Ct Tax Exempt Form

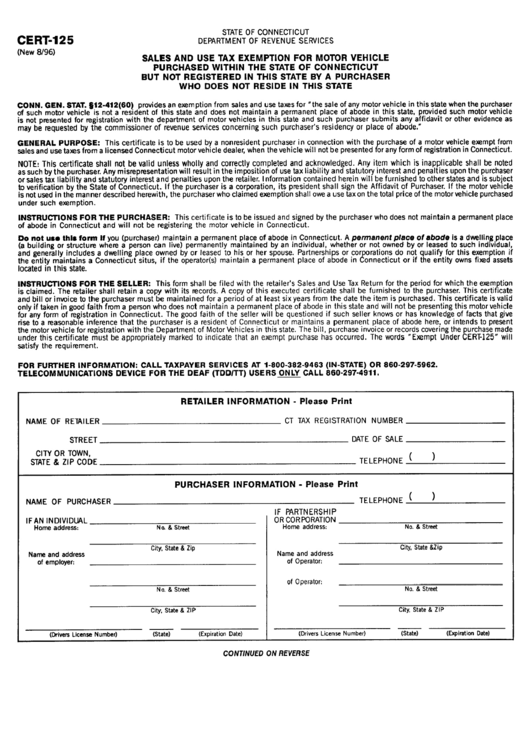

Ct Tax Exempt Form - Sales and use tax exemption for purchases by qualifying governmental agencies : If any of these links are broken, or you can't find the form you need, please let us know. Web connecticut, charges for those materials, tools, and fuel when used as indicated above are not subject to sales and use taxes. Agricultural exemption for items sold exclusively for use in agricultural production: Contractor's exempt purchase certificate for a renovation contract with a direct payment permit holder: Web to determine the portion of their income subject to connecticut’s income tax (ct agi). Name of exempt entity address ct tax registration number federal employer id number (if none, explain.) address of project type of exempt entity (see instructions.) r connecticut state government: Web tangible personal property exempt from sales and use taxes under the statutory authority listed in the instructions. Both taxable and nontaxable sales must be reported in accordance with your monthly, quarterly, or annual filing frequency assigned by the department of revenue services (drs). A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the connecticut sales tax.

Web to determine the portion of their income subject to connecticut’s income tax (ct agi). Contractor's exempt purchase certificate for a renovation contract with a direct payment permit holder: A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the connecticut sales tax. Sales and use tax exemption for purchases made under the buy connecticut provision : Both taxable and nontaxable sales must be reported in accordance with your monthly, quarterly, or annual filing frequency assigned by the department of revenue services (drs). Web connecticut, charges for those materials, tools, and fuel when used as indicated above are not subject to sales and use taxes. Web for a complete list of sales exempt from connecticut sales and use taxes, refer to the connecticut general statutes. Web tangible personal property exempt from sales and use taxes under the statutory authority listed in the instructions. Agricultural exemption for items sold exclusively for use in agricultural production: Web general sales tax exemption certificate.

Both taxable and nontaxable sales must be reported in accordance with your monthly, quarterly, or annual filing frequency assigned by the department of revenue services (drs). If your organization wants to be exempt from federal income tax, the organization must apply to the internal revenue service. You can find resale certificates for other states here. Web tangible personal property exempt from sales and use taxes under the statutory authority listed in the instructions. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the connecticut sales tax. Sales and use tax exemption for purchases made under the buy connecticut provision : Web general sales tax exemption certificate. If any of these links are broken, or you can't find the form you need, please let us know. Name of exempt entity address ct tax registration number federal employer id number (if none, explain.) address of project type of exempt entity (see instructions.) r connecticut state government: Agricultural exemption for items sold exclusively for use in agricultural production:

