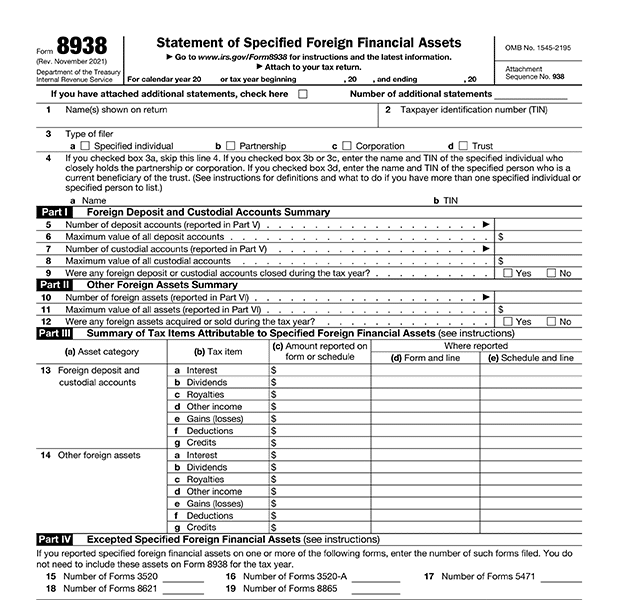

Fatca Form 8938

Fatca Form 8938 - Taxpayers holding financial assets outside the united states must report those assets to the irs on form 8938: Fatca form 8938 & 6038d: Taxpayers to disclose their “specified foreign financial assets” directly to the irs on form 8938 — unlike the fbar, which is reported to fincen. Web there are penalties if you must file irs form 8938, statement of specified foreign financial assets, and don’t, or if you file it and it is incorrect. Or at any time during the tax year is more than:. Web get started includes many categories of assets there are many different types of foreign assets: Web form 8938 is an informational irs tax form that was created as part of the foreign account tax compliance act (fatca), which was passed into law in 2010. Web fatca form 8938 & irc 6038d. Web the internal revenue service’s form 8938 instructions provide some guidance on how to report the maximum account value for fatca (foreign account tax compliance act). Please note that fatca is only a reporting requirement and has no additional tax.

Web use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the. Web form 8938 requires individual taxpayers to report financial assets they own overseas. Taxpayers holding financial assets outside the united states must report those assets to the irs on form 8938: Web get started includes many categories of assets there are many different types of foreign assets: Accounts, pension, life insurance & more. Web form 8938 is similar to the fbar, so many expats fail to understand that they are two separate forms —and understanding the key differences is important to filing your expat. Web the surrender value is reported on the fatca form 8938. Web fatca created form 8938, an additional foreign account reporting requirement over and above the report of foreign bank and financial accounts (fbar) that needs to be filed. What insurance policy information do i report on fatca form 8938? Web the internal revenue service’s form 8938 instructions provide some guidance on how to report the maximum account value for fatca (foreign account tax compliance act).

Web under fatca, certain u.s. Web the internal revenue service’s form 8938 instructions provide some guidance on how to report the maximum account value for fatca (foreign account tax compliance act). Web form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march 18, 2010. What insurance policy information do i report on fatca form 8938? Fatca form 8938 & 6038d: Web form 8938 is an informational irs tax form that was created as part of the foreign account tax compliance act (fatca), which was passed into law in 2010. Web form 8938 is similar to the fbar, so many expats fail to understand that they are two separate forms —and understanding the key differences is important to filing your expat. Web form 8938 requires individual taxpayers to report financial assets they own overseas. Web foreign account tax compliance act (fatca form 8938) as you may have heard or seen in the media, the united states government has ramped up its efforts to combat tax. Or at any time during the tax year is more than:.

Form 8938 FATCA Frequently Asked Questions Tax Attorney IRS Offshore

Web form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march 18, 2010. The main key pieces of information that. Web form 8938 filing thresholds. Web foreign account tax compliance act (fatca form 8938) as you may have heard or seen in the media, the united states government.

What is FATCA? (Foreign Account Tax Compliance Act)

Fincen form 114, report of foreign bank and financial accounts (fbar) who must file? Web fatca form 8938 & irc 6038d. Taxpayers holding financial assets outside the united states must report those assets to the irs on form 8938: Web form 8938 filing thresholds. Fatca form 8938 & 6038d:

FATCA Reporting Filing Form 8938 Gordon Law Group

Web the internal revenue service’s form 8938 instructions provide some guidance on how to report the maximum account value for fatca (foreign account tax compliance act). Or at any time during the tax year is more than:. Web the surrender value is reported on the fatca form 8938. Taxpayers holding financial assets outside the united states must report those assets.

FORM.UDLVIRTUAL.EDU.PE

The main key pieces of information that. Web the internal revenue service’s form 8938 instructions provide some guidance on how to report the maximum account value for fatca (foreign account tax compliance act). Web form 8938 requires individual taxpayers to report financial assets they own overseas. Web form 8938 is an informational irs tax form that was created as part.

FATCA Form 8938 US Expat Overview

Web fatca created form 8938, an additional foreign account reporting requirement over and above the report of foreign bank and financial accounts (fbar) that needs to be filed. Web there are penalties if you must file irs form 8938, statement of specified foreign financial assets, and don’t, or if you file it and it is incorrect. Web get started includes.

Reporting Crypto Taxes on FBAR or Form 8938 A Complete Guide mind

Web form 8938 is an informational irs tax form that was created as part of the foreign account tax compliance act (fatca), which was passed into law in 2010. Web fatca form 8938 & irc 6038d. Web the surrender value is reported on the fatca form 8938. Web foreign account tax compliance act (fatca form 8938) as you may have.

Reporting Overseas Assets FBAR vs FATCA Form 8938

Web the surrender value is reported on the fatca form 8938. Web the internal revenue service’s form 8938 instructions provide some guidance on how to report the maximum account value for fatca (foreign account tax compliance act). Web form 8938 filing thresholds. Accounts, pension, life insurance & more. Web foreign account tax compliance act (fatca form 8938) as you may.

FATCA Form 8938 FAQ What is a specified foreign asset? YouTube

Accounts, pension, life insurance & more. Web the internal revenue service’s form 8938 instructions provide some guidance on how to report the maximum account value for fatca (foreign account tax compliance act). Web form 8938 is similar to the fbar, so many expats fail to understand that they are two separate forms —and understanding the key differences is important to.

I Got A Fatca Letter From The Bank, Now What? Americans in

Or at any time during the tax year is more than:. Web form 8938 is an informational irs tax form that was created as part of the foreign account tax compliance act (fatca), which was passed into law in 2010. Fatca form 8938 & 6038d: Web the internal revenue service’s form 8938 instructions provide some guidance on how to report.

FATCA Form 8938 Yet Another Form You Might Have to File AlienMoolah

Aggregate value of all specified foreign financial assets on last day of the tax year is more than: Or at any time during the tax year is more than:. Web under fatca, certain u.s. Web the internal revenue service’s form 8938 instructions provide some guidance on how to report the maximum account value for fatca (foreign account tax compliance act)..

Fincen Form 114, Report Of Foreign Bank And Financial Accounts (Fbar) Who Must File?

When us taxpayers research about foreign account reporting rules, oftentimes it leads them to the fbar.but,. Fatca form 8938 & 6038d: Please note that fatca is only a reporting requirement and has no additional tax. Web fatca created form 8938, an additional foreign account reporting requirement over and above the report of foreign bank and financial accounts (fbar) that needs to be filed.

Taxpayers To Disclose Their “Specified Foreign Financial Assets” Directly To The Irs On Form 8938 — Unlike The Fbar, Which Is Reported To Fincen.

Web fatca form 8938 & irc 6038d. Aggregate value of all specified foreign financial assets on last day of the tax year is more than: Accounts, pension, life insurance & more. Web form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march 18, 2010.

Taxpayers Holding Financial Assets Outside The United States Must Report Those Assets To The Irs On Form 8938:

Or at any time during the tax year is more than:. Web get started includes many categories of assets there are many different types of foreign assets: Web the internal revenue service’s form 8938 instructions provide some guidance on how to report the maximum account value for fatca (foreign account tax compliance act). Web under fatca, certain u.s.

What Insurance Policy Information Do I Report On Fatca Form 8938?

Web form 8938 filing thresholds. The main key pieces of information that. Web the surrender value is reported on the fatca form 8938. Web form 8938, statement of specified foreign financial assets.