Chapter 13 Bankruptcy Debt Limits

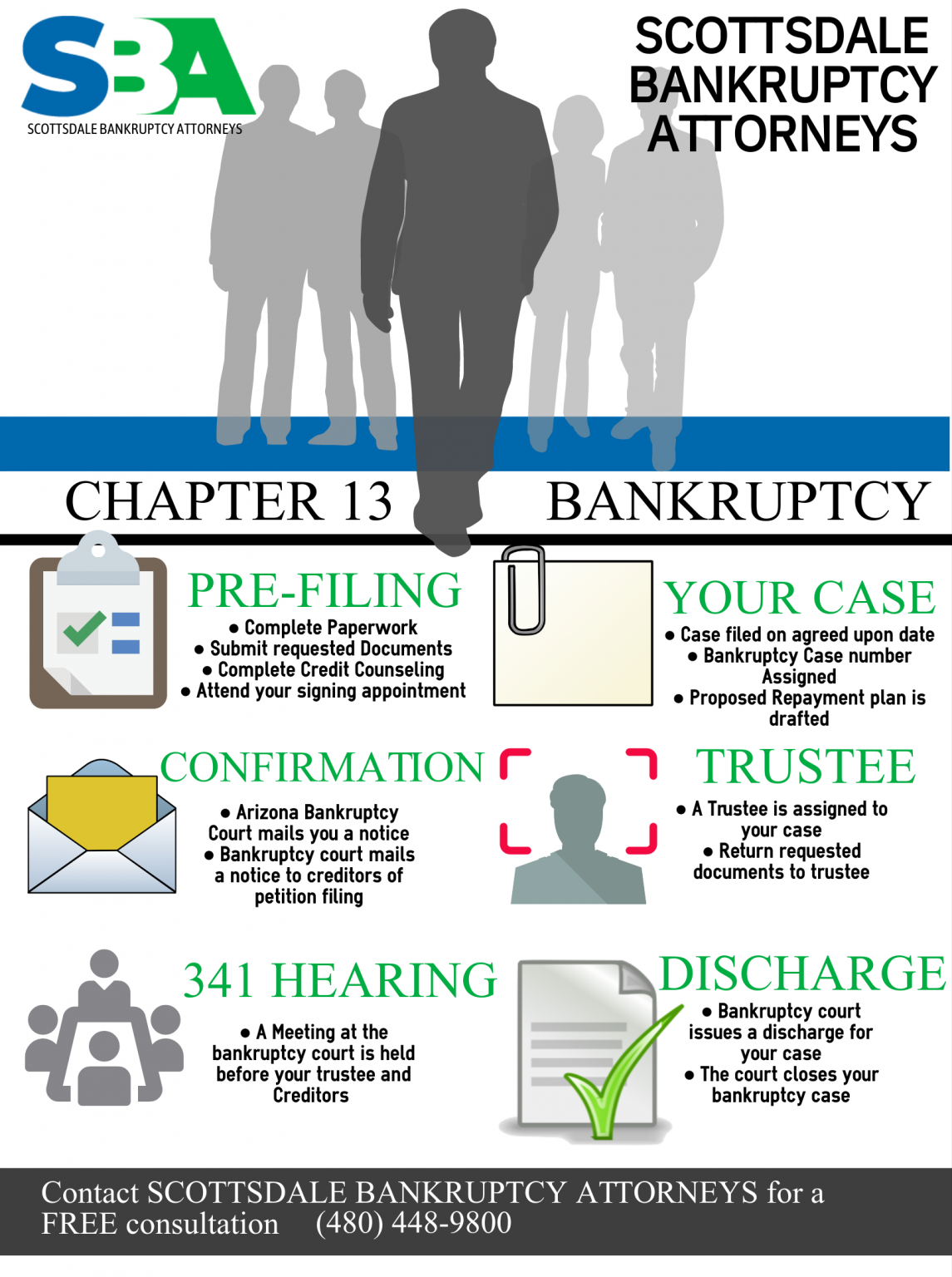

Chapter 13 Bankruptcy Debt Limits - On the date you file your chapter 13 bankruptcy petition, your debts cannot exceed these amounts or you cannot qualify for chapter 13. Web what are the chapter 13 debt limits? The distinction between secured and unsecured debt. Web chapter 13 comes with debt limits, as well. Web current chapter 13 debt limits. And, • $419,275 in unsecured debts. As of april 1, 2022:. However, bankruptcies as a whole dropped to 387,721. It’s about double what the debt limits had been, and is extremely helpful for los angeles residents who have a second property and mortgage debt. Chapter 13 is available to individual debtors with less than $419,275 in unsecured debt (debts that are not secured by property, such as credit card debt and medical bills) and less than $1,257,850 in secured debt (debts.

Effective april 1, 2019, and effective for three (3) years, the applicable debt limits for chapter 13 cases are: Adults with unsecured debts of less than $465,275 and secured debts of less than $1,395,875 can seek protection by chapter 13. For example, the debt limit for unsecured debt is around $400,000, while the debt limit for secured debt is up to $1 million. Chapter 13 is only available for people who have less than $465,275 in unsecured debts for cases filed between april 1, 2022, and march 31, 2025. You can receive tax refunds while in bankruptcy. This limit is for both secured and unsecured debt combined. Web current chapter 13 debt limits. Web chapter 13 plans are usually three to five years in length and may not exceed five years. Web until today, 11 usc §109 (e) limited the eligibility for chapter 13 proceedings to individuals with unsecured debts of no more than $465,275 and secured debts of no more than $1,395,875. Web as of april 2019, in order to be eligible to file for a chapter 13 bankruptcy (for individuals only), you must owe less than $1,257,850 in liquidated, noncontingent secured debts, and less than $419,275 in liquidated, noncontingent unsecured debts…