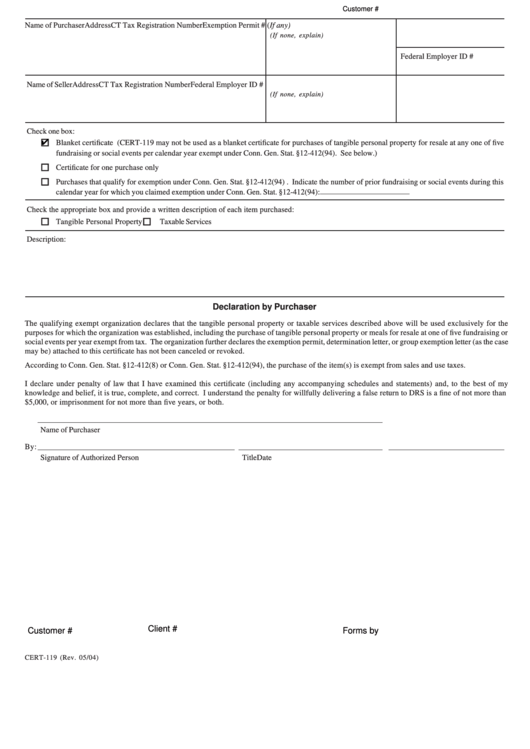

Fillable Cert119, Connecticut Tax Exempt Form printable pdf download

Agricultural exemption for items sold exclusively for use in agricultural production: Web for a complete list of sales exempt from connecticut sales and use taxes, refer to the connecticut general statutes. If your organization wants to be exempt from federal income tax, the organization must apply to the internal revenue service. Both taxable and nontaxable sales must be reported in.

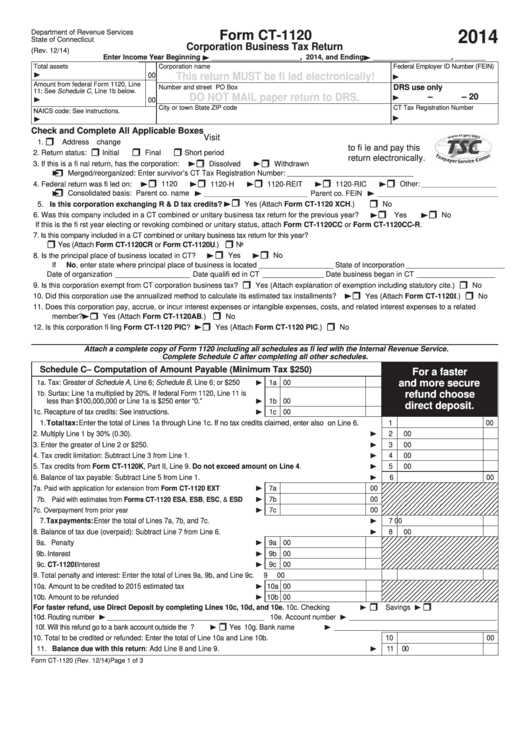

Form Ct1120 Corporation Business Tax Return Connecticut Department

Web for a complete list of sales exempt from connecticut sales and use taxes, refer to the connecticut general statutes. Agricultural exemption for items sold exclusively for use in agricultural production: Name of exempt entity address ct tax registration number federal employer id number (if none, explain.) address of project type of exempt entity (see instructions.) r connecticut state government:.

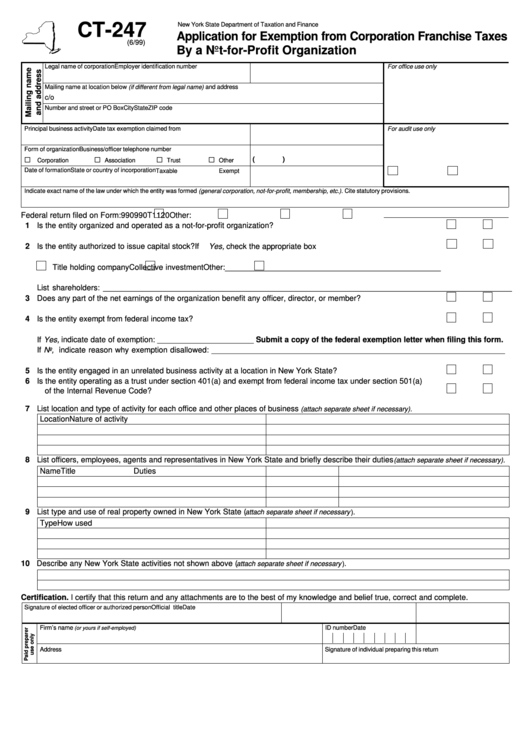

Form Ct247 Application For Exemption From Corporation Franchise

You can find resale certificates for other states here. For some filers, this amount is further reduced by a personal exemption. Web general sales tax exemption certificate. If your organization wants to be exempt from federal income tax, the organization must apply to the internal revenue service. Agricultural exemption for items sold exclusively for use in agricultural production:

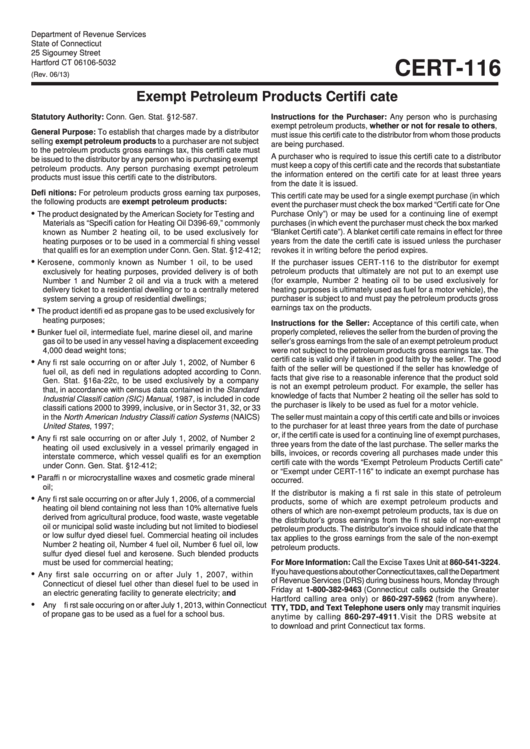

Top 60 Ct Tax Exempt Form Templates free to download in PDF format

Both taxable and nontaxable sales must be reported in accordance with your monthly, quarterly, or annual filing frequency assigned by the department of revenue services (drs). Web general sales tax exemption certificate. If the materials, tools, or fuel are not used in the manner described above, a purchaser who claimed an exemption owes use tax on the total price of.

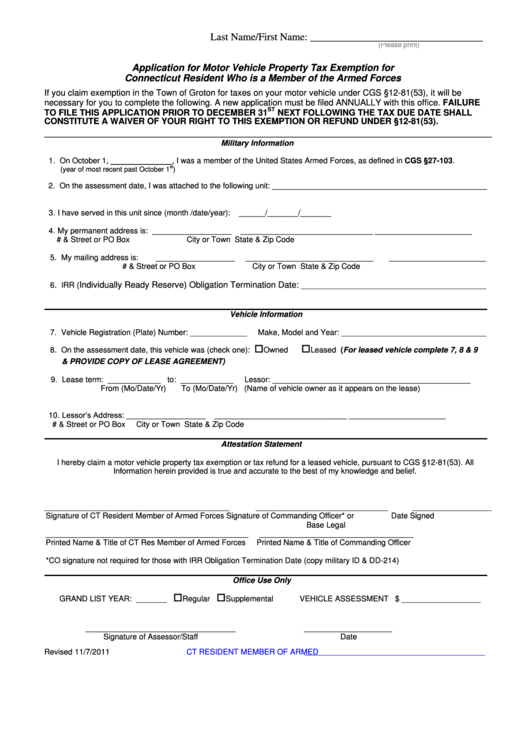

Application For Motor Vehicle Property Tax Exemption For Connecticut

If any of these links are broken, or you can't find the form you need, please let us know. Web tangible personal property exempt from sales and use taxes under the statutory authority listed in the instructions. Contractor's exempt purchase certificate for a renovation contract with a direct payment permit holder: Web we have six connecticut sales tax exemption forms.

