Donation Receipt Letter Template Word

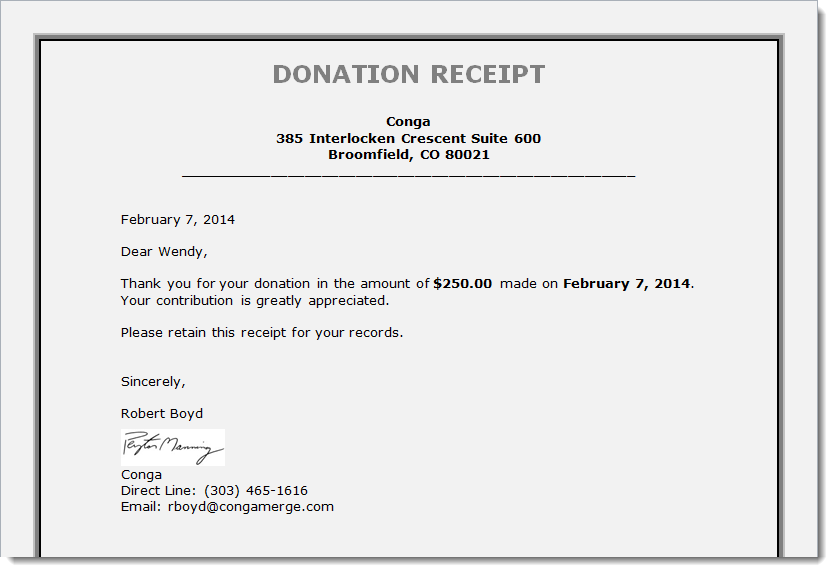

Donation Receipt Letter Template Word - It’s a good idea to start your donation receipt templates with a generic email or letter that. The irs requires nonprofits to send receipts for any charitable gift over $250, and we all know how critical it is to keep the irs happy. For your donation receipts, enter the donation date, receipt number, received by, and donor name and contact information. Web a 501(c)(3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. The first section in the body of this document is titled. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Web ronnie gomez content marketing manager, neon one donation receipts are important for a few reasons. Web 17+ donation receipt letter templates; The organization issuing this receipt in response to a donation. Web 50+ free donation receipt templates (word | pdf) when accepting donations, there are various requirements that your organization needs to meet in order to be compliant with the rules of your area.

One requirement is that you give donors a donation receipt, also known as a 501 (c) (3). Web ronnie gomez content marketing manager, neon one donation receipts are important for a few reasons. The organization issuing this receipt in response to a donation. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. The irs requires nonprofits to send receipts for any charitable gift over $250, and we all know how critical it is to keep the irs happy. Web a 501(c)(3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. For your donation receipts, enter the donation date, receipt number, received by, and donor name and contact information. It’s a good idea to start your donation receipt templates with a generic email or letter that. The first section in the body of this document is titled. Web 17+ donation receipt letter templates;

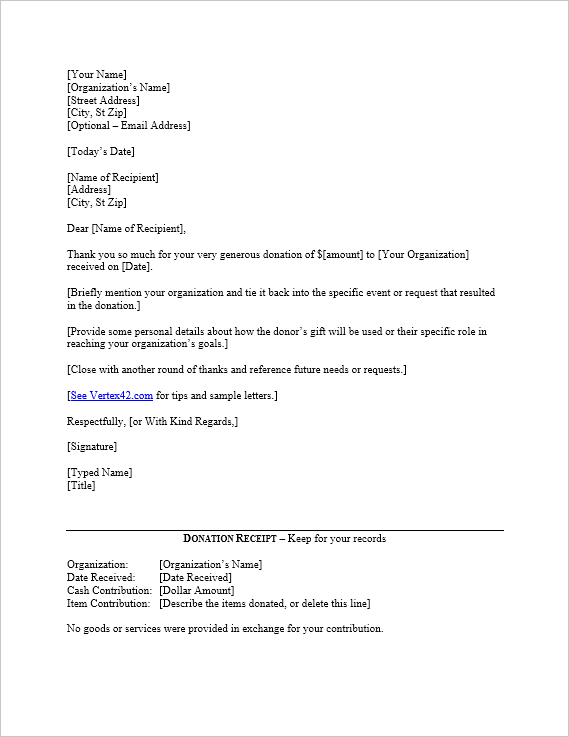

It’s a good idea to start your donation receipt templates with a generic email or letter that. One requirement is that you give donors a donation receipt, also known as a 501 (c) (3). Web a 501(c)(3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. The first section in the body of this document is titled. Web these email and letter templates will help you create compelling donation receipts without taking your time away from your donors: Web 17+ donation receipt letter templates; The irs requires nonprofits to send receipts for any charitable gift over $250, and we all know how critical it is to keep the irs happy. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. For your donation receipts, enter the donation date, receipt number, received by, and donor name and contact information. Web free thank you letter for donation of money charitable donation letter template solicitation letter for donations letter from santa template to whom it may concern letter template free thank you letter for donation to school thank you letter for donation free donation request letter format template sample donation request.

