E-Postcard Form 990-N

E-Postcard Form 990-N - Search ein, choose tax year, review & transmit to the irs. Request for transcript of tax return. Request for taxpayer identification number (tin) and certification. Association of notre dame clubs, inc. The website can be found at. Supports filing for 2022, 2021, & 2020 tax year. Pdffiller allows users to edit, sign, fill & share all type of documents online.

Pdffiller allows users to edit, sign, fill & share all type of documents online. Search ein, choose tax year, review & transmit to the irs. The website can be found at. Association of notre dame clubs, inc. Supports filing for 2022, 2021, & 2020 tax year. Request for taxpayer identification number (tin) and certification. Request for transcript of tax return.

Pdffiller allows users to edit, sign, fill & share all type of documents online. Search ein, choose tax year, review & transmit to the irs. Supports filing for 2022, 2021, & 2020 tax year. Association of notre dame clubs, inc. Request for taxpayer identification number (tin) and certification. The website can be found at. Request for transcript of tax return.

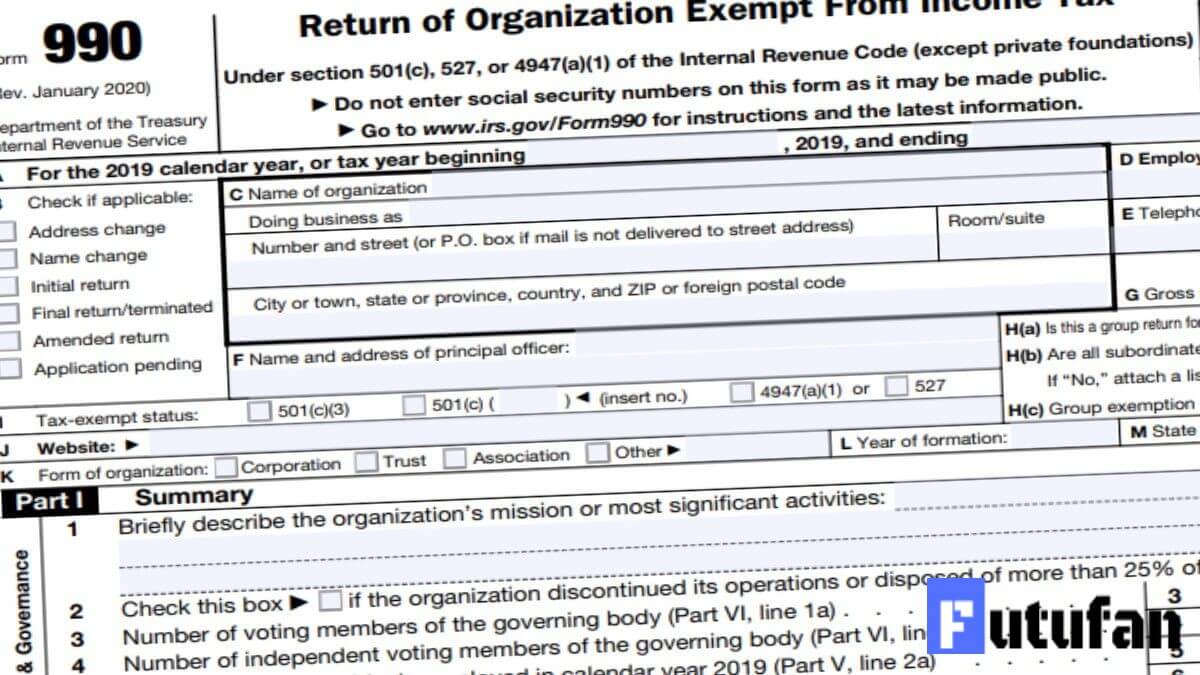

E Postcard File Your Electronic Irs Form 990 N Form Resume Examples

Search ein, choose tax year, review & transmit to the irs. Pdffiller allows users to edit, sign, fill & share all type of documents online. Request for transcript of tax return. The website can be found at. Supports filing for 2022, 2021, & 2020 tax year.

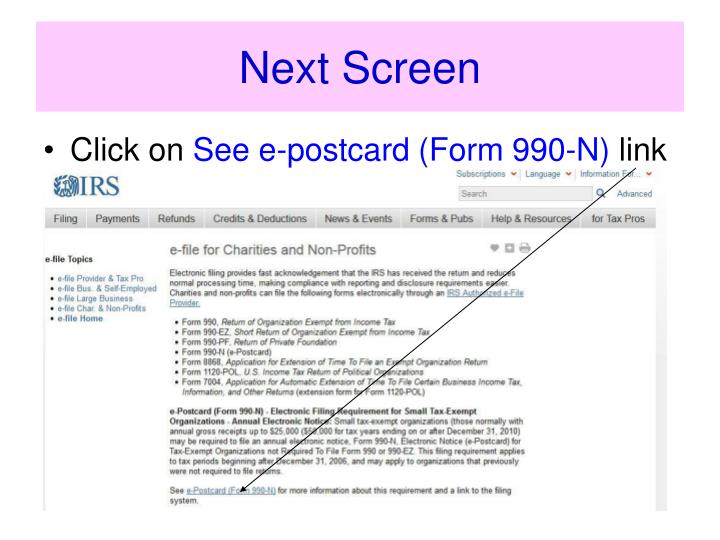

PPT to IRS & e990 filing We’re here to help you! PowerPoint

The website can be found at. Request for taxpayer identification number (tin) and certification. Request for transcript of tax return. Search ein, choose tax year, review & transmit to the irs. Pdffiller allows users to edit, sign, fill & share all type of documents online.

Form 990N ePostcard

Request for taxpayer identification number (tin) and certification. Pdffiller allows users to edit, sign, fill & share all type of documents online. Association of notre dame clubs, inc. The website can be found at. Supports filing for 2022, 2021, & 2020 tax year.

How to Send the IRS an ePostcard Form 990N

Request for transcript of tax return. Request for taxpayer identification number (tin) and certification. The website can be found at. Supports filing for 2022, 2021, & 2020 tax year. Association of notre dame clubs, inc.

Tax exempt organizations to file form 990N (ePostcard) by express990

Association of notre dame clubs, inc. Pdffiller allows users to edit, sign, fill & share all type of documents online. The website can be found at. Request for taxpayer identification number (tin) and certification. Supports filing for 2022, 2021, & 2020 tax year.

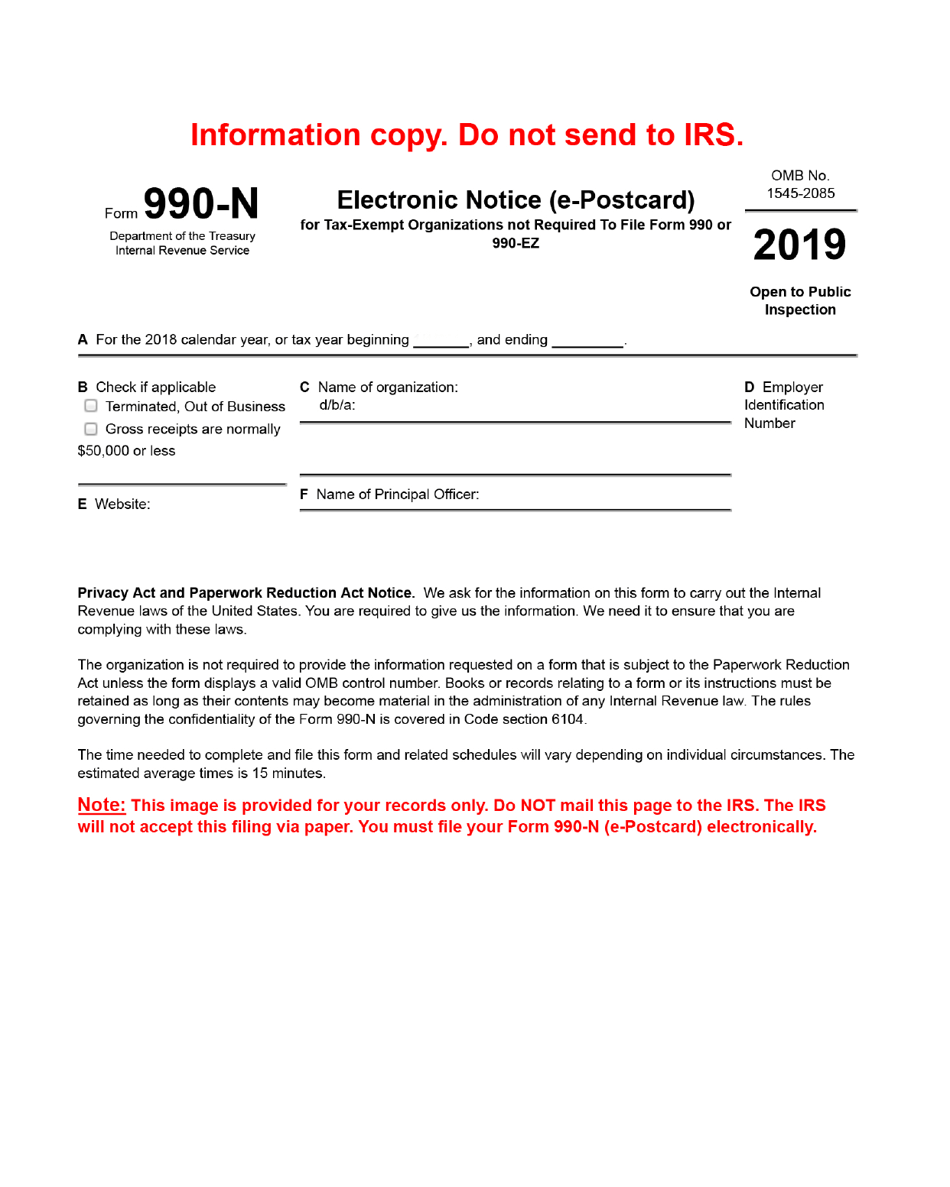

IRS Form 990N Download Printable PDF or Fill Online Electronic Notice

Association of notre dame clubs, inc. Pdffiller allows users to edit, sign, fill & share all type of documents online. Request for taxpayer identification number (tin) and certification. Search ein, choose tax year, review & transmit to the irs. Supports filing for 2022, 2021, & 2020 tax year.

Fill N Print Form Fill Out and Sign Printable PDF Template signNow

Search ein, choose tax year, review & transmit to the irs. Supports filing for 2022, 2021, & 2020 tax year. Pdffiller allows users to edit, sign, fill & share all type of documents online. Request for transcript of tax return. Association of notre dame clubs, inc.

