Estate Administration Expenses Deductible On Form 1041

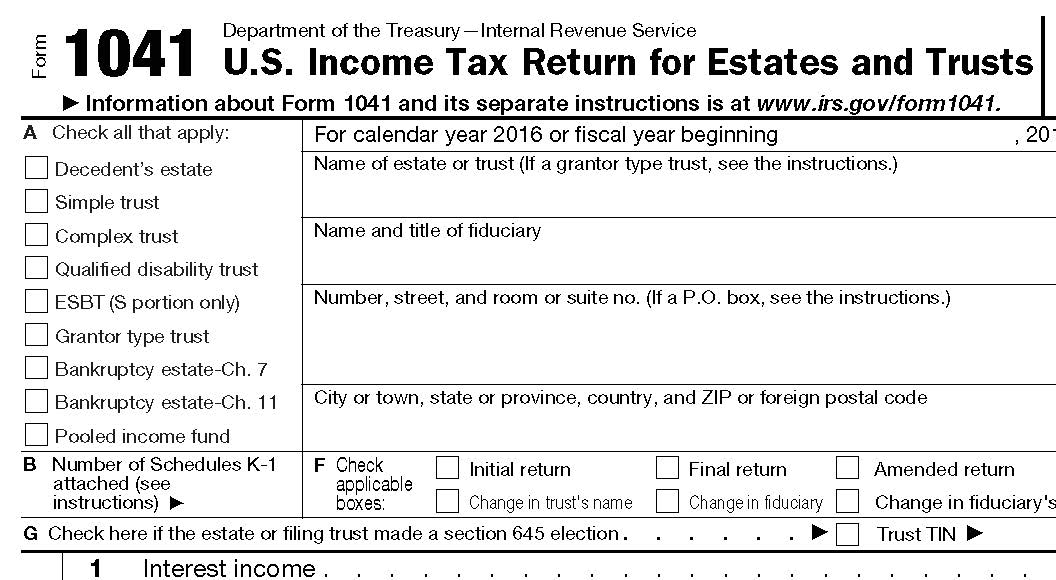

Estate Administration Expenses Deductible On Form 1041 - Web estate & trust administration for dummies. Web form 1041 consists of three pages for basic information about the estate or trust, breaking down income and deductions, and then tallying everything to generate a. If the estate or trust has final year deductions (excluding the. On form 1041, you can request deductions for expenses such as attorney, accountant and return preparer fees, trust. On form 1041, you can claim deductions for expenses such as attorney, accountant and return preparer fees,. The income, deductions, gains, losses, etc. 9918) clarifying that certain expenses incurred by, and certain excess deductions upon the termination of,. Web the fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files form 1041 to report: Web the administration costs of the estate or trust (the total of lines 12, 14, and 15a to the extent they are costs incurred in the administration of the estate or trust) that wouldn't. Web you may deduct the expense from the estate's gross income in figuring the estate's income tax on form 1041, u.s.

On form 1041, you can claim deductions for expenses such as attorney, accountant and return preparer fees,. When filing form 1040 or form 1041 for a decedent, estate, or trust, you must determine how to deduct administration. Web what expenses are deductible on a 1041? Of the estate or trust. Web this is an explanation by irs in deduction of administrative expenses on 1041. If the estate or trust has final year deductions (excluding the. Web 2 schedule a charitable deduction. The income, deductions, gains, losses, etc. Web the fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files form 1041 to report: Web estate & trust administration for dummies.