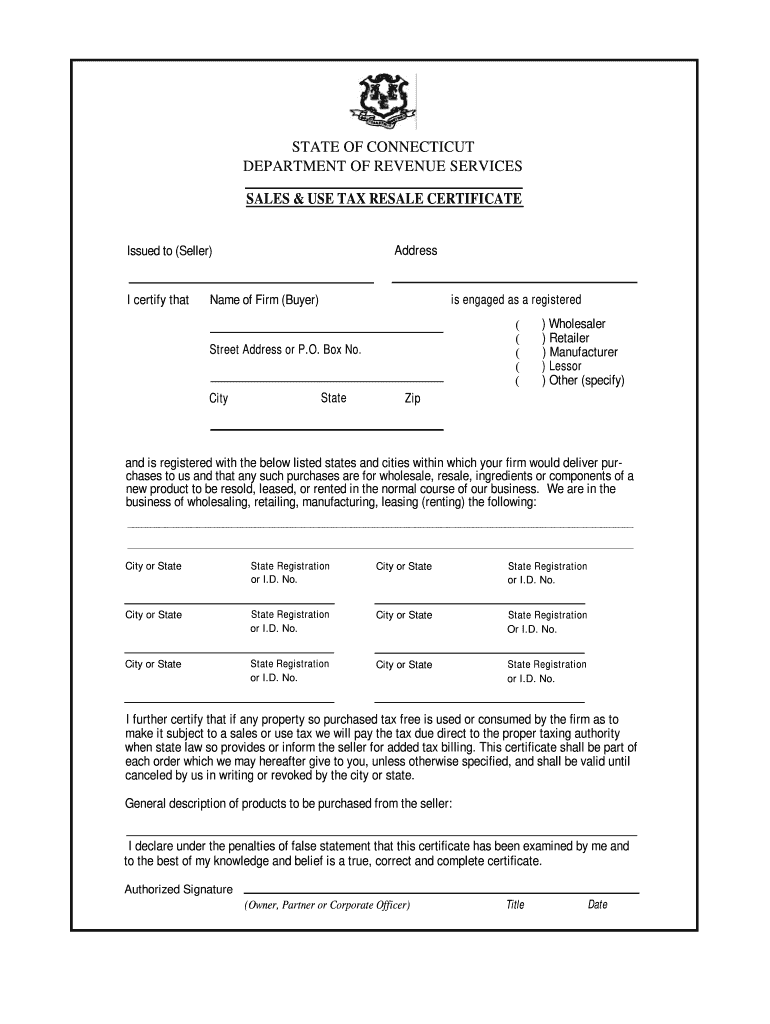

Ct Sales And Use Tax Resale Certificate Fillable Tax Walls

Taxpayers then apply tax rates based on the tax bracket income thresholds. If your organization wants to be exempt from federal income tax, the organization must apply to the internal revenue service. Web we have six connecticut sales tax exemption forms available for you to print or save as a pdf file. Web tangible personal property exempt from sales and.

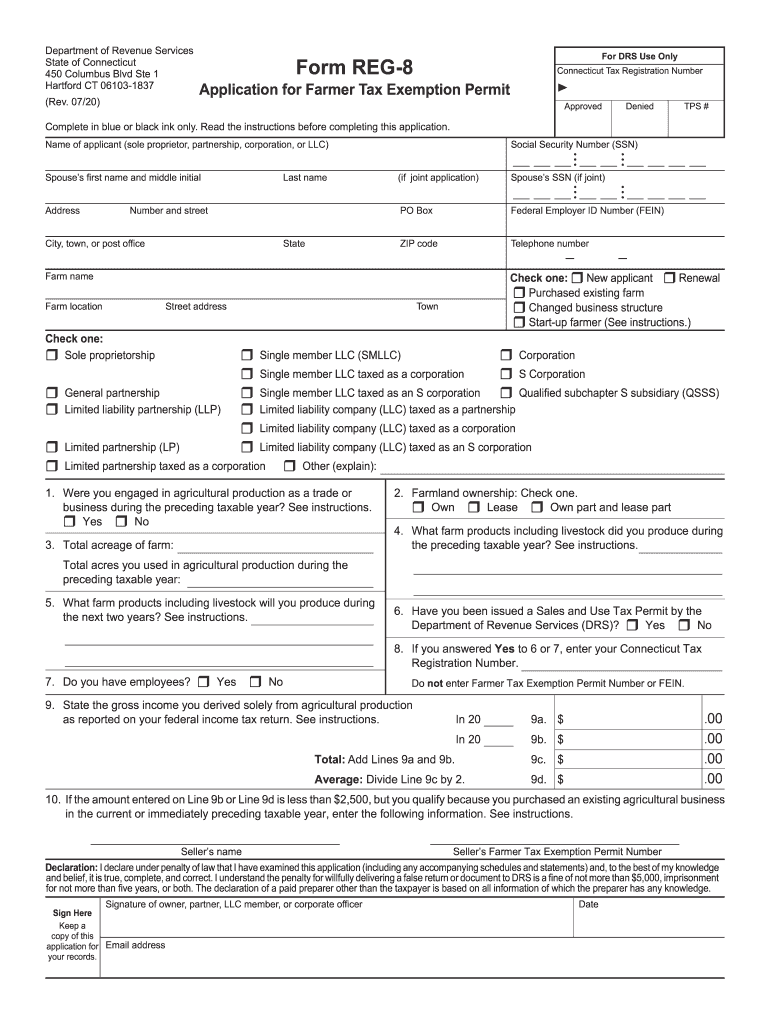

CT REG8 2020 Fill out Tax Template Online US Legal Forms

Web tangible personal property exempt from sales and use taxes under the statutory authority listed in the instructions. Web we have six connecticut sales tax exemption forms available for you to print or save as a pdf file. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt.

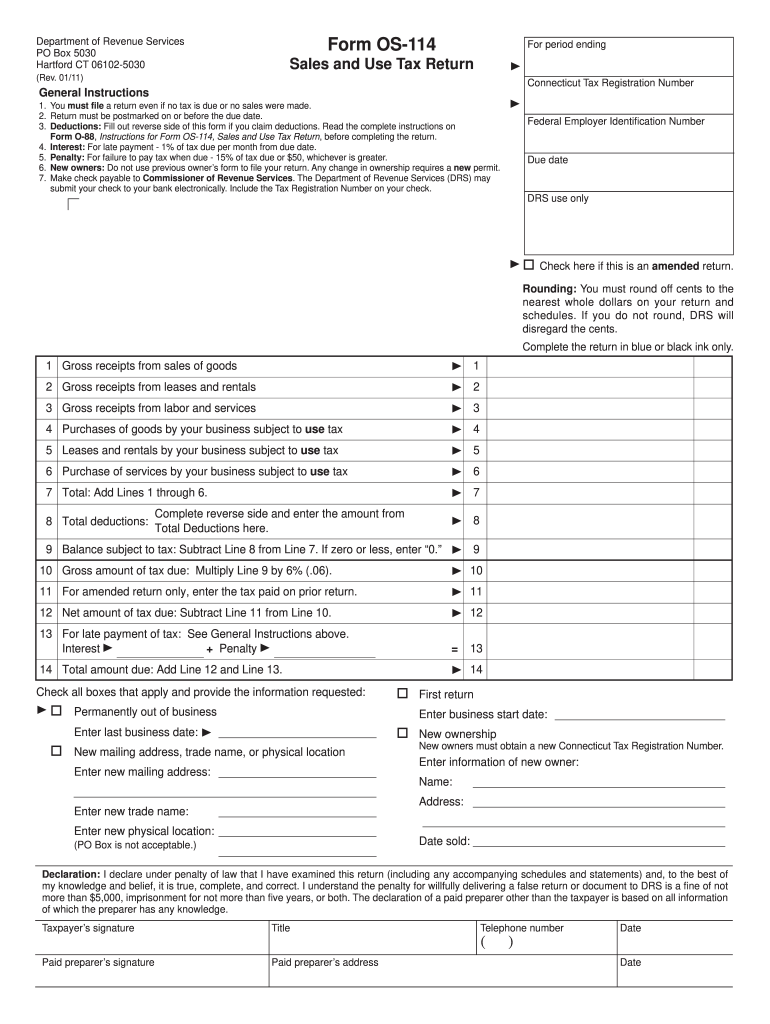

Ct Tax Form 0s 114 Fill Out and Sign Printable PDF Template signNow

Contractor's exempt purchase certificate for a renovation contract with a direct payment permit holder: Web connecticut, charges for those materials, tools, and fuel when used as indicated above are not subject to sales and use taxes. You can find resale certificates for other states here. Web for a complete list of sales exempt from connecticut sales and use taxes, refer.

