Does A Single Member Llc Need To File Form 568

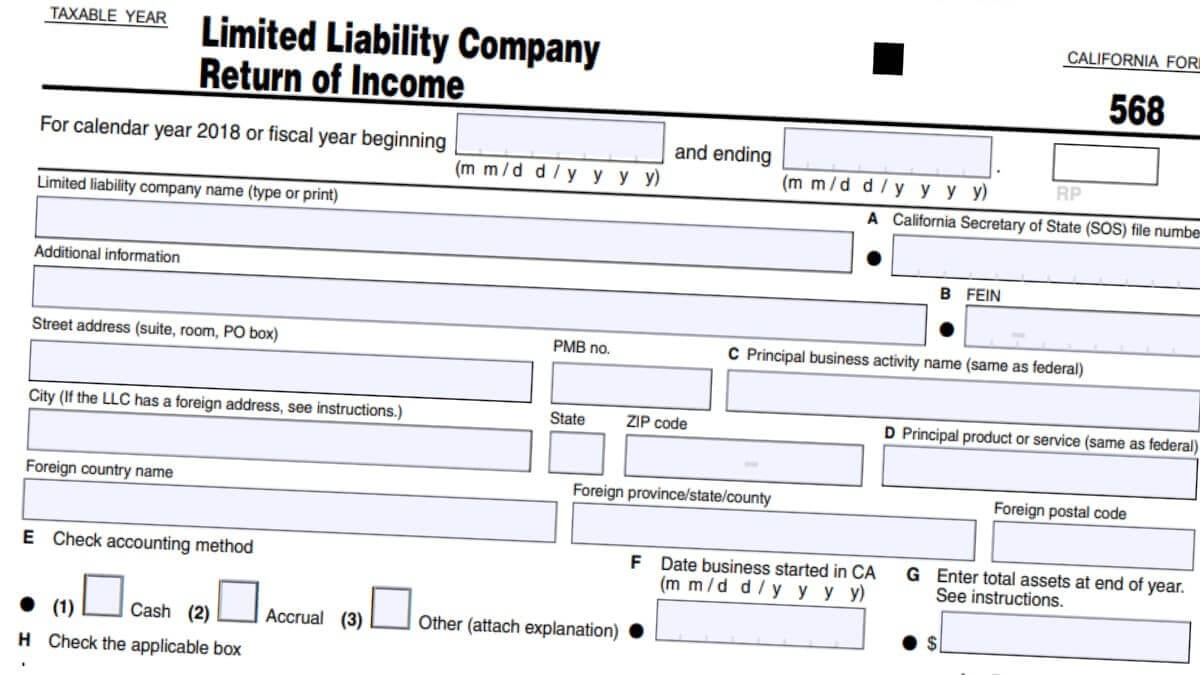

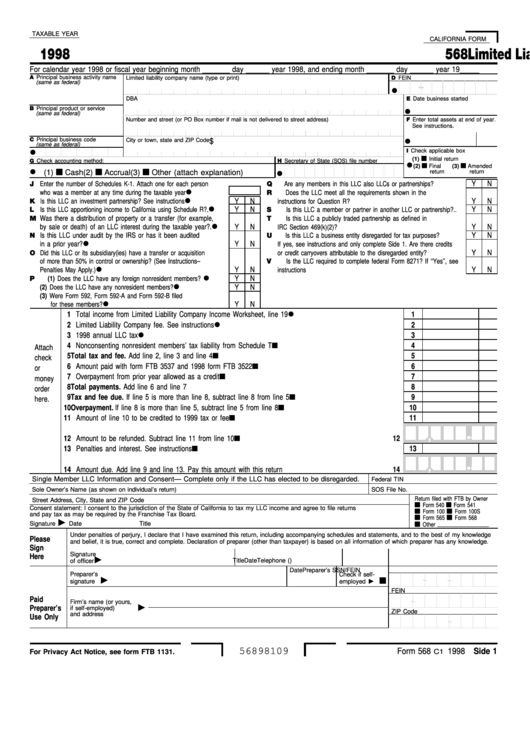

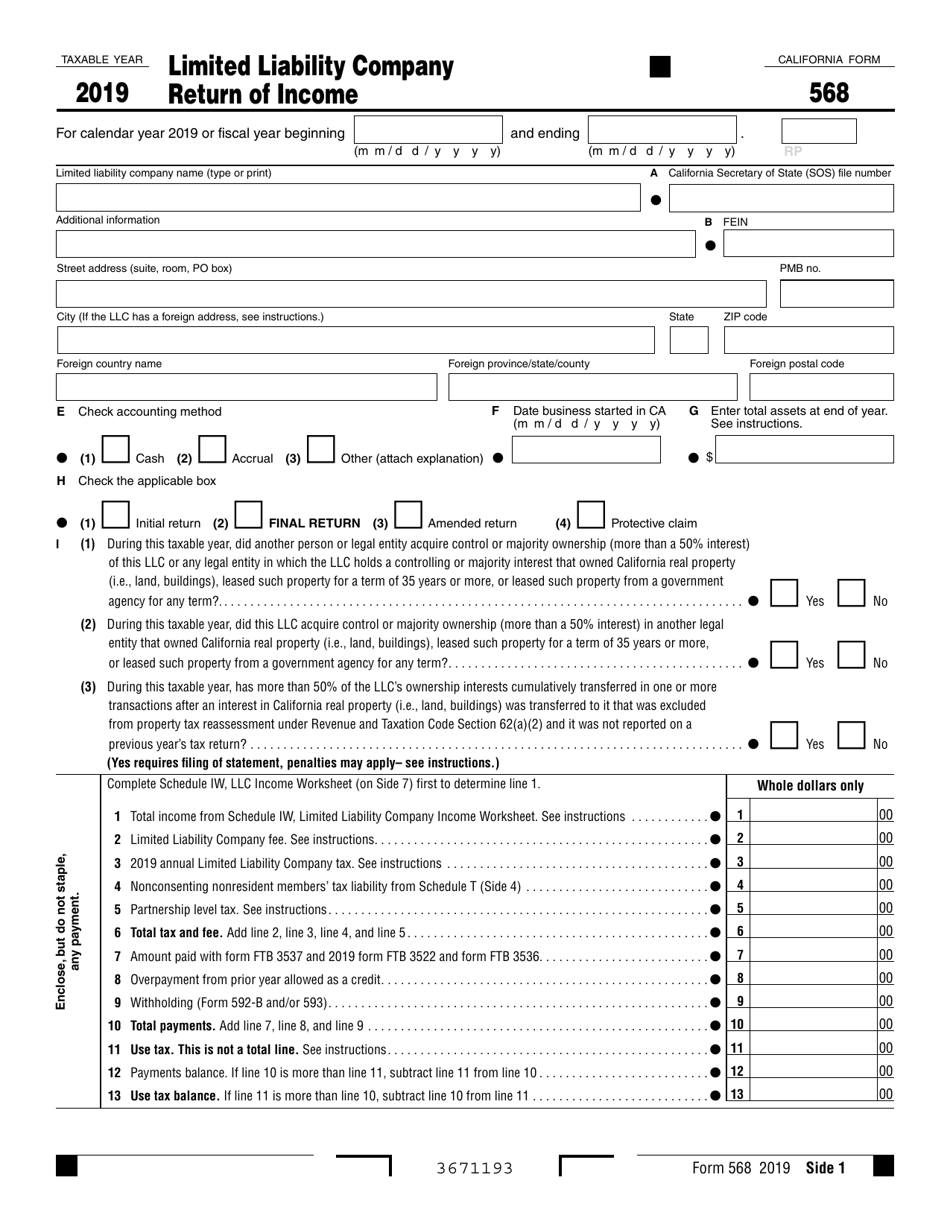

Does A Single Member Llc Need To File Form 568 - Web a single member limited liability company (smllc) is considered disregarded for federal income tax purposes. Per the ca website limited liability. Just pay state filing fees. Per the ca ftb limited liability. Web form 568 is a tax return that many california limited liability companies (llcs) must file. Web form 568 accounts for the income, withholding, coverages, taxes, and additional financial elements of your private limited liability company, or llc. Web common questions about partnership ca form 568 for single member llcs. Below are solutions to frequently. This llc is owned and operated by a single person. The llc did not conduct business in the state during the 15 day period.

Web form 568 accounts for the income, withholding, coverages, taxes, and additional financial elements of your private limited liability company, or llc. Web open the federal 1040 return.; Web a single member limited liability company (smllc) is considered disregarded for federal income tax purposes. Web 568 2020 limited liability company tax booklet members of the franchise tax board betty t. Web while a single member llc does not file california form 565, they must file california form 568 which provides details about the llc. Web if your llc has one owner, you're a single member limited liability company (smllc). Below are solutions to frequently. Web form 568 is a tax return that many california limited liability companies (llcs) must file. Per the ca ftb limited liability. Web the llc’s taxable year is 15 days or less.

