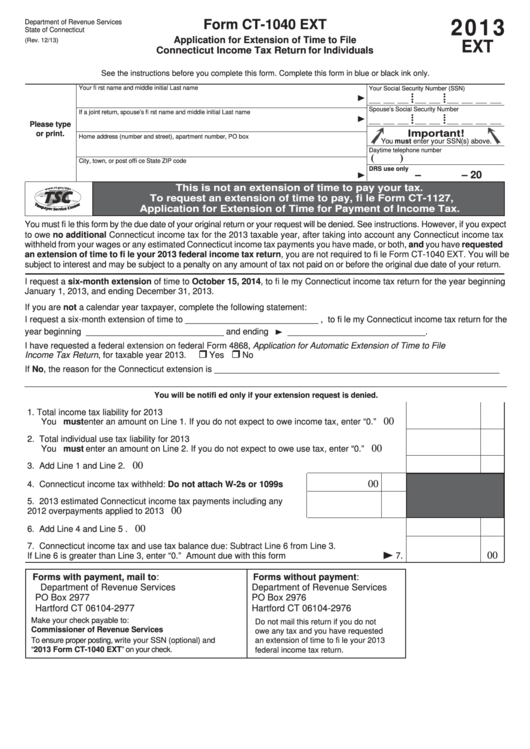

Ct Extension Form

Ct Extension Form - Or, you can request an extension electronically using webfile. If you are attending a school, college, or university outside of connecticut, you may apply for the six (6) month. Web 27 rows business tax credit summary. If you did not request an extension of time to file your federal income tax return,. Web students attending school and residing outside of connecticut: Web forms are divided into categories. Computation of interest due on underpayment of estimated tax (with instructions) 12/2022. You must file this form by the due date. Web federal extension has been requested on federal form 7004, application for an automatic extension of time to check file certain business income tax, information, and other. Click a specific link to see all forms in that category or use the search box below to search for a specific form by name, number, or keyword.

Simple, secure, and can be completed from the comfort of your home. If you are attending a school, college, or university outside of connecticut, you may apply for the six (6) month. Web forms are divided into categories. You must file this form by the due date. If you did not request an extension of time to file your federal income tax return,. Web federal extension has been requested on federal form 7004, application for an automatic extension of time to check file certain business income tax, information, and other. Computation of interest due on underpayment of estimated tax (with instructions) 12/2022. Click a specific link to see all forms in that category or use the search box below to search for a specific form by name, number, or keyword. Web 27 rows business tax credit summary. Web students attending school and residing outside of connecticut:

Having an additional extension of. Simple, secure, and can be completed from the comfort of your home. Benefits to electronic filing include: Or, you can request an extension electronically using webfile. Web 27 rows business tax credit summary. If you are attending a school, college, or university outside of connecticut, you may apply for the six (6) month. Web forms are divided into categories. Web students attending school and residing outside of connecticut: Web file your 2022 connecticut income tax return online! Click a specific link to see all forms in that category or use the search box below to search for a specific form by name, number, or keyword.

Tax extention filr ploratracks

Web file your 2022 connecticut income tax return online! Web forms are divided into categories. If you did not request an extension of time to file your federal income tax return,. Web 27 rows business tax credit summary. If you are attending a school, college, or university outside of connecticut, you may apply for the six (6) month.

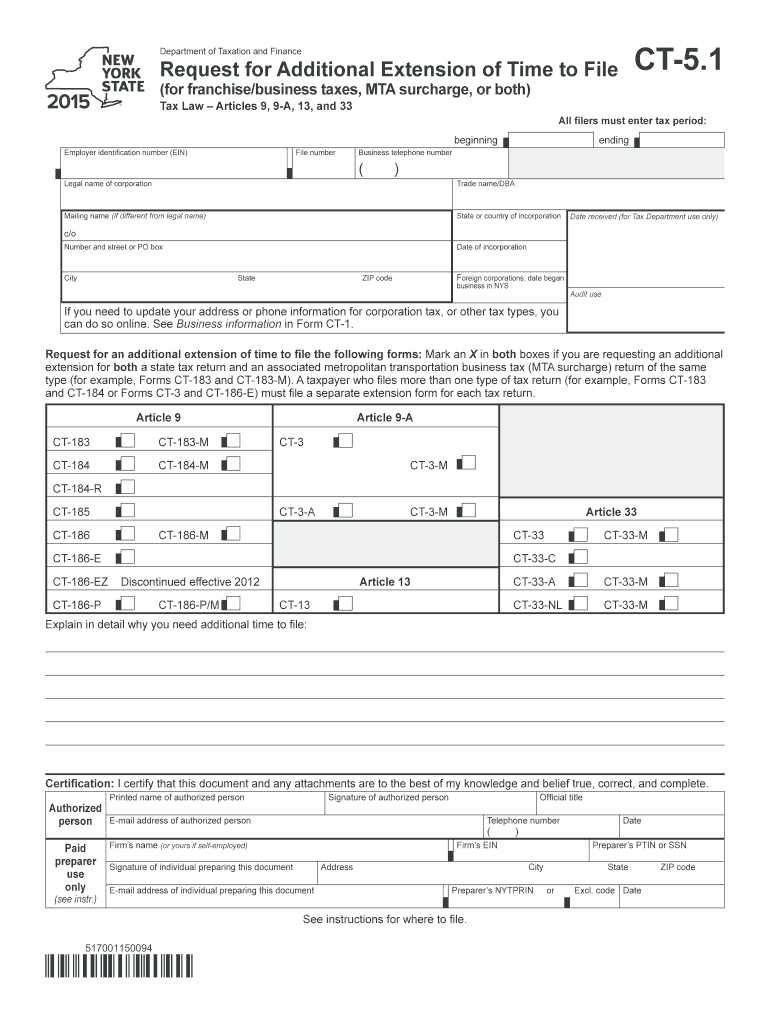

Form Ct 5 Fill Out and Sign Printable PDF Template signNow

Click a specific link to see all forms in that category or use the search box below to search for a specific form by name, number, or keyword. Simple, secure, and can be completed from the comfort of your home. Benefits to electronic filing include: Computation of interest due on underpayment of estimated tax (with instructions) 12/2022. Web students attending.

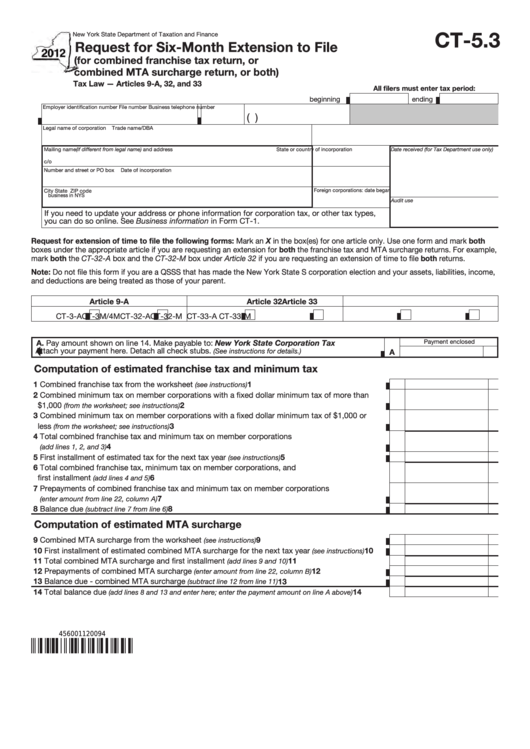

Form Ct5.3 Request For SixMonth Extension To File 2012 printable

If you are attending a school, college, or university outside of connecticut, you may apply for the six (6) month. Web forms are divided into categories. Click a specific link to see all forms in that category or use the search box below to search for a specific form by name, number, or keyword. Web file your 2022 connecticut income.

