Chapter 313 Texas

Chapter 313 Texas - There is no limit to the program. 31, 2022, will continue in effect under chapter 313. But if a developer finalizes a 313. An appraised value limitation is an agreement in which a taxpayer agrees to build or install property and create jobs in exchange for: Web the companies filed chapter 313 applications for wind and solar energy projects located in five different independent school districts across texas: Web not dead yet — planning for chapter 313's sunset. Web chapter 313 of the texas tax code allows school districts to cap the taxable value of a property for a portion of school taxes for up to 10 years, often saving companies tens of millions of dollars. Web chapter 313, the texas economic development act, is texas’ largest corporate tax break program, with a lifetime cost to the state of more than $7 billion so far. Web crafted to lure businesses to texas, chapter 313 allowed companies to lock in a minimal property valuation for a proposed industrial project for 10 years in exchange for economic growth. Bynum isd, hart isd, holliday isd, miller.

Web chapter 313 of the texas tax code allows school districts to cap the taxable value of a property for a portion of school taxes for up to 10 years, often saving companies tens of millions of dollars. An appraised value limitation is an agreement in which a taxpayer agrees to build or install property and create jobs in exchange for: Web austin, texas — at the end of the year, chapter 313 of the texas tax code will expire. There is no limit to the program. Web texas legislature 2023 new economic incentive plan clears hurdle in texas house during the floor debate for a plan to replace the expired chapter 313 program, house members added that the. Texas tax code section 313.171 provides that chapter 313 agreements executed before dec. Web named for its place in the state tax code, chapter 313 gives texas school districts the ability to cap the taxable value of a property for a portion of school taxes for up to 10 years. Added by acts 2001, 77th leg., ch. Texas economic development act subchapter a. With chapter 313 set to expire, the texas comptroller has proposed new rules that.