However, a single member llc only needs to. Web if your llc has one owner, you're a single member limited liability company (smllc). Below are solutions to frequently. Web disregarded single member limited liability companies still must file form 568, although they only need to complete a small portion of it. Web while a single member llc does not file california form 565, they must file california form 568 which provides details about the llc. Ad protect your personal assets with a free llc—just pay state filing fees. Web form 568 accounts for the income, withholding, coverages, taxes, and additional financial elements of your private limited liability company, or llc. Complete schedule iw, llc income worksheet (on. The llc did not conduct business in the state during the 15 day period. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023)

Form 568 2019 Fill Out, Sign Online and Download Fillable PDF

Web form 568 is a tax return that many california limited liability companies (llcs) must file. Below are solutions to frequently. Per the ca website limited liability. Web the llc’s taxable year is 15 days or less. While similar to a sole proprietorship, this llc provides additional tax benefits and.

2012 Form 568 Limited Liability Company Return Of Edit, Fill

An llc may be classified for tax purposes as a partnership, a. Web if your llc has one owner, you're a single member limited liability company (smllc). Llcs classified as a disregarded entity or. Web a single member limited liability company (smllc) is considered disregarded for federal income tax purposes. Complete schedule iw, llc income worksheet (on.

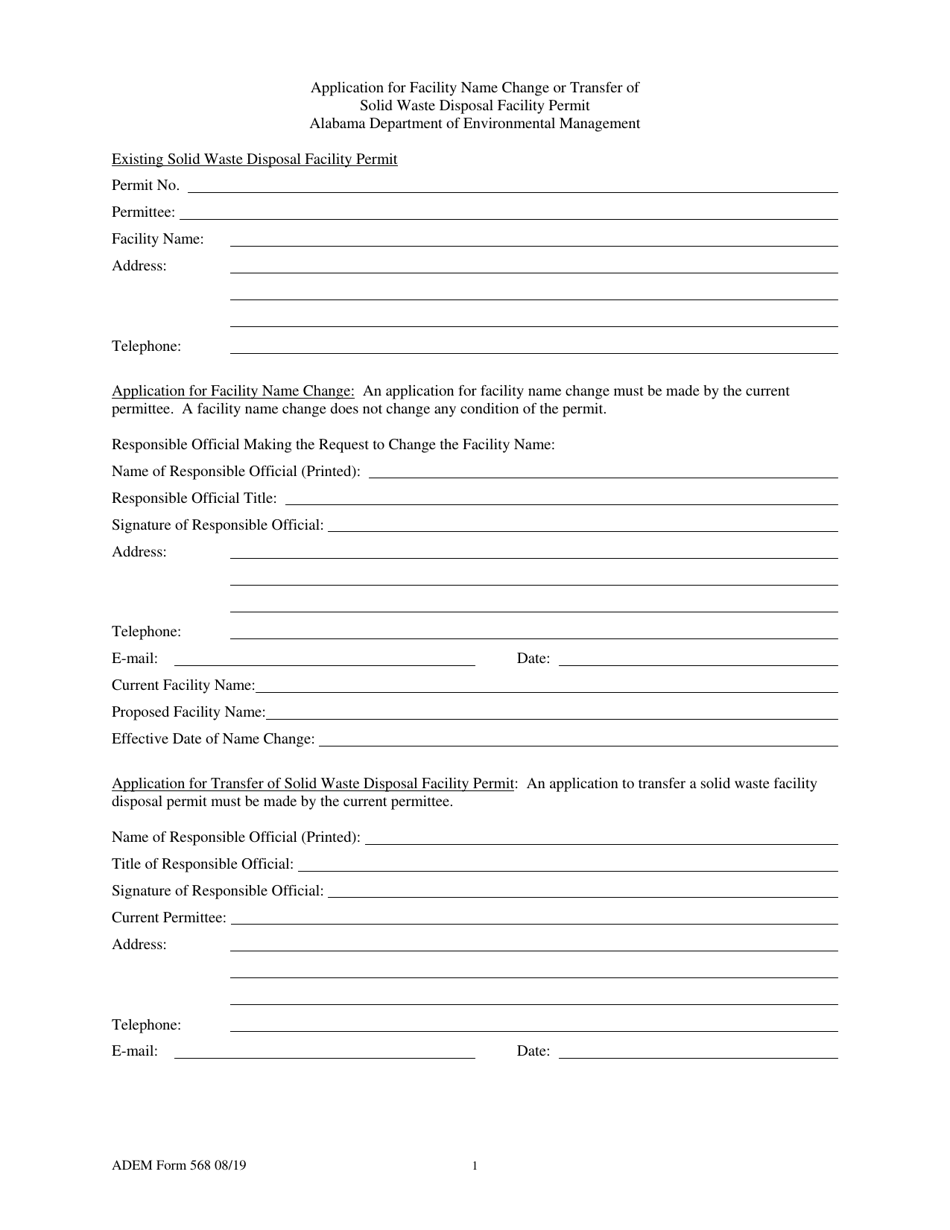

ADEM Form 568 Download Printable PDF or Fill Online Application for

While similar to a sole proprietorship, this llc provides additional tax benefits and. Llcs classified as a disregarded entity or. Web disregarded single member limited liability companies still must file form 568, although they only need to complete a small portion of it. Just pay state filing fees. This llc is owned and operated by a single person.

Free Texas Single Member LLC Operating Agreement Form PDF Word eForms

However, a single member llc only needs to. Web open the federal 1040 return.; Below are solutions to frequently. Solved • by intuit • 3 • updated july 14, 2022. Open the federal information worksheet.;

How Does Single Member Llc File Taxes Tax Walls

Complete schedule iw, llc income worksheet (on. Below are solutions to frequently. However, a single member llc only needs to. Per the ca ftb limited liability. Fast, simple, and free with a 100% satisfaction guarantee.

SingleMember LLCs and Operating Agreements

Web 568 2020 limited liability company tax booklet members of the franchise tax board betty t. Llcs classified as a disregarded entity or. Web the llc’s taxable year is 15 days or less. Web common questions about partnership ca form 568 for single member llcs. While similar to a sole proprietorship, this llc provides additional tax benefits and.