For more detailed information see the u.s. It’s about double what the debt limits had been, and is extremely helpful for los angeles residents who have a second property and mortgage debt. However, refunds may be subject to delay or used to pay down your tax debts. Web chapter 13 plans are usually three to five years in length and may not exceed five years. Web current chapter 13 debt limits. Web chapter 13 bankruptcy is used to reorganize debt, which means that you will have a limit on the unsecured and secured debt that can be discharged with this legal process. Web what are the chapter 13 debt limits? Federal tax refunds during bankruptcy. Web there is a new law changes which, among other things, increases the chapter 13 debt limit to $2.75 million dollars. Chapter 13 cases are now permitted for individuals with unsecured debts of no more than $465,275.

Paradise, NV Debt Relief Attorney Chapter 13 Bankruptcy, 7026053306

Web until today, 11 usc §109 (e) limited the eligibility for chapter 13 proceedings to individuals with unsecured debts of no more than $465,275 and secured debts of no more than $1,395,875. However, bankruptcies as a whole dropped to 387,721. The debt limits for this type of bankruptcy. The distinction between secured and unsecured debt. Chapter 13 cases are now.

Chapter 13 Bankruptcy Debt Limits Steiner Law Group

Chapter 13 debt eligibility limits chapter 13:. Web there is a new law changes which, among other things, increases the chapter 13 debt limit to $2.75 million dollars. For example, the debt limit for unsecured debt is around $400,000, while the debt limit for secured debt is up to $1 million. Web as of april 2019, in order to be.

2022 Chapter 13 Debt Ceiling Increase Tejes Law, PLLC Orlando Based

Web what are the chapter 13 debt limits? The debt limits for this type of bankruptcy. Web the most important of these are the increases in the debt limits for debtors under chapter 13 and under the small business reorganization act (the “sbra”)—increases that will continue for. Web as of april 2019, in order to be eligible to file for.

Chapter 13 Bankruptcy Attorney in Scottsdale Low Cost Bankruptcy

Web the most important of these are the increases in the debt limits for debtors under chapter 13 and under the small business reorganization act (the “sbra”)—increases that will continue for. Chapter 13 is available to individual debtors with less than $419,275 in unsecured debt (debts that are not secured by property, such as credit card debt and medical bills).