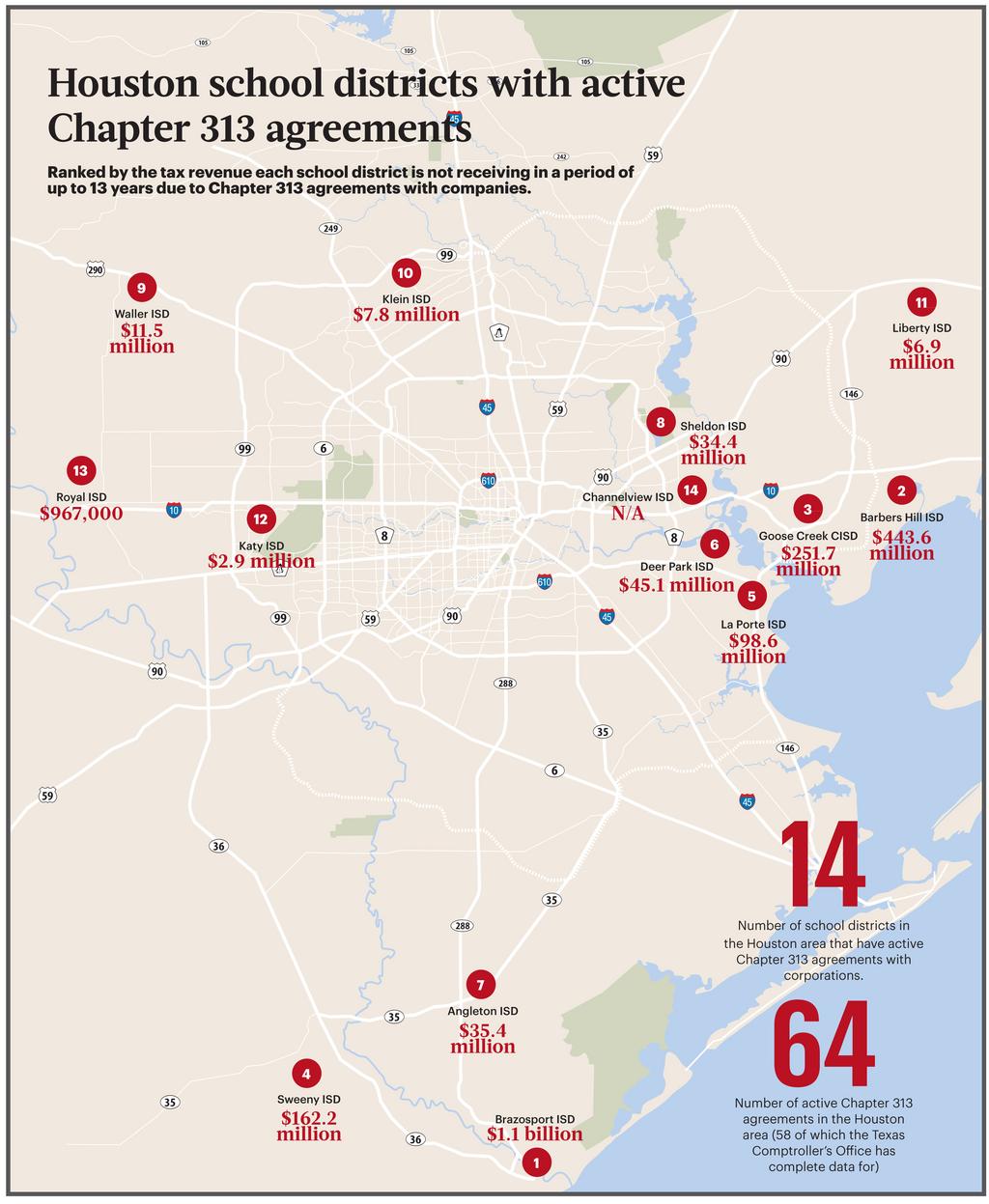

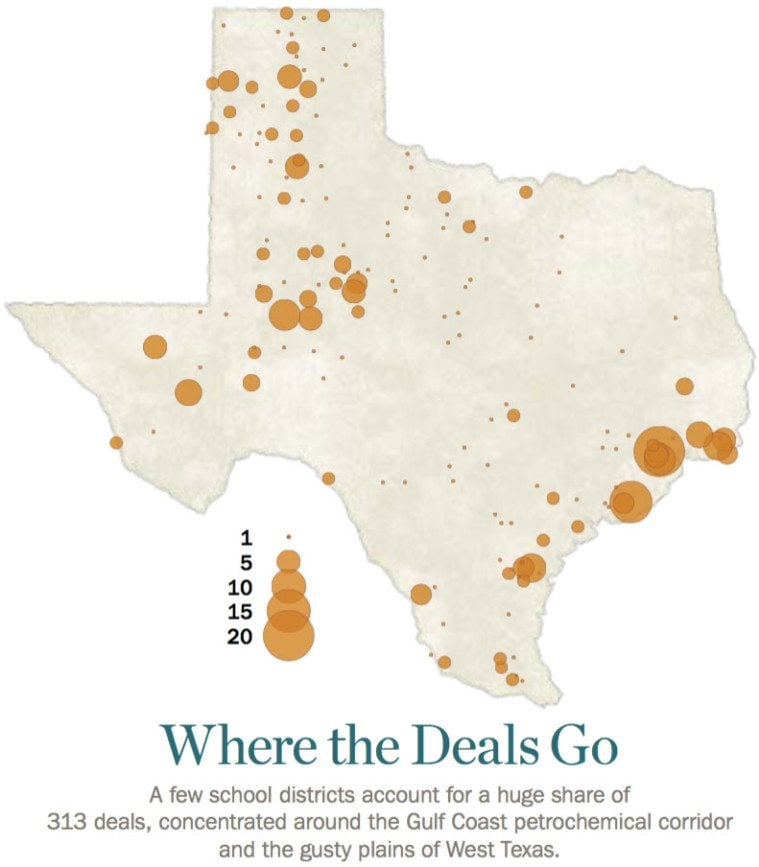

Web crafted to lure businesses to texas, chapter 313 allowed companies to lock in a minimal property valuation for a proposed industrial project for 10 years in exchange for economic growth. This particular chapter was enacted in 2001, went into effect in january of 2002, and it allows school. Web austin, texas — at the end of the year, chapter 313 of the texas tax code will expire. This chapter may be cited as the texas economic development act. Web chapter 313, the texas economic development act, is texas’ largest corporate tax break program, with a lifetime cost to the state of more than $7 billion so far. Web the texas chapter 313 value limitation program is a powerful economic development tool that allows a school district to agree temporarily to reduce ad valorem taxes on an eligible project’s investment for a period of 10 years. As texas’ $10 billion corporate tax break program closes, state comptroller wants to cover up costs. Web the local school district, barbers hill, has granted more chapter 313 tax breaks than any other district in texas. There is no limit to the program. But if a developer finalizes a 313.

Chapter 313 The Texas Observer

Web chapter 313, the texas economic development act, is texas’ largest corporate tax break program, with a lifetime cost to the state of more than $7 billion so far. An appraised value limitation is an agreement in which a taxpayer agrees to build or install property and create jobs in exchange for: It allows for.50 ce in the tax assessment.

Meet Chapter 313, Texas' Largest Corporate Welfare Program

This chapter may be cited as the texas economic development act. Web the companies filed chapter 313 applications for wind and solar energy projects located in five different independent school districts across texas: There is no limit to the program. Web the texas chapter 313 value limitation program is a powerful economic development tool that allows a school district to.