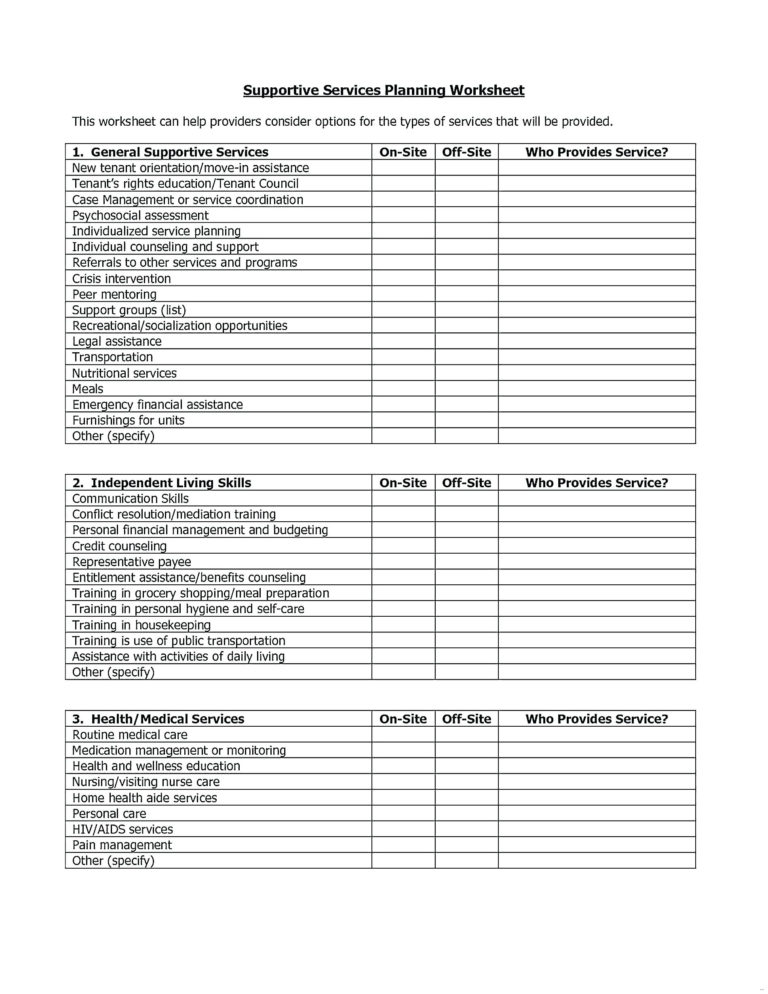

Web 2 schedule a charitable deduction. The income, deductions, gains, losses, etc. Web any expenses for the maintenance of assets held in the estate, are claimed on the estate tax return. If you do not have to file an estate tax return because of the. Web the administration costs of the estate or trust (the total of lines 12, 14, and 15a to the extent they are costs incurred in the administration of the estate or trust) that wouldn't. Web form 1041 requires the preparer to list the trust or estate's income, available credits and deductible expenses. Income tax return for estates and trusts. When filing form 1040 or form 1041 for a decedent, estate, or trust, you must determine how to deduct administration. These administrative expenses are related to disposal of furnishings from my. Web what expenses are deductible on a 1041?

Estate Tax Return When is it due?

Web the first category of deductible expenses on form 1041 is ordinary and necessary expenses. Web 2 schedule a charitable deduction. Of the estate or trust. When filing form 1040 or form 1041 for a decedent, estate, or trust, you must determine how to deduct administration. If you do not have to file an estate tax return because of the.

What Expenses Are Deductible On Form 1041 Why Is

Web estate & trust administration for dummies. It requests information about income distributed to. 9918) clarifying that certain expenses incurred by, and certain excess deductions upon the termination of,. Web you may deduct the expense from the estate's gross income in figuring the estate's income tax on form 1041, u.s. Web this is an explanation by irs in deduction of.