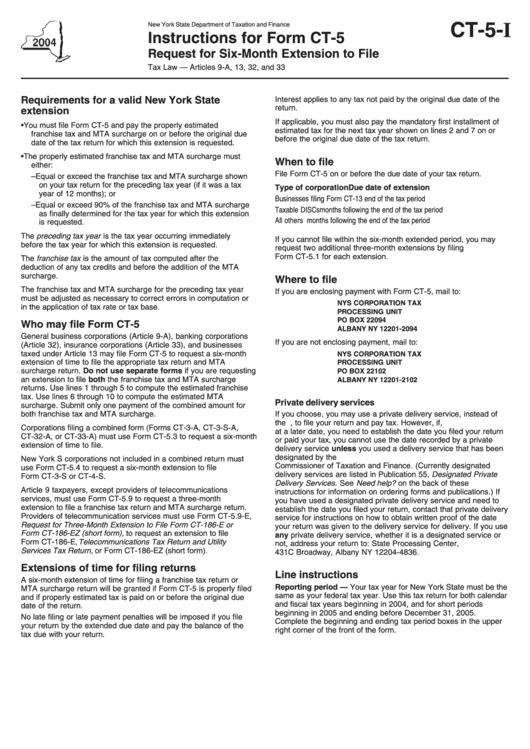

Instructions For Form Ct5 Request For SixMonth Extension To File

Web file your 2022 connecticut income tax return online! Web forms are divided into categories. Benefits to electronic filing include: Web students attending school and residing outside of connecticut: You must file this form by the due date.

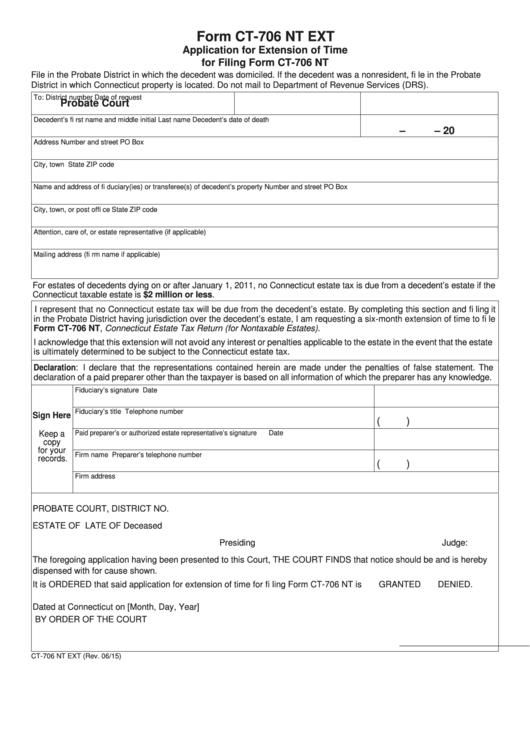

Form Ct706 Nt Ext Application For Extension Of Time For Filing Form

Having an additional extension of. Web federal extension has been requested on federal form 7004, application for an automatic extension of time to check file certain business income tax, information, and other. Web forms are divided into categories. You must file this form by the due date. Web file your 2022 connecticut income tax return online!

Pressurerated extension tube line set for power injection of CT

You must file this form by the due date. If you did not request an extension of time to file your federal income tax return,. Computation of interest due on underpayment of estimated tax (with instructions) 12/2022. Web file your 2022 connecticut income tax return online! Benefits to electronic filing include:

