federal: