Can You Fake A 1099 Form

Can You Fake A 1099 Form - Web then he got a bogus 1099. Web you cannot accept a receipt showing the employee has applied for an initial grant of employment authorization. Only certain taxpayers are eligible. Web who should receive a 1099 form? You'll need to provide copies to your contractors by january 31. But think of the form 1099 as a pretty strong nudge, you better list. Report suspected tax law violations. Web a simple tax return is one that's filed using irs form 1040 only, without having to attach any forms or schedules. Web some individuals or entities may create fake 1099 forms to falsely report income or payments made to someone. The irs also cautions taxpayers to avoid getting caught up in scams disguised as a debt payment option for credit cards or.

Web taxpayers and tax professionals should be alert to fake communications from scammers posing as legitimate organizations in the tax and financial community,. Web who should receive a 1099 form? Web actually, of course, if you have income, you must report it, whether or not you receive a form 1099. You'll need to provide copies to your contractors by january 31. Web there are some situations in which money reported in a 1099 form is not taxable, and you need to be careful when you put the numbers in your return. Web a simple tax return is one that's filed using irs form 1040 only, without having to attach any forms or schedules. This is a form of tax fraud and can result in. Web if you believe that the 1099 forms that you have received may be connected to tax fraud, it is important to contact a tax attorney. But think of the form 1099 as a pretty strong nudge, you better list. Tax law is incredibly complex.

You may be able to approach the issuer, show you really only were paid $30,000, and get the issuer to reissue it correctly. The irs also cautions taxpayers to avoid getting caught up in scams disguised as a debt payment option for credit cards or. Only certain taxpayers are eligible. Washington — the internal revenue service today began its dirty dozen list for 2021 with a warning for taxpayers, tax. Web there are some situations in which money reported in a 1099 form is not taxable, and you need to be careful when you put the numbers in your return. Web some individuals or entities may create fake 1099 forms to falsely report income or payments made to someone. Web if you fail to report the income, the irs will send you a bill. You also cannot accept receipts if employment is for. This revised form and condensed instructions streamline the materials and. Web taxpayers and tax professionals should be alert to fake communications from scammers posing as legitimate organizations in the tax and financial community,.

Form Ssa 1099 Online Universal Network

Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. This revised form and condensed instructions streamline the materials and. Eliminates common costly errors when using fillable pdf forms on other websites. Web you cannot accept a receipt showing the employee has.

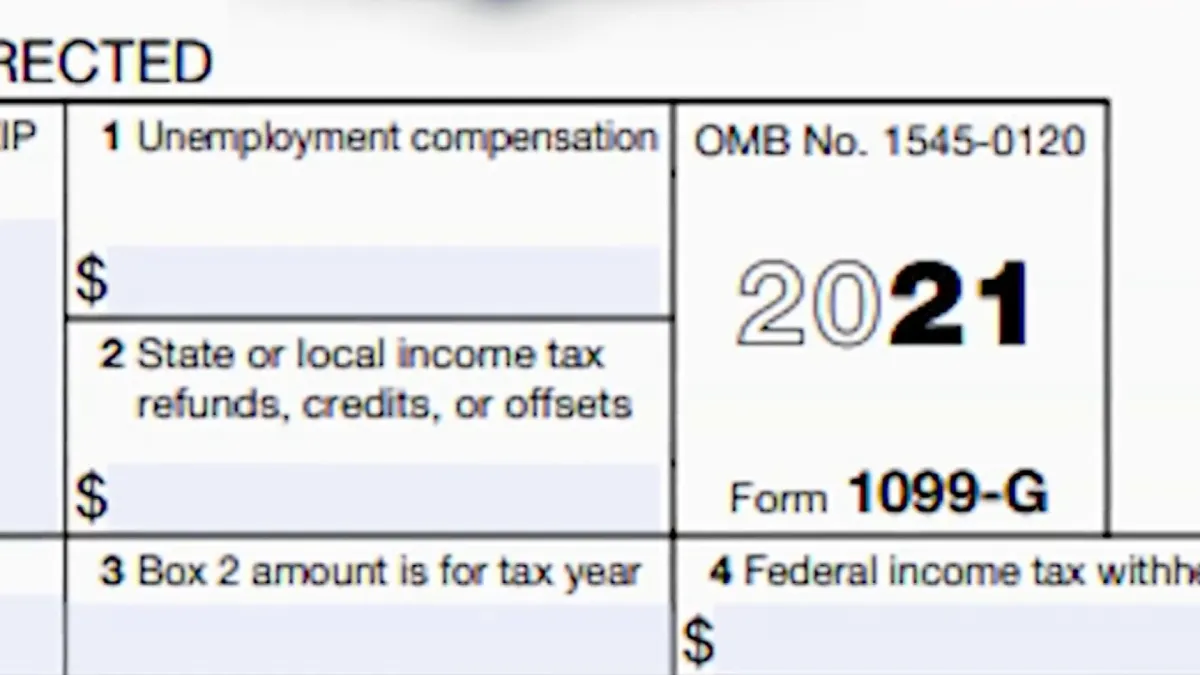

Try This If You Can’t See Your 1099G in CONNECT NBC 6 South Florida

Eliminates common costly errors when using fillable pdf forms on other websites. Someone used his social security number to get contract work with an arizona company. If you're in business, you probably dread. Web who should receive a 1099 form? Web a simple tax return is one that's filed using irs form 1040 only, without having to attach any forms.