😂 Donation request email sample. Sample Political Campaign Fundraising

The first section in the body of this document is titled. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Web a 501(c)(3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more..

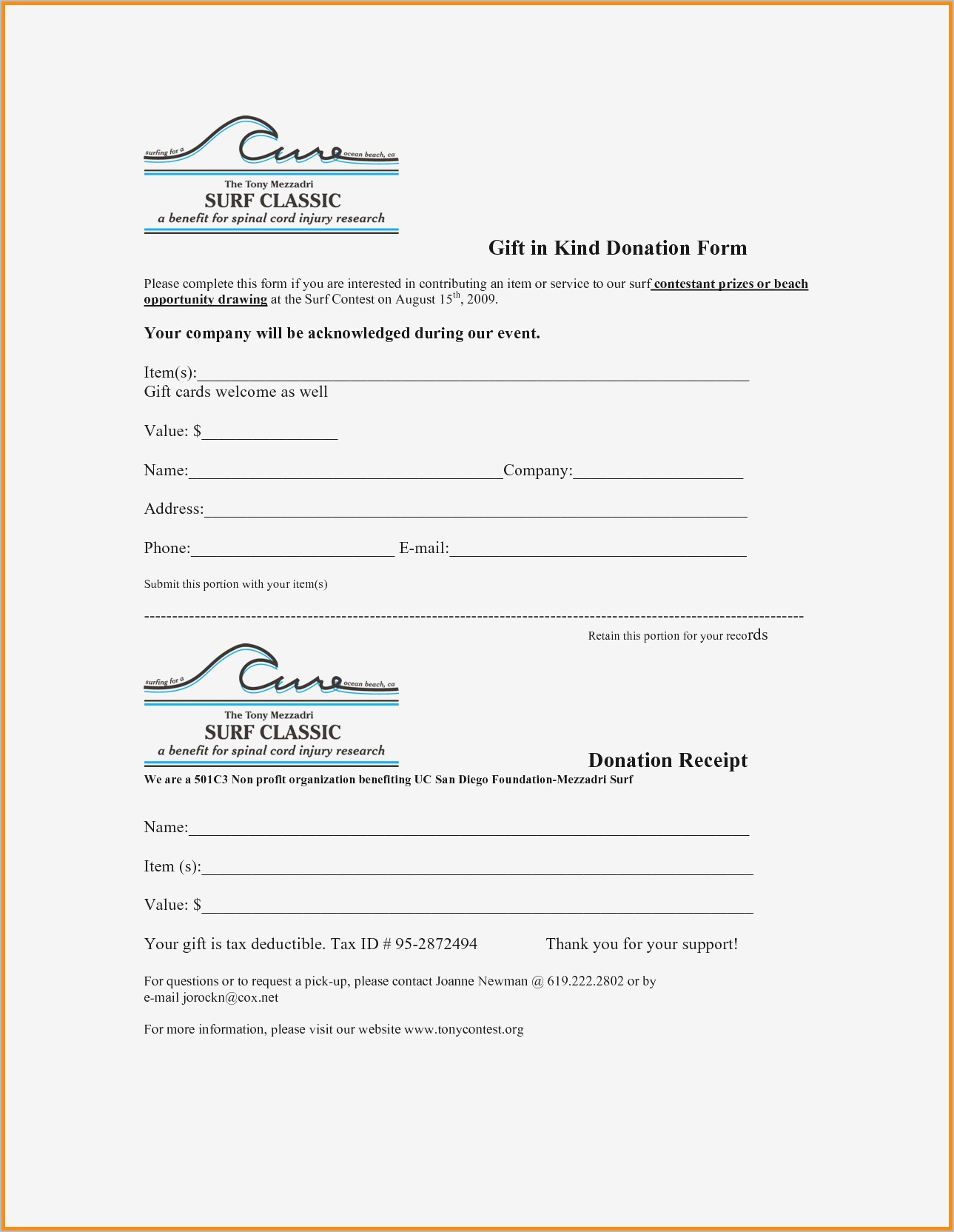

Image result for in kind donation receipt Donation letter, Donation

It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Web 50+ free donation receipt templates (word | pdf) when accepting donations, there are various requirements that your organization needs to meet in order to be compliant with the rules of your area. The.

Donation Tax Receipt Template Database

Web 17+ donation receipt letter templates; The irs requires nonprofits to send receipts for any charitable gift over $250, and we all know how critical it is to keep the irs happy. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. The organization.

Donation Receipt Letter Template charlotte clergy coalition

Web ronnie gomez content marketing manager, neon one donation receipts are important for a few reasons. The first section in the body of this document is titled. The irs requires nonprofits to send receipts for any charitable gift over $250, and we all know how critical it is to keep the irs happy. Web 50+ free donation receipt templates (word.

40 Donation Receipt Templates & Letters [Goodwill, Non Profit]

Web free thank you letter for donation of money charitable donation letter template solicitation letter for donations letter from santa template to whom it may concern letter template free thank you letter for donation to school thank you letter for donation free donation request letter format template sample donation request. Web 50+ free donation receipt templates (word | pdf) when.

Donation Receipt Letter Template Word Examples Letter Template Collection

One requirement is that you give donors a donation receipt, also known as a 501 (c) (3). The organization issuing this receipt in response to a donation. Web 50+ free donation receipt templates (word | pdf) when accepting donations, there are various requirements that your organization needs to meet in order to be compliant with the rules of your area..

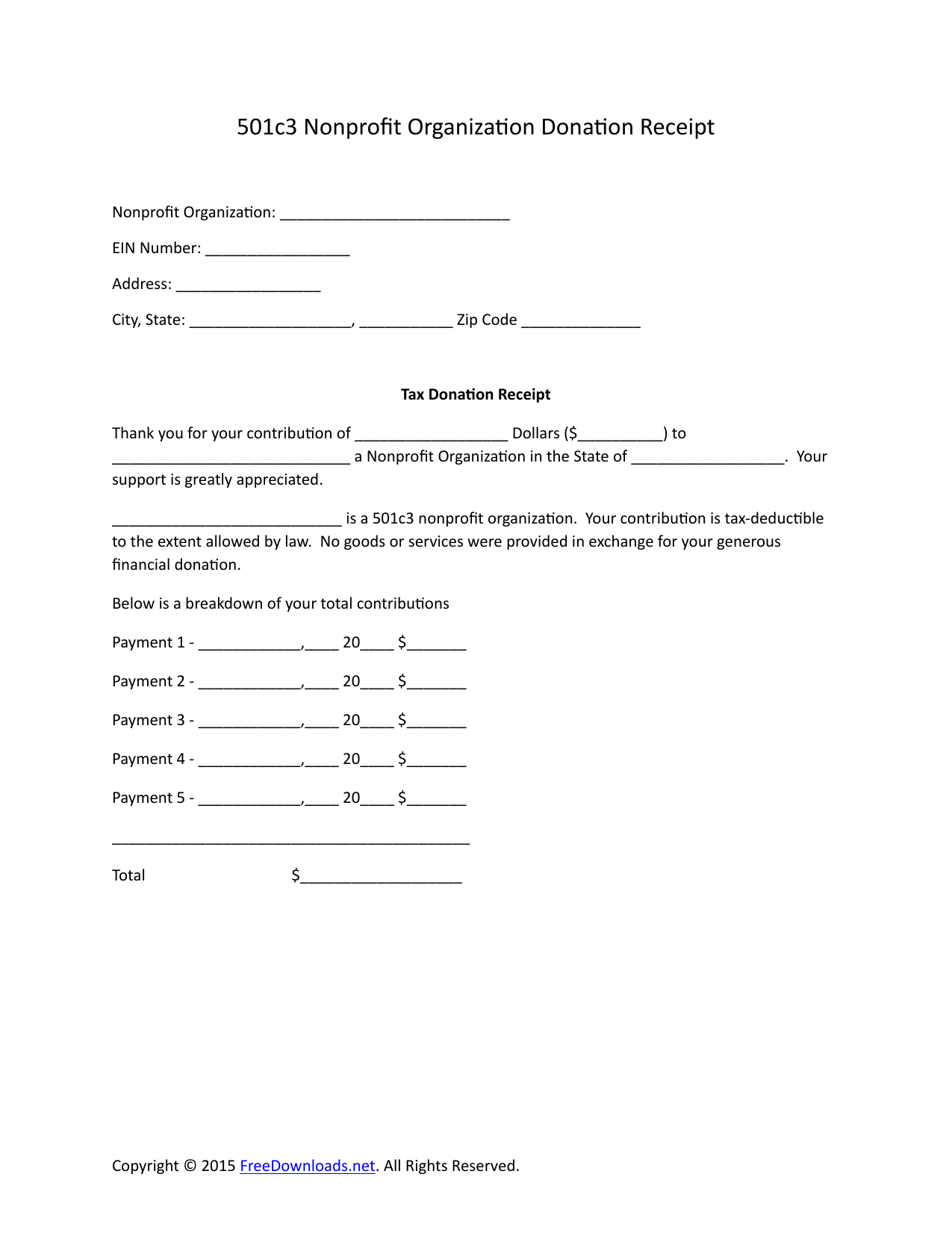

Download 501c3 Donation Receipt Letter for Tax Purposes PDF RTF

The organization issuing this receipt in response to a donation. Web free thank you letter for donation of money charitable donation letter template solicitation letter for donations letter from santa template to whom it may concern letter template free thank you letter for donation to school thank you letter for donation free donation request letter format template sample donation request..