How Long Does Chapter 13 Bankruptcy Take in &

Web chapter 13 requirements impose a limit on the amount of a filer's debt. Chapter 13 debt eligibility limits chapter 13:. As of april 1, 2022:. Chapter 13 is only available for people who have less than $465,275 in unsecured debts for cases filed between april 1, 2022, and march 31, 2025. Adults with unsecured debts of less than $465,275.

CHAPTER 11 BANKRUPTCY Zimmermann Law Office S.C.

Federal tax refunds during bankruptcy. Effective april 1, 2019, and effective for three (3) years, the applicable debt limits for chapter 13 cases are: However, bankruptcies as a whole dropped to 387,721. Chapter 13 cases are now permitted for individuals with unsecured debts of no more than $465,275. Debtors have the option of filing a chapter 13 bankruptcy as long.

What Is Chapter 13 Bankruptcy and Is It Worth It? TheStreet

On the date you file your chapter 13 bankruptcy petition, your debts cannot exceed these amounts or you cannot qualify for chapter 13. As of april 1, 2019, chapter 13 debt limits are: The debt limits for this type of bankruptcy. You can receive tax refunds while in bankruptcy. Web current chapter 13 debt limits.

Debt Limitations in Bankruptcy Filings David Offen, Esq

Web chapter 13 plans are usually three to five years in length and may not exceed five years. The debt limits for this type of bankruptcy. Web the most important of these are the increases in the debt limits for debtors under chapter 13 and under the small business reorganization act (the “sbra”)—increases that will continue for. Chapter 13 is.

Chapter 13 bankruptcy explained YouTube

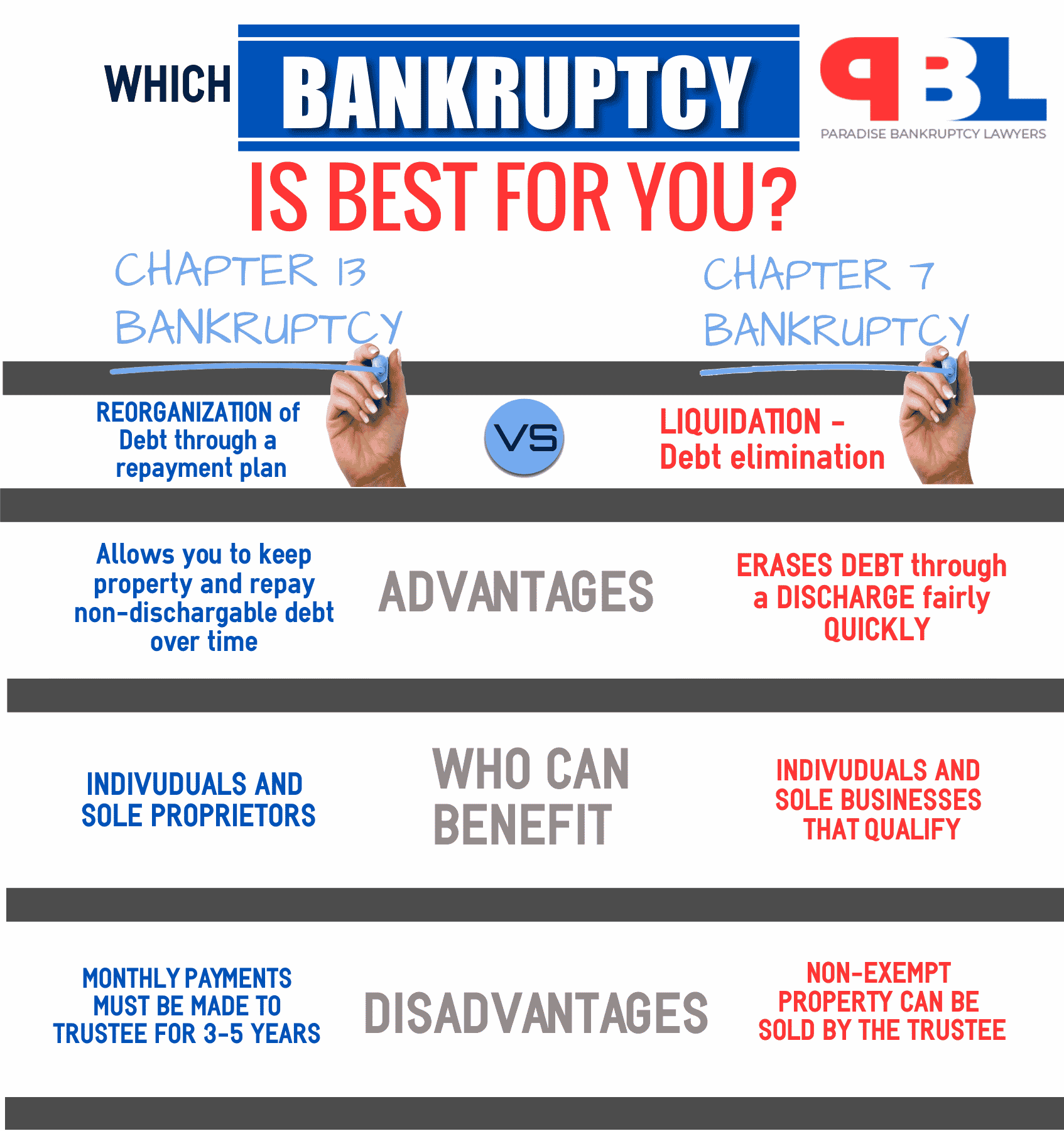

The distinction between secured and unsecured debt. Web until today, 11 usc §109 (e) limited the eligibility for chapter 13 proceedings to individuals with unsecured debts of no more than $465,275 and secured debts of no more than $1,395,875. Chapter 13 is in contrast to the purpose of chapter 7, which does not provide for a plan of reorganization, but.

Chapter 13 Debt Limits Learn About Them Easy Debt Management

Web there is a new law changes which, among other things, increases the chapter 13 debt limit to $2.75 million dollars. Under sb 3823, debtors no longer are required to limit debts. Web below, we’ll discuss debt limits, how they work, and what you can do if you owe more than the chapter 13 debt limits allow. You can receive.

Web Until Today, 11 Usc §109 (E) Limited The Eligibility For Chapter 13 Proceedings To Individuals With Unsecured Debts Of No More Than $465,275 And Secured Debts Of No More Than $1,395,875.

Chapter 13 is only available for people who have less than $465,275 in unsecured debts for cases filed between april 1, 2022, and march 31, 2025. You can receive tax refunds while in bankruptcy. Web chapter 13 bankruptcy is used to reorganize debt, which means that you will have a limit on the unsecured and secured debt that can be discharged with this legal process. Web current chapter 13 debt limits.

Web Find Basic Information About Chapter 13 Bankruptcy Below.

It’s about double what the debt limits had been, and is extremely helpful for los angeles residents who have a second property and mortgage debt. Web there is a new law changes which, among other things, increases the chapter 13 debt limit to $2.75 million dollars. The debt limits for this type of bankruptcy. Web what are the chapter 13 debt limits?

As Of April 1, 2019, Chapter 13 Debt Limits Are:

Web the bankruptcy code limits the amount of debt that a person may have in their chapter 13 bankruptcy in 11 u.s.c § 109. However, refunds may be subject to delay or used to pay down your tax debts. Effective april 1, 2019, and effective for three (3) years, the applicable debt limits for chapter 13 cases are: Chapter 13 cases are now permitted for individuals with unsecured debts of no more than $465,275.

And, • $419,275 In Unsecured Debts.

For example, the debt limit for unsecured debt is around $400,000, while the debt limit for secured debt is up to $1 million. Chapter 13 is available to individual debtors with less than $419,275 in unsecured debt (debts that are not secured by property, such as credit card debt and medical bills) and less than $1,257,850 in secured debt (debts. Web chapter 13 plans are usually three to five years in length and may not exceed five years. Chapter 13 is in contrast to the purpose of chapter 7, which does not provide for a plan of reorganization, but provides for the discharge of certain debt.