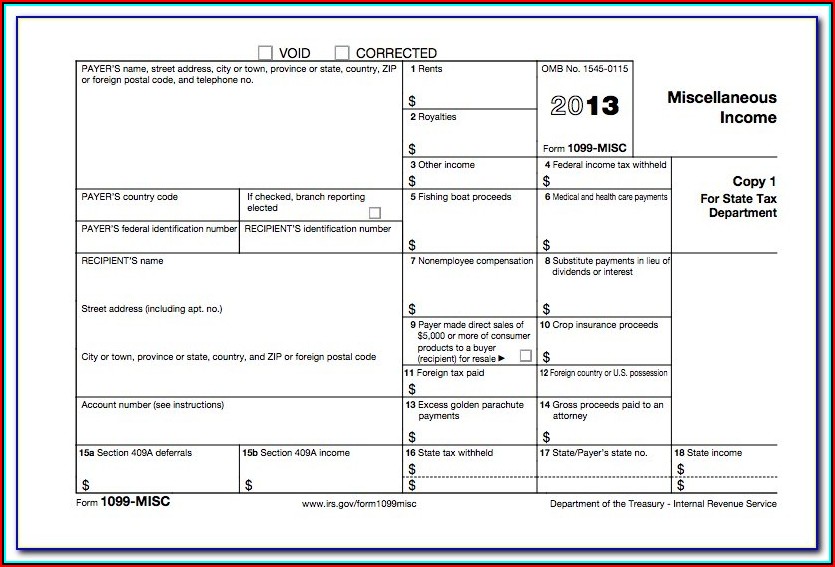

Free 1099 Form Online Form Resume Examples AjYdpnWYl0

Washington — the internal revenue service today began its dirty dozen list for 2021 with a warning for taxpayers, tax. Web first, act promptly. This revised form and condensed instructions streamline the materials and. Eliminates common costly errors when using fillable pdf forms on other websites. But think of the form 1099 as a pretty strong nudge, you better list.

Fake 1099 Form Generator Form Resume Examples nO9bzmvA94

Washington — the internal revenue service today began its dirty dozen list for 2021 with a warning for taxpayers, tax. Web if you fail to report the income, the irs will send you a bill. Web you cannot accept a receipt showing the employee has applied for an initial grant of employment authorization. Web if you believe that the 1099.

Federal 1099 Filing Requirements (1099MISC & 1099K) Irs forms, What

Web if you fail to report the income, the irs will send you a bill. This revised form and condensed instructions streamline the materials and. Web there are some situations in which money reported in a 1099 form is not taxable, and you need to be careful when you put the numbers in your return. Someone used his social security.

Fake 1099 Forms Online Form Resume Examples aL16Ngy1X7

Web who should receive a 1099 form? If the fake form isn’t fixed, he could get a tax. If you're in business, you probably dread. The irs also cautions taxpayers to avoid getting caught up in scams disguised as a debt payment option for credit cards or. Web first, act promptly.

What Is a 1099 Form, and How Do I Fill It Out? Bench Accounting

Web if you believe that the 1099 forms that you have received may be connected to tax fraud, it is important to contact a tax attorney. Web first, act promptly. The irs cautions taxpayers to avoid getting caught up in schemes disguised as a debt payment option for credit cards or mortgage debt. You also cannot accept receipts if employment.

Fake 1099 Forms Form Resume Examples xz20dnd2ql

Tax law is incredibly complex. Web you can report an individual or a business you suspect of tax fraud online. Washington — the internal revenue service today began its dirty dozen list for 2021 with a warning for taxpayers, tax. Web you cannot accept a receipt showing the employee has applied for an initial grant of employment authorization. Web there.

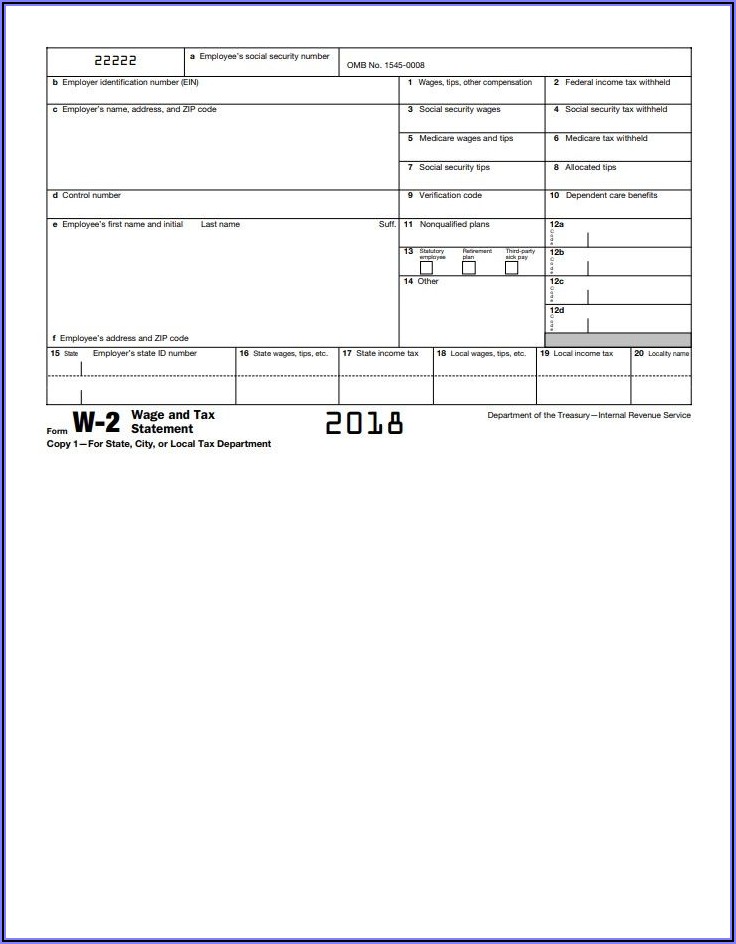

11 Common Misconceptions About Irs Form 11 Form Information Free

Web taxpayers and tax professionals should be alert to fake communications from scammers posing as legitimate organizations in the tax and financial community,. Web then he got a bogus 1099. Web first, act promptly. Someone used his social security number to get contract work with an arizona company. Eliminates common costly errors when using fillable pdf forms on other websites.

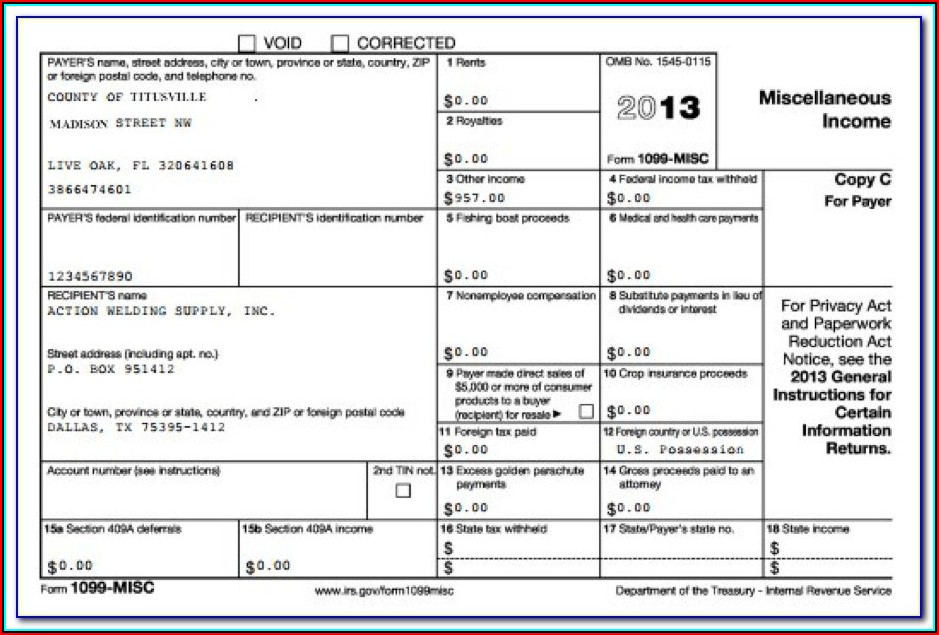

Example Of Non Ssa 1099 Form / Social Security 1099 Form 2017 Form

Web a simple tax return is one that's filed using irs form 1040 only, without having to attach any forms or schedules. Web actually, of course, if you have income, you must report it, whether or not you receive a form 1099. Eliminates common costly errors when using fillable pdf forms on other websites. Someone used his social security number.

If The Fake Form Isn’t Fixed, He Could Get A Tax.

Eliminates common costly errors when using fillable pdf forms on other websites. The irs also cautions taxpayers to avoid getting caught up in scams disguised as a debt payment option for credit cards or. This revised form and condensed instructions streamline the materials and. Web a simple tax return is one that's filed using irs form 1040 only, without having to attach any forms or schedules.

You Also Cannot Accept Receipts If Employment Is For.

But think of the form 1099 as a pretty strong nudge, you better list. Web you can report an individual or a business you suspect of tax fraud online. You'll need to provide copies to your contractors by january 31. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due.

Web Some Individuals Or Entities May Create Fake 1099 Forms To Falsely Report Income Or Payments Made To Someone.

Report suspected tax law violations. Web if you believe that the 1099 forms that you have received may be connected to tax fraud, it is important to contact a tax attorney. Web then he got a bogus 1099. Only certain taxpayers are eligible.

Tax Law Is Incredibly Complex.

Web first, act promptly. Web if you fail to report the income, the irs will send you a bill. Washington — the internal revenue service today began its dirty dozen list for 2021 with a warning for taxpayers, tax. The irs cautions taxpayers to avoid getting caught up in schemes disguised as a debt payment option for credit cards or mortgage debt.