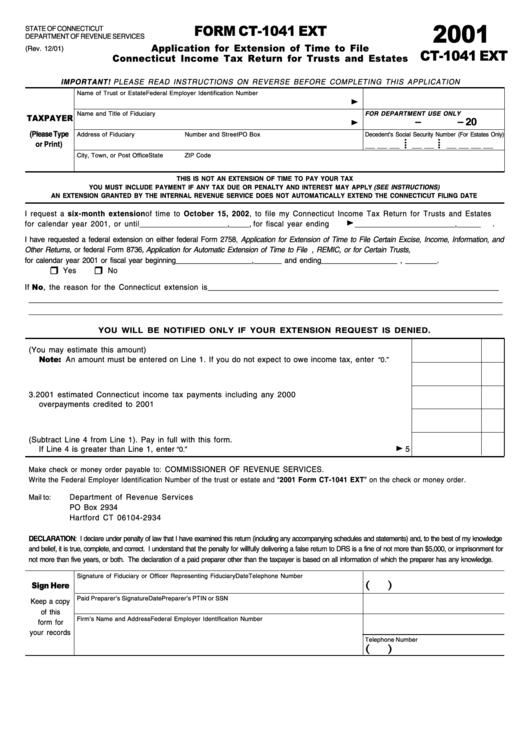

Form Ct1041 Ext Application For Extension Of Time To File

If you did not request an extension of time to file your federal income tax return,. Web forms are divided into categories. You must file this form by the due date. Web students attending school and residing outside of connecticut: Having an additional extension of.