Solved Does Turbo tax Business efile CA FORM 568 for single member LLC

Per the ca ftb limited liability. The llc did not conduct business in the state during the 15 day period. Just pay state filing fees. However, a single member llc only needs to. Web 568 2020 limited liability company tax booklet members of the franchise tax board betty t.

ftb form 568 instructions LLC Bible

Per the ca website limited liability. Web common questions about partnership ca form 568 for single member llcs. Web a single member limited liability company (smllc) is considered disregarded for federal income tax purposes. Per the ca ftb limited liability. Pay the llc fee (if applicable) items of income, deduction, and credit (after applying appropriate limitations) from the smllc.

CA Form 568 Due Dates 2023 State And Local Taxes Zrivo

Solved • by intuit • 3 • updated july 14, 2022. Llcs classified as a disregarded entity or. Web while a single member llc does not file california form 565, they must file california form 568 which provides details about the llc. Ad protect your personal assets with a free llc—just pay state filing fees. Therefore, all llcs must file.

Fillable Form 568 Limited Liability Company Return Of 1998

Fast, simple, and free with a 100% satisfaction guarantee. However, in california, smllcs are considered separate legal. Llcs classified as disregarded corporations or partnerships must file. Web 568 2020 limited liability company tax booklet members of the franchise tax board betty t. Open the federal information worksheet.;

Therefore, All Llcs Must File Franchise Tax Board Form 568.

If you are married, you and your spouse are considered one owner and can. Below are solutions to frequently. To complete california form 568 for a partnership, from the. However, a single member llc only needs to.

Web Catch The Top Stories Of The Day On Anc’s ‘Top Story’ (20 July 2023)

Pay the llc fee (if applicable) items of income, deduction, and credit (after applying appropriate limitations) from the smllc. Per the ca website limited liability. Llcs classified as disregarded corporations or partnerships must file. The llc did not conduct business in the state during the 15 day period.

Web The Llc’s Taxable Year Is 15 Days Or Less.

Web 568 2020 limited liability company tax booklet members of the franchise tax board betty t. Web while a single member llc does not file california form 565, they must file california form 568 which provides details about the llc. While similar to a sole proprietorship, this llc provides additional tax benefits and. Just pay state filing fees.

Web Llc Is Still Subject To The Annual Franchise Tax And The Gross Receipts Tax.

Web while a single member llc does not file california form 565, they must file california form 568 which provides details about the llc. This llc is owned and operated by a single person. Web common questions about partnership ca form 568 for single member llcs. Web if your llc has one owner, you're a single member limited liability company (smllc).

/GettyImages-519519433-1--574b242b3df78ccee1f0c3f8.jpg)