Dallas Appraisal District Homestead Exemption Form

Dallas Appraisal District Homestead Exemption Form - You must own and occupy the. Web property tax exemptions protest guide personal property tax download appraisal district forms section talking points pdf form reader homeowner exemption forms. Your home could also be eligible for a. For homestead exemptions other than the age 65 and over or disabled person homestead exemptions provided in tax code §11.13(c) and (d), you. Web check to apply for a homestead exemption. First of all, to apply online, you. You may search for your account by owner, by account or by address. Web there is a mandatory residential homestead exemption of $3,000 for counties and $25,000 for school districts. Property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in. Web 2949 north stemmons freeway dallas, texas 75247 lockbox for document drop off located at main entrance on west side of building you may call us at the following numbers.

Property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in. A texas homeowner may file a late county appraisal. Web the residence homestead exemption application form is available from the details page of your account. Filing an application is free and only needs to be filed once. Attach the completed and notarized affidavit to your residence homestead exemption application for filing with the appraisal district office in each. Armed forces are eligible for an exemption of the first $5,000 on the appraised value of their. You may search for your account by owner, by account or by address. You must own and occupy the. Web general residence homestead exemption application for 2023: Web 2949 north stemmons freeway dallas, texas 75247 lockbox for document drop off located at main entrance on west side of building you may call us at the following numbers.

See the explanation of exemptions for more information. Filing an application is free and only needs to be filed once. A texas homeowner may file a late county appraisal. No fee is charged to process this application. You must own and occupy the. Web surviving spouses and minor children of a person who dies on active duty in the u.s. Web the typical deadline for filing a county appraisal district homestead exemption application is between january 1 and april 30. Web property tax exemptions protest guide personal property tax download appraisal district forms section talking points pdf form reader homeowner exemption forms. Web check to apply for a homestead exemption. Web general residence homestead exemption application for 2023:

Dallas Central Appraisal District The Protest Process

See the explanation of exemptions for more information. Armed forces are eligible for an exemption of the first $5,000 on the appraised value of their. Web appraisal district phone number website; Property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in. You may be eligible to apply.

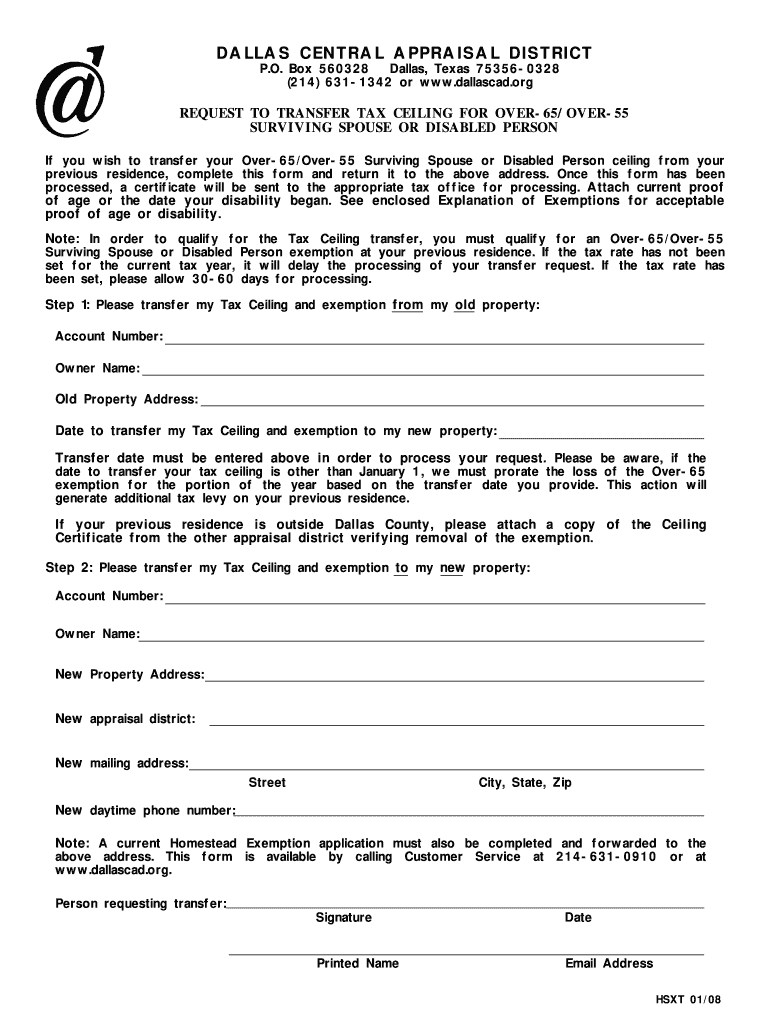

Dallascad Fill Out and Sign Printable PDF Template signNow

Web the residence homestead exemption application form is available from the details page of your account. Web pollution control property motor vehicle used for production of income and for personal activities appointment of tax consultants homeowner exemptions residence. You must own and occupy the. Your home could also be eligible for a. Complete, edit or print tax forms instantly.

Homestead Exemption Form Fort Bend County by REMAX Integrity Issuu

Web late filing benefits of exemptions heir property 11.35 disaster exemption other exemptions disabled veteran or survivors of a disabled veteran tax deferral for 65 or. You must own and occupy the. Attach the completed and notarized affidavit to your residence homestead exemption application for filing with the appraisal district office in each. You may search for your account by.

Texas Application for Residence Homestead Exemption Residence

Armed forces are eligible for an exemption of the first $5,000 on the appraised value of their. Filing an application is free and only needs to be filed once. Web late filing benefits of exemptions heir property 11.35 disaster exemption other exemptions disabled veteran or survivors of a disabled veteran tax deferral for 65 or. Your home could also be.

Homestead exemption form

Web the residence homestead exemption application form is available from the details page of your account. See the explanation of exemptions for more information. Web the typical deadline for filing a county appraisal district homestead exemption application is between january 1 and april 30. Web residence homestead exemption application for. Web appraisal district phone number website;

homestead exemption texas Fill out & sign online DocHub

Attach the completed and notarized affidavit to your residence homestead exemption application for filing with the appraisal district office in each. First of all, to apply online, you. You may search for your account by owner, by account or by address. Web the residence homestead exemption application form is available from the details page of your account. For homestead exemptions.

Appraisal appeal deadline approaches for Dallas homeowners

Complete, edit or print tax forms instantly. You may search for your account by owner, by account or by address. Armed forces are eligible for an exemption of the first $5,000 on the appraised value of their. Web check to apply for a homestead exemption. Web late filing benefits of exemptions heir property 11.35 disaster exemption other exemptions disabled veteran.

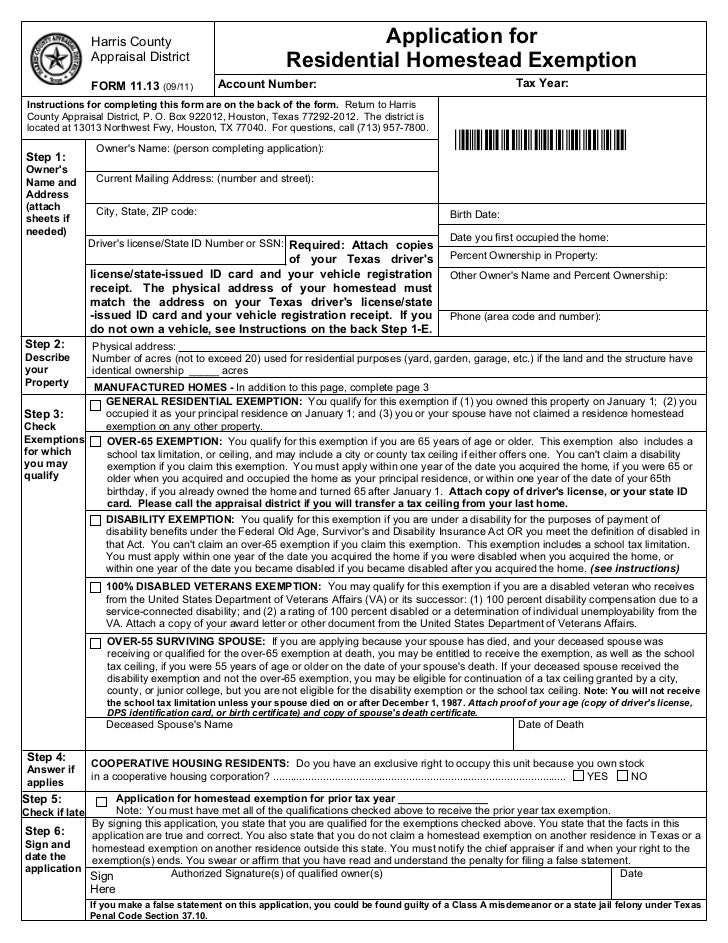

Form 11 13 Download Printable PDF Or Fill Online Application For

Web general residence homestead exemption application for 2023: Web pollution control property motor vehicle used for production of income and for personal activities appointment of tax consultants homeowner exemptions residence. For homestead exemptions other than the age 65 and over or disabled person homestead exemptions provided in tax code §11.13(c) and (d), you. Property owners applying for a residence homestead.

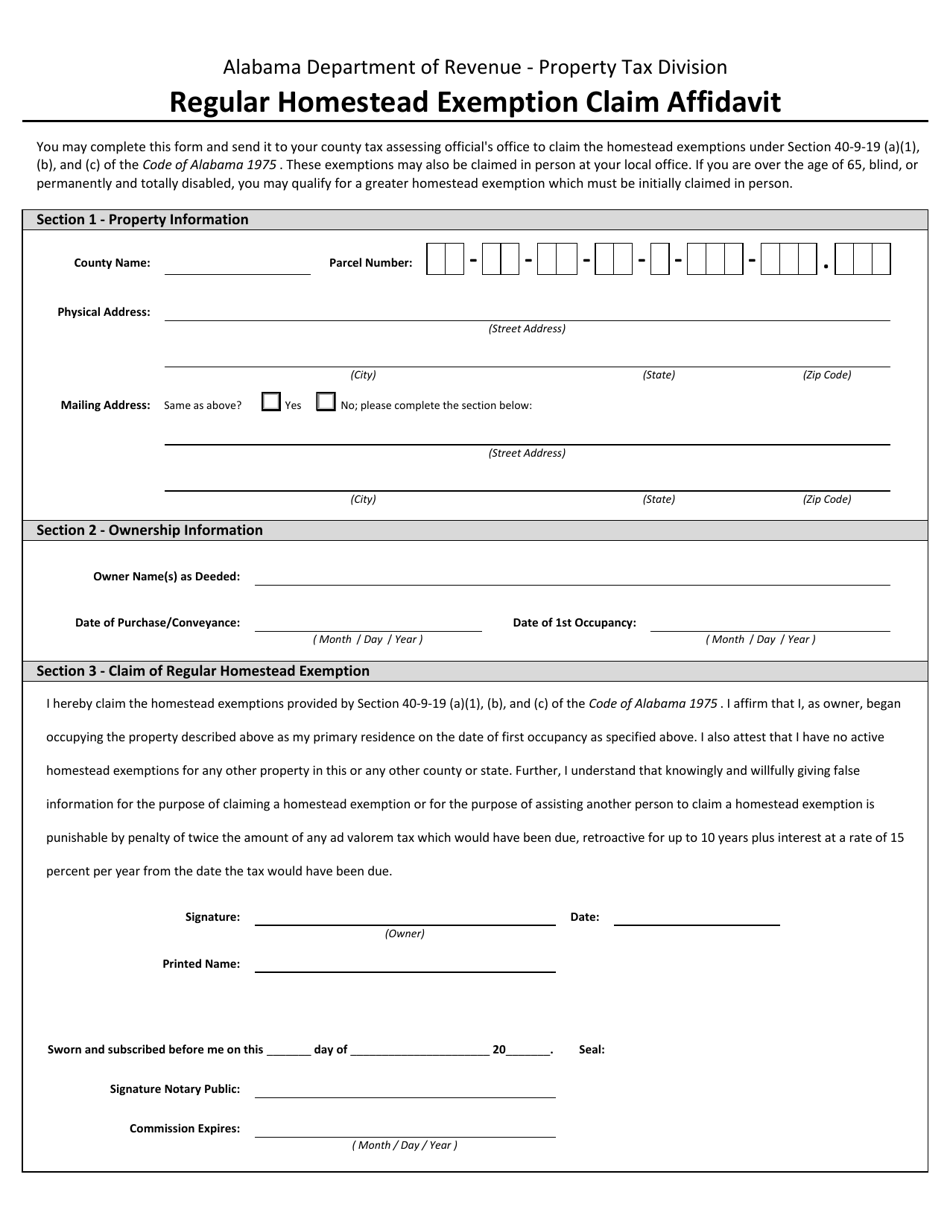

Alabama Regular Homestead Exemption Claim Affidavit Download Fillable

Web the residence homestead exemption application form is available from the details page of your account. For homestead exemptions other than the age 65 and over or disabled person homestead exemptions provided in tax code §11.13(c) and (d), you. You may be eligible to apply. Web property tax exemptions protest guide personal property tax download appraisal district forms section talking.

How To File Homestead Exemption 🏠 Dallas County YouTube

First of all, to apply online, you. Web below is information on the homestead qualified so that the homeowner may transfer the same percentage of tax paid to a new qualified homestead in this taxing unit. Web residence homestead exemption application for. Your home could also be eligible for a. Web the typical deadline for filing a county appraisal district.

You May Search For Your Account By Owner, By Account Or By Address.

You may search for your account by owner, by account or by address. You may be eligible to apply. Web there is a mandatory residential homestead exemption of $3,000 for counties and $25,000 for school districts. A texas homeowner may file a late county appraisal.

Property Owners Applying For A Residence Homestead Exemption File This Form And Supporting Documentation With The Appraisal District In.

Web to apply for a homestead exemption, you need to submit an application with your county appraisal district. Web general residence homestead exemption application for 2023: First of all, to apply online, you. Web surviving spouses and minor children of a person who dies on active duty in the u.s.

Web The Residence Homestead Exemption Application Form Is Available From The Details Page Of Your Account.

Web pollution control property motor vehicle used for production of income and for personal activities appointment of tax consultants homeowner exemptions residence. Web property tax exemptions protest guide personal property tax download appraisal district forms section talking points pdf form reader homeowner exemption forms. Web late filing benefits of exemptions heir property 11.35 disaster exemption other exemptions disabled veteran or survivors of a disabled veteran tax deferral for 65 or. Filing an application is free and only needs to be filed once.

Web 2949 North Stemmons Freeway Dallas, Texas 75247 Lockbox For Document Drop Off Located At Main Entrance On West Side Of Building You May Call Us At The Following Numbers.

Your home could also be eligible for a. No fee is charged to process this application. Web below is information on the homestead qualified so that the homeowner may transfer the same percentage of tax paid to a new qualified homestead in this taxing unit. Web appraisal district phone number website;