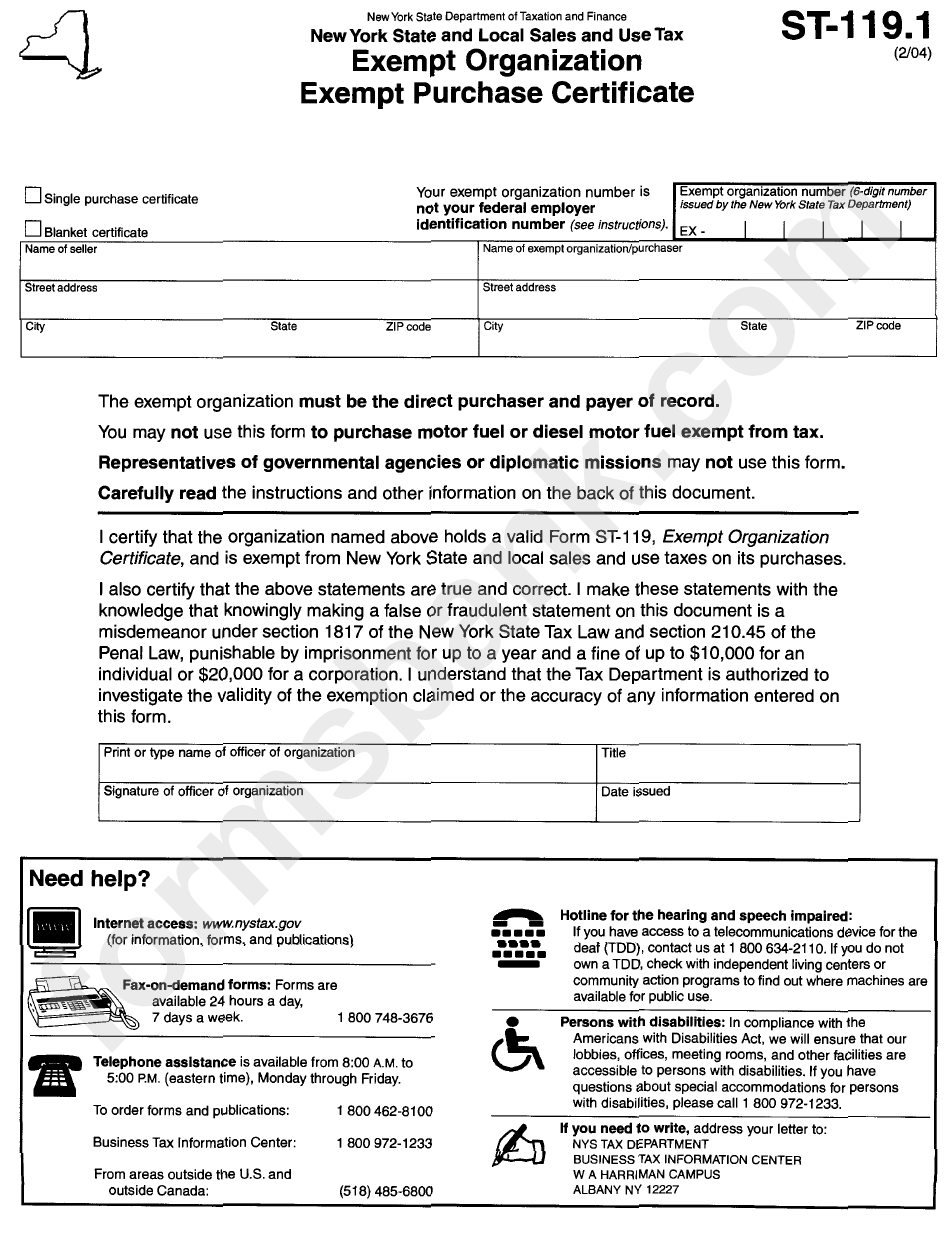

St119.1 Exempt Purchase Certificate printable pdf download

Web we have six connecticut sales tax exemption forms available for you to print or save as a pdf file. Sales and use tax exemption for purchases by qualifying governmental agencies : Web tangible personal property exempt from sales and use taxes under the statutory authority listed in the instructions. Agricultural exemption for items sold exclusively for use in agricultural.

Ct Sales And Use Tax Exempt Form 2023

Name of exempt entity address ct tax registration number federal employer id number (if none, explain.) address of project type of exempt entity (see instructions.) r connecticut state government: If the materials, tools, or fuel are not used in the manner described above, a purchaser who claimed an exemption owes use tax on the total price of any items purchased.

Web To Determine The Portion Of Their Income Subject To Connecticut’s Income Tax (Ct Agi).

Web connecticut, charges for those materials, tools, and fuel when used as indicated above are not subject to sales and use taxes. If your organization wants to be exempt from federal income tax, the organization must apply to the internal revenue service. Web we have six connecticut sales tax exemption forms available for you to print or save as a pdf file. Sales and use tax exemption for purchases by qualifying governmental agencies :

Both Taxable And Nontaxable Sales Must Be Reported In Accordance With Your Monthly, Quarterly, Or Annual Filing Frequency Assigned By The Department Of Revenue Services (Drs).

Agricultural exemption for items sold exclusively for use in agricultural production: Web tangible personal property exempt from sales and use taxes under the statutory authority listed in the instructions. Web general sales tax exemption certificate. Web for a complete list of sales exempt from connecticut sales and use taxes, refer to the connecticut general statutes.

You Can Find Resale Certificates For Other States Here.

For some filers, this amount is further reduced by a personal exemption. If the materials, tools, or fuel are not used in the manner described above, a purchaser who claimed an exemption owes use tax on the total price of any items purchased under this exemption. Sales and use tax exemption for purchases made under the buy connecticut provision : Taxpayers then apply tax rates based on the tax bracket income thresholds.

Contractor's Exempt Purchase Certificate For A Renovation Contract With A Direct Payment Permit Holder:

Name of exempt entity address ct tax registration number federal employer id number (if none, explain.) address of project type of exempt entity (see instructions.) r connecticut state government: A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the connecticut sales tax. If any of these links are broken, or you can't find the form you need, please let us know.