Federal Form 8919

Federal Form 8919 - Employees will use form 8919 to determine the amount they owe in social security and medicare taxes. Web form 8919 is the form for those who are employee but their employer treated them as an independent contractor, then they must calculate and report their. Web check appropriate box for federal tax classification of the person whose name is entered on line 1. Web about form 8919, uncollected social security and medicare tax on wages. Firm's enter date of irs check total wages. • you performed services for a firm. Who has the right to control your behavior at work? If married, complete a separate form 8919 for each spouse who must file this form. Attach to your tax return. If married, complete a separate form 8919 for each spouse who must file this form.

If married, complete a separate form 8919 for each spouse who must file this form. Web name of person who must file this form. Web irs form 8919 and the employee’s responsibilities. Web about form 8919, uncollected social security and medicare tax on wages. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: Web information about form 8919 and its instructions is at www.irs.gov/form8919. The taxpayer performed services for an individual or a firm. Web name of person who must file this form. Web form 8919, also known as “uncollected social security and medicare tax on wages,” is used by workers who were not treated as employees by their employers but believed. Employees will use form 8919 to determine the amount they owe in social security and medicare taxes.

Web name of person who must file this form. Web irs form 8919 and the employee’s responsibilities. Firm's enter date of irs check total wages. Web you must file form 8919 if all of the following apply. The internal revenue service (irs) is more likely to consider you an employee if: Who has the right to control your behavior at work? Web name of person who must file this form. Social security number who must file. The business owner gives you instructions. If married, complete a separate form 8919 for each spouse who must file this form.

2020 Form IRS 8880 Fill Online, Printable, Fillable, Blank pdfFiller

The taxpayer performed services for an individual or a firm. Who has the right to control your behavior at work? Social security number who must file. Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were treated as. The internal revenue.

Free tax filing offers and programs to help you through the process

Web what is form 8919 and when to use it? Web you must file form 8919 if all of the following apply. Web form 8919 is the form for those who are employee but their employer treated them as an independent contractor, then they must calculate and report their. Okay, so now that we know the difference between being an.

Form 8959 Additional Medicare Tax (2014) Free Download

Web about form 8919, uncollected social security and medicare tax on wages. Web name of person who must file this form. If married, complete a separate form 8919 for each spouse who must file this form. If married, complete a separate form 8919 for each spouse who must file this form. Web check appropriate box for federal tax classification of.

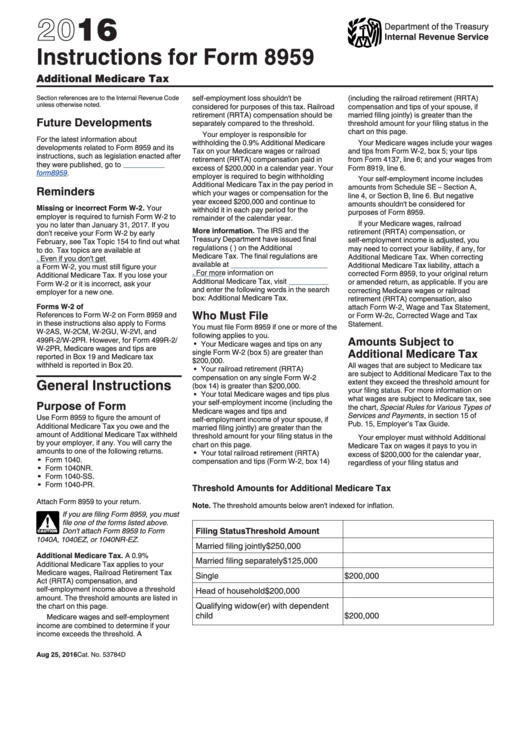

2016 Form 8919 Edit, Fill, Sign Online Handypdf

Web form 8919 is the form for those who are employee but their employer treated them as an independent contractor, then they must calculate and report their. Web what is form 8919 and when to use it? Web name of person who must file this form. Who has the right to control your behavior at work? Web use form 8919.

IRS expands crypto question on draft version of 1040 Accounting Today

Web check appropriate box for federal tax classification of the person whose name is entered on line 1. • you performed services for a firm. Web you must file form 8919 if all of the following apply. Of the following seven boxes. Web form 8919 is the form for those who are employee but their employer treated them as an.

Instructions For Form 8959 2016 printable pdf download

You performed services for a firm. If married, complete a separate form 8919 for each spouse who must file this form. Web name of person who must file this form. Web you must file form 8919 if all of the following apply. Web form 8919, also known as “uncollected social security and medicare tax on wages,” is used by workers.

Form 8919 Uncollected Social Security and Medicare Tax on Wages (2014

The internal revenue service (irs) is more likely to consider you an employee if: Who has the right to control your behavior at work? Web irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used by employees who were treated like independent contractors by their. Web use form 8919 to figure and report.

Form 8919 Uncollected Social Security And Medicare Tax On Wages

• you performed services for a firm. You performed services for a firm. Web check appropriate box for federal tax classification of the person whose name is entered on line 1. Use form 8919 to figure and report your share of the uncollected social security and. Web use form 8919 to figure and report your share of the uncollected social.

how to fill out form 8919 Fill Online, Printable, Fillable Blank

Who has the right to control your behavior at work? Web check appropriate box for federal tax classification of the person whose name is entered on line 1. Of the following seven boxes. Web about form 8919, uncollected social security and medicare tax on wages. Employees will use form 8919 to determine the amount they owe in social security and.

Form 8919 2021 Fill Online, Printable, Fillable, Blank pdfFiller

Web about form 8919, uncollected social security and medicare tax on wages. The taxpayer performed services for an individual or a firm. Web irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used by employees who were treated like independent contractors by their. Attach to your tax return. Web irs form 8919 and.

Web Department Of The Treasury Internal Revenue Service Uncollected Social Security And Medicare Tax On Wages Go To Www.irs.gov/Form8919 For The Latest Information Attach.

Social security number who must file. Web what is form 8919 and when to use it? Who has the right to control your behavior at work? Web form 8919 is the form for those who are employee but their employer treated them as an independent contractor, then they must calculate and report their.

Web About Form 8919, Uncollected Social Security And Medicare Tax On Wages.

Okay, so now that we know the difference between being an employee or an independent contractor, let's dive into the. Employees will use form 8919 to determine the amount they owe in social security and medicare taxes. • you performed services for a firm. Web name of person who must file this form.

• You Believe Your Pay From The Firm Wasn’t For Services As An Independent Contractor.

If married, complete a separate form 8919 for each spouse who must file this form. Of the following seven boxes. If married, complete a separate form 8919 for each spouse who must file this form. Firm's enter date of irs check total wages.

Web Irs Form 8819, Uncollected Social Security And Medicare Tax On Wages, Is An Official Tax Document Used By Employees Who Were Treated Like Independent Contractors By Their.

Attach to your tax return. Web name of person who must file this form. Web information about form 8919 and its instructions is at www.irs.gov/form8919. The business owner gives you instructions.