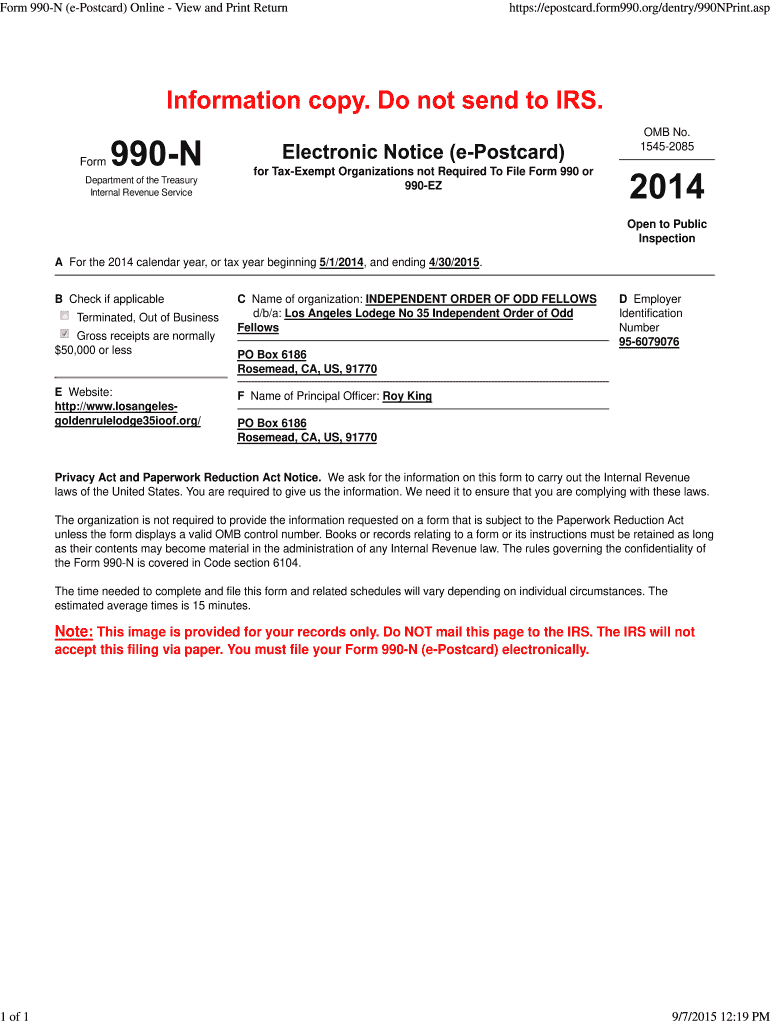

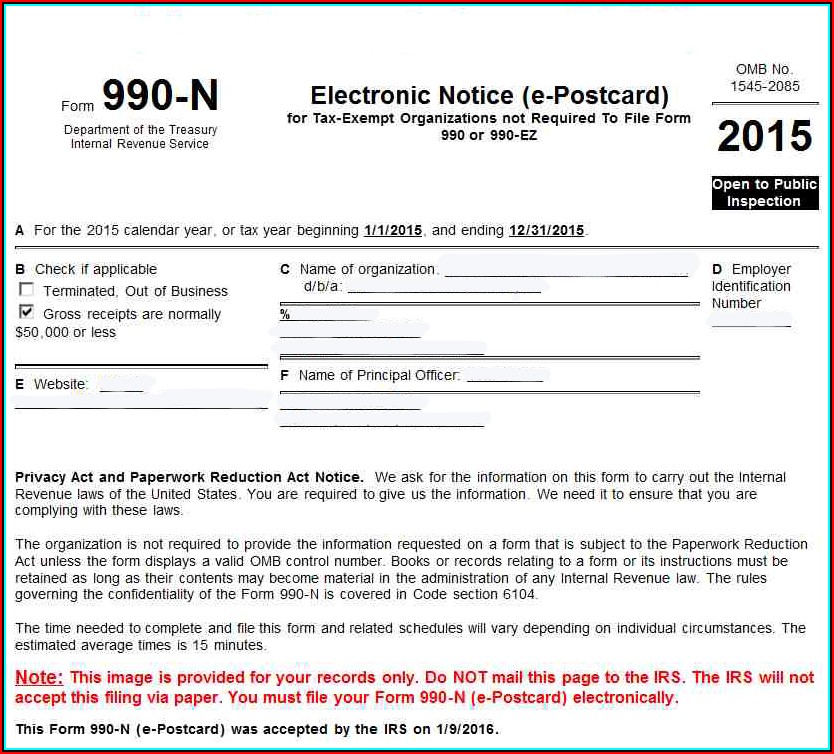

Form 990N (ePostcard) Online View and Print Returnpage001

Pdffiller allows users to edit, sign, fill & share all type of documents online. Supports filing for 2022, 2021, & 2020 tax year. The website can be found at. Search ein, choose tax year, review & transmit to the irs. Request for transcript of tax return.

Meet the May 17, 2021 EPostcard Form 990N Deadline In 3 Simple Steps

Association of notre dame clubs, inc. The website can be found at. Pdffiller allows users to edit, sign, fill & share all type of documents online. Supports filing for 2022, 2021, & 2020 tax year. Request for taxpayer identification number (tin) and certification.

Association Of Notre Dame Clubs, Inc.

Request for transcript of tax return. Request for taxpayer identification number (tin) and certification. Pdffiller allows users to edit, sign, fill & share all type of documents online. Supports filing for 2022, 2021, & 2020 tax year.

Search Ein, Choose Tax Year, Review & Transmit To The Irs.

The website can be found at.