Chapter 313 Tax Break Provision Killed in Texas House Reform Austin

Bynum isd, hart isd, holliday isd, miller. Added by acts 2001, 77th leg., ch. But if a developer finalizes a 313. Although the texas house approved recent legislation to extend the program, the legislation failed in the texas. Web the texas chapter 313 value limitation program is a powerful economic development tool that allows a school district to agree temporarily.

How Houston corporations benefit from Chapter 313, Texas’ largest tax

With chapter 313 set to expire, the texas comptroller has proposed new rules that. It allows for.50 ce in the tax assessment and collection practices. Texas economic development act subchapter a. Added by acts 2001, 77th leg., ch. Web chapter 313 of the texas tax code allows school districts to cap the taxable value of a property for a portion.

Plan to revive Texas' Chapter 313 tax breaks adds more lucrative deals

With chapter 313 set to expire, the texas comptroller has proposed new rules that. Added by acts 2001, 77th leg., ch. Will state officials let it die? As texas’ $10 billion corporate tax break program closes, state comptroller wants to cover up costs. Web the texas chapter 313 value limitation program is a powerful economic development tool that allows a.

Chapter 313 Replacement Tax Incentive Program Gets Initial Approval in

31, 2022, will continue in effect under chapter 313. Web chapter 313, the texas economic development act, is texas’ largest corporate tax break program, with a lifetime cost to the state of more than $7 billion so far. Web texas legislature 2023 new economic incentive plan clears hurdle in texas house during the floor debate for a plan to replace.

Meet Chapter 313, Texas' Largest Corporate Welfare Program

Web the companies filed chapter 313 applications for wind and solar energy projects located in five different independent school districts across texas: Web not dead yet — planning for chapter 313's sunset. Added by acts 2001, 77th leg., ch. Web the local school district, barbers hill, has granted more chapter 313 tax breaks than any other district in texas. Web.

Texas Has One Week to Save TexasSized Tax Break Connect CRE

This particular chapter was enacted in 2001, went into effect in january of 2002, and it allows school. 31, 2022, will continue in effect under chapter 313. Web not dead yet — planning for chapter 313's sunset. This chapter may be cited as the texas economic development act. Web the local school district, barbers hill, has granted more chapter 313.

Chapter 313 Agreements Texas Schools for Economic Development

Web chapter 313 of the texas tax code allows school districts to cap the taxable value of a property for a portion of school taxes for up to 10 years, often saving companies tens of millions of dollars. Texas tax code section 313.171 provides that chapter 313 agreements executed before dec. But if a developer finalizes a 313. Texas economic.

The Back Mic Breakdown of the Texas House Vote on Chapter 313

Added by acts 2001, 77th leg., ch. It allows for.50 ce in the tax assessment and collection practices. Will state officials let it die? Texas tax code section 313.171 provides that chapter 313 agreements executed before dec. 31, 2022, will continue in effect under chapter 313.

Web Named For Its Place In The State Tax Code, Chapter 313 Gives Texas School Districts The Ability To Cap The Taxable Value Of A Property For A Portion Of School Taxes For Up To 10 Years.

Web chapter 313 of the texas tax code allows school districts to cap the taxable value of a property for a portion of school taxes for up to 10 years, often saving companies tens of millions of dollars. Will state officials let it die? But if a developer finalizes a 313. This chapter may be cited as the texas economic development act.

Bynum Isd, Hart Isd, Holliday Isd, Miller.

Although the texas house approved recent legislation to extend the program, the legislation failed in the texas. Web crafted to lure businesses to texas, chapter 313 allowed companies to lock in a minimal property valuation for a proposed industrial project for 10 years in exchange for economic growth. Web not dead yet — planning for chapter 313's sunset. Web texas legislature 2023 new economic incentive plan clears hurdle in texas house during the floor debate for a plan to replace the expired chapter 313 program, house members added that the.

Web The Local School District, Barbers Hill, Has Granted More Chapter 313 Tax Breaks Than Any Other District In Texas.

As texas’ $10 billion corporate tax break program closes, state comptroller wants to cover up costs. There is no limit to the program. Web austin, texas — at the end of the year, chapter 313 of the texas tax code will expire. Web chapter 313, the texas economic development act, is texas’ largest corporate tax break program, with a lifetime cost to the state of more than $7 billion so far.

It Allows For.50 Ce In The Tax Assessment And Collection Practices.

Added by acts 2001, 77th leg., ch. Web texas economic development act. Web the texas chapter 313 value limitation program is a powerful economic development tool that allows a school district to agree temporarily to reduce ad valorem taxes on an eligible project’s investment for a period of 10 years. Web the companies filed chapter 313 applications for wind and solar energy projects located in five different independent school districts across texas: