Check The Box Election Form 8832

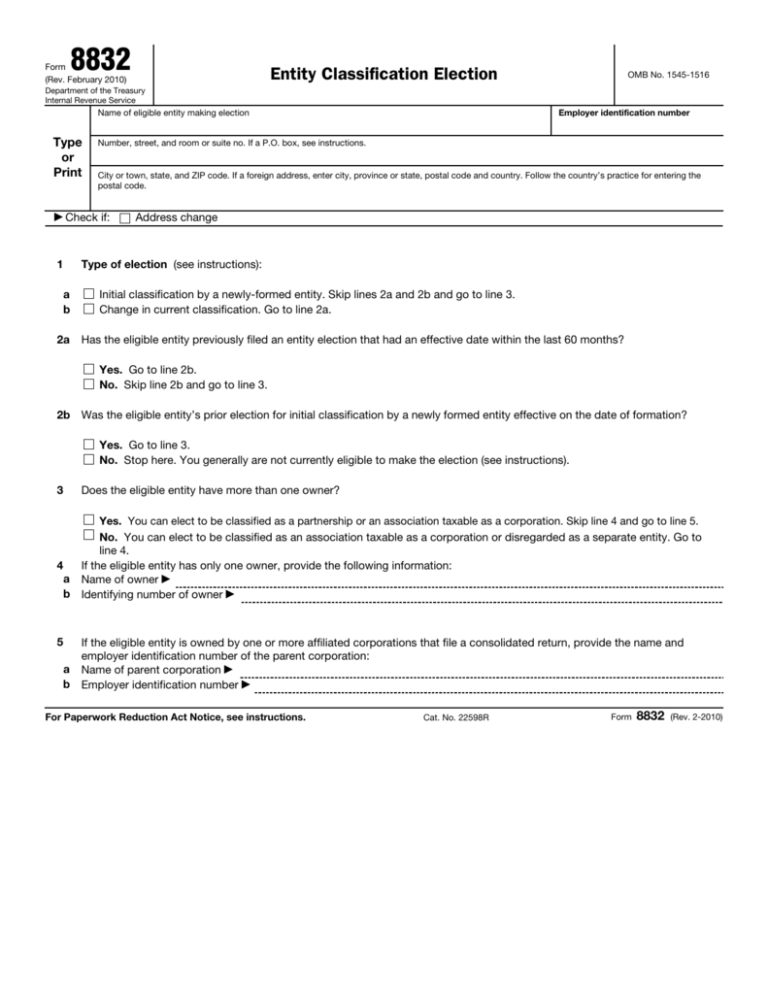

Check The Box Election Form 8832 - While the form itself is easy to fill out, the trick is to ensure the proper tax planning has been done. According to your objectives, you can elect to have your llc taxed as a. Web by filing form 8832 with the irs, you can choose a tax status for your entity besides the default status. Choose your type of election 1. Check the box, print form 8832 with complete return code 213; Irs form 8832, entity classification election, is a form business owners use to tell the irs how to classify a business for federal tax. December 2013) department of the treasury internal revenue service omb no. Check here if this is the first time you’re. Web scroll down to the election for entity classification (form 8832) section; Web to generate form 8832 entity classification election:

Web again, you’ll probably already know if you need to check this box. Check here if this is the first time you’re. Web what is irs form 8832? According to your objectives, you can elect to have your llc taxed as a. While the form itself is easy to fill out, the trick is to ensure the proper tax planning has been done. Web to generate form 8832 entity classification election: Check the box, print form 8832 with complete return code 213; The ctb election is made on irs form 8832. Web if form 8832 has been filed, the authors recommend that a copy of the form 8832 be attached to the form 2553, along with an explanatory statement stating that the. Choose your type of election 1.

Web if form 8832 has been filed, the authors recommend that a copy of the form 8832 be attached to the form 2553, along with an explanatory statement stating that the. Web scroll down to the election for entity classification (form 8832) section; December 2013) department of the treasury internal revenue service omb no. Check here if this is the first time you’re. You simply check the appropriate box, specify the date that the election is to be effective, sign and. The ctb election is made on irs form 8832. While the form itself is easy to fill out, the trick is to ensure the proper tax planning has been done. Doing so does expose owners to double. Irs form 8832, entity classification election, is a form business owners use to tell the irs how to classify a business for federal tax. Choose your type of election 1.