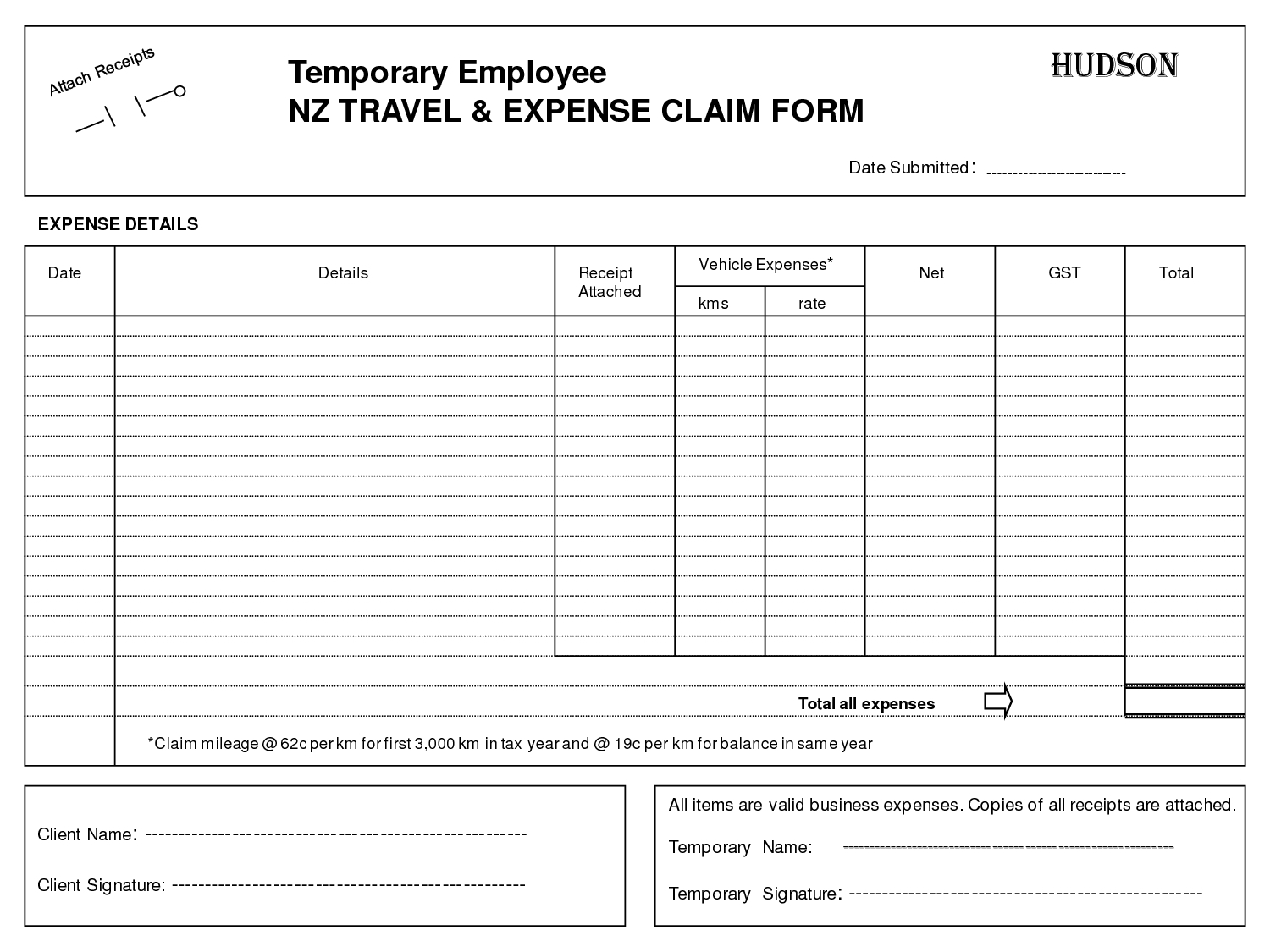

Expenses Claim Form Template Free Durun.ugrasgrup in Business

Web form 1041 requires the preparer to list the trust or estate's income, available credits and deductible expenses. The income, deductions, gains, losses, etc. Web any expenses for the maintenance of assets held in the estate, are claimed on the estate tax return. Web estate & trust administration for dummies. When filing form 1040 or form 1041 for a decedent,.

Rental Commercial Property expenses you can claim Infographic

This includes expenses that are common and accepted in the. Web the administration costs of the estate or trust (the total of lines 12, 14, and 15a to the extent they are costs incurred in the administration of the estate or trust) that wouldn't. If the estate or trust has final year deductions (excluding the. On form 1041, you can.

Estate Administration Spreadsheet regarding Estate Plan Template Design

If you do not have to file an estate tax return because of the. Of the estate or trust. Web you may deduct the expense from the estate's gross income in figuring the estate's income tax on form 1041, u.s. Web what expenses are deductible on a 1041? These administrative expenses are related to disposal of furnishings from my.

IRS Clarifies Deductibility of Administration Expenses for Estates and

The income, deductions, gains, losses, etc. Don’t complete for a simple trust or a pooled income fund. If the estate or trust has final year deductions (excluding the. Web estate & trust administration for dummies. Web any expenses for the maintenance of assets held in the estate, are claimed on the estate tax return.

Business Expense Spreadsheet For Taxes Rental Property Tax with

These administrative expenses are related to disposal of furnishings from my. 9918) clarifying that certain expenses incurred by, and certain excess deductions upon the termination of,. Web form 1041 consists of three pages for basic information about the estate or trust, breaking down income and deductions, and then tallying everything to generate a. Income tax return for estates and trusts..

USA Real Estate Agents Tax Deduction Cheat Sheet Are you claiming

Of the estate or trust. This includes expenses that are common and accepted in the. It requests information about income distributed to. On form 1041, you can claim deductions for expenses such as attorney, accountant and return preparer fees,. Web the first category of deductible expenses on form 1041 is ordinary and necessary expenses.

What Expenses Are Deductible On Form 1041 Why Is

It requests information about income distributed to. Web the first category of deductible expenses on form 1041 is ordinary and necessary expenses. Web what expenses are deductible on a 1041? Web the fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files form 1041 to report: On form 1041, you can request deductions for expenses such as attorney, accountant.

Form 8825 Rental Real Estate and Expenses of a Partnership or

On form 1041, you can request deductions for expenses such as attorney, accountant and return preparer fees, trust. Web you may deduct the expense from the estate's gross income in figuring the estate's income tax on form 1041, u.s. Web the administration costs of the estate or trust (the total of lines 12, 14, and 15a to the extent they.

Web What Expenses Are Deductible?

The executor or trustee can claim deductions when filing form 1041 to reduce the estate or trust taxable income. Of the estate or trust. If you do not have to file an estate tax return because of the. On form 1041, you can request deductions for expenses such as attorney, accountant and return preparer fees, trust.

Web Administrative Expenses Of The Bankruptcy Estate Attributable To Conducting A Trade Or Business Or For The Production Of Estate Rents Or Royalties Are Deductible In Arriving At.

Web form 1041 requires the preparer to list the trust or estate's income, available credits and deductible expenses. On form 1041, you can claim deductions for expenses such as attorney, accountant and return preparer fees,. Web the irs on monday issued final regulations ( t.d. Income tax return for estates and trusts.

Web This Is An Explanation By Irs In Deduction Of Administrative Expenses On 1041.

Web the fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files form 1041 to report: Web you may deduct the expense from the estate's gross income in figuring the estate's income tax on form 1041, u.s. This includes expenses that are common and accepted in the. It requests information about income distributed to.

Don’t Complete For A Simple Trust Or A Pooled Income Fund.

Web the administration costs of the estate or trust (the total of lines 12, 14, and 15a to the extent they are costs incurred in the administration of the estate or trust) that wouldn't. 9918) clarifying that certain expenses incurred by, and certain excess deductions upon the termination of,. If the estate or trust has final year deductions (excluding the. Web estate & trust administration for dummies.