45+ Free Donation Receipt Templates (501c3, NonProfit, Charity)

Web ronnie gomez content marketing manager, neon one donation receipts are important for a few reasons. It’s a good idea to start your donation receipt templates with a generic email or letter that. Web 17+ donation receipt letter templates; One requirement is that you give donors a donation receipt, also known as a 501 (c) (3). Web free thank you.

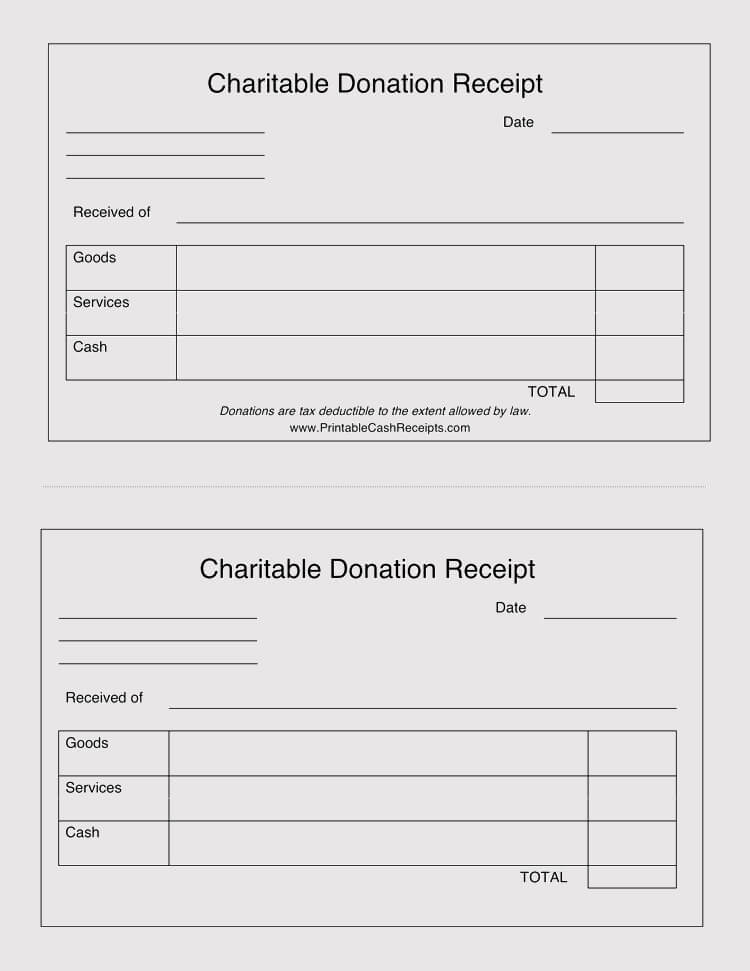

FREE 9+ Sample Fundraiser Receipt Templates in PDF MS Word

Web 50+ free donation receipt templates (word | pdf) when accepting donations, there are various requirements that your organization needs to meet in order to be compliant with the rules of your area. One requirement is that you give donors a donation receipt, also known as a 501 (c) (3). For your donation receipts, enter the donation date, receipt number,.

Donation Receipt Letter Templates at

Web these email and letter templates will help you create compelling donation receipts without taking your time away from your donors: It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Web 17+ donation receipt letter templates; The first section in the body of.

The Irs Requires Nonprofits To Send Receipts For Any Charitable Gift Over $250, And We All Know How Critical It Is To Keep The Irs Happy.

Web 17+ donation receipt letter templates; The first section in the body of this document is titled. For your donation receipts, enter the donation date, receipt number, received by, and donor name and contact information. Web a 501(c)(3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more.

The Organization Issuing This Receipt In Response To A Donation.

Web ronnie gomez content marketing manager, neon one donation receipts are important for a few reasons. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. One requirement is that you give donors a donation receipt, also known as a 501 (c) (3). Web these email and letter templates will help you create compelling donation receipts without taking your time away from your donors:

It’s A Good Idea To Start Your Donation Receipt Templates With A Generic Email Or Letter That.

Web free thank you letter for donation of money charitable donation letter template solicitation letter for donations letter from santa template to whom it may concern letter template free thank you letter for donation to school thank you letter for donation free donation request letter format template sample donation request. Web 50+ free donation receipt templates (word | pdf) when accepting donations, there are various requirements that your organization needs to meet in order to be compliant with the rules of your area.

![40 Donation Receipt Templates & Letters [Goodwill, Non Profit]](https://templatearchive.com/wp-content/uploads/2017/05/donation-receipt-template-12.jpg)