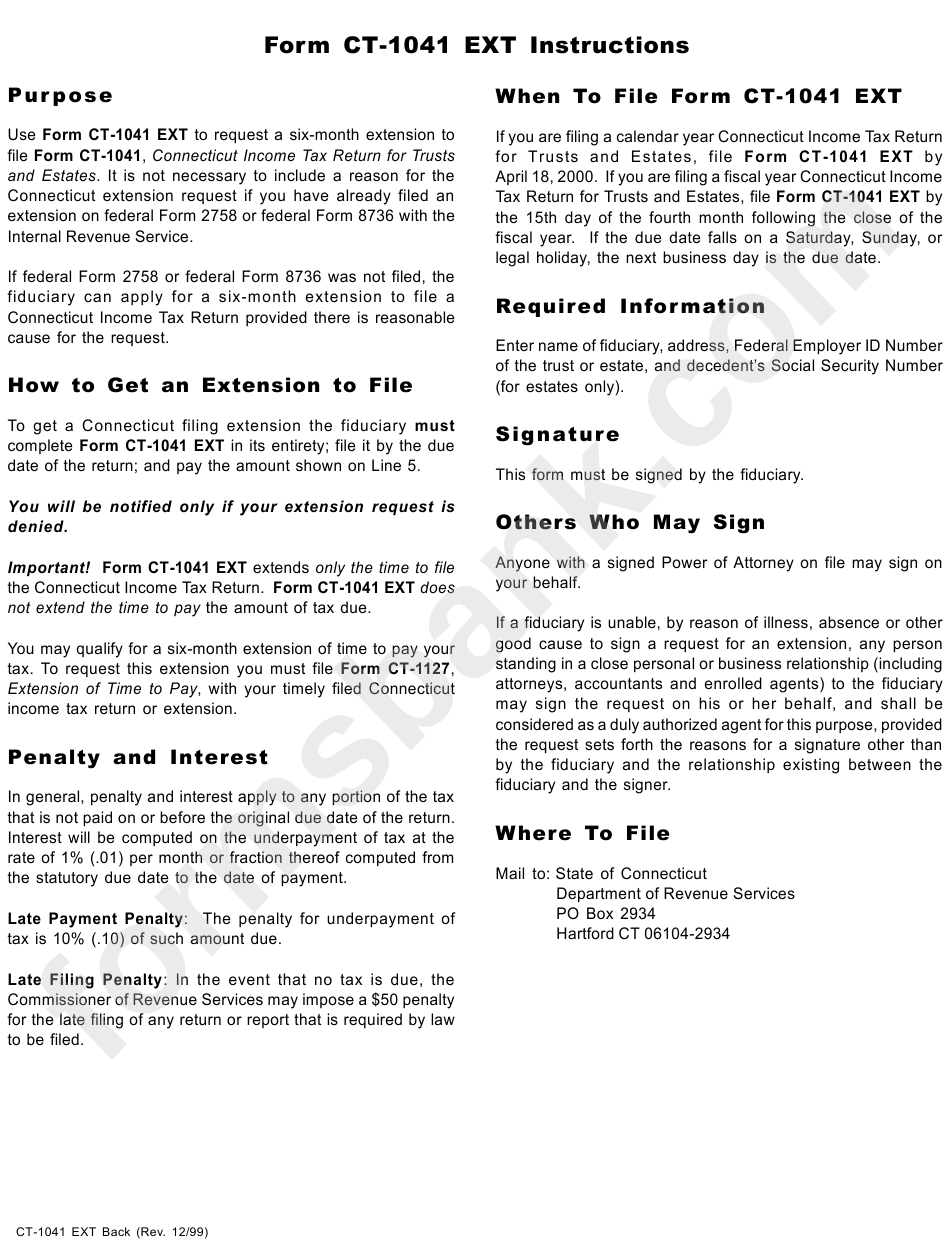

Form Ct1041 Ext Instructions printable pdf download

If you are attending a school, college, or university outside of connecticut, you may apply for the six (6) month. Or, you can request an extension electronically using webfile. Web file your 2022 connecticut income tax return online! If you did not request an extension of time to file your federal income tax return,. Having an additional extension of.

Megger 246033 CT Extension Cable, 20 ft (6 m) TEquipment

Benefits to electronic filing include: Simple, secure, and can be completed from the comfort of your home. Web forms are divided into categories. Web students attending school and residing outside of connecticut: Click a specific link to see all forms in that category or use the search box below to search for a specific form by name, number, or keyword.

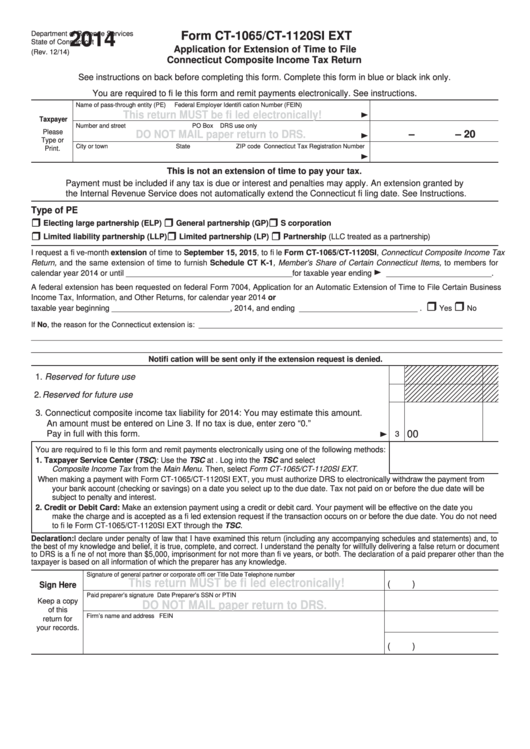

Form Ct1065/ct1120si Ext Application For Extension Of Time To File

If you did not request an extension of time to file your federal income tax return,. If you are attending a school, college, or university outside of connecticut, you may apply for the six (6) month. Benefits to electronic filing include: Web federal extension has been requested on federal form 7004, application for an automatic extension of time to check.

Web Students Attending School And Residing Outside Of Connecticut:

Simple, secure, and can be completed from the comfort of your home. Benefits to electronic filing include: Web 27 rows business tax credit summary. Computation of interest due on underpayment of estimated tax (with instructions) 12/2022.

You Must File This Form By The Due Date.

Click a specific link to see all forms in that category or use the search box below to search for a specific form by name, number, or keyword. If you did not request an extension of time to file your federal income tax return,. Web file your 2022 connecticut income tax return online! Having an additional extension of.

Web Federal Extension Has Been Requested On Federal Form 7004, Application For An Automatic Extension Of Time To Check File Certain Business Income Tax, Information, And Other.

Or, you can request an extension electronically using webfile. Web forms are divided into categories. If you are attending a school, college, or university outside of connecticut, you may apply for the six (6) month.