What is Form 8832? Check Stub Maker

Choose your type of election 1. Irs form 8832, entity classification election, is a form business owners use to tell the irs how to classify a business for federal tax. Web irs form 8832 (entity classification election) is the form an eligible business entity uses to elect federal income tax treatment other than its default. From the input return tab,.

What Is Form 8832 and How Do I Fill It Out? Ask Gusto

Check here if this is the first time you’re. You simply check the appropriate box, specify the date that the election is to be effective, sign and. Irs form 8832, entity classification election, is a form business owners use to tell the irs how to classify a business for federal tax. Web if form 8832 has been filed, the authors.

Check The Box Election and Foreign Corporation, IRS Form 8832 Asena

Web making the election. Web again, you’ll probably already know if you need to check this box. From the input return tab, go to other. Web irs form 8832 (entity classification election) is the form an eligible business entity uses to elect federal income tax treatment other than its default. While the form itself is easy to fill out, the.

Form 8832 (Rev. February 2010)

Web business entities that are classified as disregarded entities or partnerships may elect to be classified as c corporations by checking the (appropriate) box on irs. Web scroll down to the election for entity classification (form 8832) section; Choose your type of election 1. Web to generate form 8832 entity classification election: Web if form 8832 has been filed, the.

Vote Check Box 3D Royalty Free Stock Photo Image 6015205

Web again, you’ll probably already know if you need to check this box. Choose your type of election 1. Web making the election. According to your objectives, you can elect to have your llc taxed as a. Web irs form 8832 (entity classification election) is the form an eligible business entity uses to elect federal income tax treatment other than.

School Elections Concept. Election Check Box And School Accessories On

Web again, you’ll probably already know if you need to check this box. According to your objectives, you can elect to have your llc taxed as a. Web business entities that are classified as disregarded entities or partnerships may elect to be classified as c corporations by checking the (appropriate) box on irs. Web irs form 8832 (entity classification election).

LLC taxed as CCorp (Form 8832) [Pros and cons] LLC University®

According to your objectives, you can elect to have your llc taxed as a. Web business entities that are classified as disregarded entities or partnerships may elect to be classified as c corporations by checking the (appropriate) box on irs. The ctb election is made on irs form 8832. Web if form 8832 has been filed, the authors recommend that.

Delaware Llc Uk Tax Treatment Eayan

While the form itself is easy to fill out, the trick is to ensure the proper tax planning has been done. Irs form 8832, entity classification election, is a form business owners use to tell the irs how to classify a business for federal tax. Web what is irs form 8832? Check here if this is the first time you’re..

Check Box 3D Graphic Royalty Free Stock Images Image 5848199

Web an eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as a corporation, a partnership, or an entity disregarded as separate from its owner. Web to generate form 8832 entity classification election: Web again, you’ll probably already know if you need to check this box. According to your objectives, you can elect.

Form 8832 Entity Classification Election

Check here if this is the first time you’re. Irs form 8832, entity classification election, is a form business owners use to tell the irs how to classify a business for federal tax. Check the box, print form 8832 with complete return code 213; Web scroll down to the election for entity classification (form 8832) section; Web again, you’ll probably.

Check Here If This Is The First Time You’re.

According to your objectives, you can elect to have your llc taxed as a. From the input return tab, go to other. Web by filing form 8832 with the irs, you can choose a tax status for your entity besides the default status. Web again, you’ll probably already know if you need to check this box.

Web Making The Election.

Web business entities that are classified as disregarded entities or partnerships may elect to be classified as c corporations by checking the (appropriate) box on irs. Web to generate form 8832 entity classification election: Web an eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as a corporation, a partnership, or an entity disregarded as separate from its owner. Check the box, print form 8832 with complete return code 213;

The Ctb Election Is Made On Irs Form 8832.

December 2013) department of the treasury internal revenue service omb no. While the form itself is easy to fill out, the trick is to ensure the proper tax planning has been done. Web if form 8832 has been filed, the authors recommend that a copy of the form 8832 be attached to the form 2553, along with an explanatory statement stating that the. Irs form 8832, entity classification election, is a form business owners use to tell the irs how to classify a business for federal tax.

Doing So Does Expose Owners To Double.

Web what is irs form 8832? Web scroll down to the election for entity classification (form 8832) section; Choose your type of election 1. Web irs form 8832 (entity classification election) is the form an eligible business entity uses to elect federal income tax treatment other than its default.

![LLC taxed as CCorp (Form 8832) [Pros and cons] LLC University®](https://www.llcuniversity.com/wp-content/uploads/IRS-CP277-Form-8832-Approval.jpg)